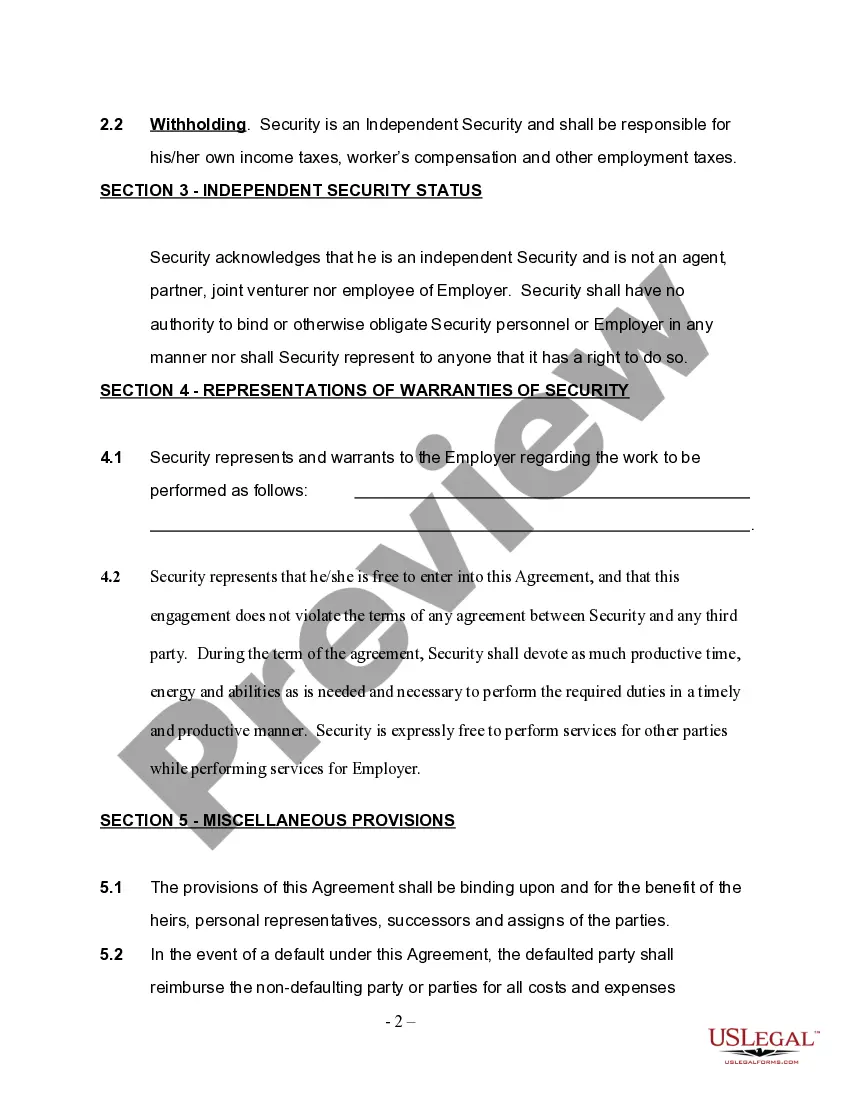

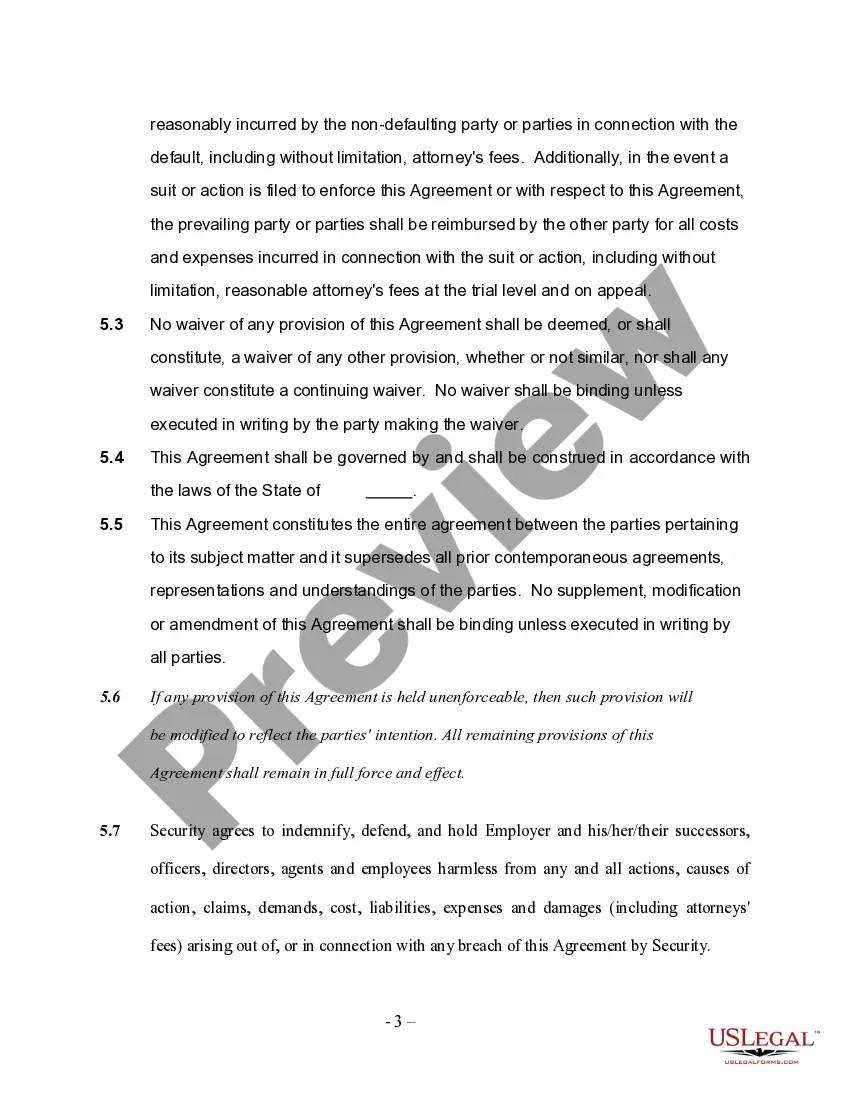

Travis Texas Self-Employed Security Guard Services Contract

Description

How to fill out Self-Employed Security Guard Services Contract?

A documentation process consistently accompanies any legal action you undertake.

Starting a business, applying for or accepting a job opportunity, transferring assets, and many other life circumstances require you to prepare official documents that vary by state.

That’s the reason having everything gathered in one location is incredibly advantageous.

US Legal Forms stands as the largest online repository of current federal and state-specific legal documents.

Decide on the appropriate subscription plan, then Log In or create an account. Choose the preferred payment option (via credit card or PayPal) to continue. Select file format and download the Travis Self-Employed Security Guard Services Agreement onto your device. Use it as necessary: print it or complete it electronically, sign it, and submit where needed. This is the easiest and most dependable method to acquire legal documentation. All templates offered by our library are professionally crafted and validated for compliance with local laws and regulations. Prepare your documents and handle your legal matters effectively with US Legal Forms!

- Here, you can easily find and acquire a document for any personal or business need utilized in your county, including the Travis Self-Employed Security Guard Services Agreement.

- Finding forms on the platform is highly straightforward.

- If you already possess a subscription to our library, Log In to your account, search for the sample using the search bar, and click Download to save it onto your device.

- Subsequently, the Travis Self-Employed Security Guard Services Agreement will be accessible for further use in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this brief guide to acquire the Travis Self-Employed Security Guard Services Agreement.

- Ensure you have accessed the correct page for your local form.

- Utilize the Preview mode (if available) and navigate through the template.

- Examine the description (if provided) to confirm the form meets your needs.

- Look for another document using the search tab if the sample does not suit you.

- Click Buy Now when you find the required template.

