What is Probate?

Probate is the legal process for distributing a deceased person's assets. It involves various documents to ensure proper estate management. Explore our templates tailored for Alabama.

Probate involves managing a deceased person's estate. Our attorney-drafted templates are quick and easy to complete.

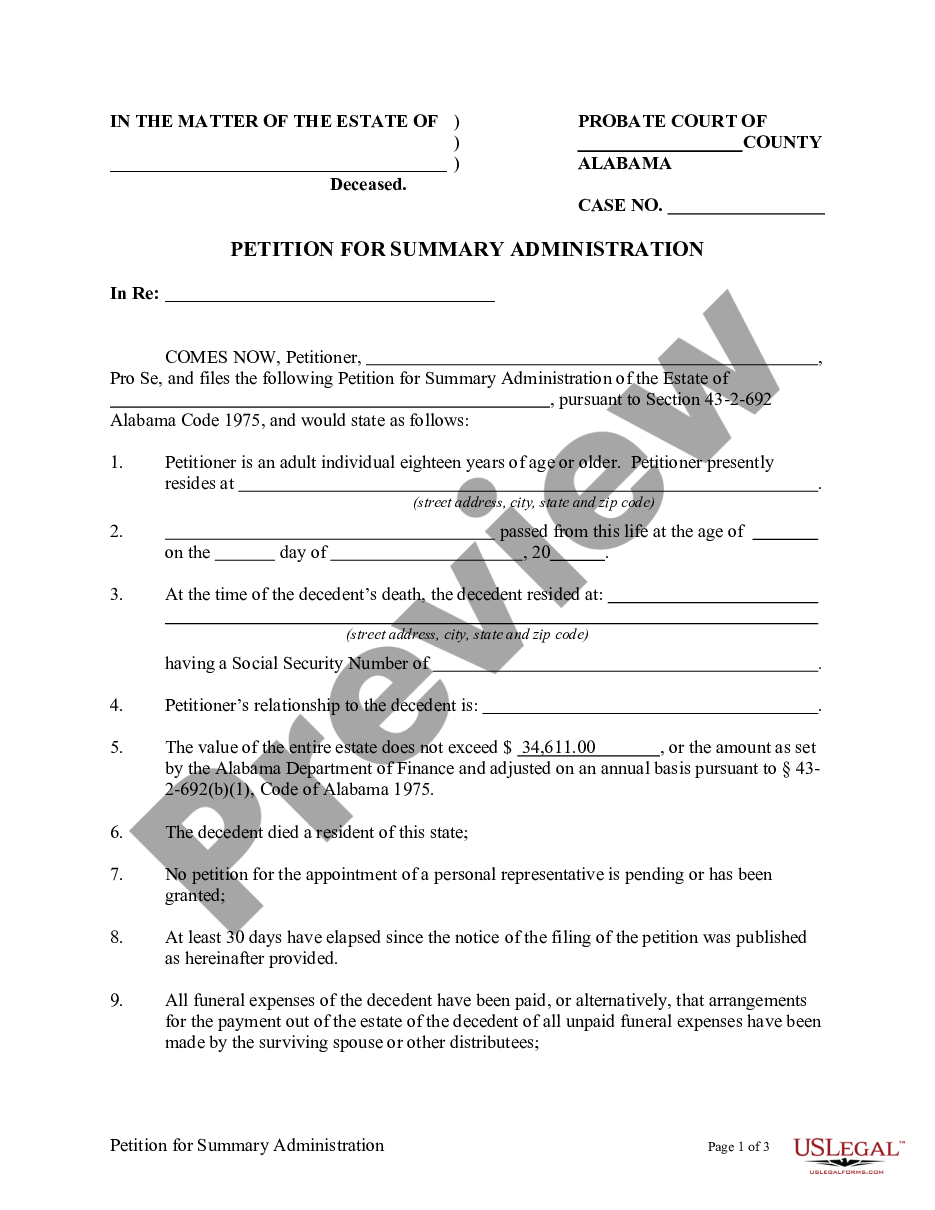

Use this form to initiate a simplified estate administration for estates valued under $37,050, streamlining the process for small estates.

