This is an official Washington court form for use in Garnishment cases, a Note on Usage: Notice to Defendant of Non- Responsive Exemption Claim. Available in Word or rich text format.

King Washington WPF GARN 01.0570 - Note on Usage - Notice to Defendant of Non-Responsive Exemption Claim

Description

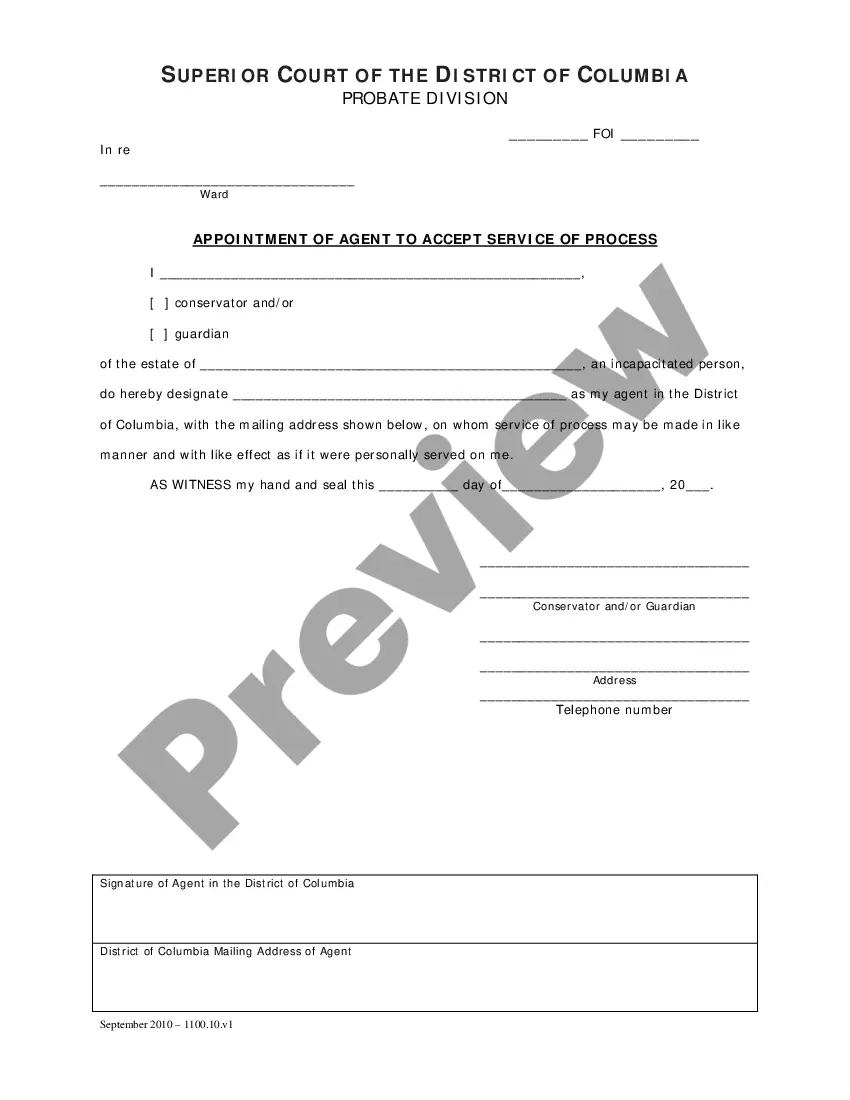

How to fill out Washington WPF GARN 01.0570 - Note On Usage - Notice To Defendant Of Non-Responsive Exemption Claim?

Locating verified templates that align with your local laws can be challenging unless you utilize the US Legal Forms library.

This is an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life situations.

All documents are appropriately categorized by their area of application and jurisdiction, making the search for the King Washington WPF GARN 01.0570 - Note on Usage - Notice to Defendant of Non-Responsive Exemption Claim as straightforward as pie.

Providing your credit card information or using your PayPal account will enable you to pay for the service. Save the King Washington WPF GARN 01.0570 - Note on Usage - Notice to Defendant of Non-Responsive Exemption Claim on your device for its completion, and access it anytime in the My documents menu of your profile. Maintaining paperwork organized and compliant with legal standards is crucial. Leverage the US Legal Forms library to always have vital document templates readily available!

- Examine the Preview mode and form description.

- Ensure that you’ve selected the correct document that fulfills your needs and aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you discover any discrepancies, utilize the Search tab above to find the accurate template. If it meets your criteria, proceed to the following step.

- Complete the document purchase.

Form popularity

FAQ

In Washington state, certain exemptions protect your income and assets from garnishment. The King Washington WPF GARN 01.0570 - Note on Usage - Notice to Defendant of Non-Responsive Exemption Claim is a critical document used to claim these exemptions effectively. Common exemptions include funds for essential living expenses and specific types of income, like social security benefits. Understanding these exemptions can provide significant relief, so utilizing resources like uslegalforms can help you navigate the process efficiently.

In Washington state, a writ of garnishment is a legal order that enables creditors to secure payment of debts. It directs a third party, such as an employer or bank, to withhold funds or property belonging to the debtor. The King Washington WPF GARN 01.0570 - Note on Usage - Notice to Defendant of Non-Responsive Exemption Claim is an essential guide for defendants. It details the procedure, rights, and exemptions available, helping individuals understand their situation clearly.

The application of a writ of garnishment allows a creditor to collect a debt owed by a debtor. In this process, funds or property belonging to the debtor that are held by a third party can be seized. Specifically, the King Washington WPF GARN 01.0570 - Note on Usage - Notice to Defendant of Non-Responsive Exemption Claim serves as a crucial document in this regard. It informs the defendant of their rights and any exemptions they may claim against the garnishment.

Worker's compensation benefits, retirement income, annuities, and life insurance are also exempt from wage garnishment. Also, child support and alimony (spousal support) payments are generally exempt from wage garnishment orders.

A popular way to collect on your judgment award is by a writ of garnishment. A garnishment entitles a judgment creditor to garnish and take the proceeds belonging to the debtor. It is typically used to garnish wages being paid by an employer or to garnish the proceeds in the debtor's bank account.

A popular way to collect on your judgment award is by a writ of garnishment. A garnishment entitles a judgment creditor to garnish and take the proceeds belonging to the debtor. It is typically used to garnish wages being paid by an employer or to garnish the proceeds in the debtor's bank account.

In Washington, most creditors can garnish the lesser of (subject to some exceptions?more below): 25% of your weekly disposable earnings, or. your weekly disposable earnings less 35 times the federal minimum hourly wage.

Eighty (80) percent of disposable earnings or thirty-five times the state minimum hourly wage, whichever is larger, is the exempt amount. This 80 percent (or thirty-five times) must be paid to the employee. The remaining 20 percent is subject to the writ of garnishment (continuing lien).

Washington Wage Garnishment Process. To get a wage garnishment, a creditor must first go to court and get a court order and judgment. This is true for wage and bank account garnishments. This is done by filing a summons and complaint with the court and serving the debtor with the summons and complaint.

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments.