This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

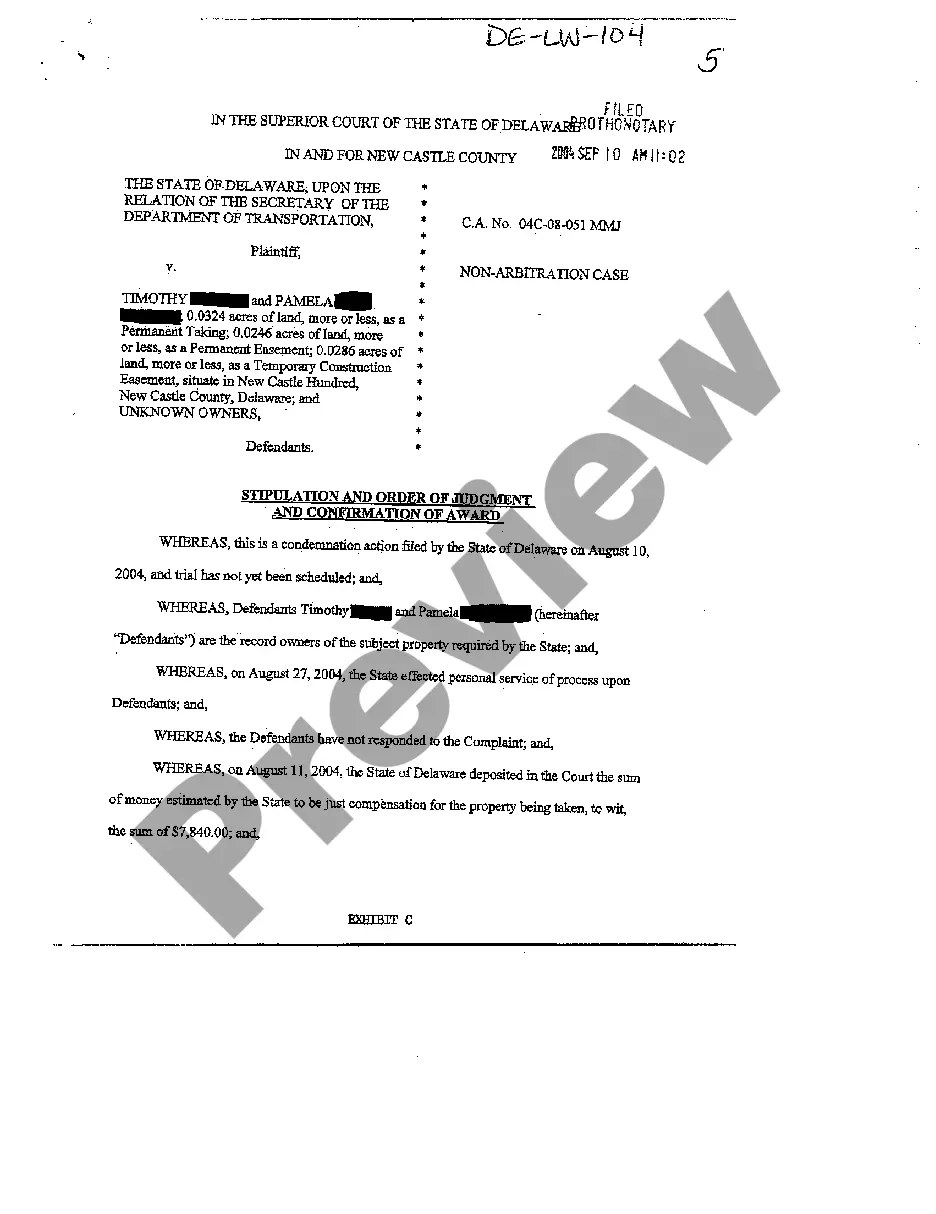

Note: The preview only shows the 1st page of the document.

The "Cook Illinois Guide to Complying with the Red Flags Rule under FCRA and FACT" is a comprehensive resource designed to assist individuals, businesses, and organizations in understanding and adhering to the regulations set forth by the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) in relation to Red Flags Rule compliance. This guide provides detailed instructions, explanations, and best practices for effectively implementing these rules in various industries and sectors. Key Features: 1. Red Flags Rule Overview: The guide begins with an overview of the Red Flags Rule and its significance in preventing identity theft and fraudulent activities. It explains how FCRA and FACT compliance play a crucial role in safeguarding sensitive personal information. 2. Identifying Red Flags: The guide thoroughly covers the identification process of potential red flags, which can be indicators of identity theft or fraud. It outlines various red flags specific to different industries such as financial institutions, healthcare organizations, educational institutions, and more. 3. Creating a Written Identity Theft Prevention Program (IPP): This guide provides step-by-step instructions for developing a comprehensive Identity Theft Prevention Program tailored to an organization's specific needs. It includes customizable templates, sample policies, and guidelines to ensure compliance with both FCRA and FACT requirements. 4. Employee Training and Compliance: Recognizing the significance of employee awareness, the guide emphasizes the importance of comprehensive training programs. It provides guidance on conducting effective training sessions, educating staff members about their roles and responsibilities, and promoting a culture of vigilance and adherence to the red flags' identification process. 5. Regular Program Updates: The Cook Illinois Guide emphasizes the need for regular program updates to reflect new industry trends, emerging red flags, and technological advancements. It advises on conducting periodic risk assessments to identify and address potential vulnerabilities in existing systems and processes. Types of Cook Illinois Guide to Complying with the Red Flags Rule under FCRA and FACT: 1. Cook Illinois Guide for Financial Institutions: This variant of the guide caters specifically to banks, credit unions, lenders, and other financial institutions, offering industry-specific examples and compliance strategies. 2. Cook Illinois Guide for Healthcare Providers: This variant focuses on helping healthcare organizations, medical facilities, and private practitioners navigate the Red Flags Rule implementation in a healthcare context. It emphasizes the importance of protecting patient health information and preventing medical identity theft. 3. Cook Illinois Guide for Educational Institutions: Tailored for schools, colleges, and universities, this variant delves into the unique challenges and red flags applicable to the education sector. It offers insights into securing personal information of students, faculty, and staff, while addressing potential risks within campus environments. The Cook Illinois Guide to Complying with the Red Flags Rule under FCRA and FACT serves as a comprehensive resource covering various industries and sectors, enabling businesses and organizations to establish and maintain effective identity theft prevention programs aligned with federal regulations.