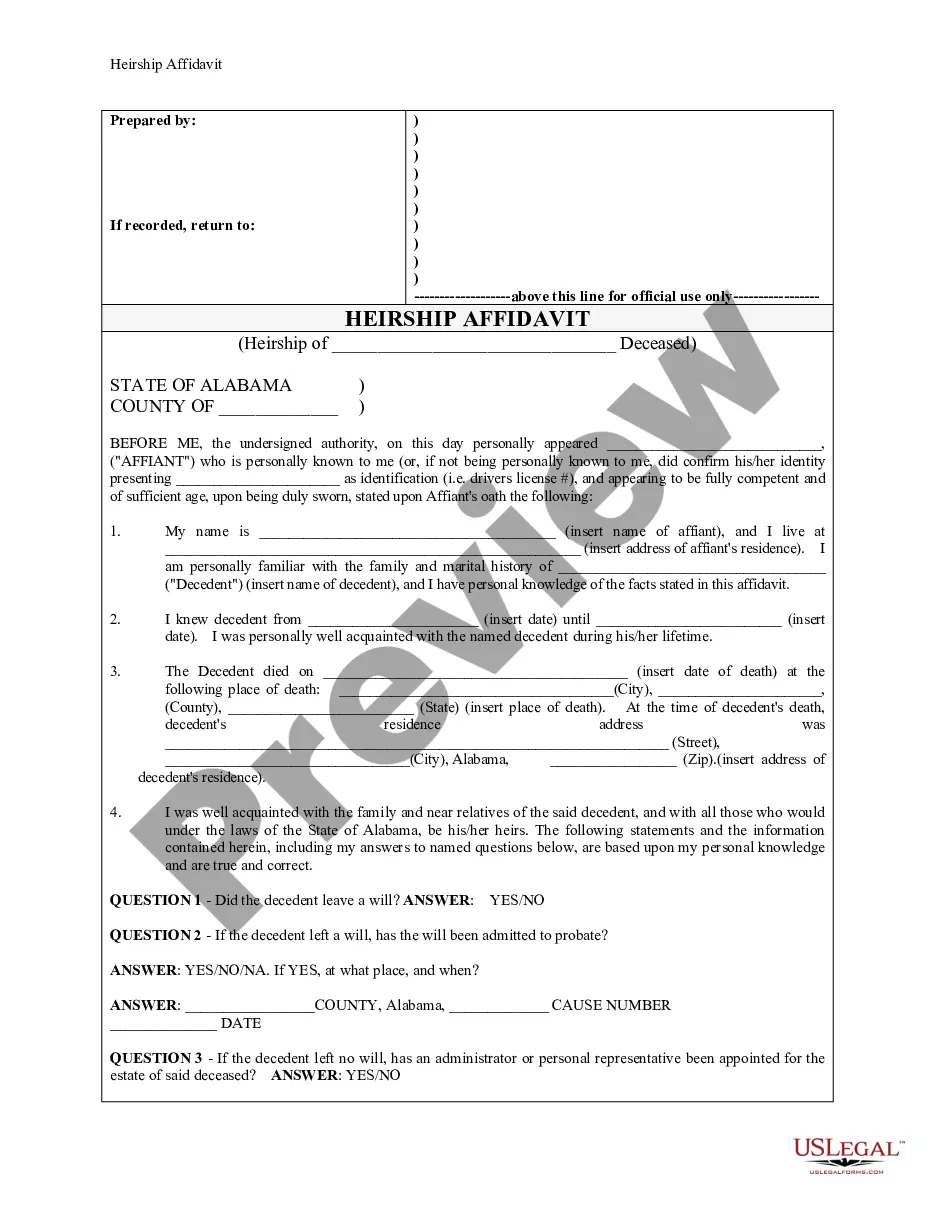

A key document for establishing heirship and succession rights after a death, especially when no will exists.

