What is Power of Attorney?

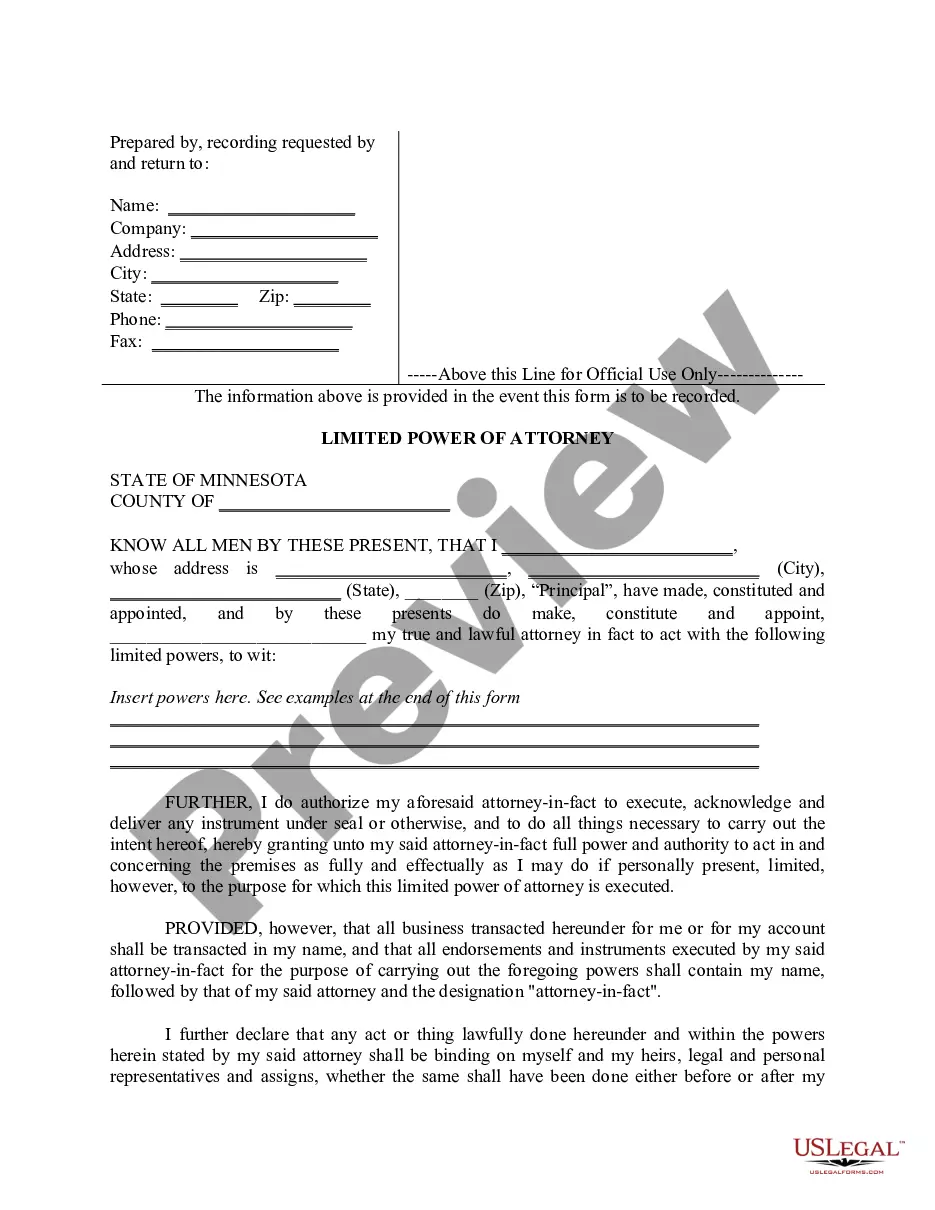

A Power of Attorney allows an individual to appoint someone to manage their affairs. These documents are commonly used when individuals cannot act for themselves. Explore our state-specific templates for your needs.

Power of Attorney documents let someone act on your behalf. Our attorney-drafted templates are quick and easy to complete.

Prepare for later life with essential legal forms, providing peace of mind and organization for health and financial matters all in one package.

Prepare for health and financial decisions with multiple related legal forms in one convenient package.

Secure parental authority for your child’s care and custody through a designated representative in specific situations.

Authorize someone to manage your financial affairs, even if you become incapacitated, with this versatile durable power of attorney.

Ensure your medical treatment decisions are honored with multiple related legal forms conveniently in one package.

Designate someone to manage your bank accounts, especially if you become incapacitated. This form provides your agent with the authority to handle your banking needs seamlessly.

Prepare for medical emergencies by designating a health care agent and providing instructions for your treatment preferences.

Empower someone to handle the sale of real estate, ensuring all necessary transactions are completed smoothly and legally.

Authorize someone to manage the sale of a vehicle on your behalf, ensuring a smooth transfer process.

Grant specific powers to someone to act on your behalf in financial matters.

Power of Attorney documents can provide peace of mind and clarity.

They can be tailored to different needs and situations.

The appointed agent, or attorney-in-fact, acts in your best interest.

Many documents require notarization or witnessing.

Powers can be limited or broad, depending on your preferences.

Incapacitation does not affect Durable Power of Attorney.

Understanding the differences between document types is essential.

Begin the process with these simple steps.

A trust and a will serve different purposes; both can be beneficial.

If no Power of Attorney is established, decisions may default to state laws.

Review your Power of Attorney regularly, especially after major life events.

Beneficiary designations can bypass your estate plan but should align with it.

Yes, you can designate separate agents for financial and healthcare matters.