New Jersey Heirship Affidavit - Descent

Understanding this form

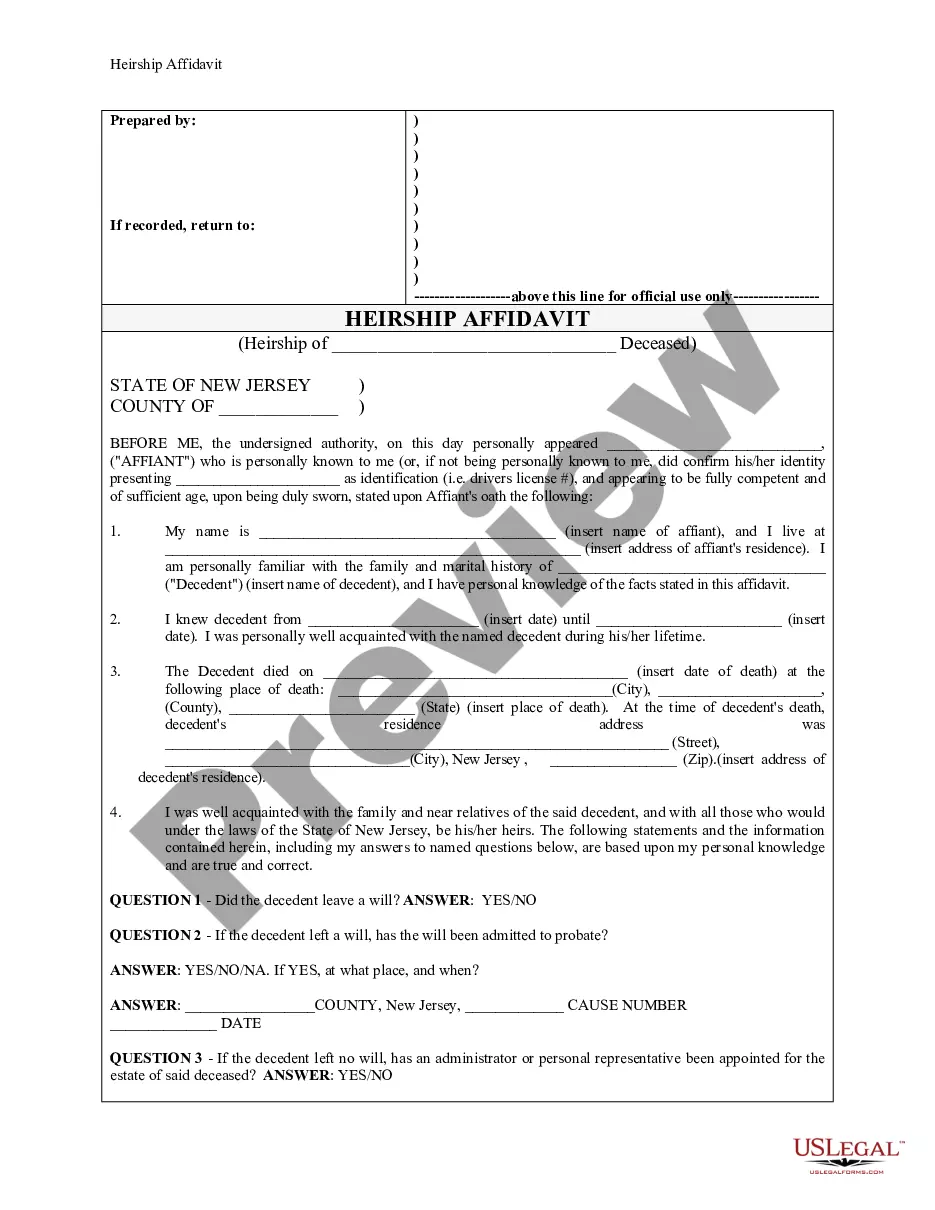

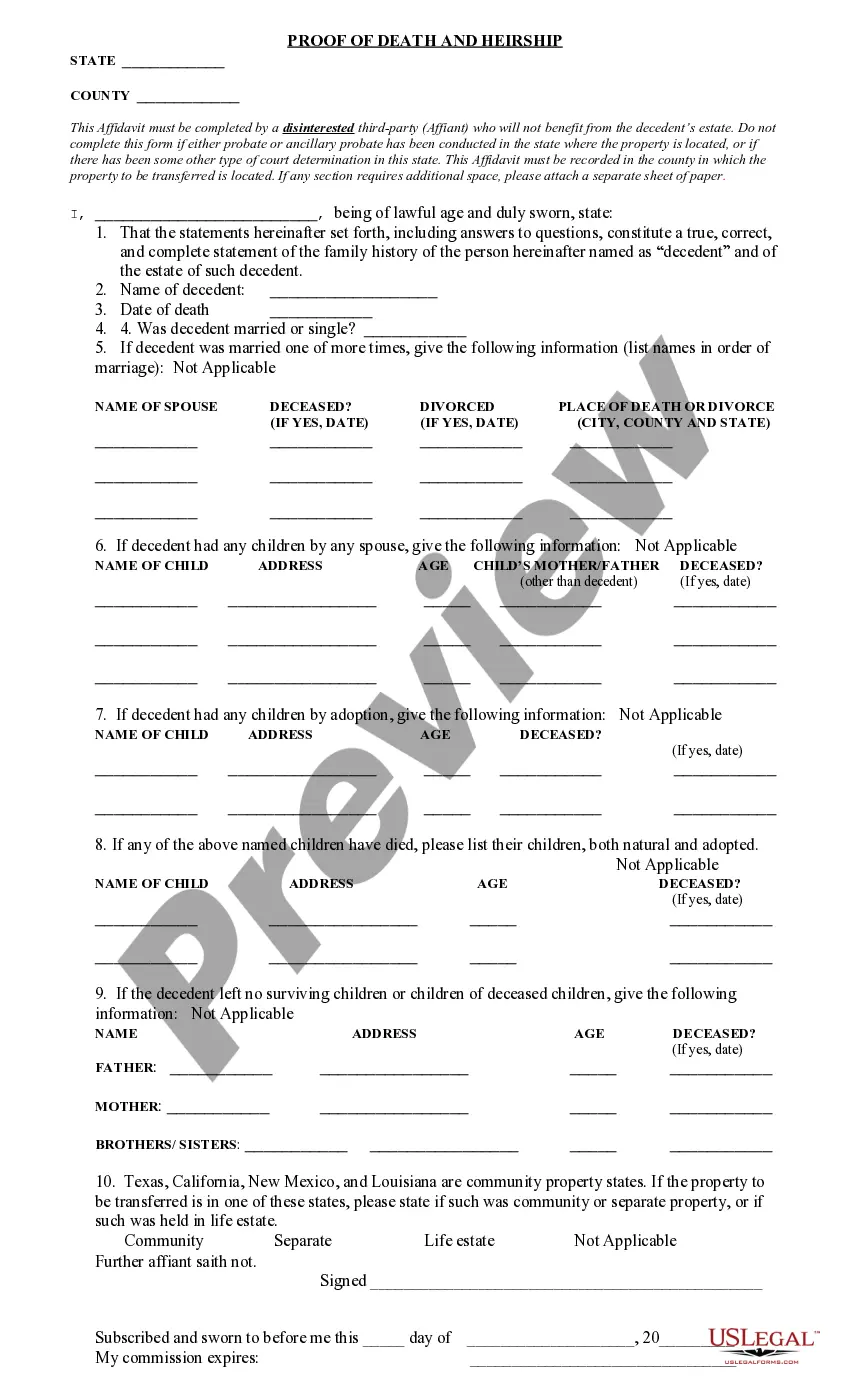

The Heirship Affidavit - Descent is a legal document used to declare the heirs of a deceased individual. The primary purpose of this form is to establish the rightful ownership of personal and real property when someone dies without a will. It differs from a will as it does not determine how assets should be distributed, but rather clarifies who the lawful heirs are, allowing them to claim the deceased's property.