Find everything you need for estate administration in one package, including multiple essential legal forms tailored for your state's requirements.

This package provides multiple legal forms to assist with the probate of a will, ensuring everything you need is in one convenient place.

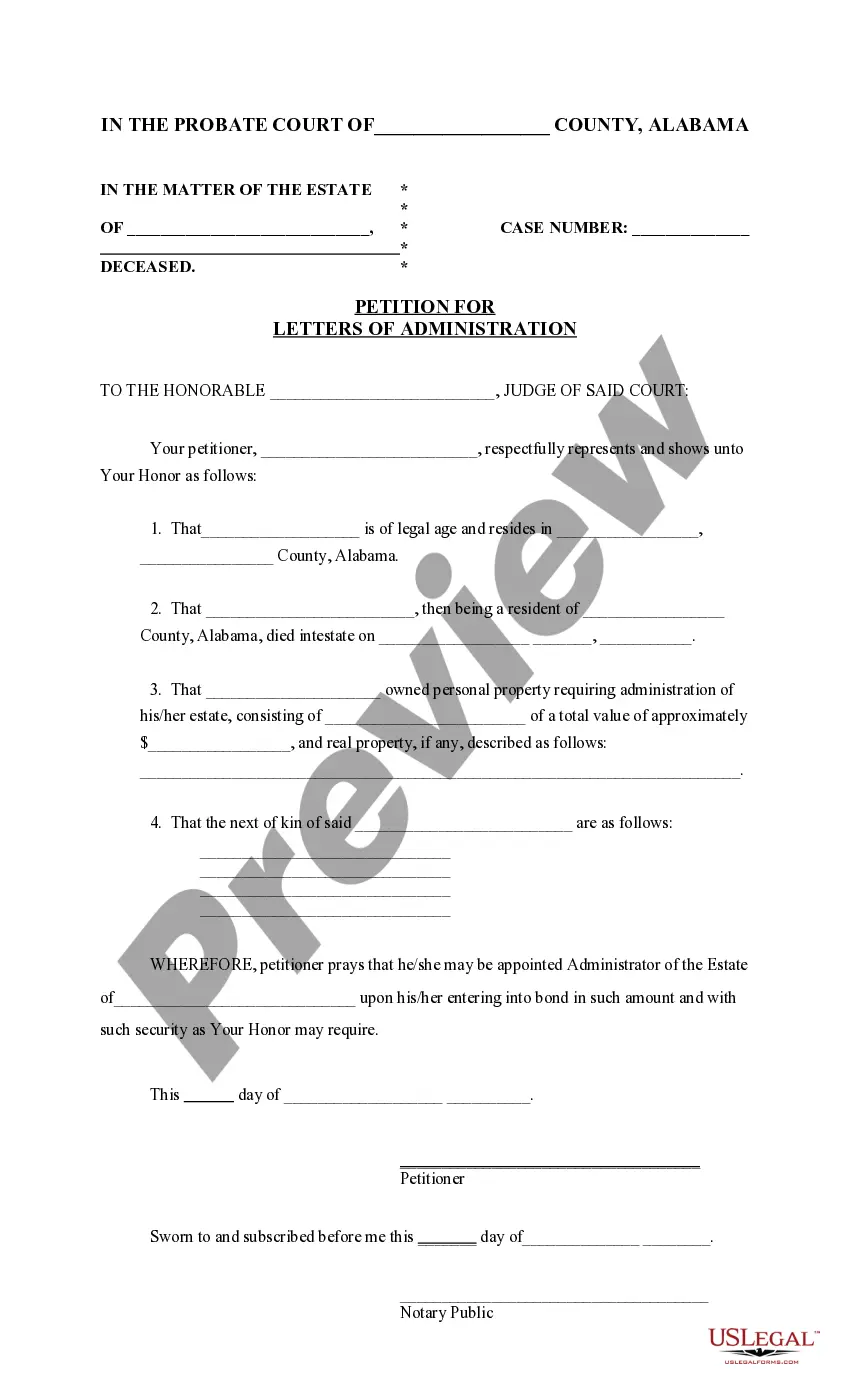

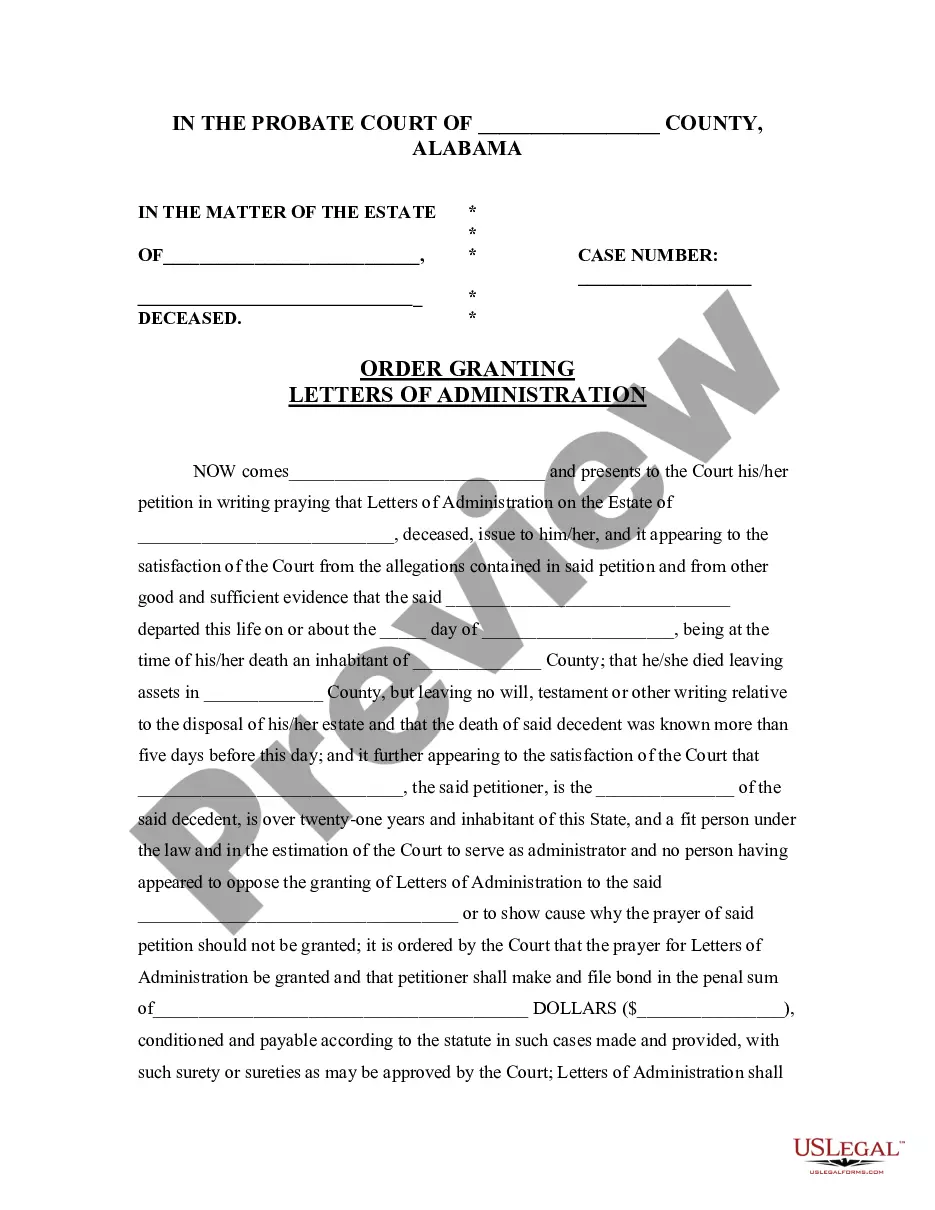

Navigate the estate administration process with this petition, essential for appointing an administrator when a person dies without a will.

