What is Probate?

Probate is the legal process for settling an estate after someone passes away. It involves validating wills, distributing assets, and ensuring debts are paid. Explore state-specific templates for your needs.

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and easy to use.

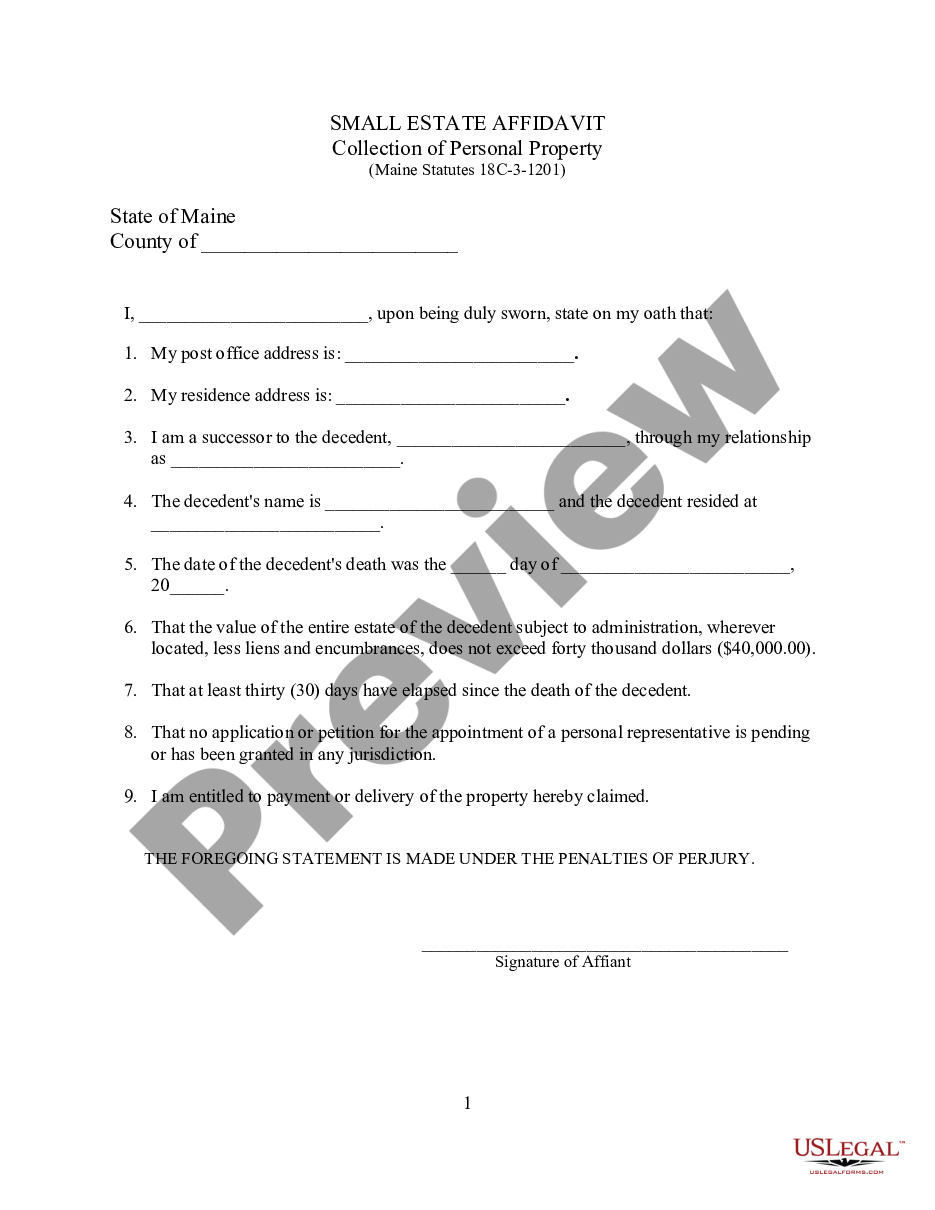

Easily claim property from a deceased person's estate valued under $40,000 without complicated probate processes.

