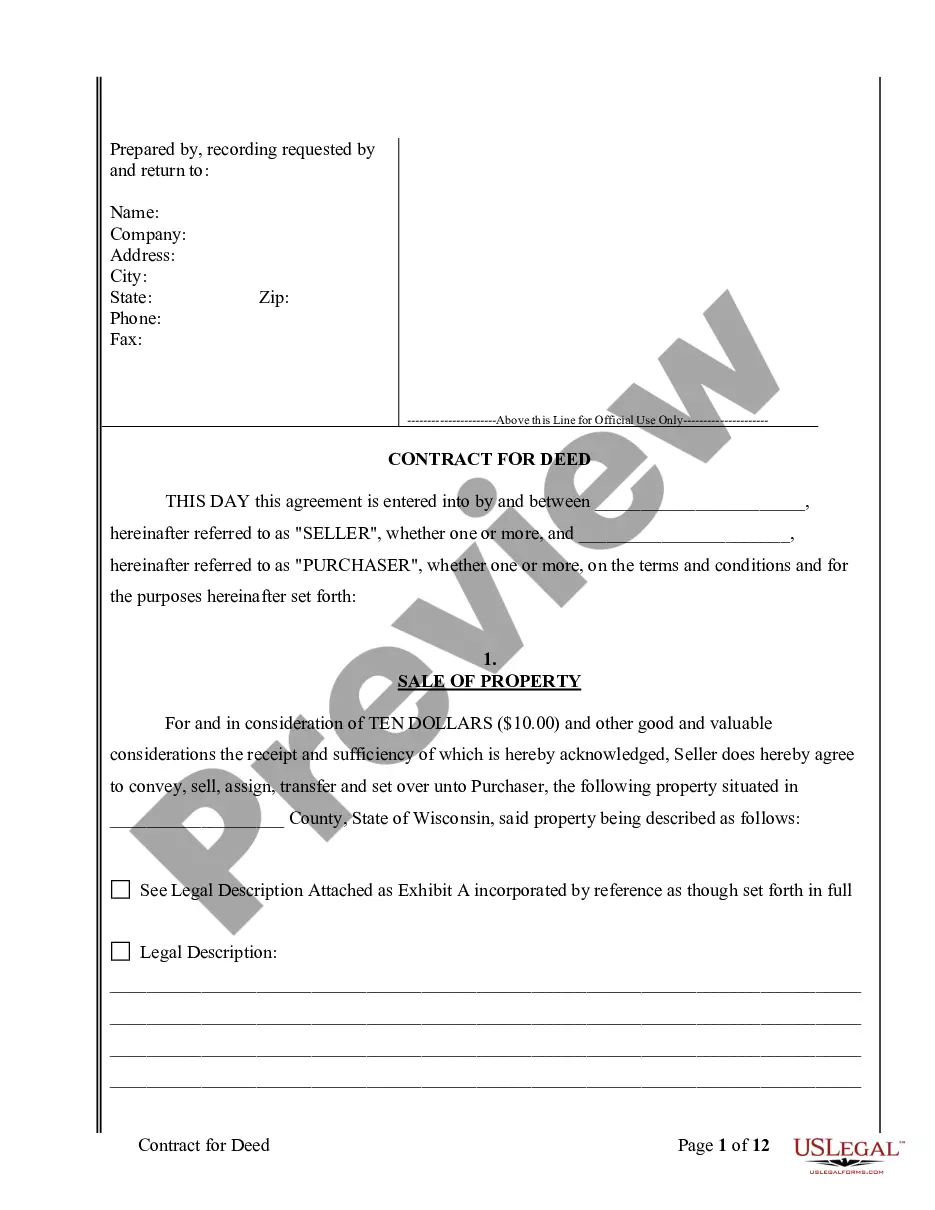

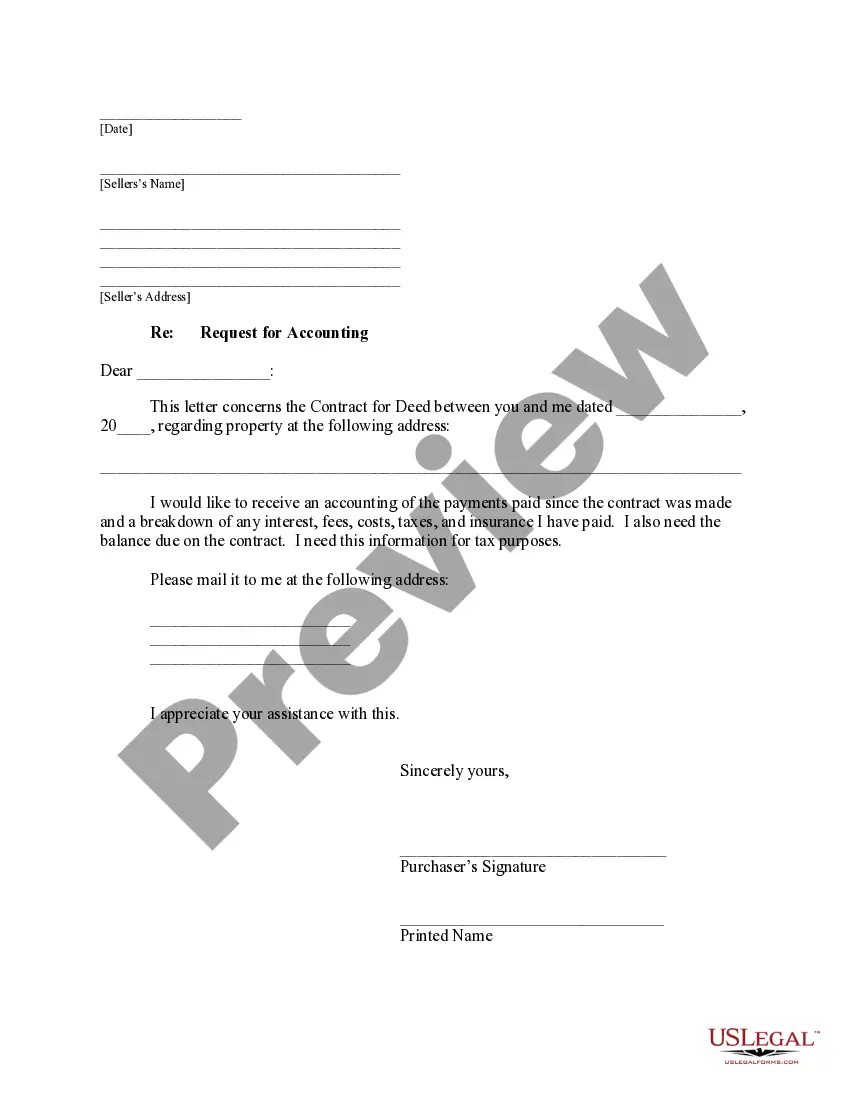

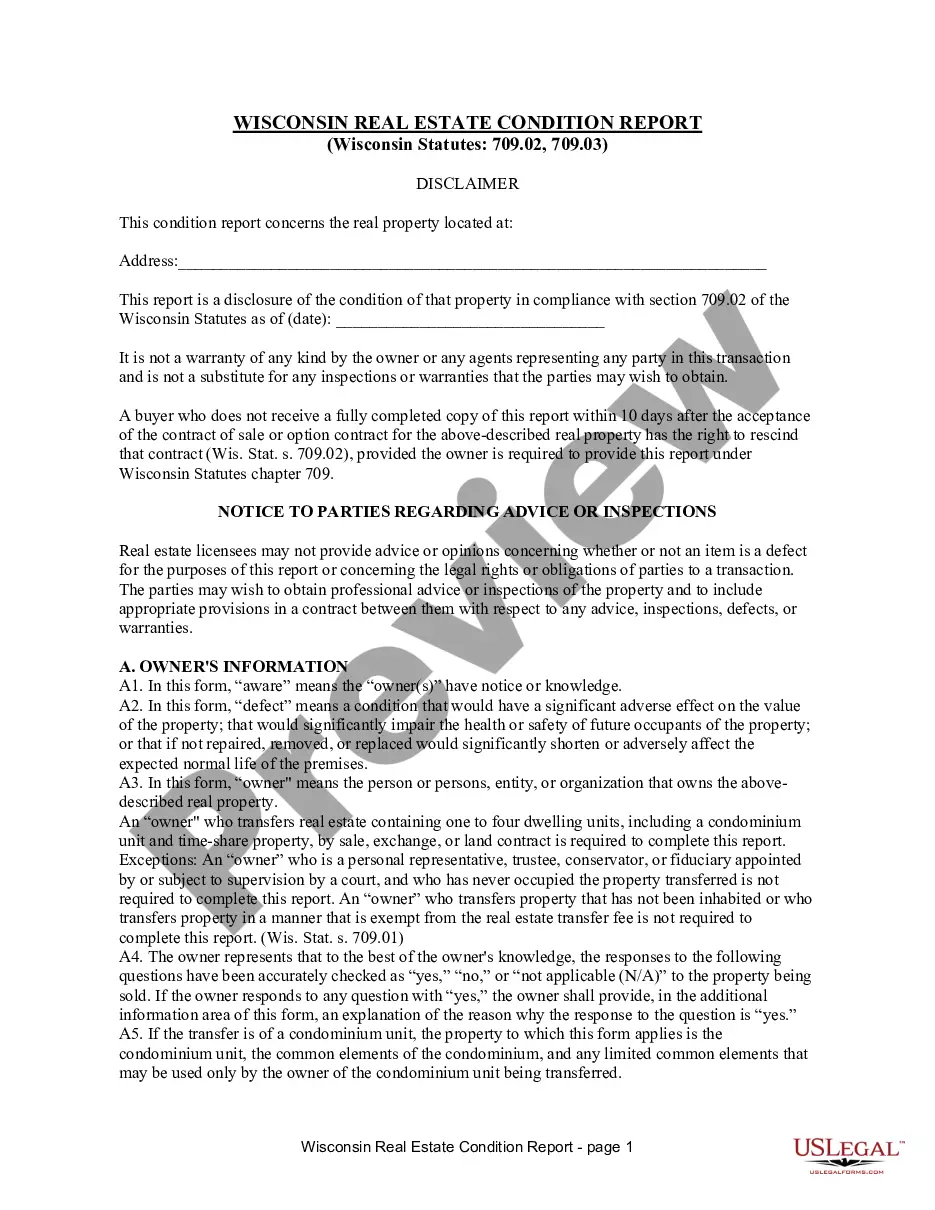