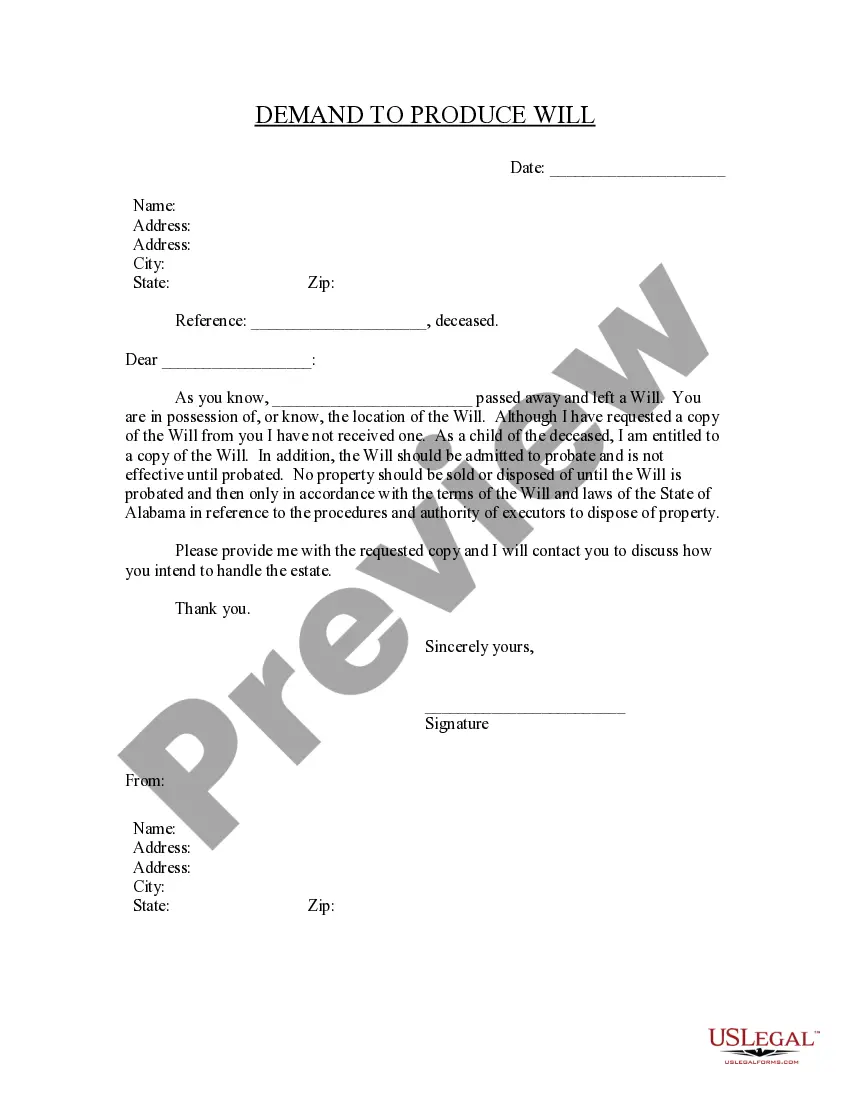

Request a copy of a deceased person's will to ensure your rights as an heir are respected during estate administration.

