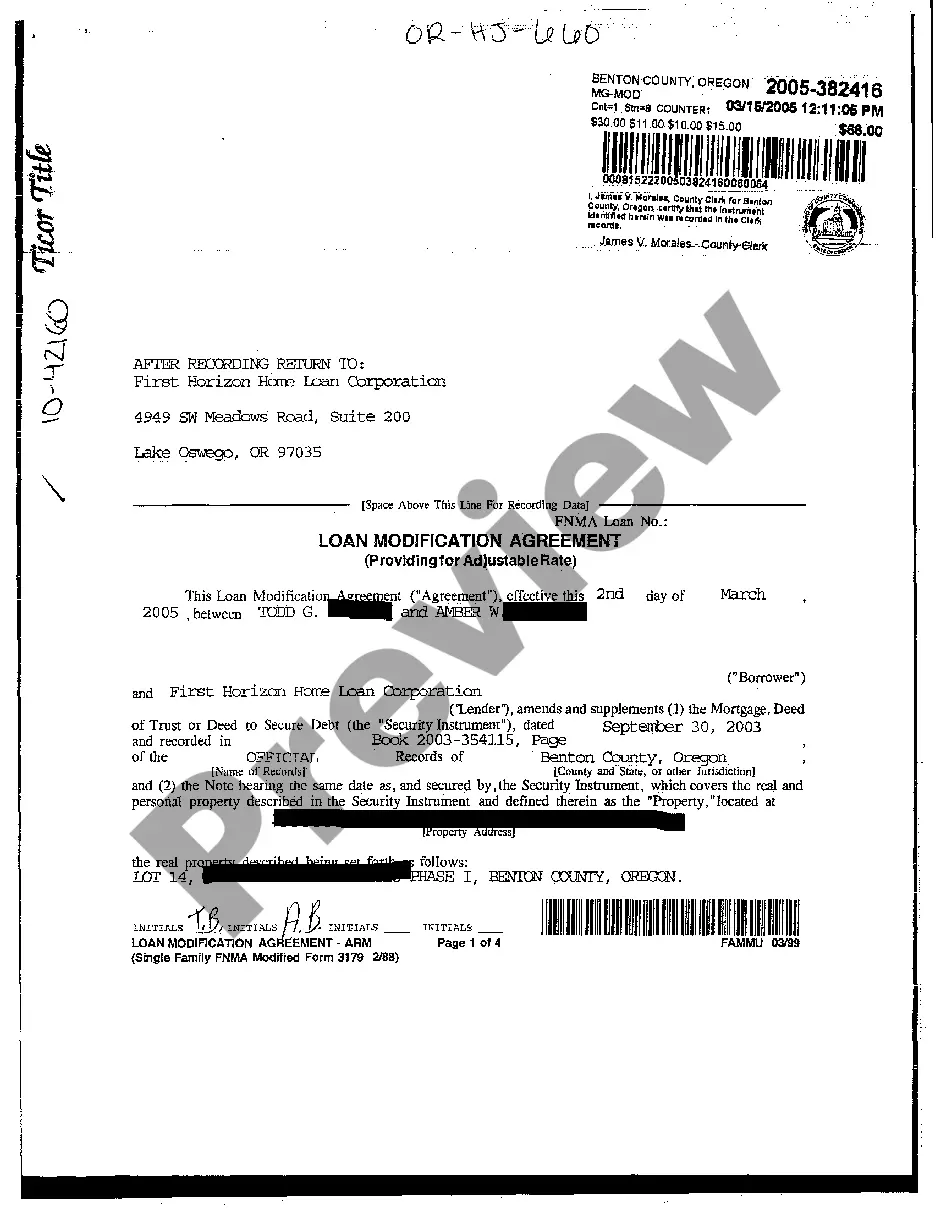

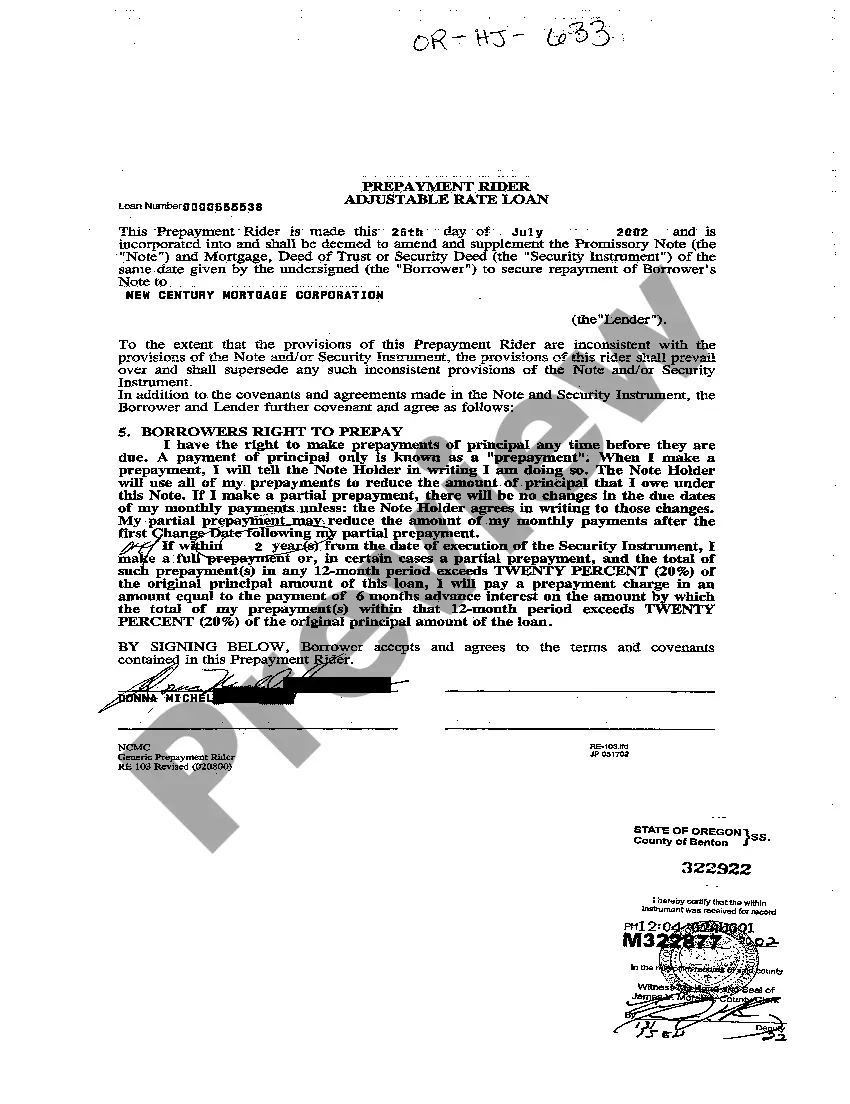

Oregon Prepayment Rider Adjustable Rate Loan

Description

How to fill out Oregon Prepayment Rider Adjustable Rate Loan?

The work with papers isn't the most uncomplicated job, especially for people who rarely work with legal papers. That's why we advise using accurate Oregon Prepayment Rider Adjustable Rate Loan templates created by skilled attorneys. It allows you to prevent troubles when in court or dealing with official organizations. Find the samples you require on our site for high-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. As soon as you are in, the Download button will automatically appear on the template webpage. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users with no a subscription can quickly create an account. Look at this brief step-by-step help guide to get the Oregon Prepayment Rider Adjustable Rate Loan:

- Ensure that the document you found is eligible for use in the state it is needed in.

- Confirm the file. Use the Preview option or read its description (if readily available).

- Click Buy Now if this sample is the thing you need or utilize the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these easy actions, you can fill out the sample in an appropriate editor. Recheck filled in data and consider requesting a lawyer to examine your Oregon Prepayment Rider Adjustable Rate Loan for correctness. With US Legal Forms, everything gets much simpler. Try it out now!

Form popularity

FAQ

A variable rate mortgage is one where the interest rates change with the market but the monthly payments are always the same. An adjustable rate mortgage is one where the monthly payments can change when the interest rate changes.For variable rate mortgages, more of your payment will go towards the interest.

The term prepayment privilege refers to the right a consumer has to pay part or all of a debt prior to its maturity or ahead of schedule, usually without the risk of incurring any penalties.Consumers are able to save money by using prepayment privileges since they avoid paying interest charges.