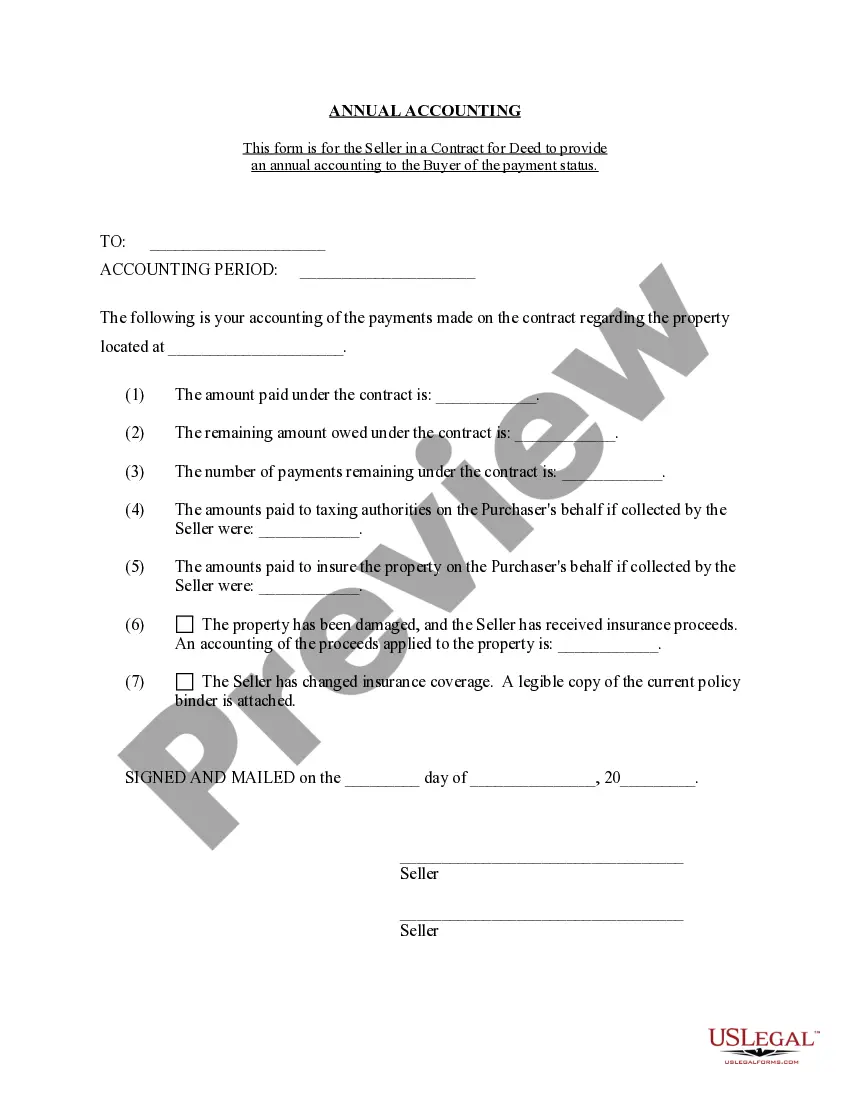

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Green Bay Wisconsin Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Wisconsin Contract For Deed Seller's Annual Accounting Statement?

