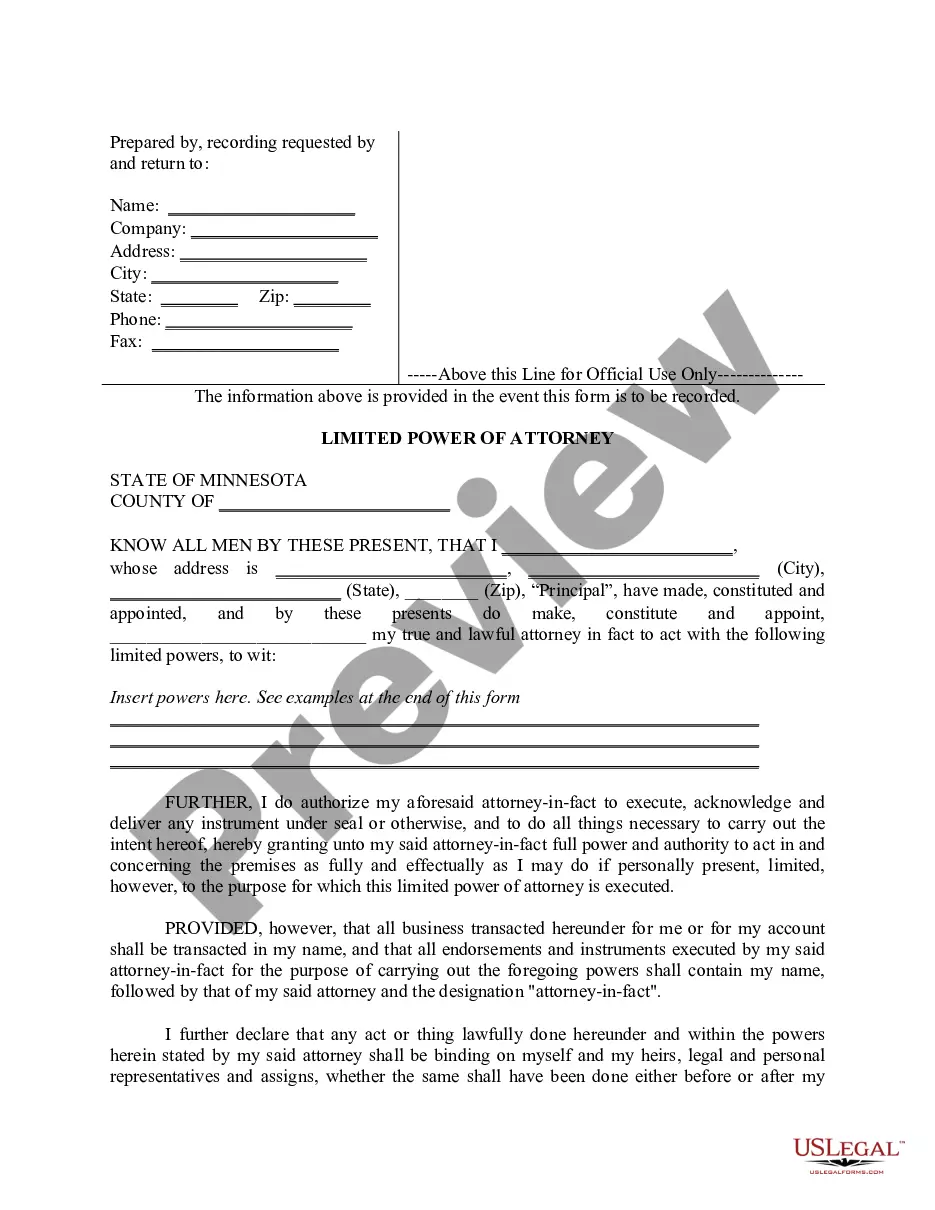

Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Minnesota Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Obtain any version from 85,000 lawful documents including Minnesota Limited Power of Attorney where you Define Powers with Sample Powers Provided online with US Legal Forms.

Each template is crafted and revised by state-licensed lawyers.

If you possess a subscription, Log In. When on the form's page, click the Download button and navigate to My documents to gain access to it.

With US Legal Forms, you will consistently have immediate access to the suitable downloadable sample. The platform provides you with forms and categorizes them for easier searching. Utilize US Legal Forms to acquire your Minnesota Limited Power of Attorney where you Define Powers with Sample Powers Provided quickly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Limited Power of Attorney where you Define Powers with Sample Powers Provided you wish to utilize.

- Examine the description and preview the template.

- When you are certain the sample meets your needs, click Buy Now.

- Select a subscription plan that fits your financial situation.

- Establish a personal account.