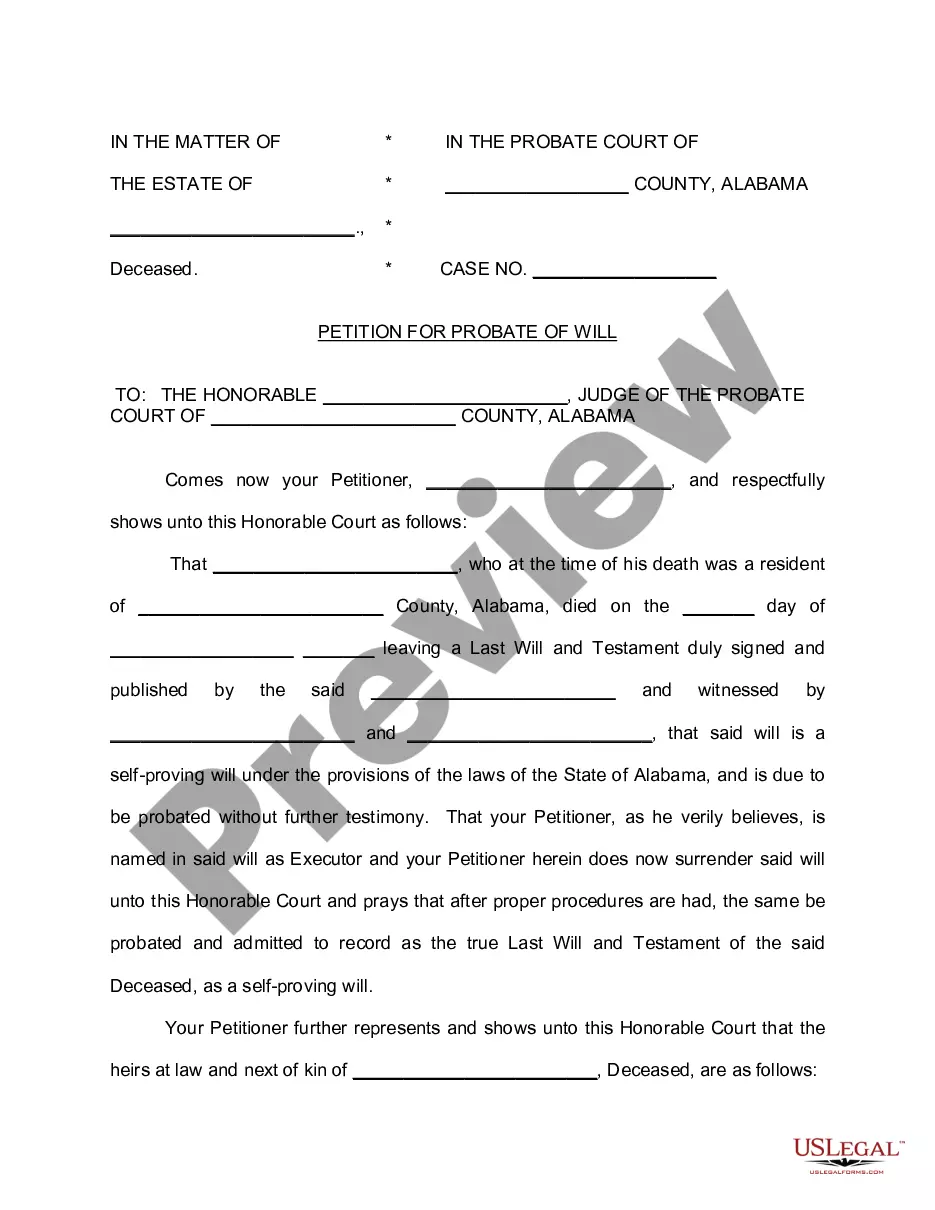

Initiate the probate process for a deceased person's will, ensuring it is legally recognized in court.