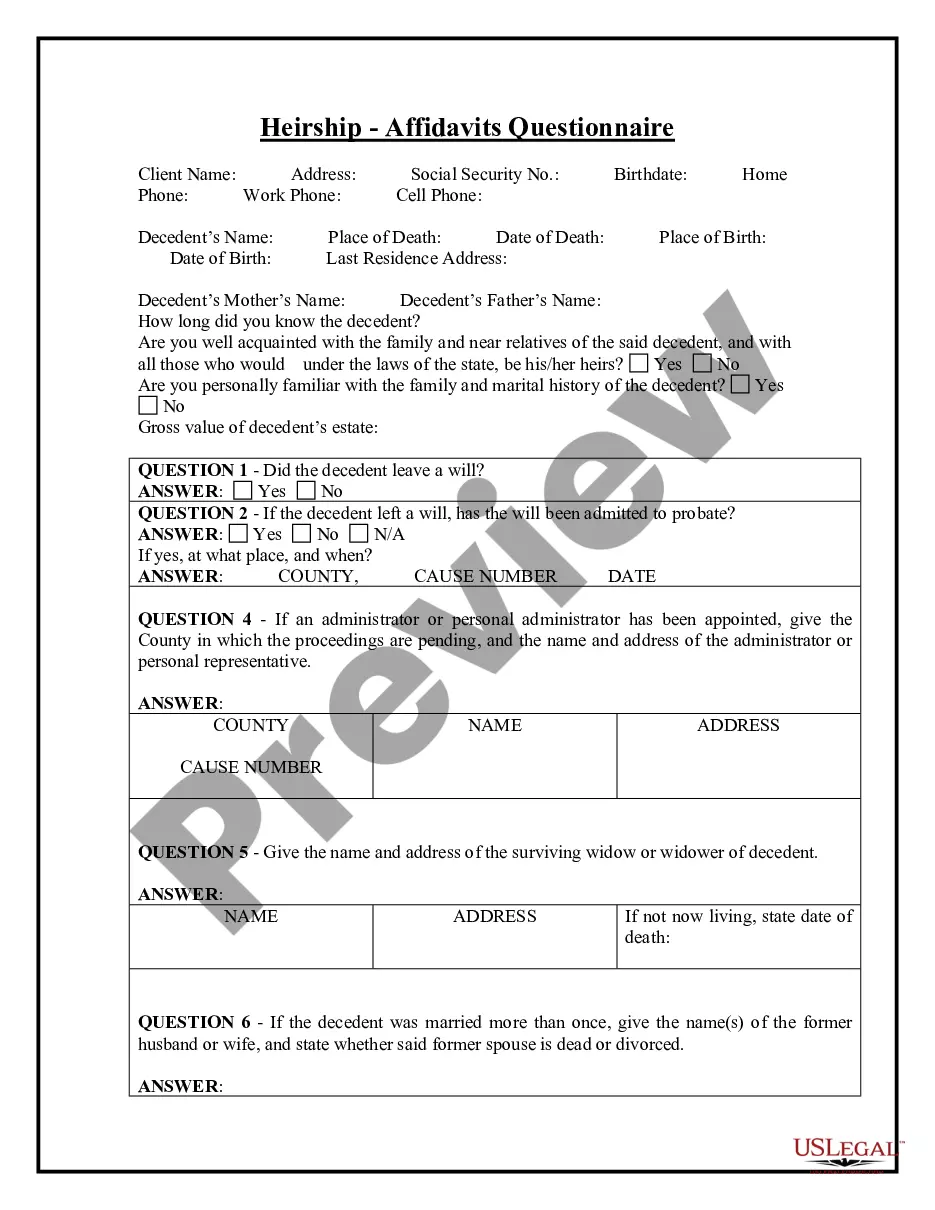

Key parts of this document

- The affiant's details, including name and address.

