Orange California Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

Description

How to fill out Orange California Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Orange Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc..

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Orange Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Orange Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.:

- Make sure you have opened the proper page with your regional form.

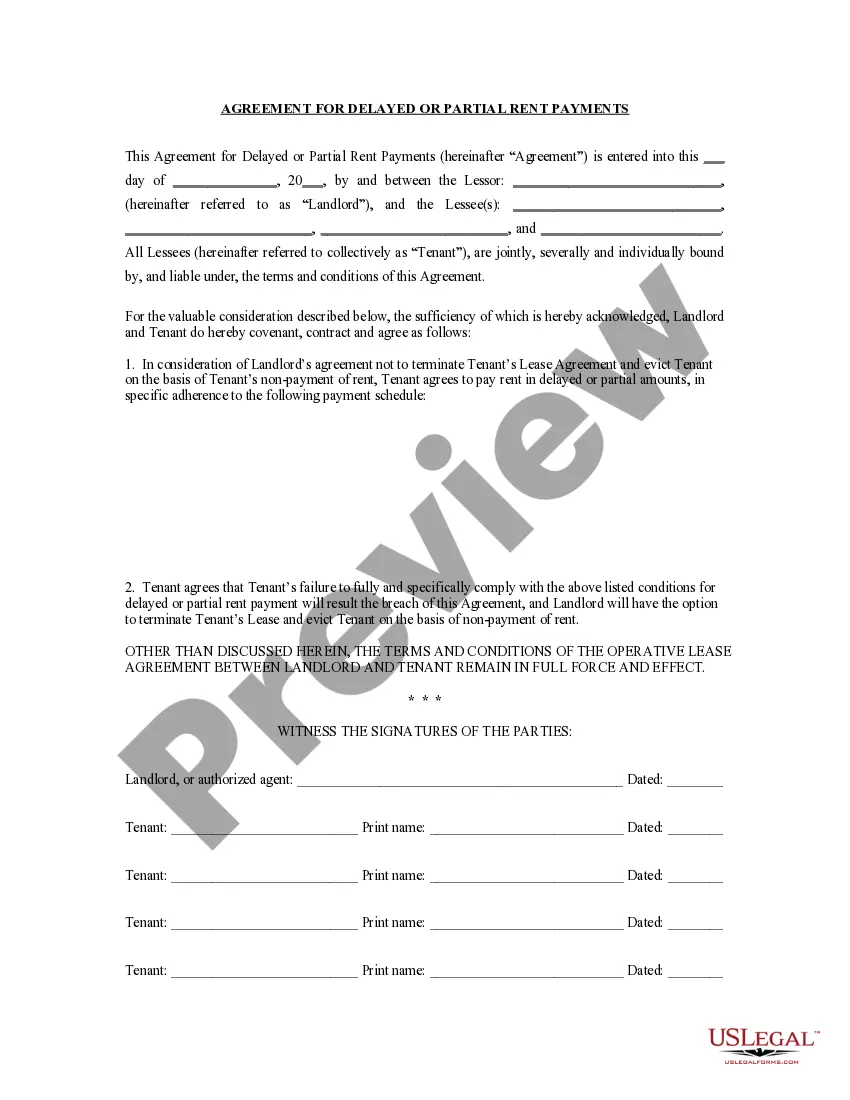

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Orange Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Explain the five stage model of mergers and acquisitions Stage 1: Corporate strategy evolution.Stage 2: Organising for acquisition.Stage 3: Deal structuring and negotiation.Stage 4: Post-acquisition integration.Stage 5: Post-acquisition audit and organisational learning.Marketing Management MCQ Questions.

Each of the transferor and transferee companies involved in merger must take an approval of their members holding 90% of shares in number, by holding a General Meeting. If all the shareholders give their consent in writing then ROC may dispense the need to convene physical general meeting.

The LLC laws of most states permit one LLC to merge into another LLC....Merge Your Old LLC Into a New LLC in a New State Create a written plan of merger. Have the plan approved by a vote of the LLC's members. File the articles of merger with the secretary of state where you formed the LLC.

The merger & acquisition process is very complex, yet can be broken down into four phases: due diligence, agreement, integration, and value attainment.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies.

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company.

Key Takeaways A merger, or acquisition, is when two companies combine to form one to take advantage of synergies. A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock.

State Agency Involvement After the articles of merger are created, they should be filed with the secretary of state or another agency in the state. You'll need to pay the mandatory filing fee and wait for the merger to be approved by the state agency. This dissolves the LLC that ends up merging.

8 Step in the Mergers and Acquisitions (M&A) Process #1 Developing Strategy.#2 Identifying and Contacting Targets.#3 Information Exchange.#4 Valuation and Synergies.#5 Offer and Negotiation.#6 Due Diligence.#7 Purchase Agreement.#8 Deal Closure and Integration.