Form popularity

FAQ

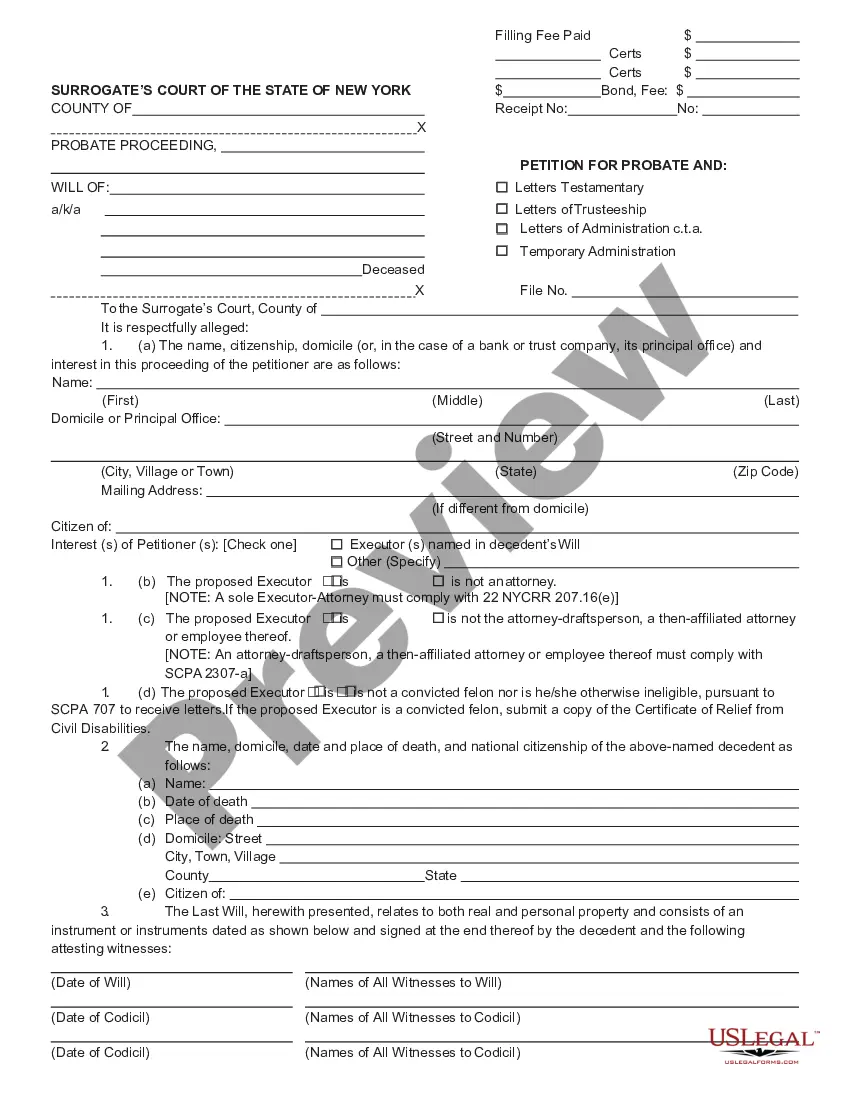

In Texas, there are several types of security licenses, including Level 2 and Level 3 licenses for security officers. Each license serves a different purpose and has specific training requirements. Furthermore, the Travis Texas Self-Employed Security Guard Services Contract may stipulate which license type a guard must possess based on the services provided.

Any security guard or similar personnel in the private security industry who is allowed to work after the probationary period shall be considered a regular employee.

A PPO license is required to provide security services on contract to any person or business. A security guard may not act as an independent contractor to provide security services.

Gavin Newsom signed new state legislation, Assembly Bill 5 (AB5), into law. Effective January 1, 2020, AB5 affects independent contractors throughout California, radically changing 30 years of worker classification and reclassifying millions as employees.

If you're looking for a career in the security industry, you might even be wondering can a security guard be self-employed? They absolutely can.

Security guards frequently work long hours and are often classified as independent contractors and paid a flat hourly rate or day rate, regardless of the number of hours they actually work in a week.

A: 1099s are forms issued by companies to independent contractors for services rendered. Guard carded security guards are not allowed to work as an independent contractor. Therefore, security guards must be issued a W2 after completing a W4.

With simple markup pricing what companies do is take how much they are paying their security officers and mark that number up X percent. So if they are paying their security officers $15 per hour, they might mark that number up 50% and have a billing rate of $22.50.

Since California offers no grace period, any security work done must be conducted by employees of a State licensed company and not by independent contractors.