Dallas Texas Affidavit of Death and Heirship (Information to Include in Affadavit)

Description

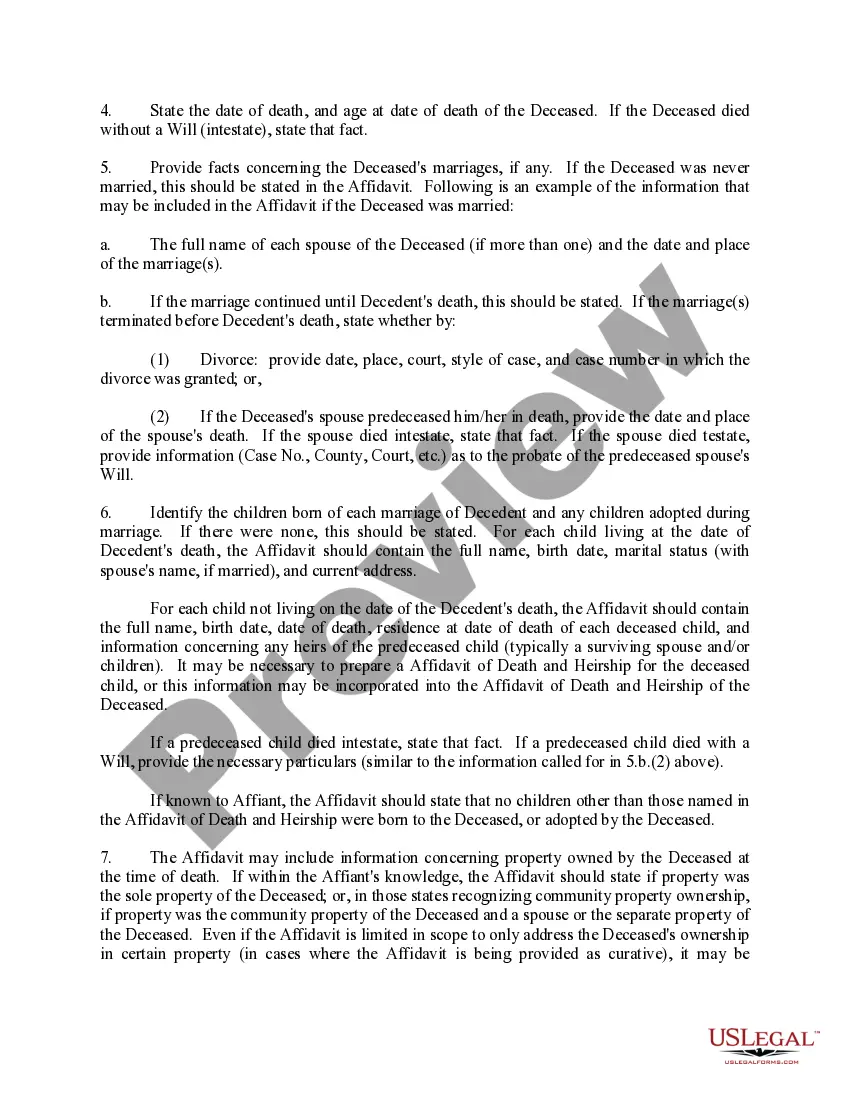

How to fill out Affidavit Of Death And Heirship (Information To Include In Affadavit)?

Preparing documents for business or personal purposes is always a significant duty.

While formulating a contract, a public service application, or a power of attorney, it's crucial to consider all federal and state laws relevant to the specific region.

Nevertheless, small counties and even municipalities also have legislative processes that must be acknowledged.

The beneficial aspect of the US Legal Forms library is that all the documents you have ever acquired are never misplaced - you can access them in your profile under the My documents tab at any time. Join the platform and effortlessly obtain verified legal templates for any circumstance with just a few clicks!

- All these factors contribute to the challenge and lengthy process of drafting a Dallas Affidavit of Death and Heirship (Information to Include in Affidavit) without expert help.

- It is feasible to avoid expenditures on lawyers for preparing your documents and to create a legally sound Dallas Affidavit of Death and Heirship (Information to Include in Affidavit) independently, utilizing the US Legal Forms online library.

- This is the largest online repository of state-specific legal templates that have been professionally verified, ensuring their authenticity when selecting a form for your locality.

- Previous subscribers simply need to Log In to their accounts to retrieve the required form.

- If you do not yet possess a subscription, follow the step-by-step instructions below to obtain the Dallas Affidavit of Death and Heirship (Information to Include in Affidavit).

- Review the page you’ve accessed and confirm if it contains the document you require.

- To verify this, utilize the form description and preview options if they are present.