- Information about the deceased, such as their name and date of death.

- Questions regarding the existence of a will and probate proceedings.

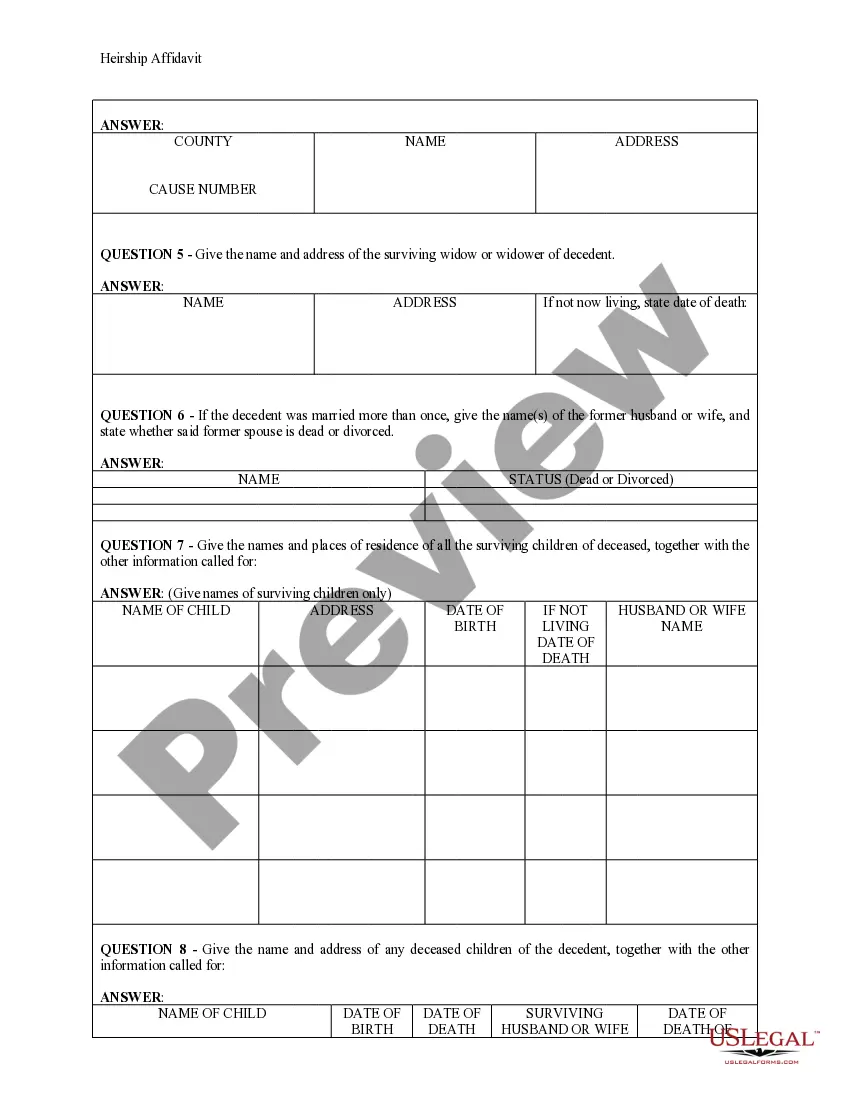

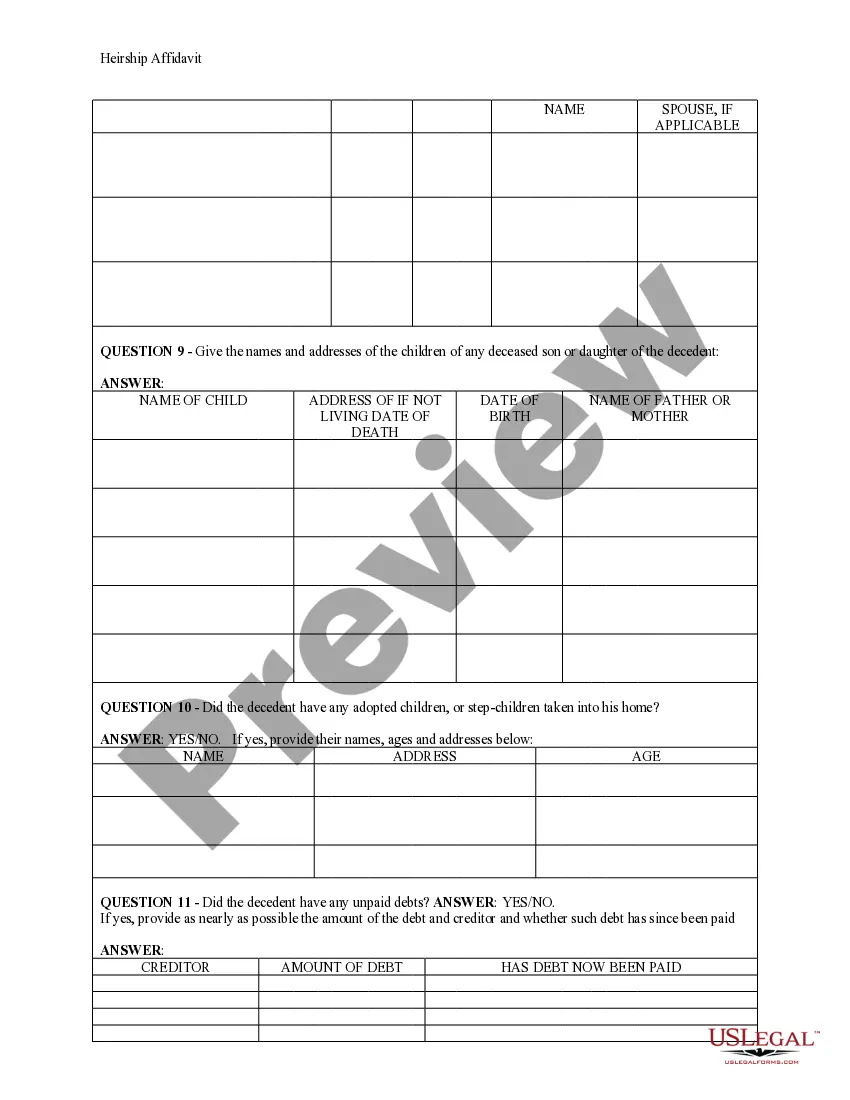

- Details of surviving family members, including children and spouse.

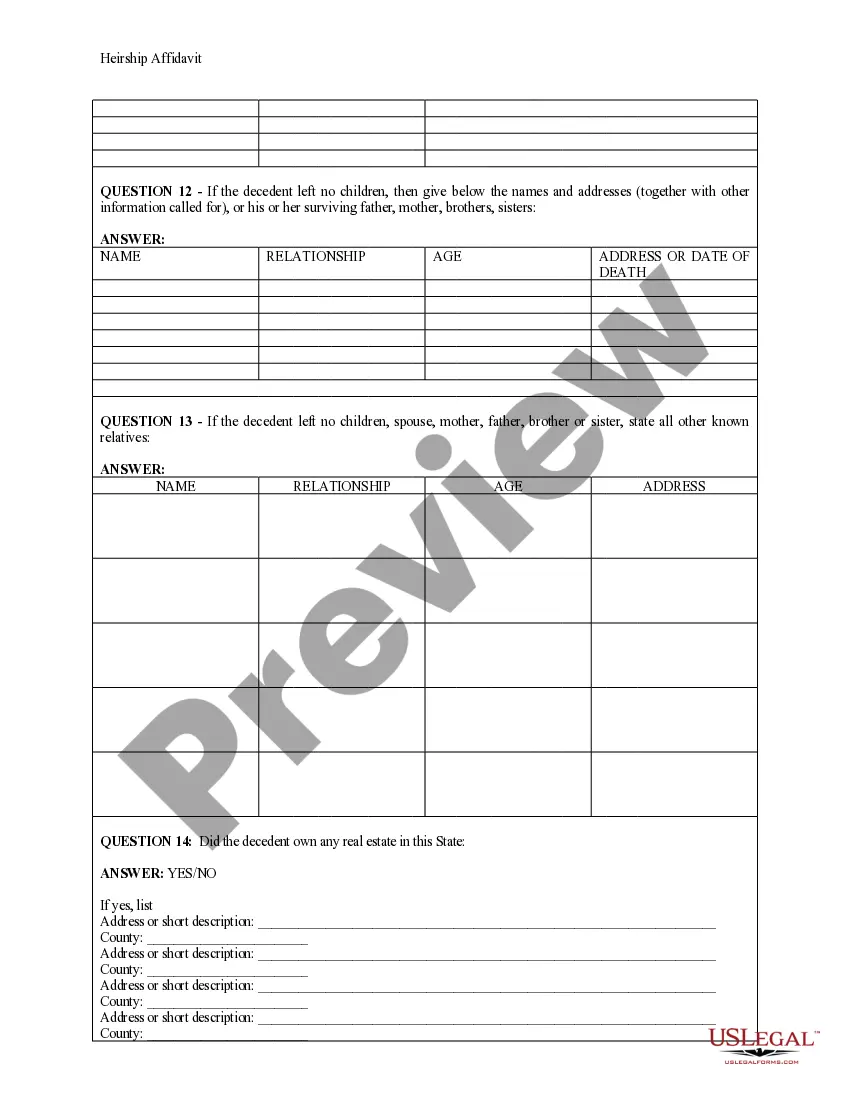

- Information on any real estate owned by the deceased.