- Make payment in one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- Once your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

Yes, a bank can refuse a limited Power of Attorney. They may question the validity or the powers granted if the document does not meet their requirements. To avoid issues, ensure your Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included is clear and properly executed. Consulting US Legal Forms can help you create a document that banks are more likely to accept.

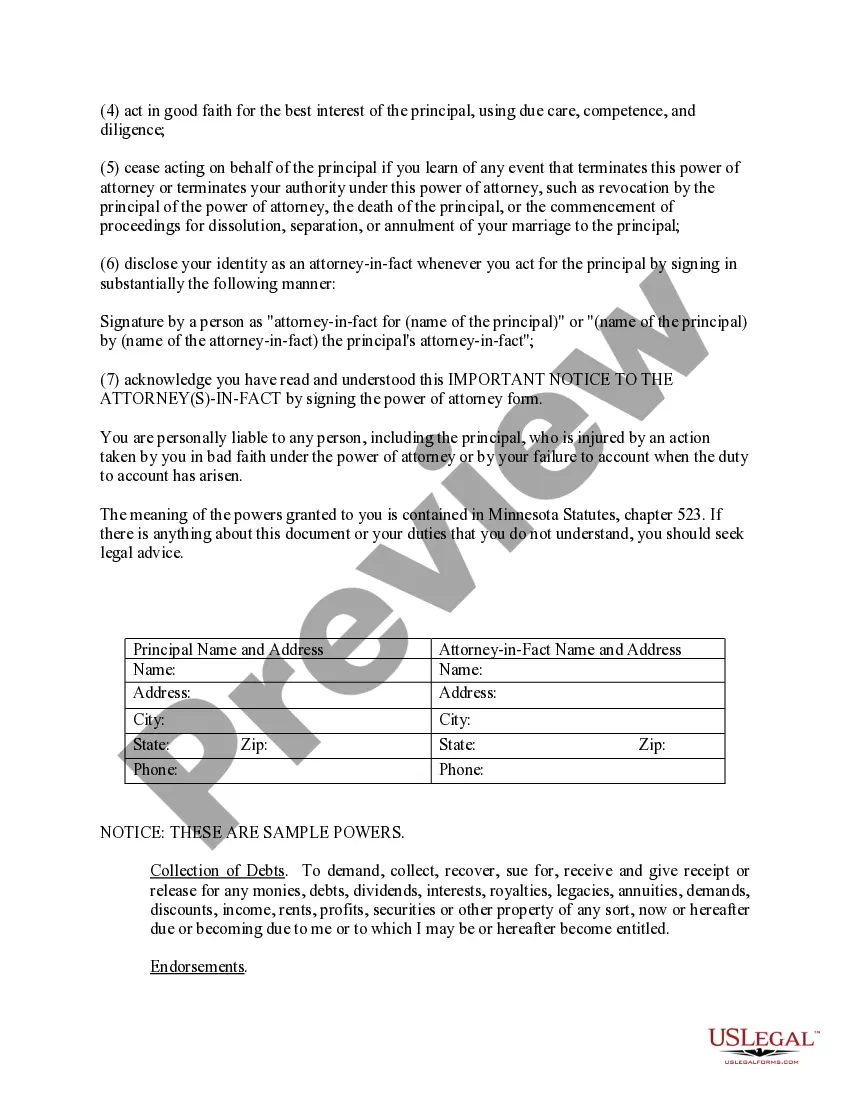

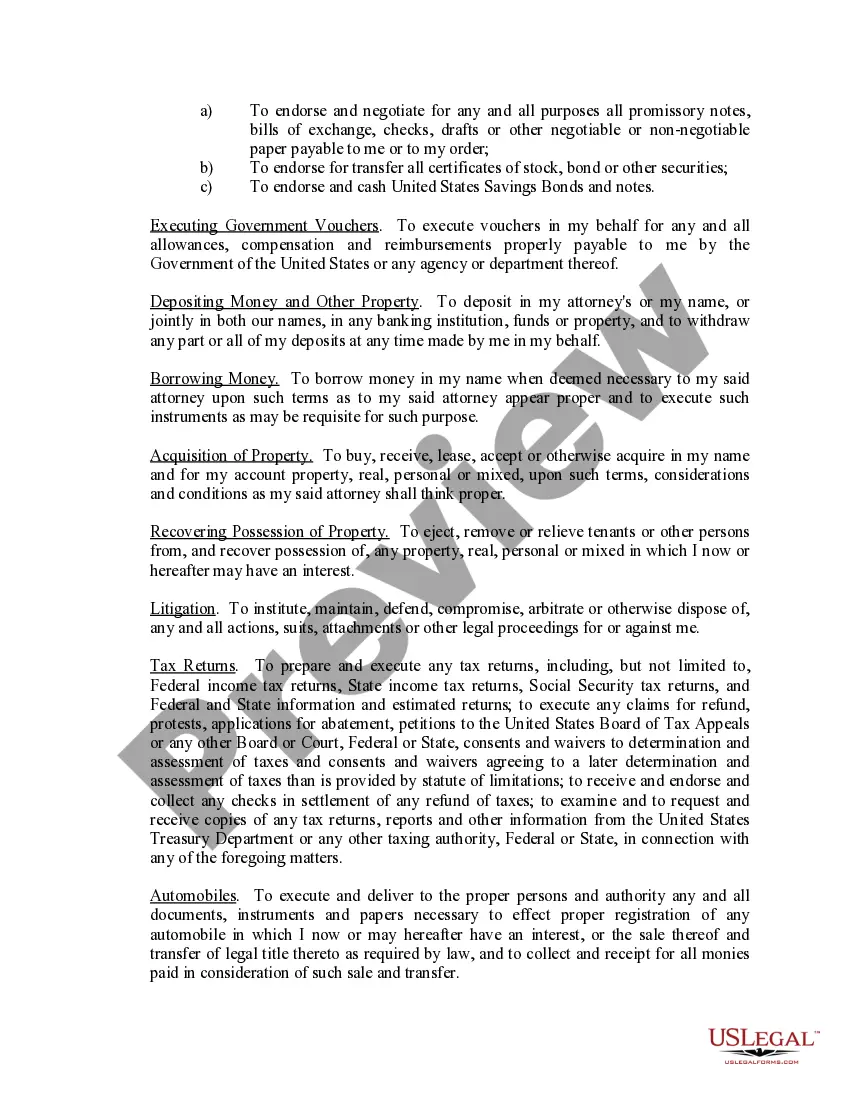

A power of attorney sample is a template that illustrates how to create a Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included. This sample outlines the essential components, such as the principal's name, the agent's name, and the powers granted. Using a sample can guide you in drafting your document accurately and comprehensively.

Filling out a Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included is straightforward. Start by downloading the form from a reliable source like US Legal Forms. Clearly identify the principal, the agent, and the specific powers you wish to grant. Finally, sign and date the document in front of a notary to ensure its legality.

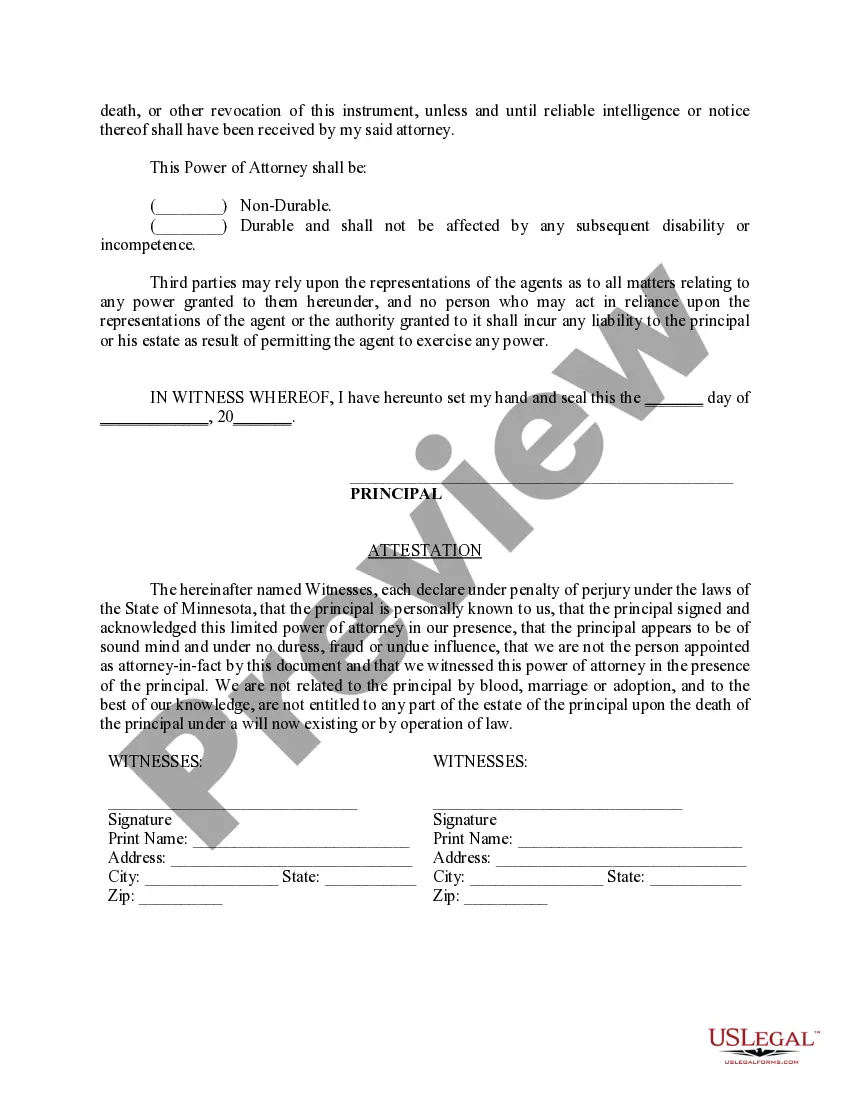

The main difference between a limited power of attorney and a durable power of attorney lies in the duration and scope of authority. A Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included is typically effective for a specific task or timeframe, while a durable power of attorney remains in effect even if the principal becomes incapacitated. This distinction is crucial when deciding which type best fits your needs. Always consider consulting a legal expert or using platforms like uslegalforms to ensure you select the right option.

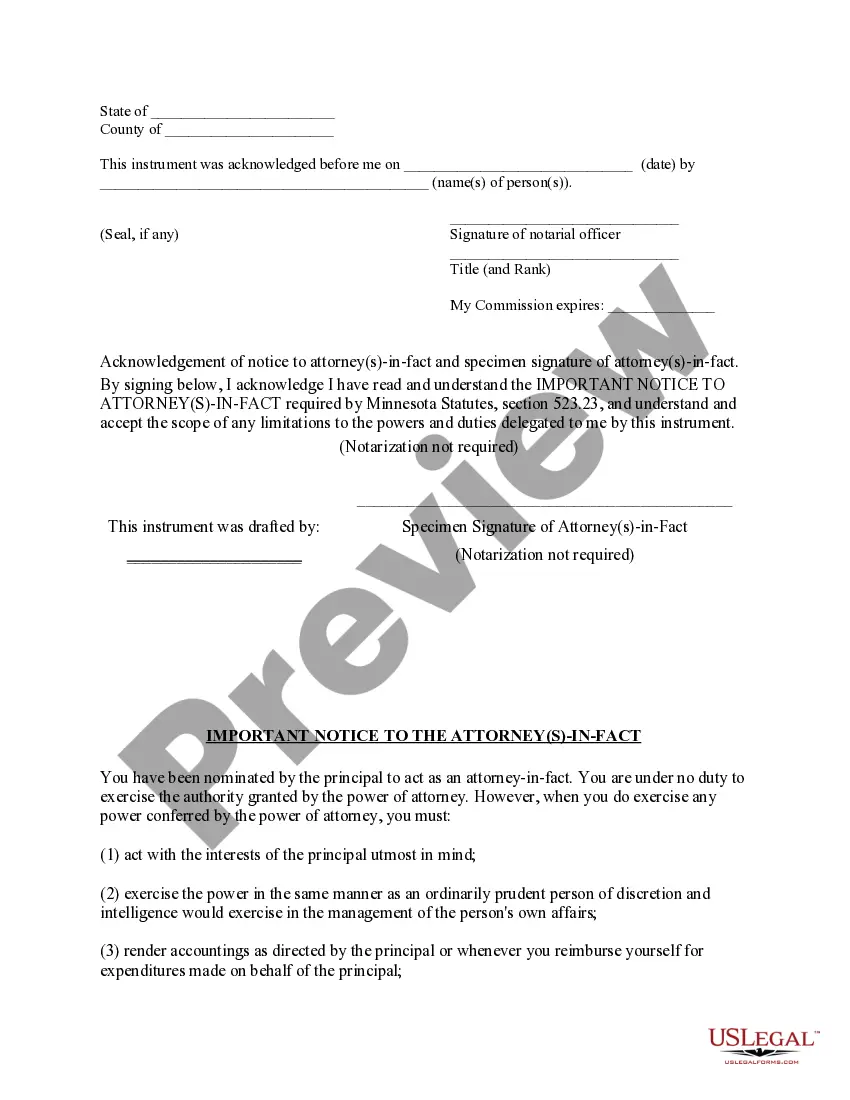

Filling out a Minnesota Limited Power of Attorney where you Specify Powers with Sample Powers Included involves a few key steps. First, you need to clearly identify the principal, the agent, and the specific powers you are granting. Next, make sure to include any limitations or conditions regarding the powers specified. Finally, both parties must sign the document, and it may need to be notarized to ensure its validity.

Under the Minnesota power of attorney statutes, the principal's signature on a Minnesota Power of Attorney document need not be acknowledged before a notary public. However, third parties may require it, and a Minnesota Statutory Short Form Power of Attorney document will look incomplete without such an acknowledgment.

Signature Requirements In all states, the principal must sign the document and have it notarized. Some states also mandate two witnesses to the signature. As of 2018, some 23 states have adopted the Uniform Power of Attorney Act, which requires neither witnesses nor the agent's signature.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.