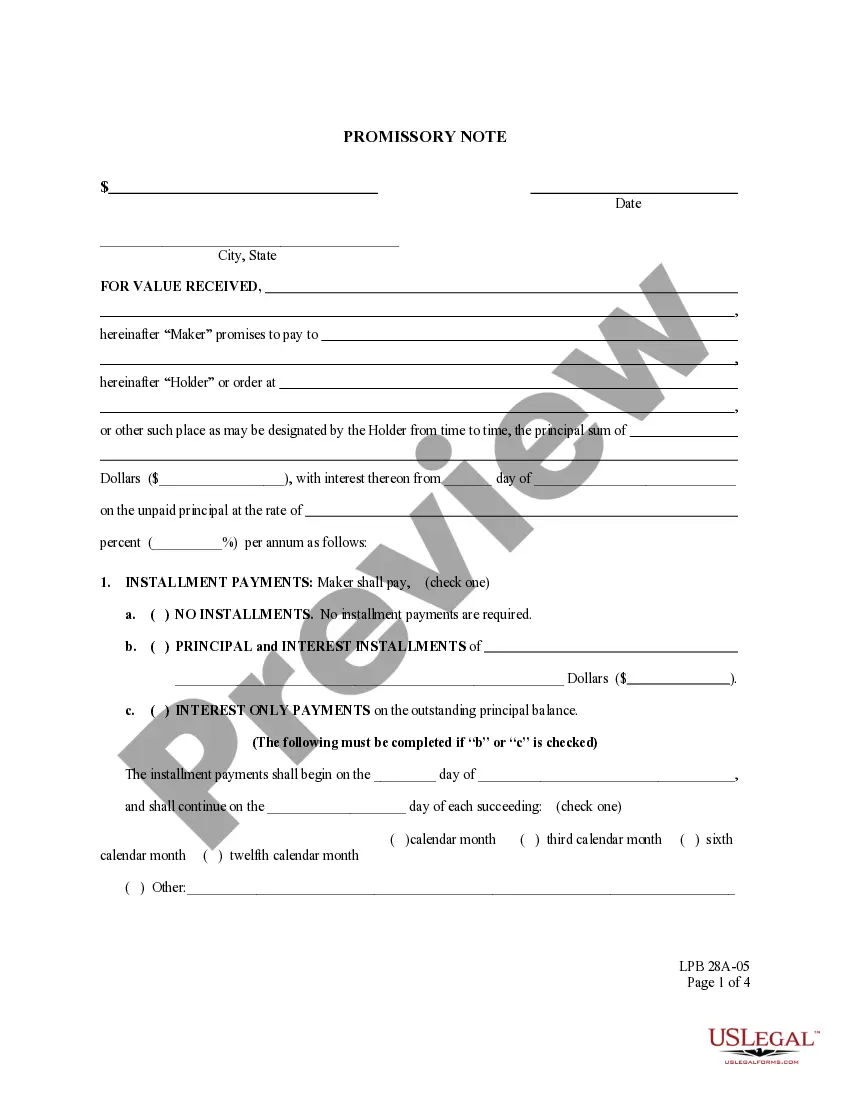

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

If you are seeking a pertinent template, it's challenging to find a more user-friendly service than the US Legal Forms site – one of the largest repositories online.

With this collection, you can obtain a vast array of sample forms for business and personal use by categories and regions, or keywords.

With our sophisticated search feature, locating the latest Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is as simple as 1-2-3.

Confirm your choice. Click the Buy now button. After that, select your desired pricing plan and enter your details to set up an account.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

- Moreover, the accuracy of each document is verified by a team of expert lawyers who routinely assess the templates on our website and refresh them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to access the Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is to Log In to your account and click the Download button.

- If this is your first time using US Legal Forms, just adhere to the instructions below.

- Ensure you have located the template you desire.

- Examine its description and utilize the Preview feature to view its contents. If it doesn’t align with your needs, use the Search bar at the top of the page to find the required document.

Form popularity

FAQ

Yes, an Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is likely to uphold in court if it is properly executed and legally compliant. Courts generally enforce these agreements if they contain clear and concise terms, like payment details and collateral specifications. It's crucial to create a note that reflects both parties' intentions and obligations accurately. For best practices, consider utilizing platforms like US Legal Forms to ensure your document meets all requirements.

To secure a promissory note, consider using real estate as collateral, specifically through an Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. This approach gives the lender reassurance in the case of default. It's essential to include a clear description of the collateral in the note and possibly file a lien against the property. Resources like US Legal Forms can assist you in structuring the note properly to ensure it meets legal standards.

Writing a simple promissory note requires clarity and straightforward language. Clearly state the lender's and borrower's names, the amount borrowed, and the repayment terms. To make it effective, especially for the Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, outline what happens in case of default or late payments.

Examples of promissory notes vary in terms of purpose and complexity. They can range from personal loans between friends to formal legal documents like the Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, which involves securing the note with commercial property. Each example showcases different terms, but all serve to outline the borrower's promise to repay the debt.

The document that secures the promissory note to the real property is generally known as a mortgage or deed of trust. In the context of the Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this document establishes the lender's interest in the property. It serves as a legal claim against the property and sets forth the rights and obligations of both the borrower and lender. Proper execution of this document is crucial for protecting both parties.

To secure a promissory note with real property, you need to have a legally binding agreement that outlines the property as collateral. The Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate will typically require a mortgage or deed of trust. This documentation legally binds the property to the note, providing the lender an avenue to reclaim their investment in case of default. Involving a legal expert can greatly streamline this process.

A promissory note itself does not go on your public record, but if the note is secured by property, it may create a lien on that property. Therefore, when dealing with Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, understand that while the note itself remains private, the associated property records may be public. This distinction can impact future transactions involving the property. For thoroughness, consider using resources like USLegalForms to navigate these complexities.

Filing a promissory note typically involves recording it with your local county recorder’s office. For those dealing with Everett Washington Installments Fixed Rate Promissory Notes Secured by Commercial Real Estate, it’s particularly important to follow the local regulations to maintain the legal standing of the note. Using an online platform like USLegalForms can facilitate this process, enabling smooth filing and record-keeping. Always verify local requirements before proceeding.

When it comes to taxes, you usually report income generated from a promissory note as ordinary income. If your Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate produces interest, you must report that interest on your tax return. Keep track of all payments and interest collected, as they will itemize your financial records. Consulting with a tax professional can provide further clarity based on your specific situation.

In Washington state, a promissory note does not legally require notarization to be enforceable. However, notarizing your Everett Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate can provide additional legal protection and authenticity. Notarization enhances the credibility of your document should disputes arise. Many individuals opt for this step for peace of mind.