This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Bellevue Washington Closing Statement

Description

How to fill out Washington Closing Statement?

We consistently endeavor to minimize or evade legal harm when handling intricate legal or financial issues.

To achieve this, we enlist attorney services that are typically quite costly.

However, not all legal challenges are equally complicated. Many can be managed by ourselves.

US Legal Forms is a digital collection of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform enables you to handle your issues independently without the necessity of utilizing legal counsel services.

The procedure is just as straightforward if you are new to the platform! You can create your account within minutes. Ensure you verify that the Bellevue Washington Closing Statement adheres to the laws and regulations of your state and region. Additionally, it is essential that you review the form's outline (if available), and if you encounter any inconsistencies with your initial requirements, look for a different template. Once you have confirmed that the Bellevue Washington Closing Statement is suitable for your situation, you can select the subscription option and proceed to payment. You can then download the document in any preferred file format. For over 24 years, we have assisted millions by providing ready-to-customize and current legal forms. Take advantage of US Legal Forms now to conserve effort and resources!

- Our templates are accessible for specific states and regions, which greatly simplifies the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Bellevue Washington Closing Statement or any other form effortlessly and securely.

- Simply Log In to your account and click the Get button next to the desired form.

- If you misplace the document, you can always re-download it by visiting the My documents tab.

Form popularity

FAQ

As of now, Tacoma boasts one of the highest sales tax rates in Washington state, at around 10.3%. This rate can impact your overall budget if you're considering a transaction there. When drafting your Bellevue Washington Closing Statement, keeping tabs on various tax rates across different cities can help you make informed decisions when it comes to property transactions. Always check for the latest tax rates during your planning process.

The B&O tax in Bellevue is a tax on the gross income of businesses operating in the area, which varies depending on the type of business. Rates are generally between 0.1% to 0.2%. Knowing how this tax impacts your business is essential, particularly when preparing your Bellevue Washington Closing Statement, to ensure that you account for all financial obligations and avoid any potential penalties.

Sales tax in Western Washington varies by city but generally ranges from 9% to 10.4%. Since Bellevue has a sales tax rate of 10.1%, it falls within this broader range. When working on your Bellevue Washington Closing Statement, it is crucial to account for the correct tax rate applicable to your specific transactions. This understanding helps you to budget and plan accordingly.

Bellevue imposes a Business and Occupation (B&O) tax at a rate of 0.1% to 0.2%, depending on the type of business activity. This tax applies to gross receipts from business operations within the city limits. Understanding this tax is vital when preparing your Bellevue Washington Closing Statement, ensuring that all business-related expenses and obligations are properly documented. For clarity, you may want to consult resources or services that specialize in tax calculations.

