What is Probate?

Probate refers to the legal process of administering a deceased person's estate. It includes validating wills, distributing assets, and settling debts. Explore state-specific templates for your needs.

Probate involves managing a deceased person's estate. Attorney-drafted templates make the process quick and straightforward.

Manage estate assets under $20,000 without formal administration using a simple affidavit process.

Establishes inheritance rights for the deceased's estate when no will exists. Essential for proving heirship for property distribution.

Use this form to officially reject an inheritance or right to inherit property, protecting your interests and those of others involved.

Request access to a deceased person's will crucial for estate management and probate, ensuring rightful heirs receive necessary documents.

Complete this form to voluntarily discharge an executor or administrator of an estate in New Jersey, ensuring a smoother estate management process.

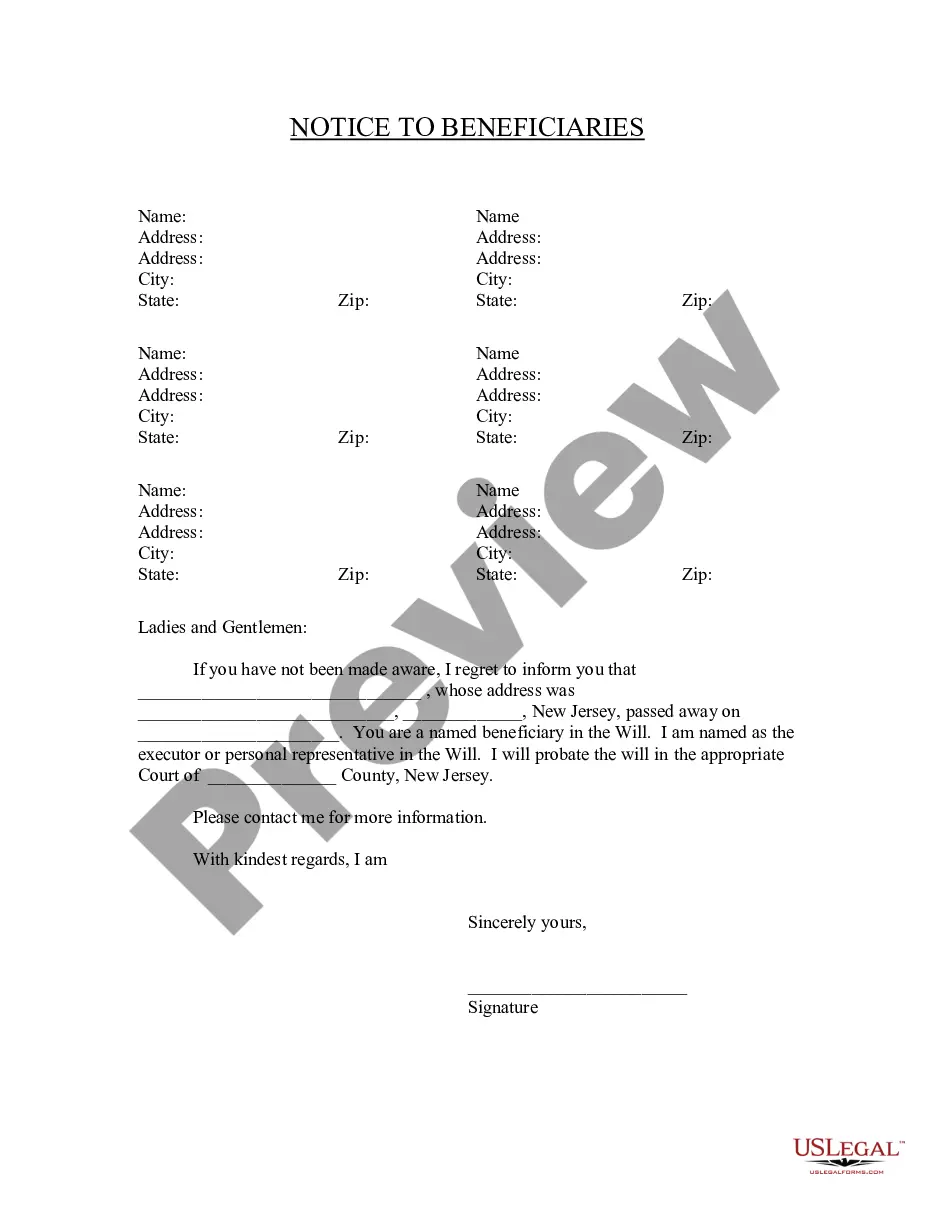

Notify beneficiaries named in a will about their inheritance and your role as the executor.

