Fairfax Virginia Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries

Description

How to fill out Trustee's Deed And Assignment For Distribution By Trustee To Testamentary Trust Beneficiaries?

Drafting legal documents can be tedious. Moreover, if you opt to hire a lawyer to create a commercial contract, ownership transfer documents, prenuptial agreements, divorce paperwork, or the Fairfax Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries, it could cost you a significant amount.

What is the most effective way to conserve time and finances while preparing valid documents that fully adhere to your state and local regulations? US Legal Forms serves as an ideal solution, whether you require templates for personal or business purposes.

Don't fret if the form does not fulfill your needs - search for the correct one in the header. Click Buy Now once you find the desired sample and choose the most suitable subscription. Log In or create an account to purchase your subscription. Make payment via credit card or PayPal. Select the document format for your Fairfax Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries and download it. Once completed, you can print it and fill it out on paper or import the samples into an online editor for quicker and more efficient completion. US Legal Forms allows repeated use of all documents you have ever acquired - you can locate your templates in the My documents tab in your profile. Give it a try today!

- US Legal Forms boasts the largest online assortment of state-specific legal forms, delivering users with current and professionally validated templates for any scenario all curated in one location.

- Thus, if you're in need of the most recent version of the Fairfax Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries, locating it on our platform is simple.

- Acquiring the documents requires minimal time.

- For existing account holders, ensure your subscription is active, Log In, and select the sample using the Download button.

- If you're not yet subscribed, here's how to obtain the Fairfax Trustee's Deed and Assignment for Distribution by Trustee to Testamentary Trust Beneficiaries.

- Browse the page and confirm there's a sample for your locality.