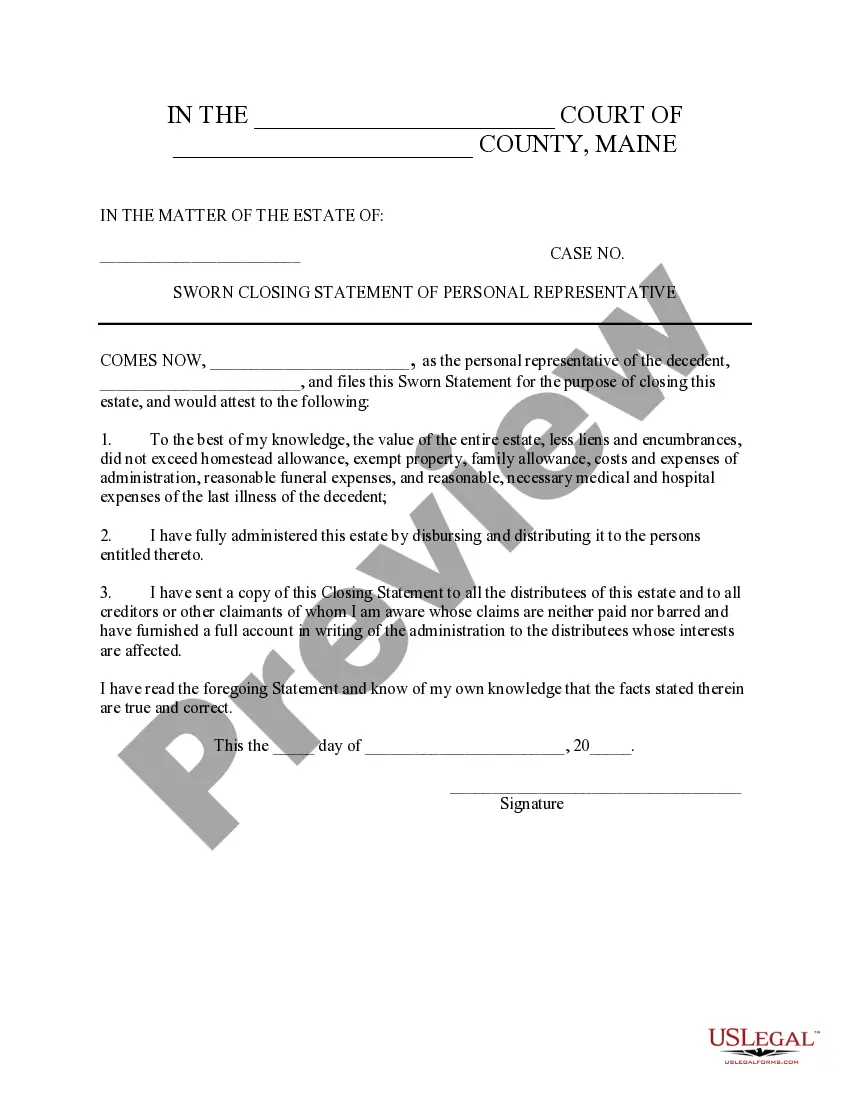

Ideal for personal representatives, this statement helps finalize small estates by confirming the distribution of assets and settling any outstanding claims.