Form popularity

FAQ

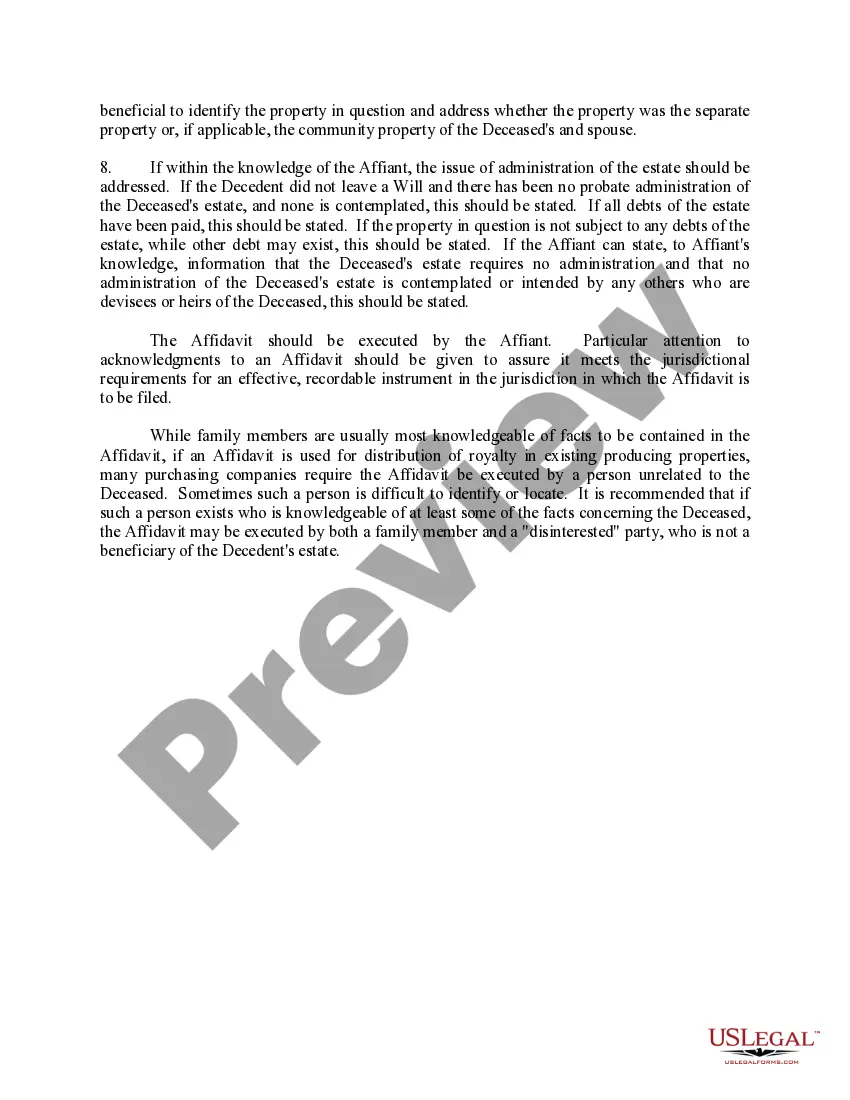

Two documents are recommended for the transfer of property after death without a Will. An Affidavit of Heirship. The Affidavit of Heirship is a sworn statement that identifies the heirs. It is signed in front of a notary by an heir and two witnesses knowledgeable about the family history of the deceased.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

The state divides separate personal property between your spouse and your children, with two thirds afforded to all the children and the leftover one third going to the spouse. Separate real property is divvied out in the same manner, but once the surviving spouse dies, real property is transferred to the children.

An affidavit of heirship can be used when someone dies without a will, and the estate consists mostly of real property titled in the deceased's name. It is an affidavit used to identify the heirs to real property when the deceased died without a will (that is, intestate).

Once they finalise the distribution, heirs can draw a family settlement deed where each member signs, which can then be registered for official records. To transfer property, you need to apply at the sub-registrar's office. You will need the ownership documents, the Will with probate or succession certificate.

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

Thanks to the 84th Legislature, Texans have a new, easy way to transfer real property to someone else upon their death. It does not involve going through probate court, which can be a lengthy and costly process.

The Texas Estates Code allows for the use of Affidavits of Heirship, meaning, a court shall receive Affidavits of Heirship in (a) a proceeding to declare heirship or (b) a suit involving title to property to establish prima facie evidence of the statement of family history, genealogy, marital status or the identity of

The Affidavit of Heirship form you file must contain: The decedent's date of death. The names and addresses of all witnesses. The relationships the witnesses had with the deceased. Details of the decedent's marital history. Family history listing all the heirs and the percentage of the estate they may inherit.

The Transfer on Death Deed must: Be in writing, signed by the owner, and notarized. Have a legal description of the property (The description is found on the deed to the property or in the deed records.Have the name and address of one or more beneficiaries. State that the transfer will happen at the owner's death.