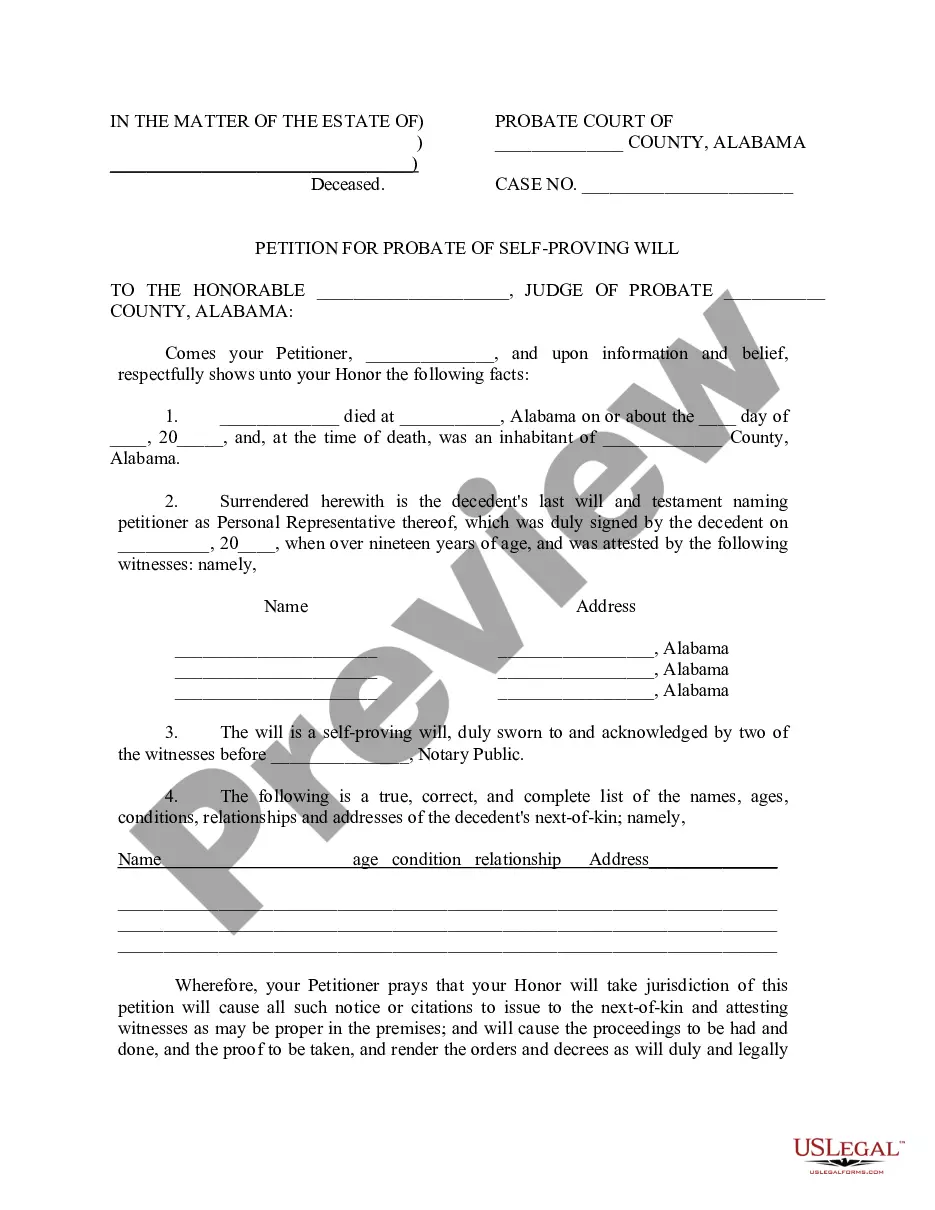

File this petition to quickly probate a self-proving will, streamlining the legal process for estates in Alabama.

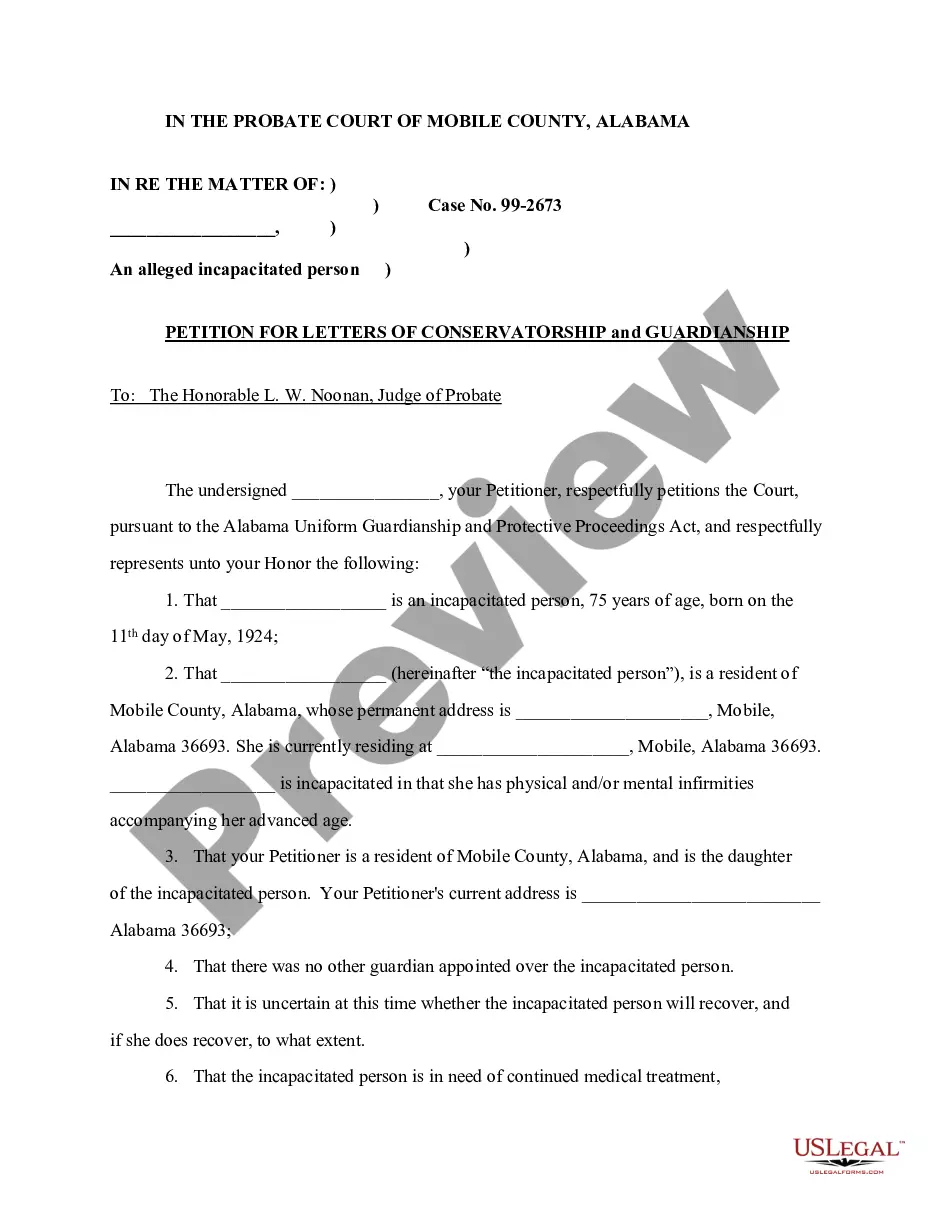

Use this petition to request legal authority to manage the affairs of someone unable to do so due to incapacity.

Secure legal authority to manage an estate when someone dies without a will. Essential for settling debts and distributing assets.

Probate is necessary to settle a deceased person's estate.

Some assets may not require probate, such as jointly owned property.

Probate can take several months to complete.

Not all estates are subject to probate; it depends on asset types.

Documents often need notarization or witness signatures.

Beneficiaries may challenge the validity of a will during probate.

Executor responsibilities include managing debts and distributing assets.

Begin your probate process easily with these steps.

A trust can help manage assets during your lifetime and avoid probate, while a will distributes assets after death.

If you leave no plan, state laws will determine how your assets are distributed.

Review your plan regularly, especially after major life changes, like marriage or having children.

Beneficiary designations for accounts may override your will, so ensure they match your overall plan.

Yes, you can designate separate agents for financial and health care decisions in your advance directives.