Protect your interests against an unverified will by filing a formal notice to prevent its probate.

Use this form to formally release a guardian from their duties once a minor comes of age, ensuring all claims are settled.

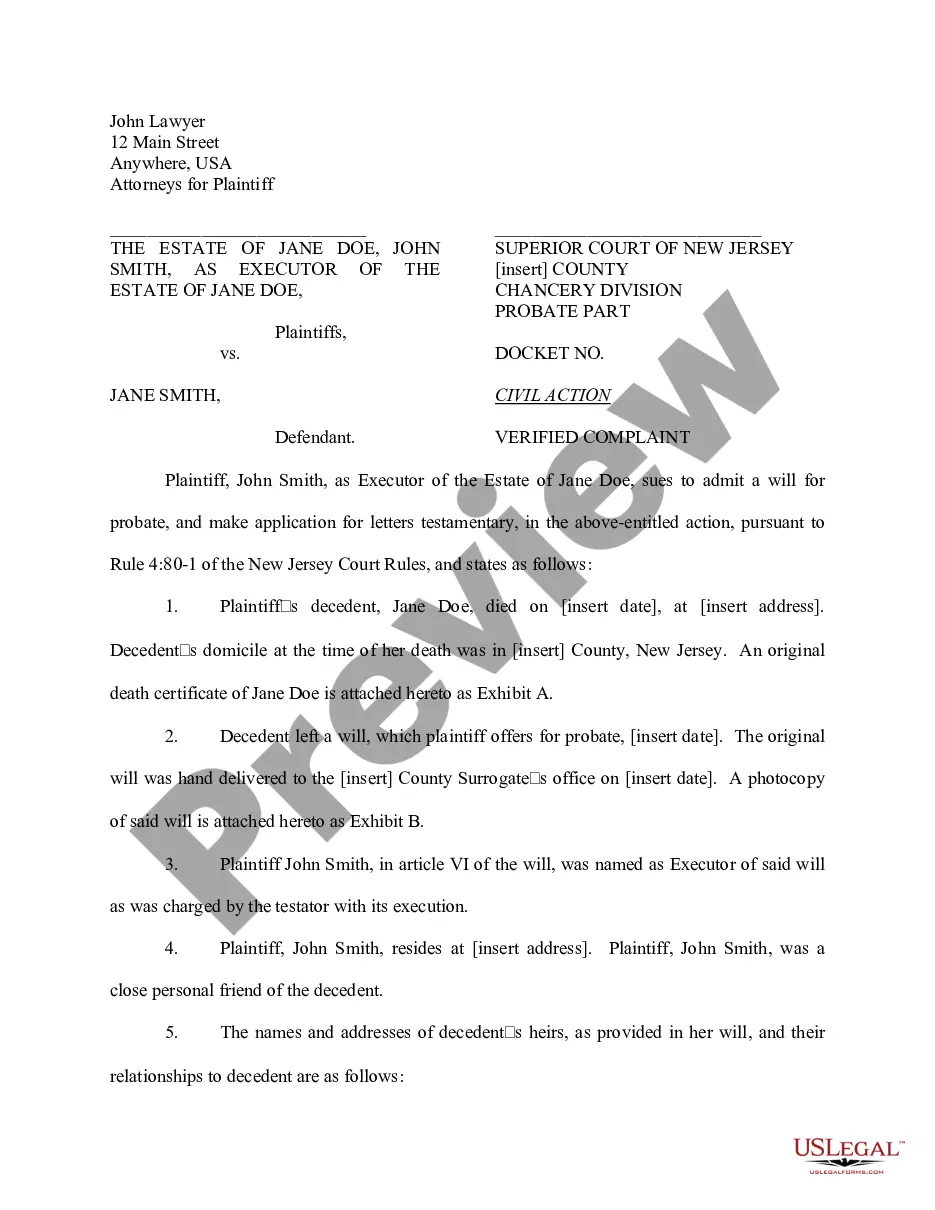

Use this to legally acknowledge a will and initiate probate proceedings for an estate, ensuring the decedent's wishes are honored.

