"Subordination Agreement Form and Variations" is a American Lawyer Media form. This is a subordination agreement with variations form.

Cook Illinois Subordination Agreement Form and Variations

Description

How to fill out Subordination Agreement Form And Variations?

Are you seeking to swiftly compose a legally-enforceable Cook Subordination Agreement Form and Variations or perhaps any other document to manage your personal or business issues.

You have two choices: employ a specialist to draft a legal document for you or create it completely by yourself. The positive news is, there’s a third alternative - US Legal Forms.

If the document includes a description, confirm what it’s intended for.

If the document is not what you were searching for, restart the search process using the search bar in the header.

- It will assist you in obtaining expertly crafted legal documents without needing to incur exorbitant charges for legal assistance.

- US Legal Forms provides an extensive collection of over 85,000 state-appropriate form templates, encompassing Cook Subordination Agreement Form and Variations and form bundles.

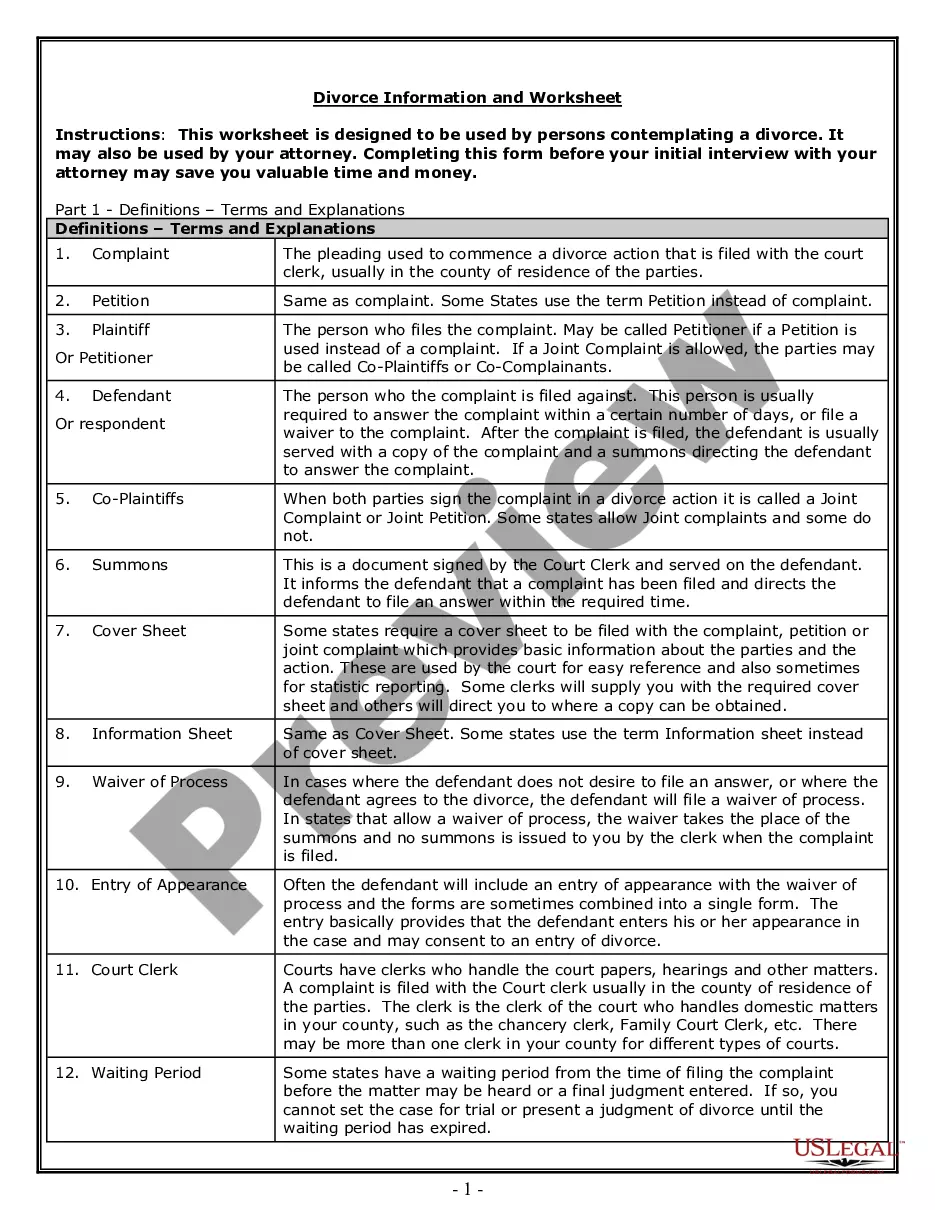

- We offer documents for a variety of life situations: from divorce papers to real estate forms.

- We've been in business for over a quarter-century and have earned an impeccable reputation among our clients.

- Here’s how you can join them and acquire the required document effortlessly.

- To begin, meticulously ensure that the Cook Subordination Agreement Form and Variations is designed for your state’s or county’s requirements.

Form popularity

FAQ

The 60-day rule in Cook County stipulates that defendants in mortgage foreclosure cases must respond to legal complaints within 60 days of being served. This rule is significant as it affects the timeline of legal proceedings. For those using a Cook Illinois Subordination Agreement Form and Variations, understanding this time frame can prevent delays and ensure compliance with the court's expectations.

Intercompany Subordination Agreement means a subordination agreement executed and delivered by Borrower and each of its Subsidiaries and Lender, the form and substance of which is reasonably satisfactory to Lender.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

Example of a Subordination Agreement The business files for bankruptcy and its assets are liquidated at market value$900,000. The senior debtholders will be paid in full, and the remaining $230,000 will be distributed among the subordinated debtholders, typically for 50 cents on the dollar.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

When you take out a mortgage loan, the lender will likely include a subordination clause. Within this clause, the lender essentially states that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender in case you default.

A subordination agreement acknowledges that one party's claim or interest is superior to that of another party in the event that the borrower's assets must be liquidated to repay the debts.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.