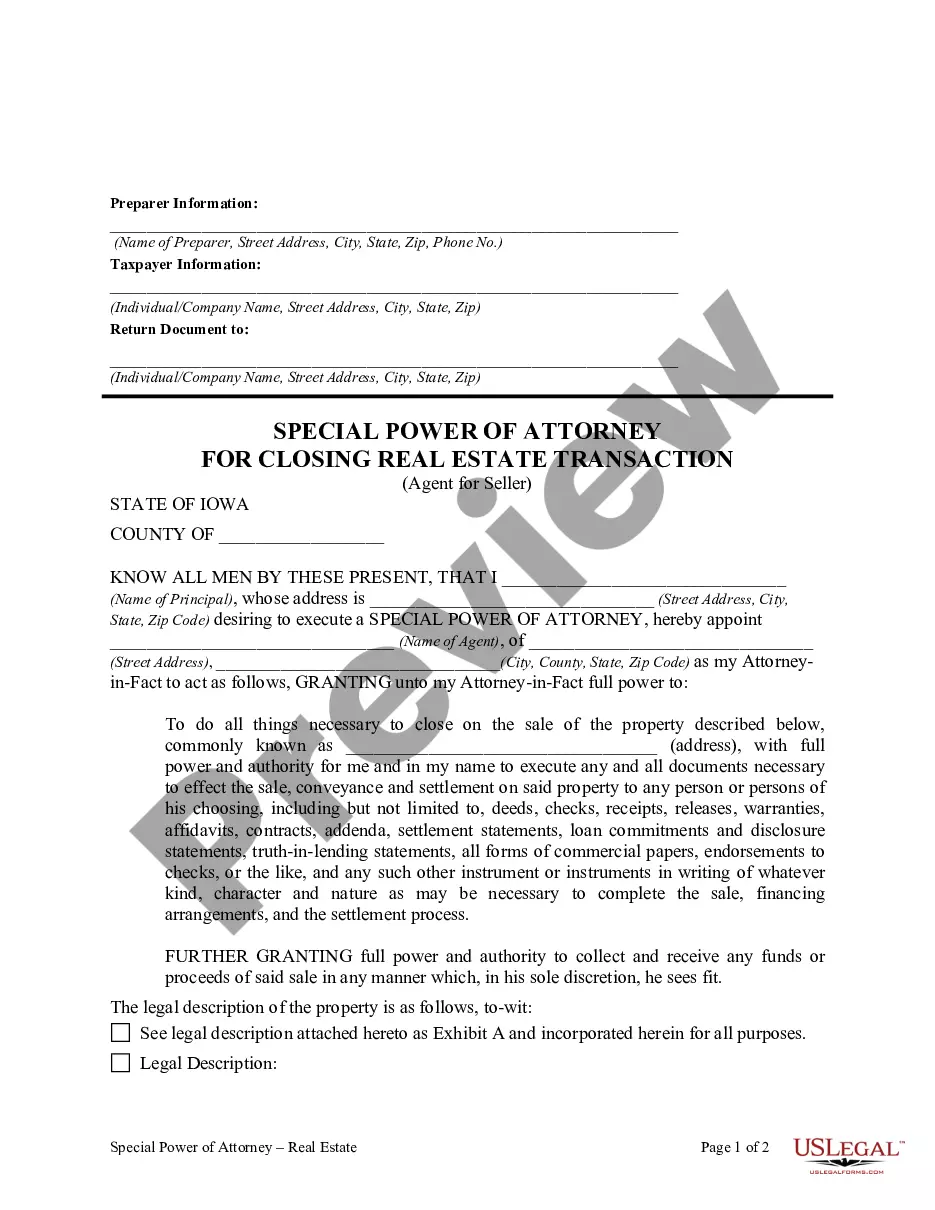

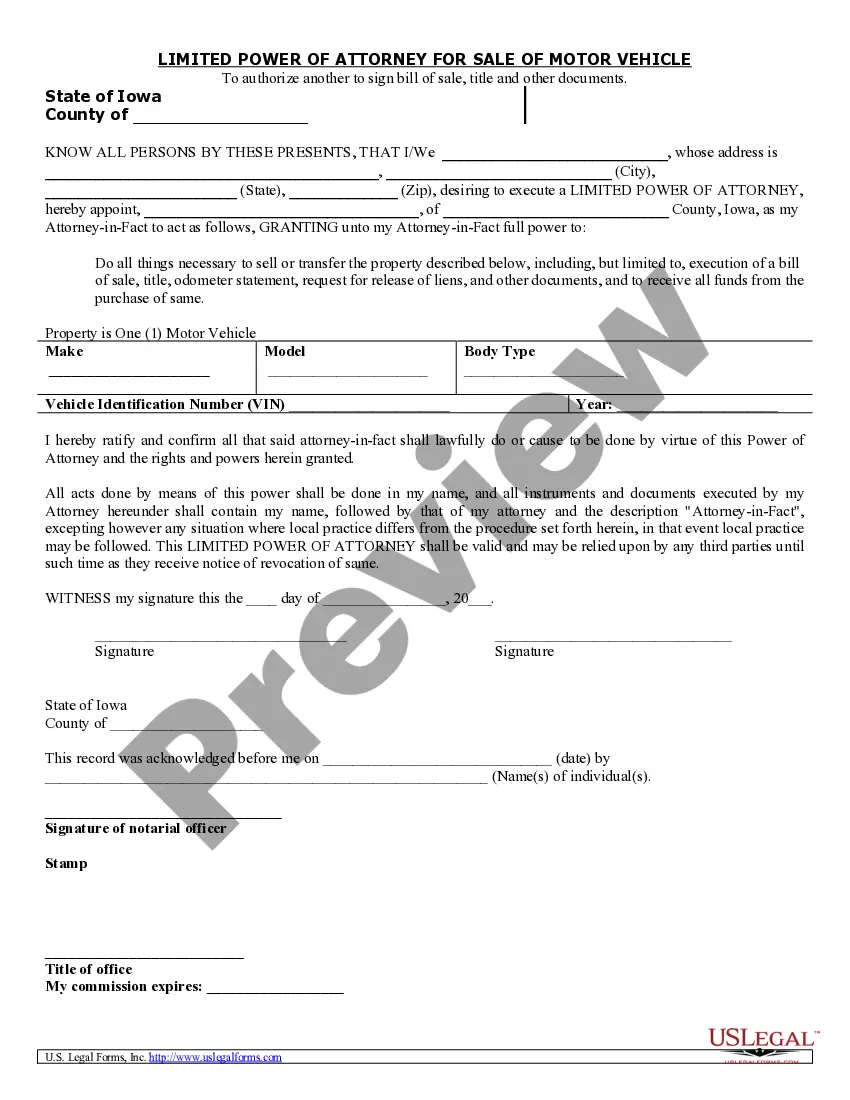

What is Power of Attorney?

Power of Attorney documents allow individuals to designate someone to make legal and financial decisions for them. These documents are used when a person is unable to act on their own. Explore state-specific templates to find the right one for your needs.