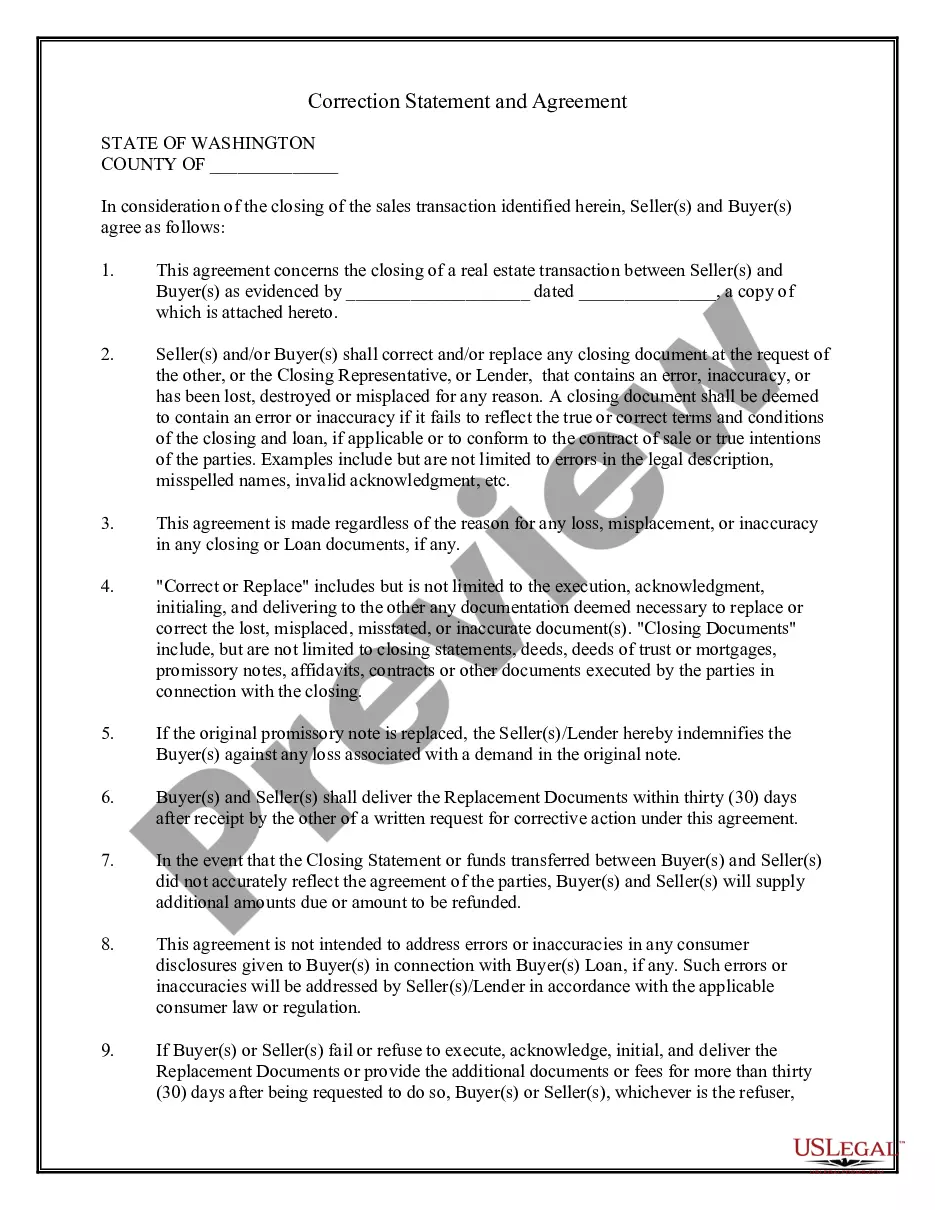

A typical closing statement outlines the essential financial details of a transaction, encompassing costs and credits for both parties involved. In Bellevue Washington, it serves as a final recap that reinforces the terms of the agreement. Properly structured, it includes clear line items that ensure everyone understands their financial responsibilities. Reviewing this statement beforehand helps prevent any last-minute issues at closing.

In a court setting, a closing statement includes a summary of the evidence presented, legal arguments, and the desired outcomes sought by each party. For a Bellevue Washington closing statement, it is critical to articulate the strengths of your case effectively. This statement connects all the dots for the judge and jury, helping them reach a verdict aligned with the presented arguments. Clarity and focus throughout enhance your chances of a favorable outcome.

The final closing statement is generally prepared by the closing agent, title company, or attorney overseeing the transaction. In Bellevue Washington, this individual consolidates all information related to costs, credits, and financing terms. Their expertise ensures that the closing statement accurately reflects the agreement between buyers and sellers. This step is crucial to achieving a successful closing.

The settlement statement is typically completed by the closing agent or escrow officer, who ensures that all financial details are accurately represented. In Bellevue Washington, these professionals gather information from both parties to compile the statement. It is important for all involved to review the statement for accuracy before closing. An organized and transparent process results in a smoother transaction.

A closing statement is often similar to a settlement statement but may serve different purposes in various contexts. Both documents summarize the financial aspects of a transaction, but a settlement statement is commonly used in real estate to outline amounts due and received. In Bellevue Washington, understanding the distinction helps ensure that you receive the appropriate documentation for your specific situation. Clarity in these documents is crucial for a successful closing.

A good closing statement in a debate effectively summarizes your main arguments while addressing the opposing view. It should reinforce your key points, clearly demonstrating why your position holds more weight. In Bellevue Washington, a cohesive and persuasive closing statement can turn the tide in your favor by leaving a lasting impression. Ensuring clarity and confidence will give your audience a clear understanding of your stance.