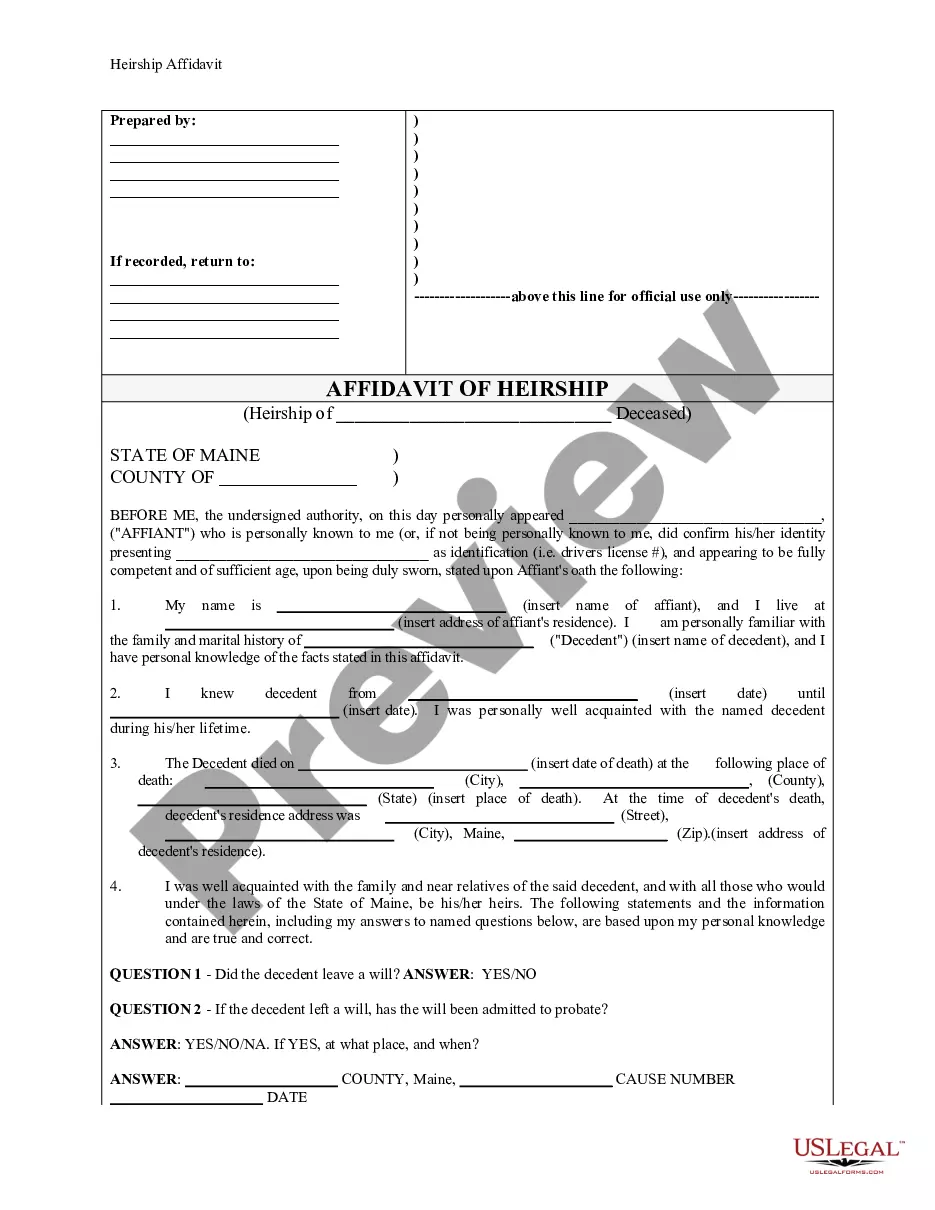

Clarify inheritance and estate claims with this affidavit used to affirm heirs' identities and relationships to a deceased person.

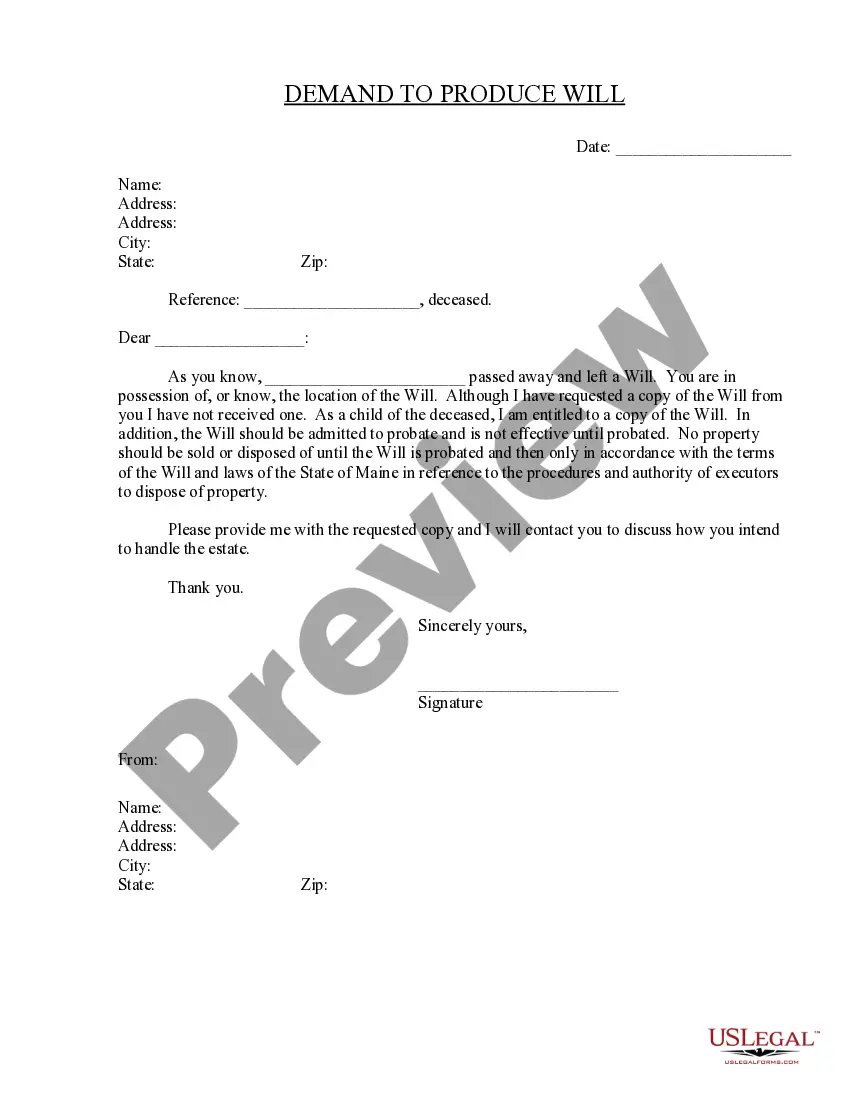

Request a copy of a deceased person's will to ensure property is handled according to their wishes.

