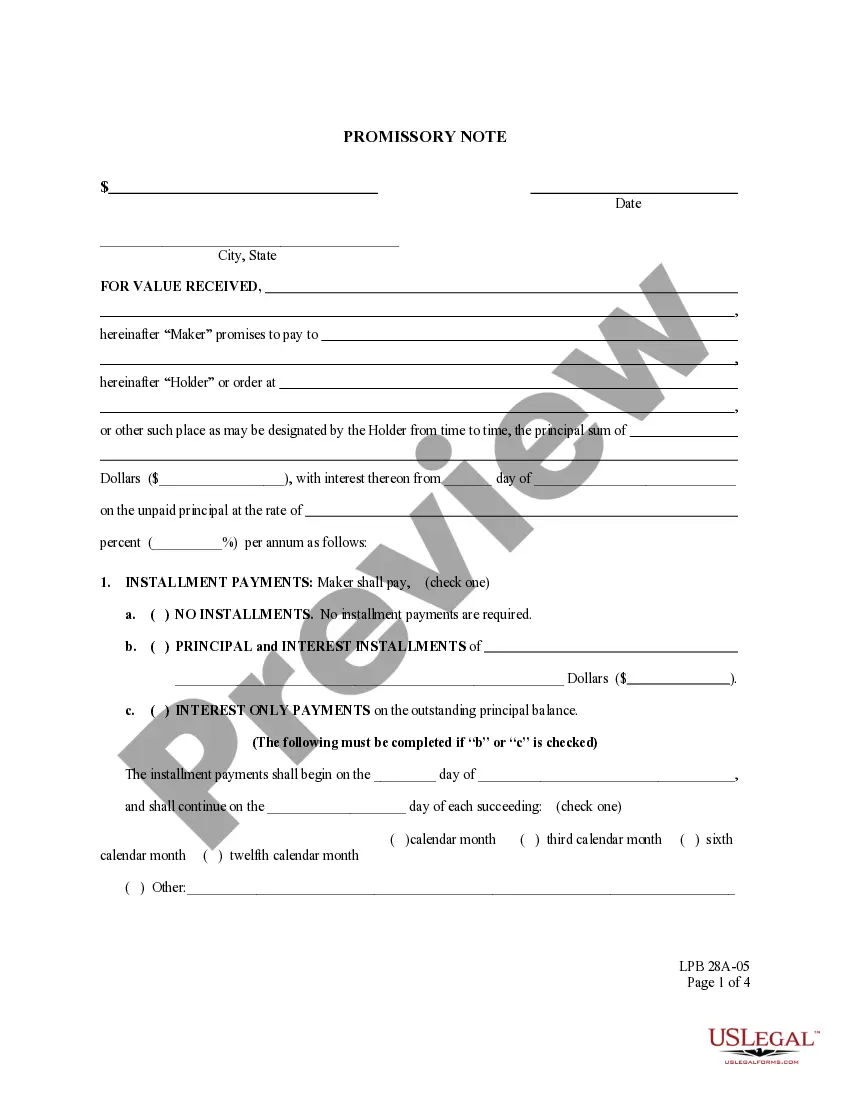

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Utilize the US Legal Forms and gain prompt access to any form sample you desire.

Our convenient website with a vast array of templates enables you to locate and acquire nearly any document sample you seek.

You can download, complete, and sign the Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in only a few minutes instead of spending hours searching the Internet for a suitable template.

Accessing our library is an excellent approach to enhance the security of your document submissions.

Open the page with the template you require. Ensure that it is the document you were looking for: check its title and description, and use the Preview feature when available. If not, utilize the Search field to seek the correct one.

Initiate the saving process. Click Buy Now and choose the pricing plan you prefer. Next, create an account and complete your order using a credit card or PayPal.

- Our skilled attorneys routinely examine all documents to ensure that the templates are suitable for a specific jurisdiction and adhere to updated laws and regulations.

- How can you obtain the Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

- If you already possess a subscription, simply Log In to your account. The Download option will manifest on all documents you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the instructions below.

Form popularity

FAQ

A simple promissory note typically outlines the amount borrowed, the interest rate, and the repayment schedule. For instance, a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate may state that a borrower will repay a specific sum over a defined period, secured by a property. This structure provides clarity for both parties. You can easily find templates on platforms like uslegalforms to create or understand these notes.

The promissory rule is a legal principle that recognizes promissory estoppel, meaning that a promise can be enforced even without a formal contract under certain conditions. Particularly for a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, if an individual reasonably relies on a promise made by another party, they may be entitled to seek damages if the promise is not fulfilled. Understanding this rule can protect both borrowers and lenders in their transactions.

Promissory notes generally follow specific rules to be considered valid and enforceable. For a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's important to ensure that the note is in writing, signed by the borrower, and includes essential terms such as the amount, interest rate, and repayment schedule. Following these rules creates a clear understanding between the parties and secures legal protection for both. Always consult with legal experts or resources like uslegalforms to ensure compliance.

Yes, a promissory note can be secured by collateral, such as commercial real estate. In the case of a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the property serves as assurance for the lender. If the borrower does not fulfill their payment obligations, the lender may seize the property to recover the debt. This added security benefits both parties by reducing risk.

A promissory note can be secured by various assets, such as real estate, vehicles, or other valuables. When it comes to a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the note is backed by the property itself, providing security for the lender. This arrangement reduces the risk involved and ensures that obligations are met.

In Washington state, a promissory note does not necessarily need to be notarized, but doing so can provide added legal protection. Notarization helps verify the identities of the parties involved, ensuring the note is enforceable. When dealing with significant loans like a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it may be wise to consider notarization for peace of mind.

Promissory notes come in various forms, including demand notes, installment notes, and secured notes. An installment promissory note, like a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, allows for payment over time, while a secured note is backed by collateral. Understanding these types helps you choose the right option for your financial needs.

To write a simple promissory note, start by including the date, names of the borrower and lender, and the amount borrowed. Next, outline the repayment terms, such as interest rate and payment schedule. Finally, both parties should sign and date the document to make it legally binding, especially in the context of a Tacoma Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.