King Washington Due Diligence Field Review and Checklist

Description

How to fill out King Washington Due Diligence Field Review And Checklist?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your county, including the King Due Diligence Field Review and Checklist.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the King Due Diligence Field Review and Checklist will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the King Due Diligence Field Review and Checklist:

- Make sure you have opened the right page with your local form.

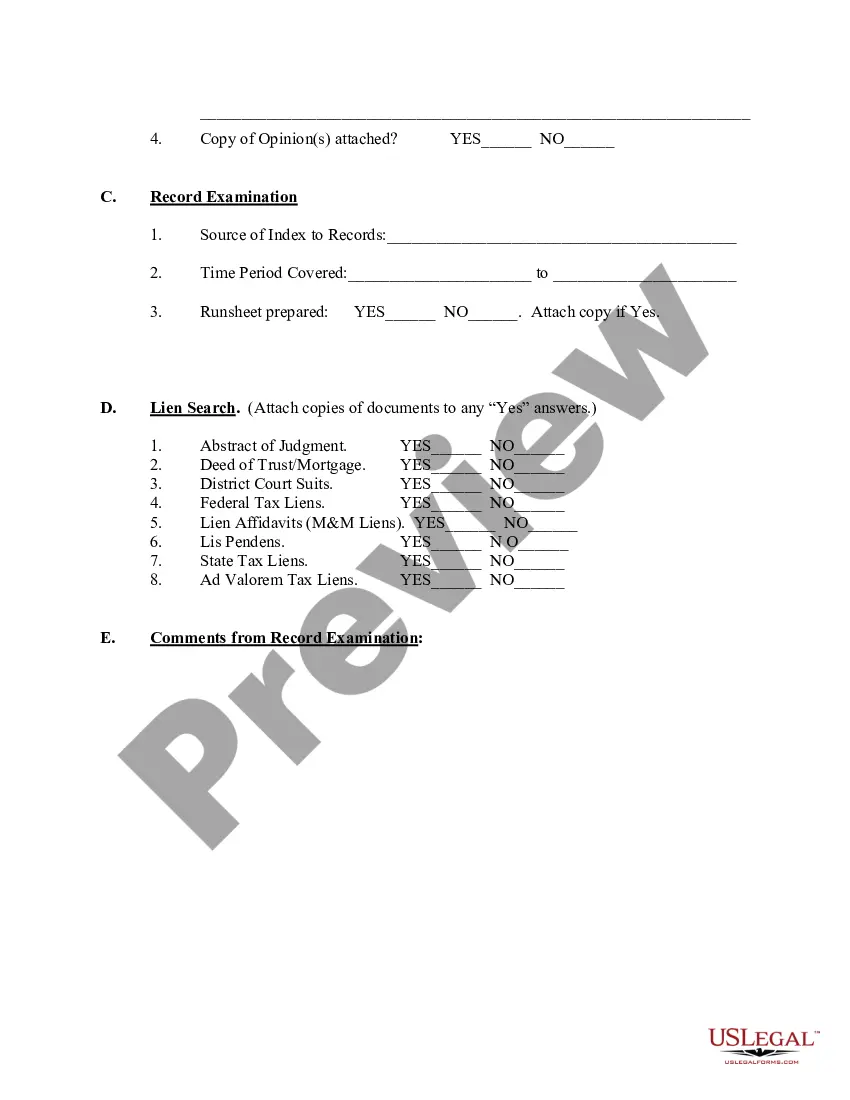

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the King Due Diligence Field Review and Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

To conduct due diligence you'll need to carefully review: income statements. records of accounts receivable and payable. balance sheets and tax returns including business activity statements (last 3-5 years) profit and loss records (last 2-3 years) cash deposit and payment records, as reconciled with the accounts.

In financial setting, due diligence means an investigation or audit of a potential investment consummated by a prospective buyer. The objective is to confirm the accuracy of the seller's information and appraise its value. These investigations are typically undertaken by investors and companies considering M&A deals.

There are seven necessary steps to conduct effective IT due diligence. Step 1: Initiate.Step 2: Prepare.Step 3: Conduct the on-site discovery.Step 4: Discovery defines the issues.Step 5: Analyze the information and prioritize your initiatives.Step 6: Develop an IT due diligence report.

It can be a legal obligation, but the term will more commonly apply to voluntary investigations. A common example of due diligence in various industries is the process through which a potential acquirer evaluates a target company or its assets for an acquisition.

Due Diligence is a process that involves conducting an investigation, review, or audit to verify facts and information about a particular subject. In simple words, Due Diligence means doing your homework and acquisitions of required knowledge before entering into any agreement or contract with another company.

A due diligence checklist is an organized way to analyze a company. The checklist will include all the areas to be analyzed, such as ownership and organization, assets and operations, the financial ratios, shareholder value, processes and policies, future growth potential, management, and human resources.

Below are typical due diligence questions addressed in an M&A transaction: Target Company Overview. Understanding why the owners of the company are selling the business Financials.Technology/Patents.Strategic Fit.Target Base.Management/Workforce.Legal Issues.Information Technology.

Due Diligence Review (DDR) is a process, whereby an individual or an organization, seeks sufficient information about a business entity to reach an informed judgment as to its value for a specific purpose. Dictionary meaning of 'Due' is 'Sufficient' & 'Diligence' is 'Persistent effort or work'.

During the due diligence process, an investor will request information about your company that will inform their investment decision moving forward. In addition to asking questions of you and key members of your management team during meetings or phone calls, they will provide you with a request list.