Utilize the US Legal Forms to gain instant access to any document you require.

Our advantageous platform, hosting thousands of document templates, simplifies the process of locating and acquiring nearly any document sample you need.

You can save, complete, and sign the Green Bay Wisconsin Contract for Deed Seller's Annual Accounting Statement in just a few minutes instead of spending hours online searching for a suitable template.

Leveraging our catalog is a fantastic approach to enhance the security of your document submissions.

If you do not yet have a profile, follow the guidelines below.

- Our knowledgeable legal experts routinely review all the documents to confirm that the templates are applicable for a specific area and adhere to updated laws and regulations.

- How can you obtain the Green Bay Wisconsin Contract for Deed Seller's Annual Accounting Statement? If you already possess a profile, simply Log In to your account.

- The Download button will be visible on all the samples you examine. Additionally, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

In a contract for deed sale, the buyer agrees to pay the purchase price of the property in monthly installments. The buyer immediately takes possession of the property, often paying little or nothing down, while the seller retains the legal title to the property until the contract is fulfilled.

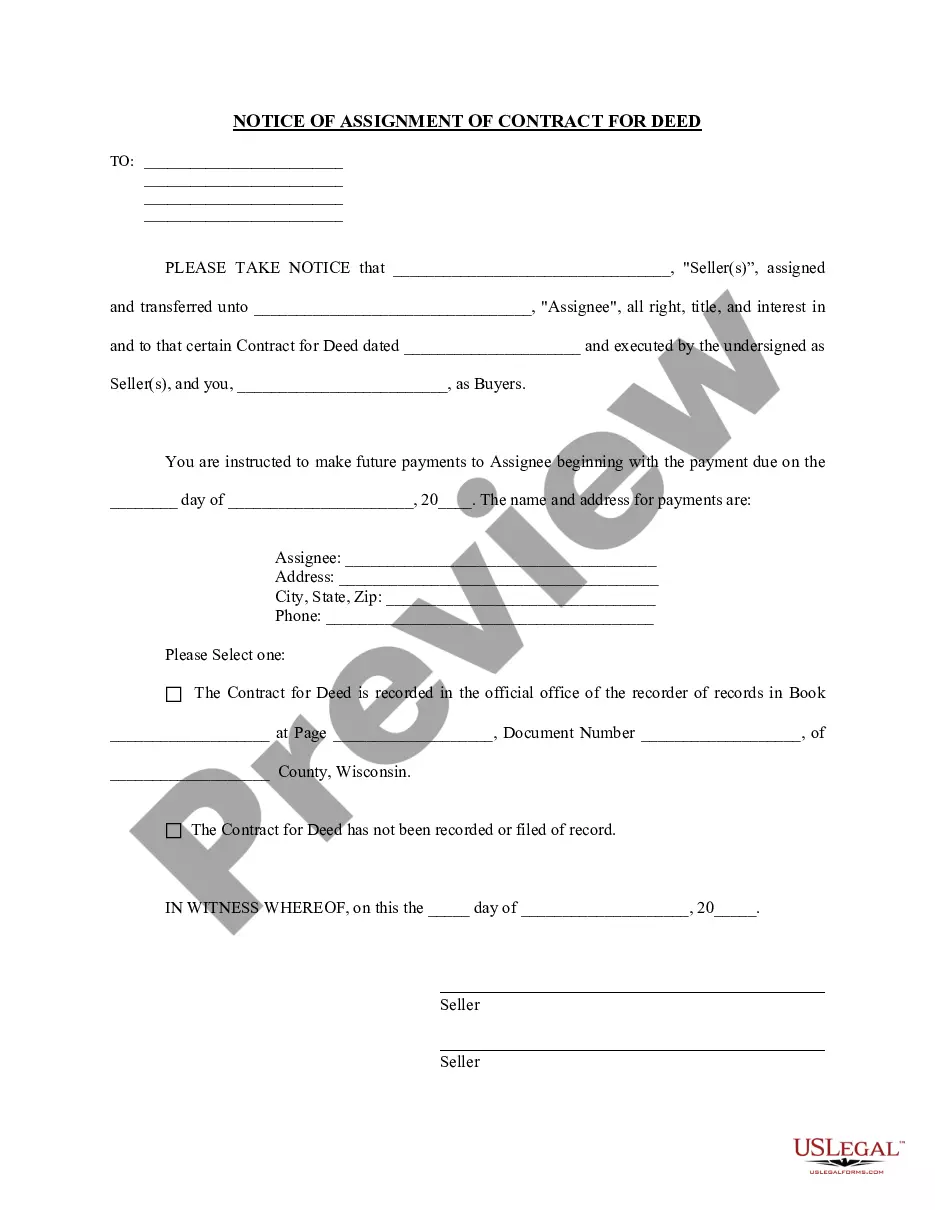

The Land Contract or Memorandum must state that the buyer is responsible for paying the property taxes. The Land Contract or Memorandum must be selling the property. Option to buy or lease agreements will not qualify for the homestead and mortgage deductions. The Land Contract or Memorandum must be recorded.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