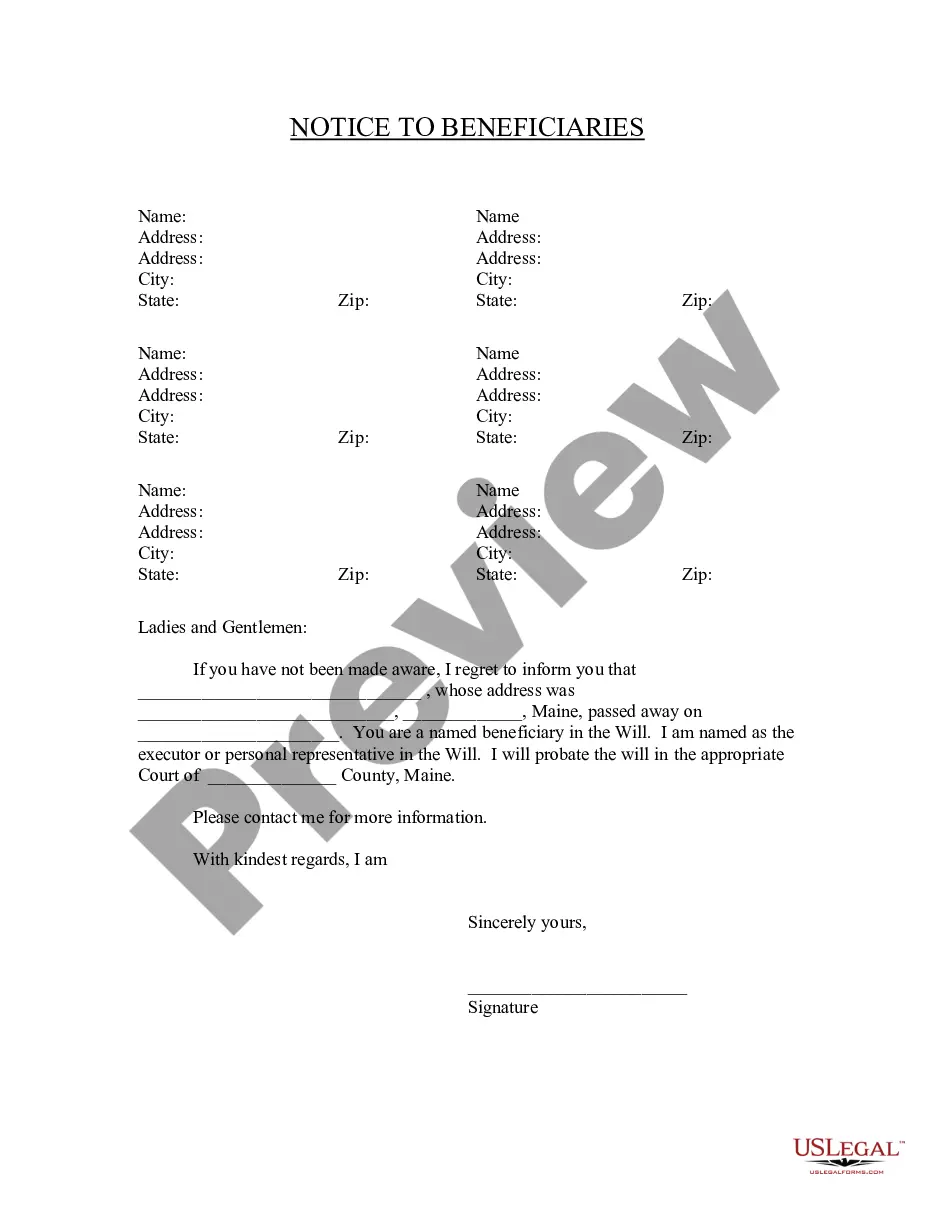

Notify named beneficiaries about their status in a deceased's will and the probate process.