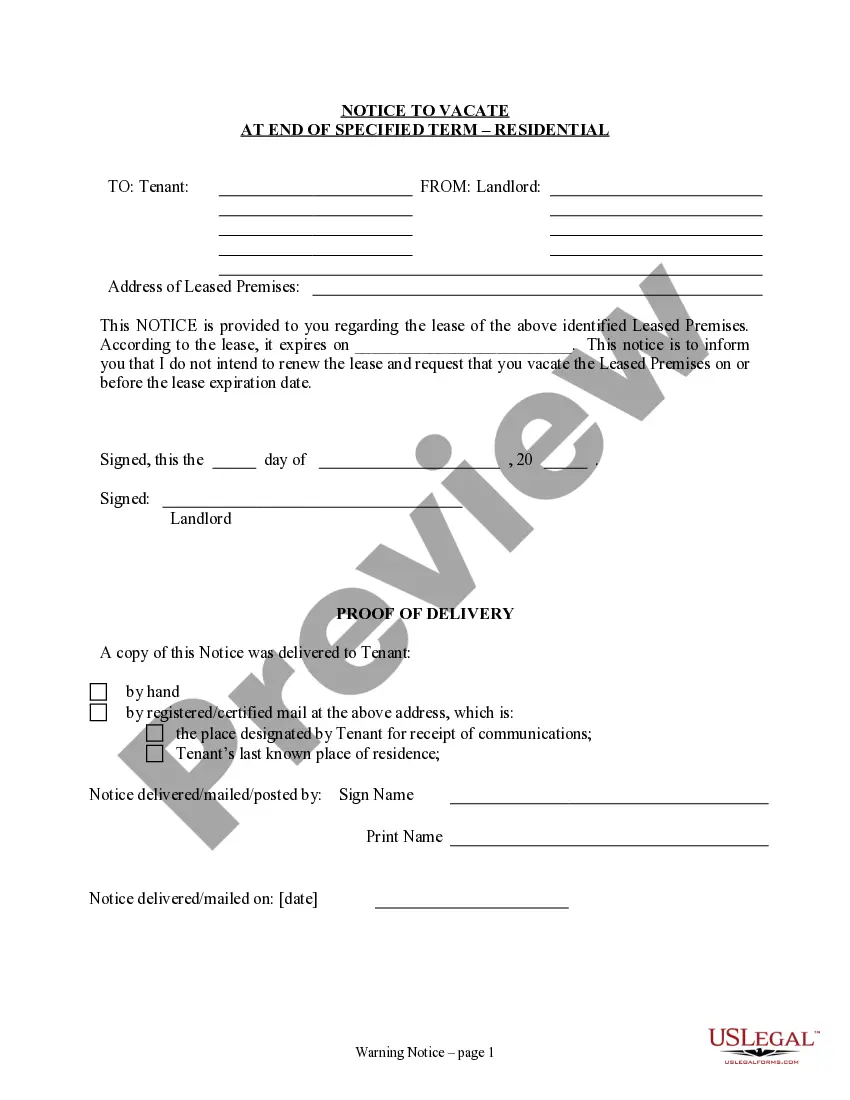

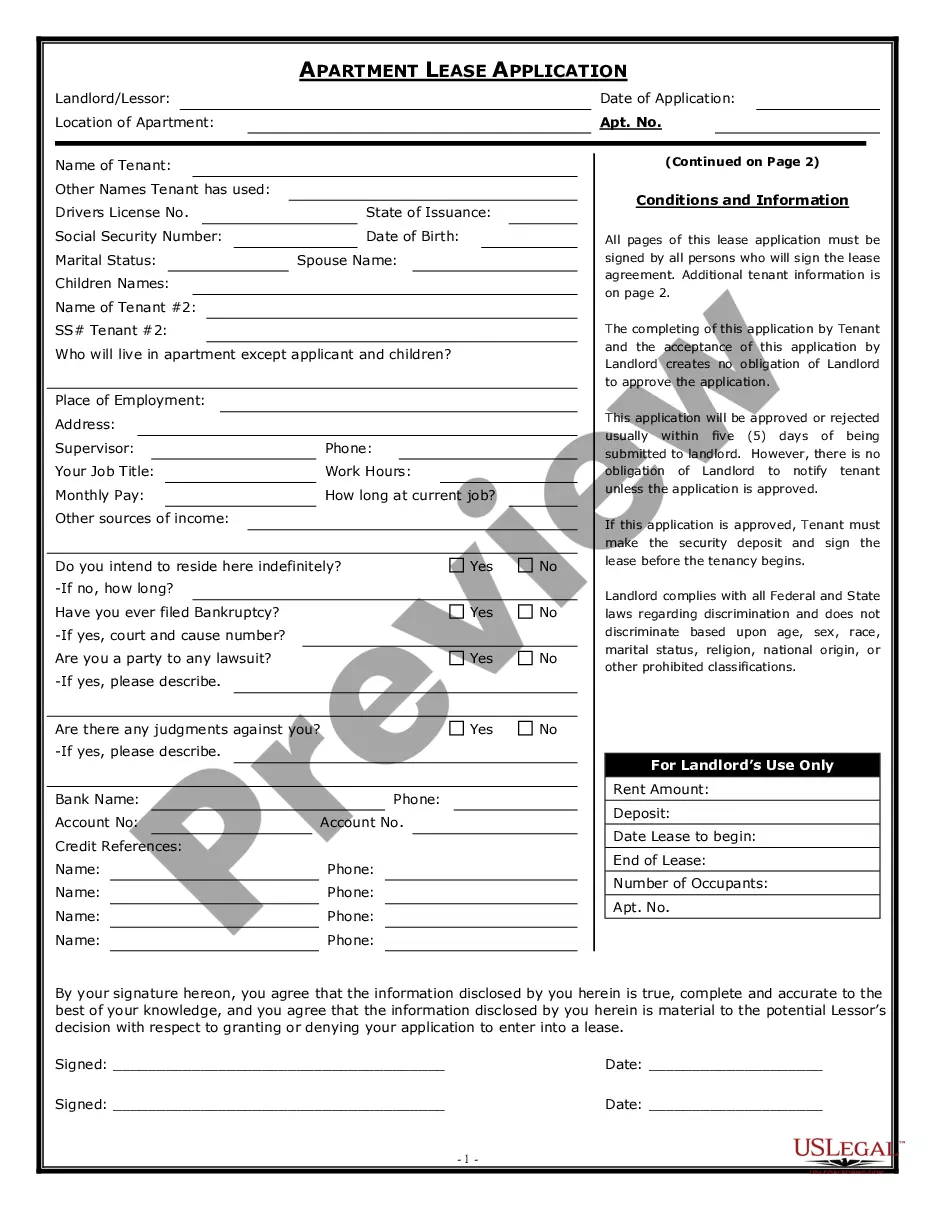

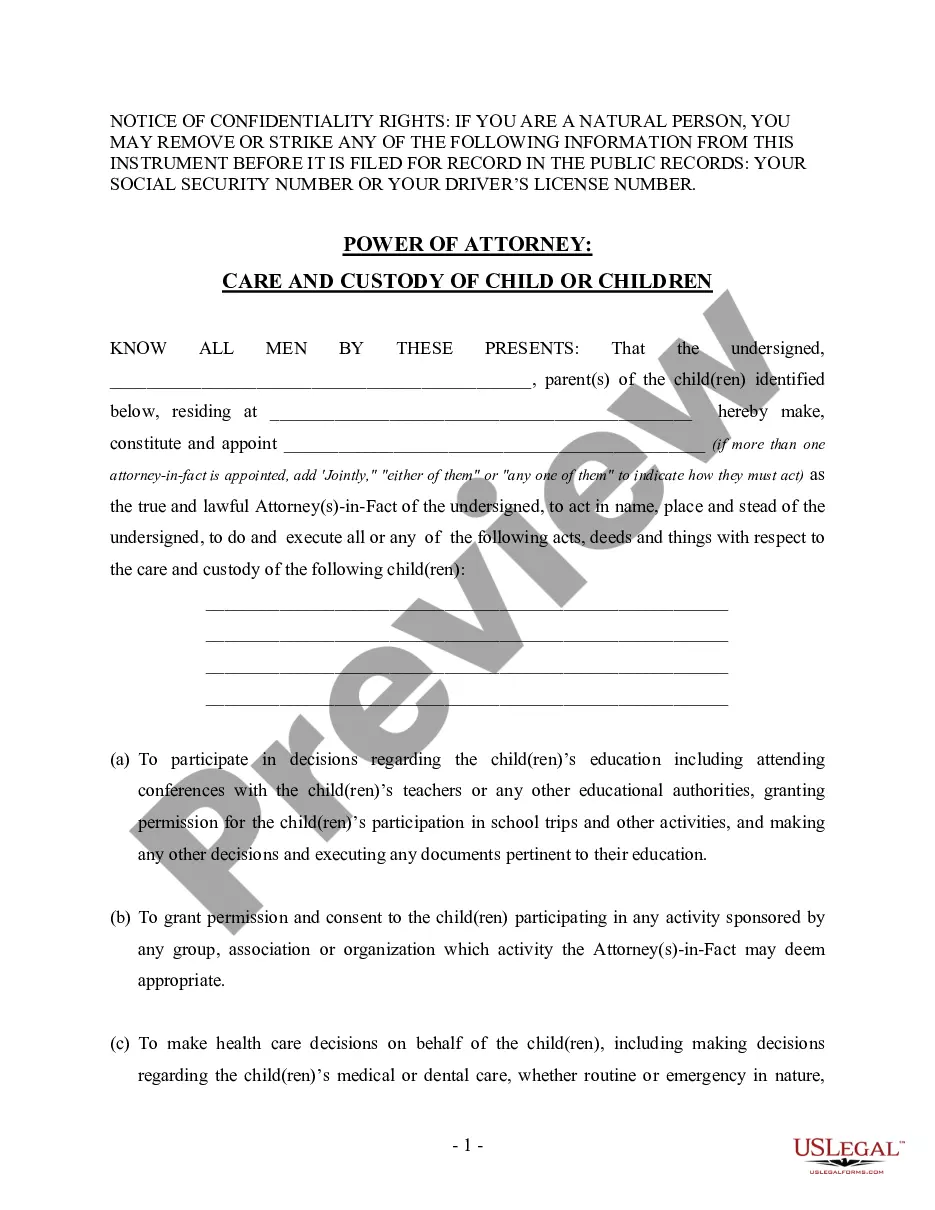

- Review the form description and utilize the Preview option, if available, to ensure it matches your needs.

Form popularity

FAQ

Sales of assets between a grantor trust and its grantor are disregarded for income tax purposes, which allows sales to occur without triggering capital gains taxes. Distributions can be made from grantor trusts to beneficiaries of the trust without any gift tax consequence.

In the case of a good Trustee, the Trust should be fully distributed within twelve to eighteen months after the Trust administration begins. But that presumes there are no problems, such as a lawsuit or inheritance fights.

Virginia has no set time limit for settling an estate. You can take the time you need to grieve and get your affairs in order before you settle the estate. However, Virginia courts do generally recommend that you start the process within a week to 30 days after the funeral.

Once the trustee has determined what represents the income or the capital of the trust, the trustee must then confirm his powers to distribute that income and capital and his discretion to choose the beneficiaries who will receive the distributions of that income or capital.

To distribute real estate held by a trust to a beneficiary, the trustee will have to obtain a document known as a grant deed, which, if executed correctly and in accordance with state laws, transfers the title of the property from the trustee to the designated beneficiaries, who will become the new owners of the asset.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

If the trust earned any ordinary income or accumulated ordinary income from previous years, the distributions must first come from the ordinary income. If the distribution exceeds the trust's ordinary income, the balance of the distribution is treated as coming from capital gains (both current and accumulated).

Preservation Family Wealth Protection & Planning Too bad, says the IRS, unless you are an estate or trust. Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

How does Testamentary Trust Taxation Work? Testamentary Trusts are taxed as a whole, though beneficiaries will not be forced to pay taxes on distributions from the Trust. Note that you could be responsible for the capital gains tax, depending on your state.

As noted above, a personal representative can obtain the protection of an Order of Distribution within six months and make complete distribution by that time. A trustee cannot secure that protection and might deem it prudent to wait longer than six months to make final distribution.