Philadelphia Pennsylvania Deed and Assignment from individual to A Trust

Description

How to fill out Deed And Assignment From Individual To A Trust?

How long does it generally require for you to create a legal document.

As each state possesses its own statutes and regulations for every aspect of life, finding a Philadelphia Deed and Assignment from an individual to A Trust that meets all local criteria can be laborious, and obtaining it from a qualified attorney is frequently costly.

Many online platforms provide the most frequently used state-specific documents for download, but utilizing the US Legal Forms library is the most advantageous.

You can print the document or utilize any desired online editor to complete it electronically. No matter how many times you need to access the purchased document, you can locate all the files you’ve ever downloaded in your profile by visiting the My documents section. Give it a try!

- US Legal Forms is the largest online collection of templates, organized by states and areas of application.

- In addition to the Philadelphia Deed and Assignment from an individual to A Trust, you can discover any particular form to manage your business or personal matters, adhering to your local standards.

- Experts confirm the validity of all templates, ensuring that you can prepare your documentation accurately.

- Using the service is incredibly straightforward.

- If you already possess an account on the site and your subscription is active, you simply need to Log In, select the required template, and download it.

- You can obtain the document in your profile at any point in the future.

- If you are visiting the website for the first time, a few additional steps will be needed before you can acquire your Philadelphia Deed and Assignment from an individual to A Trust.

- Examine the content of the page you are currently on.

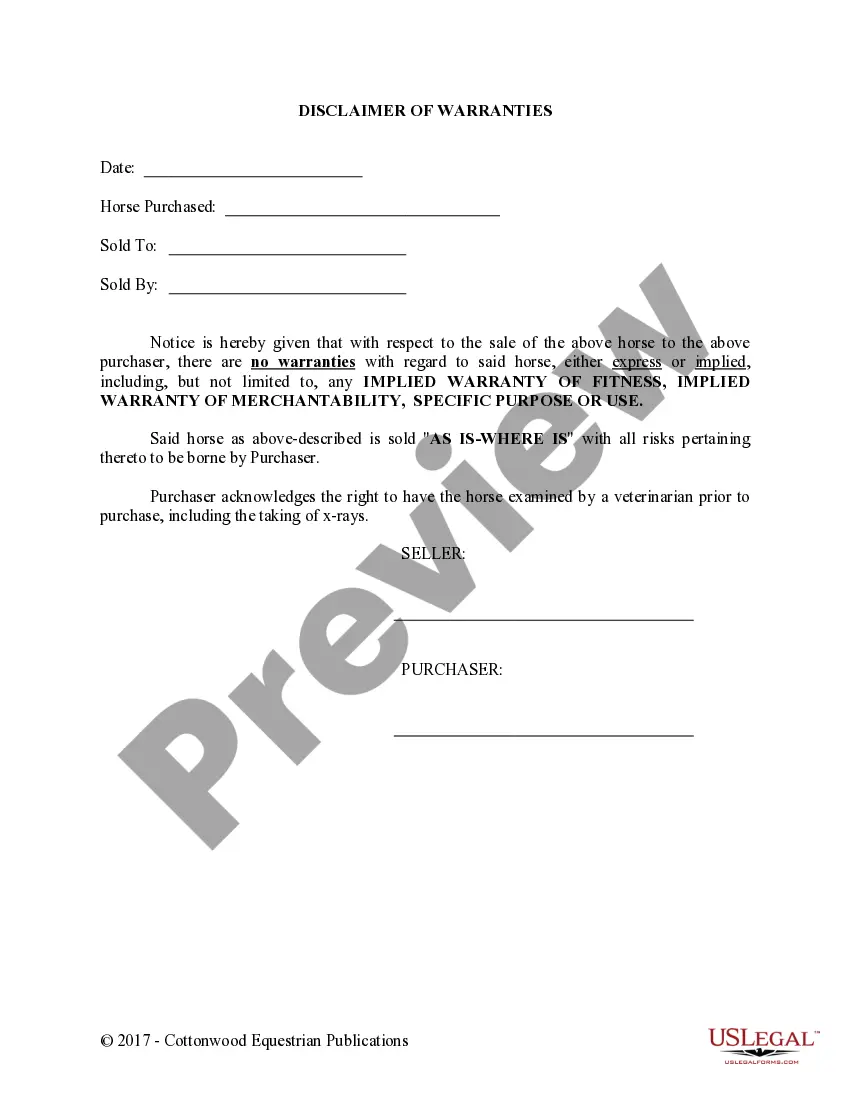

- Review the description of the template or Preview it, if accessible.

- Search for another form using the corresponding option in the header.

- Click Buy Now once you are certain about the selected file.

- Choose the subscription plan that best fits your needs.

- Establish an account on the platform or sign in to move forward to payment options.

- Complete payment through PayPal or using your credit card.

- Alter the file format if required.

- Click Download to save the Philadelphia Deed and Assignment from an individual to A Trust.

Form popularity

FAQ

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own. We also recommend that you get title insurance.

A gift must be given out of disinterest or pure generosity. This means to qualify as a gift; the property must be given freely or in exchange for goods or services that cost significantly less than the value of the gift.

Currently, the fee for filing the deed, which distributes the house from your Mother's estate into your own name, is $252.00. This amount is comprised of: $107 (Filing Fee), $107 (Philadelphia Housing Trust Fee), $. 50 (State Writ Tax), $2.00 (Philadelphia County Fee) and $35.50 (Access to Justice Fee).

Transfer of property in relation to Property Settlement Agreement or Divorce Decree. deeds@phillydeeds.com. e090 Phone: (215) 989-4530. e103 Fax: (215) 701-9186.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

To change, add or remove a name on your deed a new deed needs to be recorded reflecting the change. Many people think they can come into the office and change the present recorded deed with a form, but that is not the case. Once a deed is recorded it cannot be changed.

Our regular service will file your deed with any Pennsylvania county within 10 business days. Please check with us as many counties have COVID-related delays. Need it FAST? Your deed transfer will be filed the NEXT business day upon receipt of notarized deed if you choose our expedited service for an additional $300.

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

What does it cost? The recording charge is set by the county and we charge a administative fee. For counties from Erie, Elk, Franklin and Centre to Bucks, Berks, and Butler, the charge for a deed transfer across Pennsylvania is $700, with the sole exception of Philadelphia, which is $750.

Average Title transfer service fee is 20b120,000 for properties within Metro Manila and 20b130,000 for properties outside of Metro Manila.