Montgomery Maryland Grant Agreement from 501(c)(3) to 501(c)(4)

Description

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

How long does it usually take you to draft a legal document.

Considering that each state has its own laws and regulations for every life circumstance, locating a Montgomery Grant Agreement from 501(c)(3) to 501(c)(4) that meets all local standards can be exhausting, and obtaining it from a professional attorney is frequently expensive.

Multiple online platforms provide the most common state-specific templates for download, but utilizing the US Legal Forms library is most beneficial.

Select the subscription plan that best fits your needs. Create an account on the platform or Log In to advance to payment options. Process payment via PayPal or with your credit card. Change the file format if required. Click Download to save the Montgomery Grant Agreement from 501(c)(3) to 501(c)(4). Print the document or employ any preferred online editor to finalize it electronically. Regardless of how many times you need to utilize the obtained document, you can find all the templates you’ve downloaded in your profile by opening the My documents tab. Give it a try!

- US Legal Forms is the most extensive online repository of templates, organized by states and areas of application.

- In addition to the Montgomery Grant Agreement from 501(c)(3) to 501(c)(4), you can access any specific form to manage your business or personal matters while adhering to your county regulations.

- Experts authenticate all samples for their relevance, ensuring you can prepare your documentation accurately.

- Using the service is quite simple.

- If you already possess an account on the platform and your subscription is active, you just need to Log In, select the necessary sample, and download it.

- You can retrieve the document in your profile at any future time.

- If you are new to the platform, some additional steps will be required before you can acquire your Montgomery Grant Agreement from 501(c)(3) to 501(c)(4).

- Review the contents of the page you’re visiting.

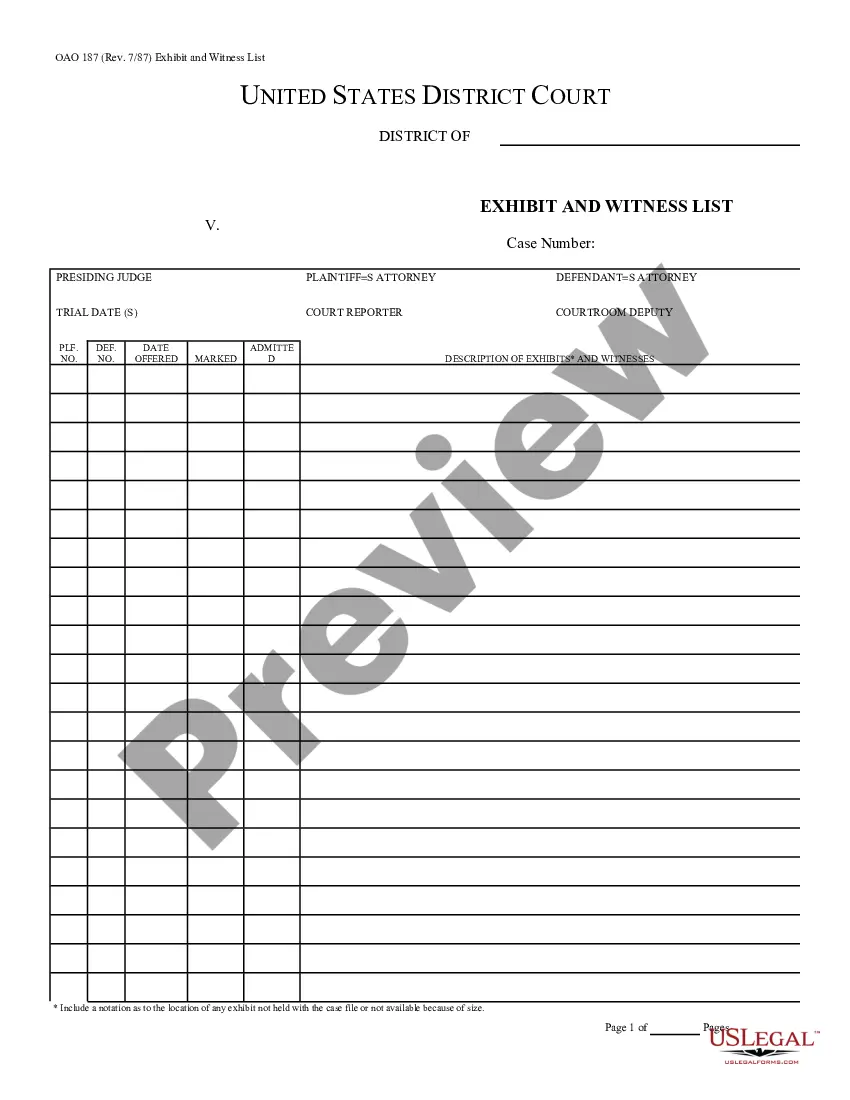

- Examine the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you are confident in the chosen document.

Form popularity

FAQ

Generally, a 501(c)(3) organization cannot give grants directly to individuals as per IRS guidelines. Instead, they should focus on funding projects and initiatives that align with the Montgomery Maryland Grant Agreement from 501(c)(3) to 501(c)(4). If your organization seeks to support individuals, consider exploring options to convert to a 501(c)(4) status.

The purpose of a grant or contribution is to provide financial support aimed at achieving designated outcomes. These funds facilitate projects that address community needs, promote research, or advance important causes. In the context of a Montgomery Maryland Grant Agreement from 501(c)(3) to 501(c)(4), grants are vital for organizations seeking to evolve while maintaining their commitment to their mission.

Creating an Effective Grant Agreement Amount and purpose of the grant. Grant agreements note specifically how much the fund is committing to what purpose, such as general operating support or a specific program.Grant period and payment schedule.Confirmation of charity's tax-exempt status.Notification of changes.

The FTA Full Funding Grant Agreement (FFGA) is the means mandated by statute for providing Federal financial assistance under 49 U.S.C. Section 5309 in the amount of $25 million or more for a major capital investment (new starts) project.

Grants are awards of financial assistance, usually from a governmental agency or foundation, primarily for carrying out a public purpose of support or stimulation. A grant is distinguished from a contract, which is used to acquire property or services for the government's direct benefit or use.

How to write an effective grant proposal: Write a strong cover letter. Start with a short executive summary. Introduce your organization. Write a direct problem statement. State your goals and objectives. Project design: methods and strategies. The evaluation section: tracking success. Other funding sources and sustainability.

Grant agreement means a legal instrument of financial assistance between a Federal awarding agency or pass-through entity and a non-Federal entity that, consistent with 31 U.S.C.

Grant Award Letter means the official notification that a Grant has been approved by the Authority.

Essentially, a contract is a legally binding document in which the parties make promises to deliver a product or service in exchange for consideration (usually money.) A grant on the other hand is when one party grants funds to another party to do something, in reasonable hopes that the task can be accomplished.

This Grant Funding Agreement sets out the conditions which apply to the Grant Recipient receiving the Grant from the Authority up to the Maximum Sum.