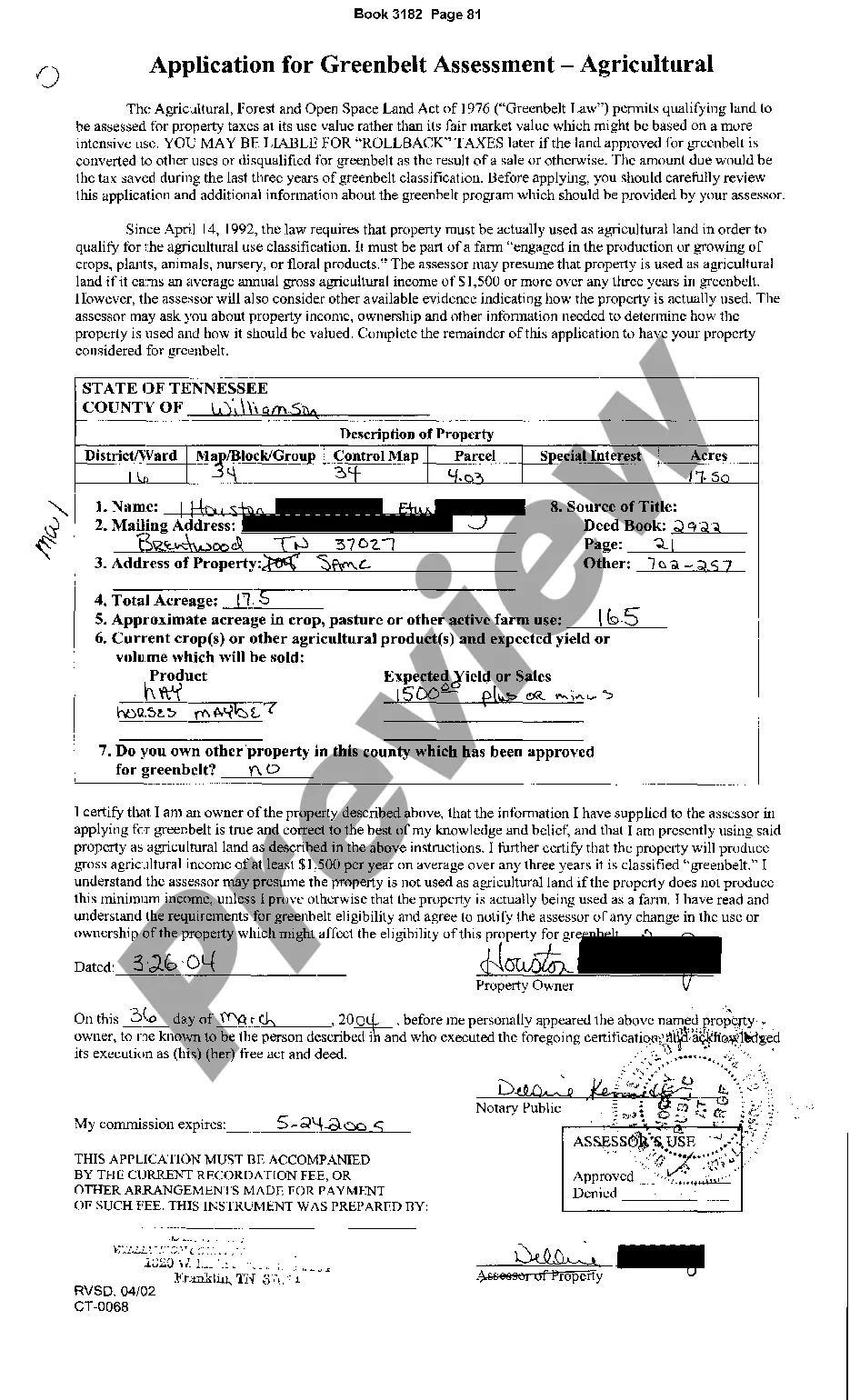

Nashville Tennessee Greenbelt Assessment

Description

How to fill out Tennessee Greenbelt Assessment?

If you’ve utilized our service previously, Log In to your account and retrieve the Nashville Tennessee Greenbelt Assessment on your device by clicking the Download button. Ensure that your subscription is active. If not, renew it according to your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have continuous access to every document you have bought: you can find it in your profile within the My documents menu whenever you wish to use it again. Leverage the US Legal Forms service to swiftly locate and save any template for your personal or professional use!

- Ensure you’ve located an appropriate document. Review the description and use the Preview feature, if available, to see if it satisfies your needs. If it’s not suitable, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete a transaction. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Nashville Tennessee Greenbelt Assessment. Choose the file format for your document and save it to your device.

- Finalize your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Despite this there are a number of companies around London and the UK offering parcels of Green Belt land for sale. Companies buy up rural land, sub-divide it into plots, and then sell it on to investors on the basis that if planning permission is given their initial investment will see a massive rise.

Under the law, protected farms and farm operations include farmland, buildings, machinery, and activities that involve commercial agriculture production, including farm products and nursery stock such as forages, seeds, hemp, trees, vegetables, fruits, livestock, dairy, poultry, apiaries, and other products that

Yes. In order to have land classified as agricultural, forest, or open space, an owner must file an application with the assessor of property in the county where the property is located. Where can I get the application?

Buildings which are to be used for agriculture or forestry. Facilities associated with outdoor sports or recreation. Facilities for cemeteries.

The law provides that no person may place more than 1,500 acres under greenbelt within any one taxing jurisdiction. The 1,500-acre limit does not apply to an agricultural classification that an owner obtained before July 1, 1984.

Agricultural Land Requirements for Greenbelt Consideration A parcel must have at least fifteen (15) acres, including woodlands and wastelands which form a contiguous part thereof, constituting a farm unit engaged in the production or growing of crops, plants, animals, nursery, or floral products.

If you own 15 acres or more, you just might be able to reduce your Tennessee property tax liability by applying for the Greenbelt Law. The Greenbelt Law, or the Agricultural, Forest, and Open Space Land Act of 1976, was designed to preserve farms, forests, and open space and to reduce urbanization across Tennessee.

Agriculture ? 15 acres minimum (can also have a separate tract of at least 10 acres within the county).

Typically, the amount of property tax owed is based on what the property would be worth on the open market. However, the Agricultural, Forest, and Open Space Land Act of 1976, better known as the ?Greenbelt Law,? allows certain land to be taxed on its present use instead.