San Jose California Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

A documentation routine is always associated with any judicial action you undertake.

Initiating a business, applying for or accepting a job proposal, transferring ownership, and many other life situations necessitate you to prepare formal papers that differ from state to state. That’s why having everything compiled in a single location is immensely beneficial.

US Legal Forms is the most comprehensive online repository of contemporary federal and state-specific legal templates. Here, you can effortlessly find and acquire a document for any personal or business purpose utilized in your area, including the San Jose Deed and Assignment from Trustee to Trust Beneficiaries.

Finding forms on the platform is extraordinarily straightforward. If you already possess a subscription to our service, Log In to your account, locate the sample using the search field, and click Download to save it onto your device. Subsequently, the San Jose Deed and Assignment from Trustee to Trust Beneficiaries will be available for further use in the My documents section of your profile.

This is the most straightforward and dependable approach to obtain legal documents. All the samples available in our collection are expertly drafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Ensure you have reached the correct page with your local form.

- Utilize the Preview mode (if accessible) and scroll through the template.

- Examine the description (if available) to confirm the template suits your needs.

- Search for another document via the search bar if the sample does not meet your criteria.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then Log In or establish an account.

- Choose the desired payment option (via credit card or PayPal) to continue.

- Select the file format and save the San Jose Deed and Assignment from Trustee to Trust Beneficiaries on your device.

- Utilize it as necessary: print it or complete it electronically, sign it, and send it wherever needed.

Form popularity

FAQ

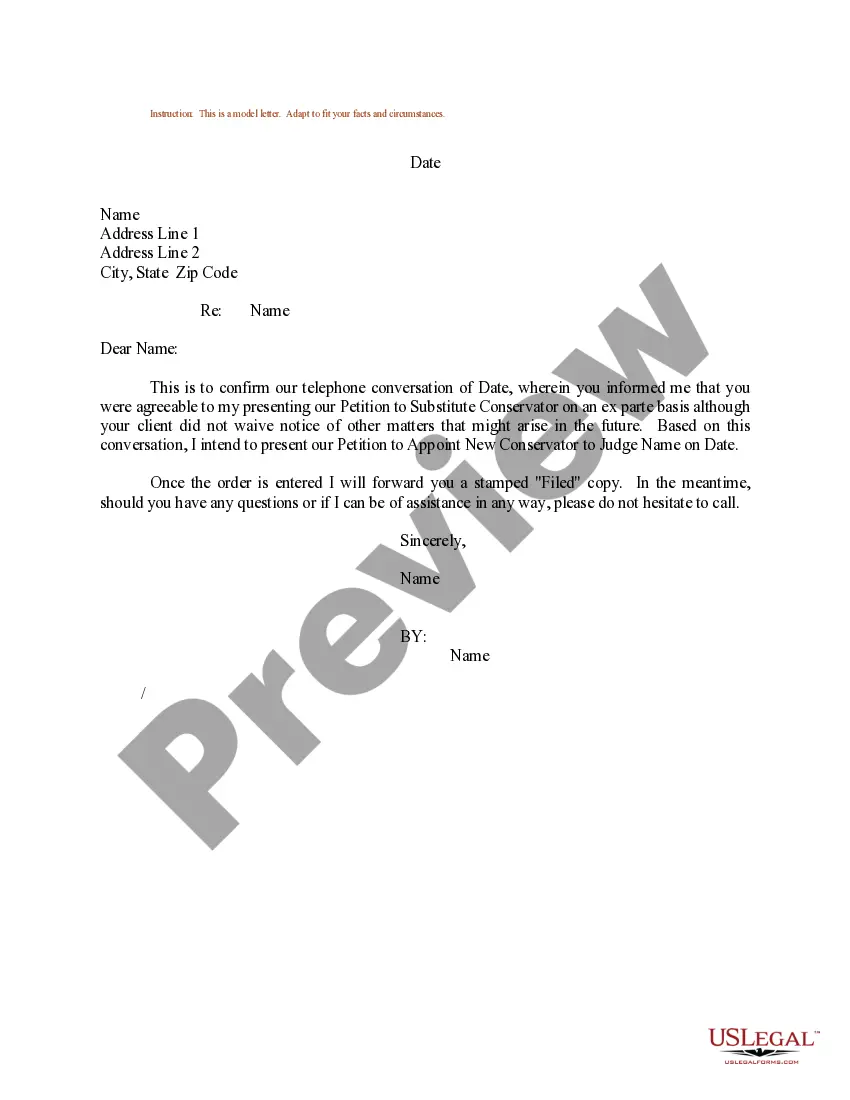

One of the biggest mistakes parents make when setting up a trust fund is failing to communicate their intentions clearly to their beneficiaries. This lack of clarity can lead to misunderstandings and conflicts down the line. Additionally, not having a proper San Jose California Deed and Assignment from Trustee to Trust Beneficiaries can complicate transfers. It’s essential to establish a well-structured plan that includes thorough discussions about the trust's purpose and processes.