A prepayment penalty, also known as a prepay in the industry, is an agreement between a borrower and a bank or mortgage lender that regulates what the borrower is allowed to pay off and when. Most mortgage lenders allow borrowers to pay off up to 20 percent of the loan balance each year.

Why might an adjustable-rate mortgage, or ARM, be a bad idea? When interest rates are rising it means you're taking all of the risk. With an ARM loan, after just a couple of rate resets, your initial interest-rate savings could evaporate.

Prepayment is an accounting term for the settlement of a debt or installment loan in advance of its official due date. A prepayment may be the settlement of a bill, an operating expense, or a non-operating expense that closes an account before its due date.

Function: noun. The Prepayment Rider discusses the borrower's right to prepay their loan. Sometimes there are penalties for prepaying a loan during the life of the loan, or during the first several years of the loan. Some borrowers like to pay a little bit more than the monthly payments to pay off their loan sooner.

Adjustable-rate mortgage riders explain that the interest rate on the loan will change on a set date.The terms of this rider allow a lender to collect the property rent if you default on the loan. The rent the lender collects goes toward the outstanding loan balance.

With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time. After this initial period of time, the interest rate resets periodically, at yearly or even monthly intervals.The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin.

Pros of an adjustable-rate mortgage It has lower rates and payments early in the loan term. Because lenders can consider the lower payment when qualifying borrowers, people can buy more expensive homes than they otherwise could. It allows borrowers to take advantage of falling rates without refinancing.