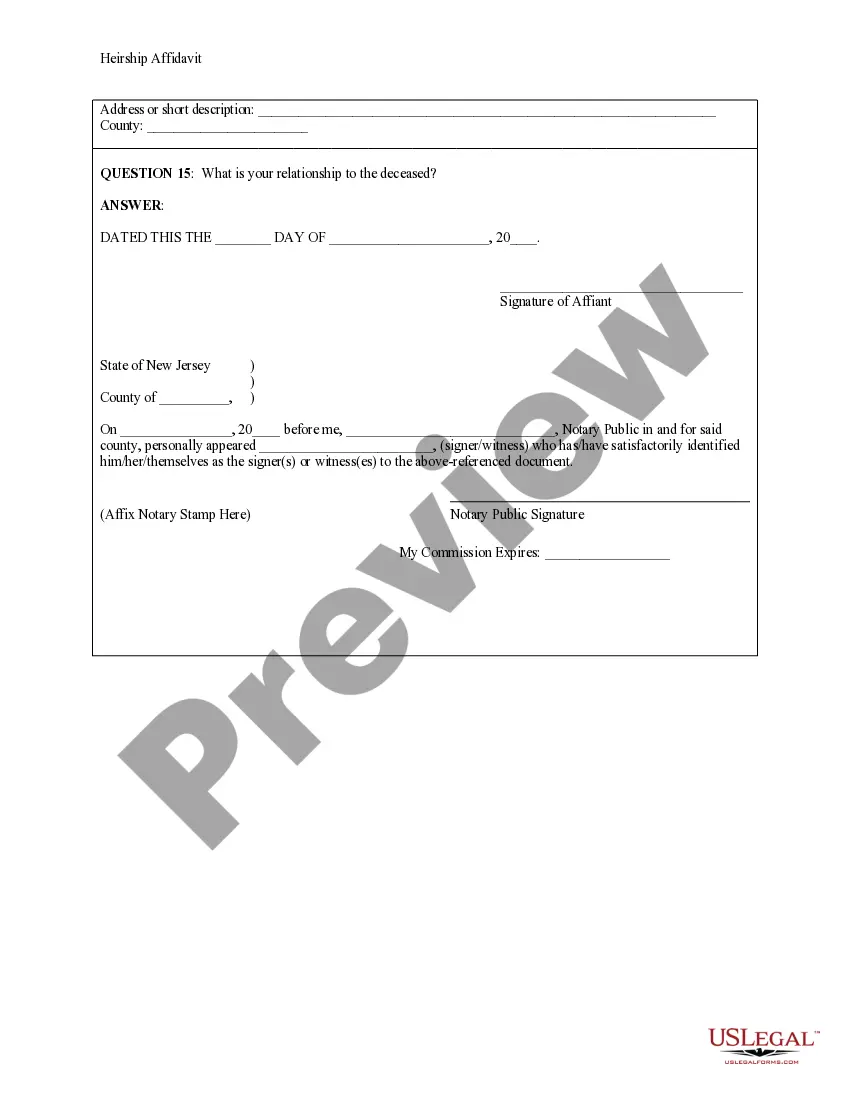

- Affiant's signature and notary public confirmation.

When to use this document

You should use the Heirship Affidavit when a person passes away without leaving behind a will, and you need to establish who their legal heirs are. This may be necessary in various situations, such as when a family member is selling inherited property or settling the decedent's estate. If you are an heir but no formal estate process has been initiated, this affidavit is crucial for clarifying your relationship to the deceased and asserting your rights to their property.

Who this form is for

- Individuals who are heirs to a deceased person's estate.

- People assisting heirs in establishing their rights to property.

- Estate representatives needing to prove heirship in property transactions.

- Anyone involved in settling the affairs of a deceased person who died intestate (without a will).

How to prepare this document

- Identify the affiant and provide their personal information, including name and address.

- Fill in the details about the deceased, including their name and date of death.

- Answer the questions regarding wills, probate, and surviving relatives.

- Include information on any real estate owned by the decedent.

- Have the affiant sign the affidavit and get it notarized.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide accurate information about the deceased.

- Not answering all questions included in the affidavit.

- Not having the affidavit notarized if required.

- Using outdated definitions of relationships or legal terms.

Why use this form online

- Convenience of downloading from anywhere at any time.

- Easy to edit and customize to meet specific needs.

- Access to templates drafted by licensed attorneys for reliability.

Looking for another form?

Form popularity

FAQ

181. Therefore, under the statute of descent and distribution, next of kin in New Jersey are: Surviving spouse or domestic partner. Descendants.

If you die in New Jersey without having a will, then you have died intestate. This is a legal term that means that you have no will to probate once you are dead. Therefore, since you don't have a will, your estate is distributed according to New Jersey's law of intestacy.

The death certificate and the original deed are the only documents needed to have the deceased's name removed from the deed. File papers in New Jersey probate court to have a deed transferred, in case of a tenancy in common.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If you die in New Jersey without having a will, then you have died intestate. This is a legal term that means that you have no will to probate once you are dead. Therefore, since you don't have a will, your estate is distributed according to New Jersey's law of intestacy.

The law of intestate succession in New Jersey states that: If you die leaving a spouse, a registered domestic partner, or civil union partner and children who are also the children of the spouse or legal partner, the spouse/legal partner receives 100% of the estate and no bond is required to be posted.

The law of intestate succession in New Jersey states that: If you die leaving a spouse, a registered domestic partner, or civil union partner and children who are also the children of the spouse or legal partner, the spouse/legal partner receives 100% of the estate and no bond is required to be posted.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.