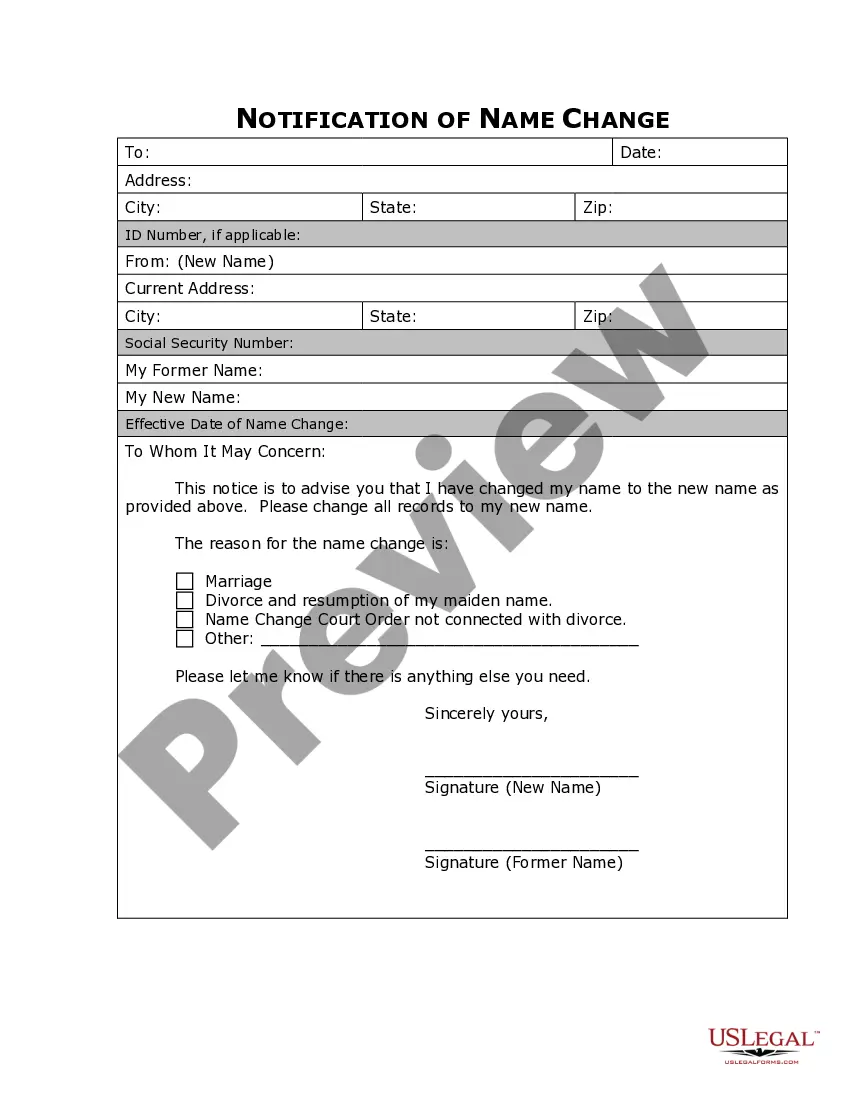

Distributing trust property to beneficiaries requires a clear understanding of the trust's provisions. Begin by utilizing the San Jose California Deed and Assignment from Trustee to Trust Beneficiaries to formalize the transfer of property. Make sure all legal documentation is completed accurately, and inform beneficiaries of their rights and responsibilities regarding the property. This proactive approach minimizes disputes and promotes a harmonious transition.

To distribute trust assets to beneficiaries, the trustee must first review the trust terms. The San Jose California Deed and Assignment from Trustee to Trust Beneficiaries plays a vital role in executing these distributions. Trustees should assess all trust assets and their values to ensure equitable distribution. Open communication with beneficiaries about the distribution process fosters transparency and helps manage expectations effectively.

Transferring property from a trust to a beneficiary in California involves executing a San Jose California Deed and Assignment from Trustee to Trust Beneficiaries. This legal document allows the trustee to convey the property interests directly to the designated beneficiaries, ensuring a clear transfer of ownership. To initiate this process, gather the necessary documentation, such as the trust agreement, and ensure that all parties are informed about the transfer. Consulting a legal expert can also help ensure compliance with state laws, making the process smooth and efficient.

To transfer property from a trust to a beneficiary in California, you need to use the San Jose California Deed and Assignment from Trustee to Trust Beneficiaries. This deed legally transfers ownership from the trust to the beneficiary once the trustee executes it. It's advisable to work with a knowledgeable platform like US Legal Forms to access the right forms and ensure a seamless transfer process.

Yes, you can transfer assets from a trust to beneficiaries. This process involves the San Jose California Deed and Assignment from Trustee to Trust Beneficiaries. By executing the necessary documents, you ensure that the intended beneficiaries receive their rightful assets. Using a platform like US Legal Forms can simplify this process, guiding you through the necessary steps.

In California, a trust does not have to be recorded to be legal unless it holds title on real estate. If a trust does not hold title on real estate property, all assets held in the name of the trust are kept private. The trustee maintains a record of all trust property in a trust portfolio.

So can a trustee also be a beneficiary? The short answer is yes, but the trustee will have to be exceedingly careful to never engage in any actions that would constitute a breach of trust, including placing their personal interests above those of the other beneficiaries.

The sole trustee cannot be the sole beneficiary because a trust is a legal relationship between a trustee and the beneficiary or beneficiaries. If a sole trustee were also the sole beneficiary, then this would be an agreement that a person had with themselves.

How to Write Step 1 Obtain The California Deed Of Trust Form For Your Use.Step 2 Determine And Present Where This Deed Must Be Returned.Step 3 Report The Assessor's Parcel Number.Step 4 Record The Effective Date Of This Deed.Step 5 Produce The Debtor's Identity As The Trustor.