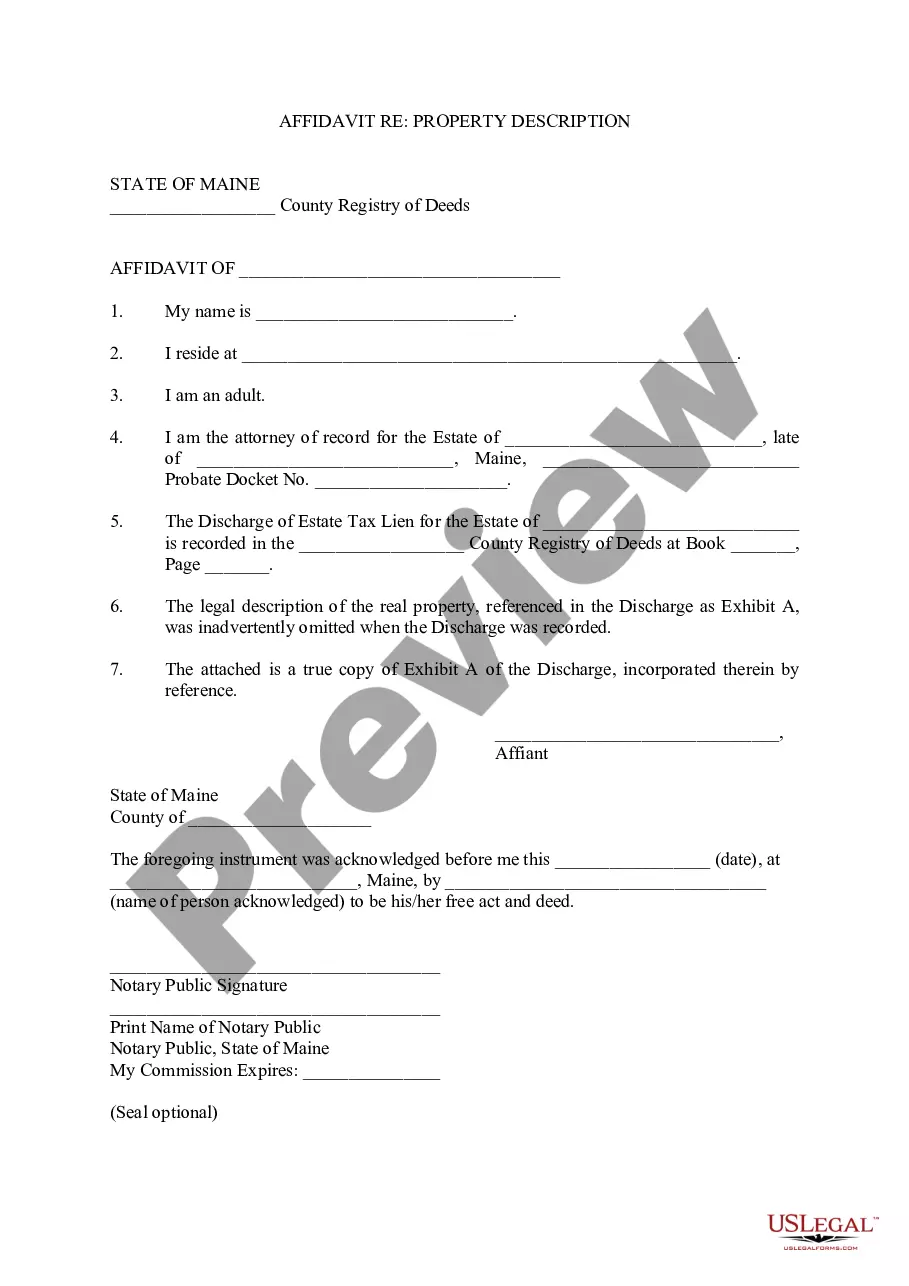

Use this affidavit to officially add a legal property description that was omitted from a recorded discharge, ensuring clear ownership documentation.

Accepting a guardianship role requires this form to confirm your commitment and responsibility towards the individual's care.

Use this document to appoint a guardian ad litem for minors, ensuring their best interests are represented in legal proceedings.

Probate is necessary for asset distribution if a will exists.

Not all assets go through probate, such as joint accounts.

Executors must follow legal procedures for estate management.

Debts must be settled before distributing assets to heirs.

Probate can be contested if heirs dispute the will's validity.

Begin the process with these simple steps.

A trust can help manage assets during life and avoid probate.

If no plan is in place, state laws determine asset distribution.

Review your plan regularly, especially after major life changes.

Beneficiary designations may override will instructions for specific assets.

Yes, you can appoint different agents for financial and medical decisions.