Wayne Michigan Assignment of Overriding Royalty Interest with Proportionate Reduction

Description

How to fill out Wayne Michigan Assignment Of Overriding Royalty Interest With Proportionate Reduction?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business purpose utilized in your county, including the Wayne Assignment of Overriding Royalty Interest with Proportionate Reduction.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Wayne Assignment of Overriding Royalty Interest with Proportionate Reduction will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Wayne Assignment of Overriding Royalty Interest with Proportionate Reduction:

- Ensure you have opened the proper page with your localised form.

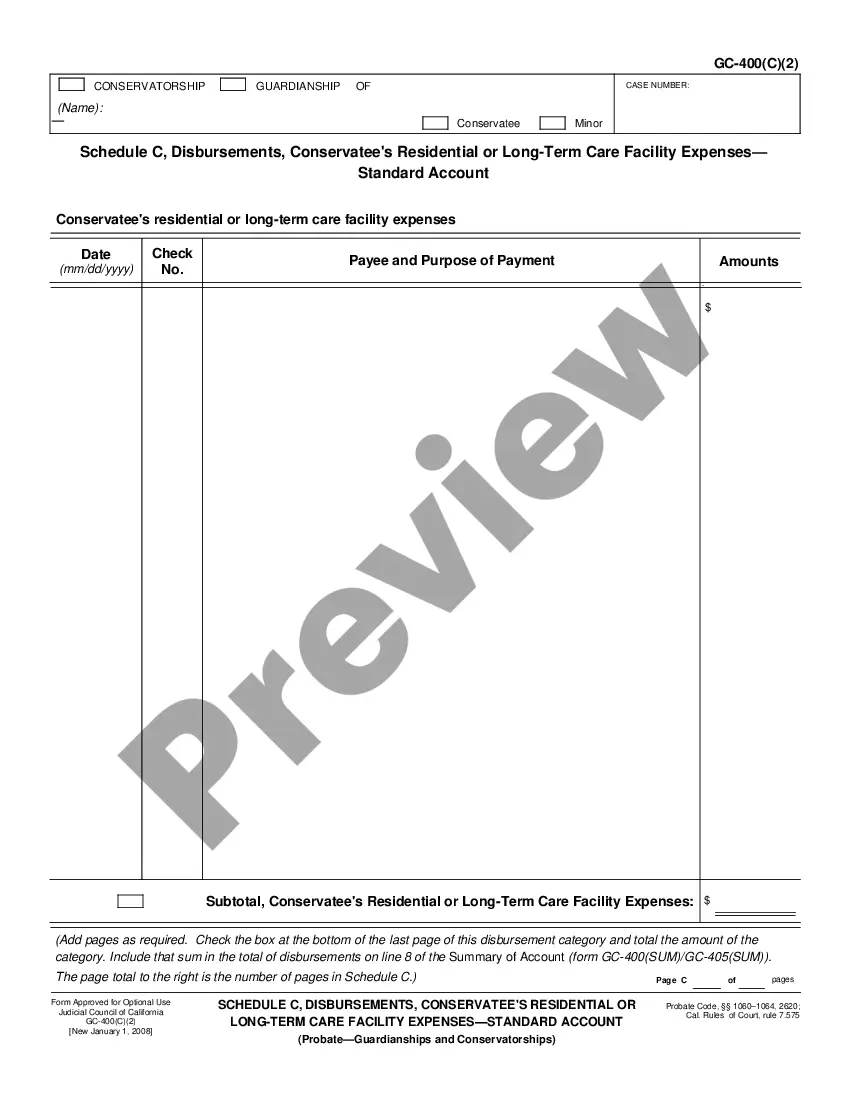

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Wayne Assignment of Overriding Royalty Interest with Proportionate Reduction on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

If a prepetition overriding royalty interest transaction is characterized as a transfer of real property (i.e., a sale), then the interest has effectively been transferred from the debtor's ownership and is not part of the bankruptcy estate.

If you receive more than $600 in a calendar year in overriding royalty interest payments, you will receive a 1099 tax form to claim the money as income during your annual tax filing.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced.NRI = Working Interest Royalty Interests. 100 25 = 75 percent (NRI) $1,000,000 $250,000 = $750,000 (monthly NRI)

To determine net revenue interest, multiply the royalty interest by the owner's shared interest. For example, if you have a 5/16 royalty, your net royalty interest would be 25% multiplied by 5/16, which equals 7.8125% calculated to four decimal places.

Overriding Royalty Interest (ORRI) a percentage share of production, or the value derived from production, which is free of all costs of drilling and producing, and is created by the lessee or working interest owner and paid by the lessee or working interest owner.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

Overriding royalty interests are an important financing tool for oil and gas companies involved in the exploration and development of oil gas and mineral interests. For investors, they provide an opportunity to participate in mineral production without incurring the costs.

1. n. Oil and Gas Business Ownership in a percentage of production or production revenues, free of the cost of production, created by the lessee, company and/or working interest owner and paid by the lessee, company and/or working interest owner out of revenue from the well.