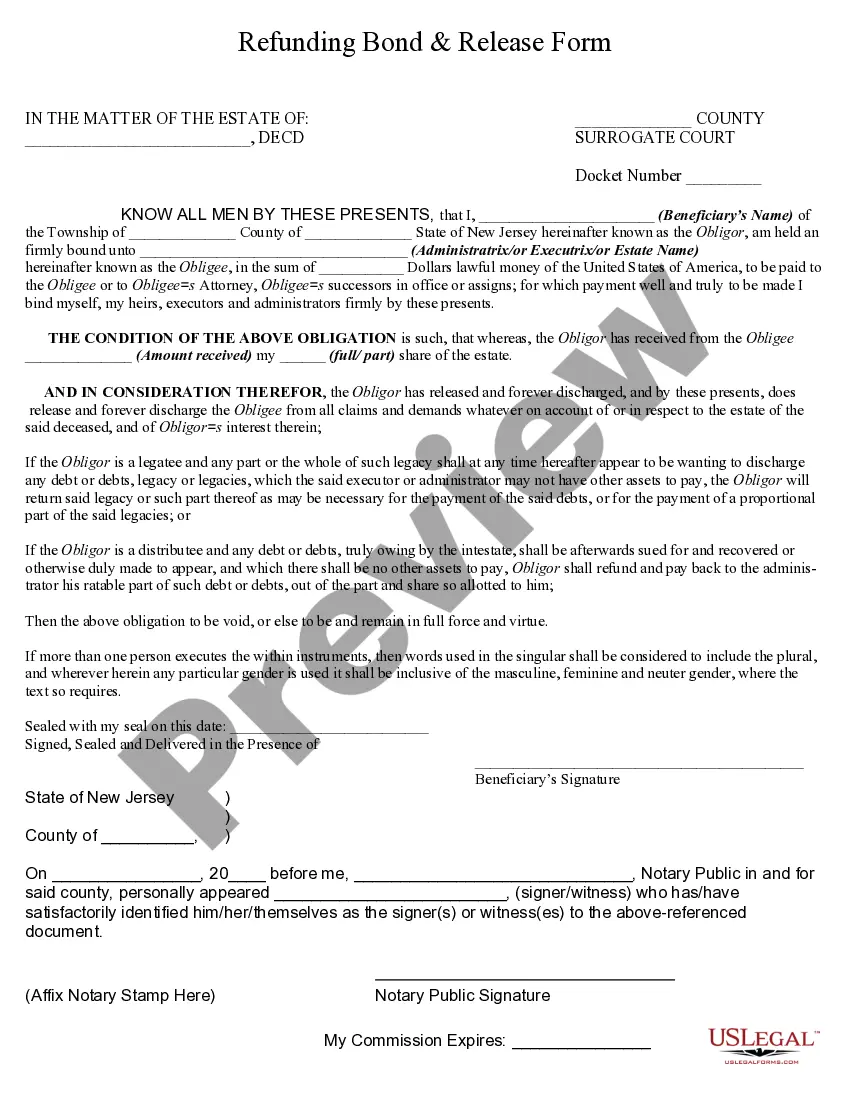

Use this form to discharge estate claims after receiving your share, ensuring protection from future obligations related to the estate.

Probate is essential for settling a deceased person's estate.

Not all assets go through probate, such as joint accounts.

Probate can include both debts and assets.

Documents must often be filed with the probate court.

Probate proceedings vary by state, including New Jersey.

Heirs may contest a will during the probate process.

Timely filing of probate documents is crucial.

Begin the process easily with these straightforward steps.

A trust can offer additional benefits, like avoiding probate, but it's not mandatory.

If you do not prepare a will or trust, state laws will determine asset distribution.

Review your estate plan regularly, especially after major life changes.

Beneficiary designations typically override will instructions, ensuring direct asset transfer.

Yes, you can appoint separate individuals for financial and health care decisions.