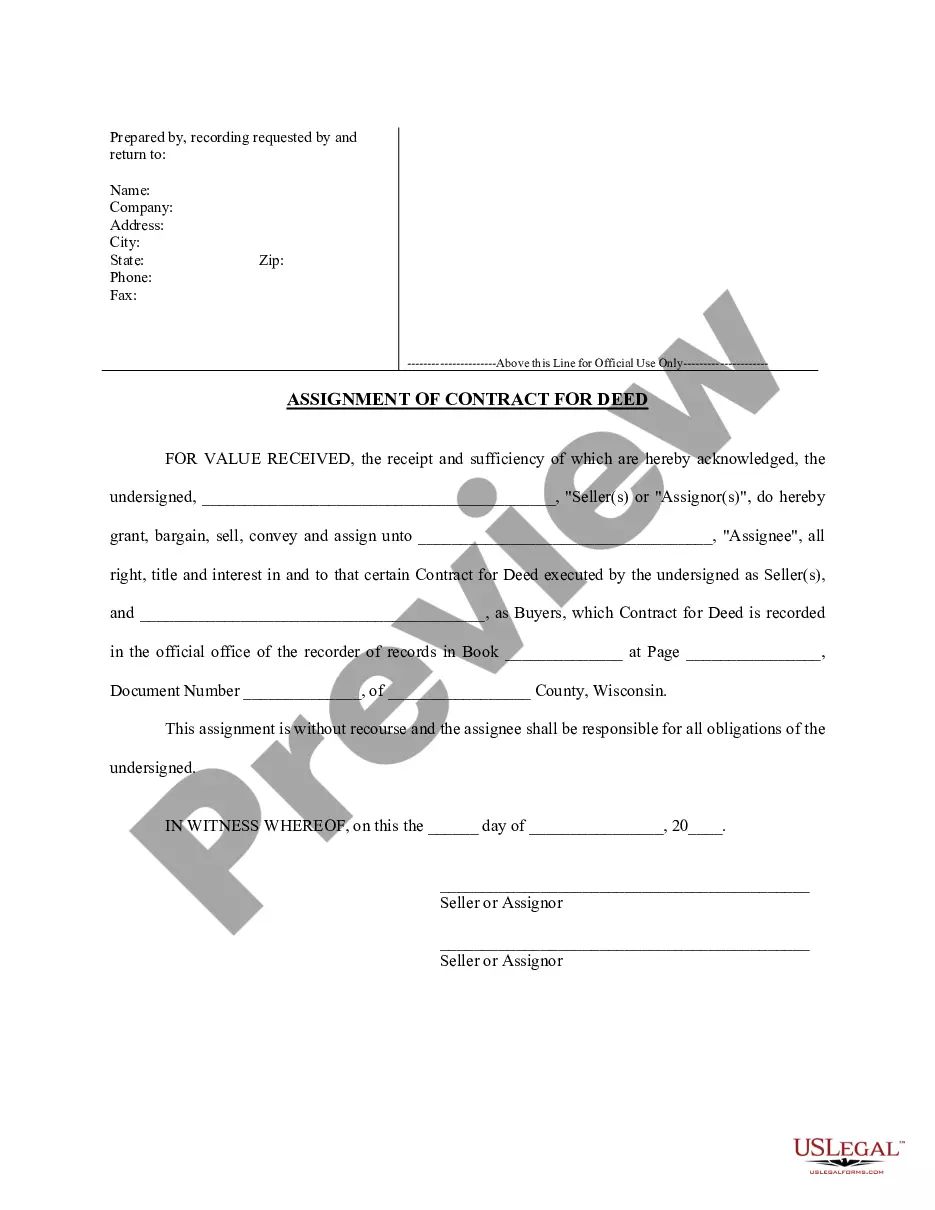

The land contract is recorded with the Register of Deeds, giving notice to all of the vendee's interest in the real estate and the vendor's obligation to convey the real estate upon full payment. The transfer fee is due at the time the land contract is recorded, along with a transfer return.

7. Can all licensees draft a land contract? No, only those licensed as a Wisconsin real estate broker may use the State Bar forms.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.