King Washington The FACTA Red Flags Rule: A Primer

Description

How to fill out King Washington The FACTA Red Flags Rule: A Primer?

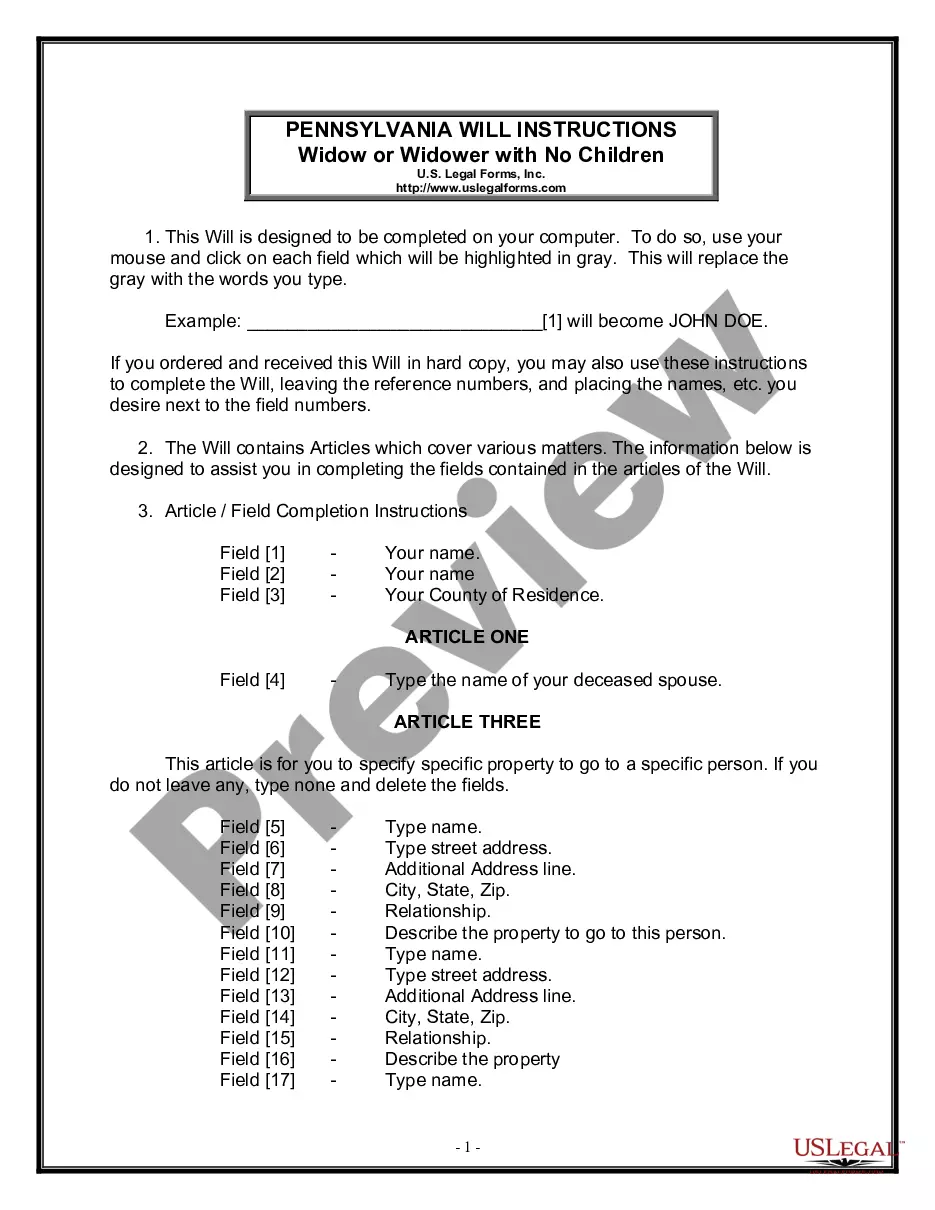

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including King The FACTA Red Flags Rule: A Primer, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks associated with paperwork execution simple.

Here's how to purchase and download King The FACTA Red Flags Rule: A Primer.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the similar document templates or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and buy King The FACTA Red Flags Rule: A Primer.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed King The FACTA Red Flags Rule: A Primer, log in to your account, and download it. Of course, our website can’t take the place of an attorney entirely. If you need to cope with an exceptionally challenging case, we advise using the services of an attorney to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant paperwork effortlessly!

Form popularity

FAQ

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to red flagspatterns, practices or specific activitiesthat could indicate identity theft.

The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

Essentially, the rule requires businesses to protect themselves and their customers against identity theft by defining red flags (i.e. any suspicious account activity, informational inconsistencies, or other signals that may be indicative of identity theft), putting systems in place to detect and act on those red

The Red Flags Rule seeks to prevent identity theft, too, by ensuring that your business or organization is on the lookout for the signs that a crook is using someone else's information, typically to get products or services from you without paying for them.

The FACTA disposal rule requires businesses to take reasonable measures to protect against unauthorized access to or use of consumers' information. According to the FTC, burning, pulverizing, and shredding are all considered reasonable measures under the disposal rule.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to red flagspatterns, practices or specific activitiesthat could indicate identity theft.

The Five Categories of Red Flags Warnings, alerts, alarms or notifications from a consumer reporting agency. Suspicious documents. Unusual use of, or suspicious activity related to, a covered account. Suspicious personally identifying information, such as a suspicious inconsistency with a last name or address.

The Red Flags Rule requires organizations to implement a written identity theft prevention program to help them identify any of the relevant red flags that indicate identity theft in daily operations. The Rule also offers steps to help prevent the crime and to mitigate its damage.

When the address or phone number is fictitious, a mail drop, or a prison, it is a red flag that indicates suspicious personal identifying information.

The Red Flags Rule requires specified firms to create a written Identity Theft Prevention Program (ITPP) designed to identify, detect and respond to red flagspatterns, practices or specific activitiesthat could indicate identity theft.