Columbus Ohio Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

State:

Multi-State

City:

Columbus

Control #:

US-EG-9080

Format:

Word;

Rich Text

Instant download

Description

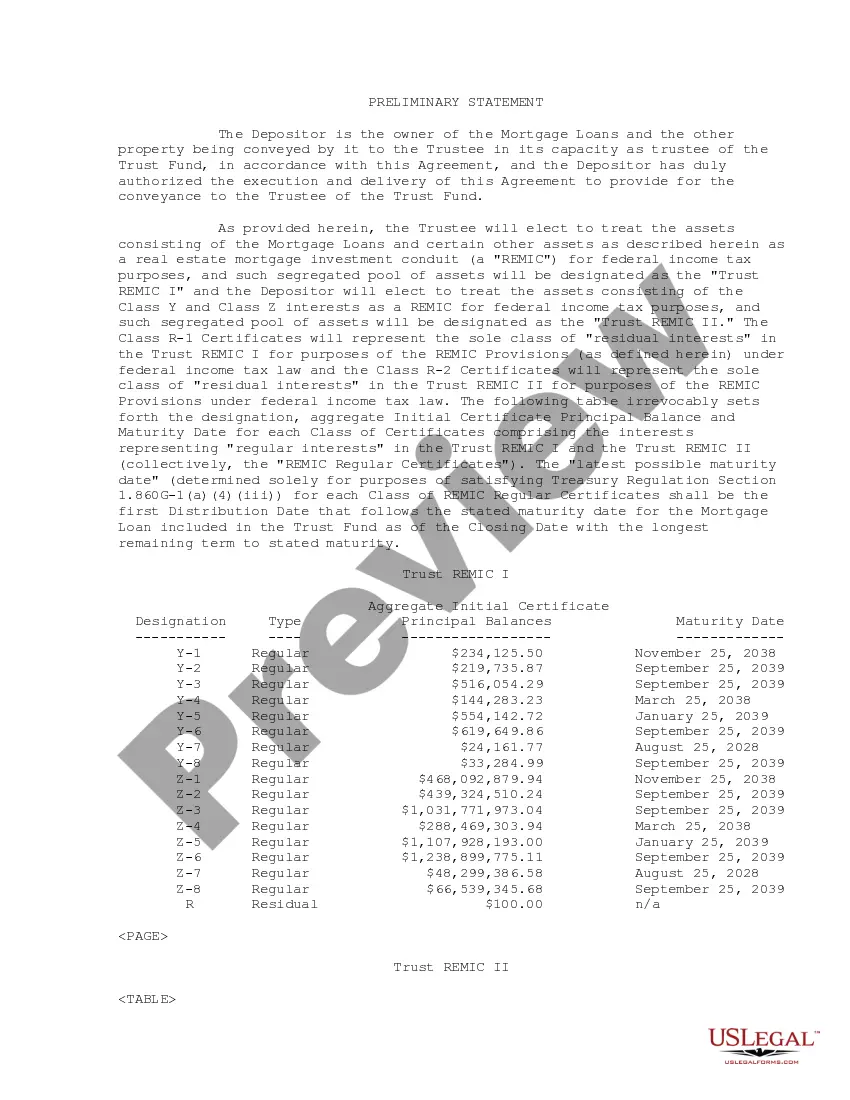

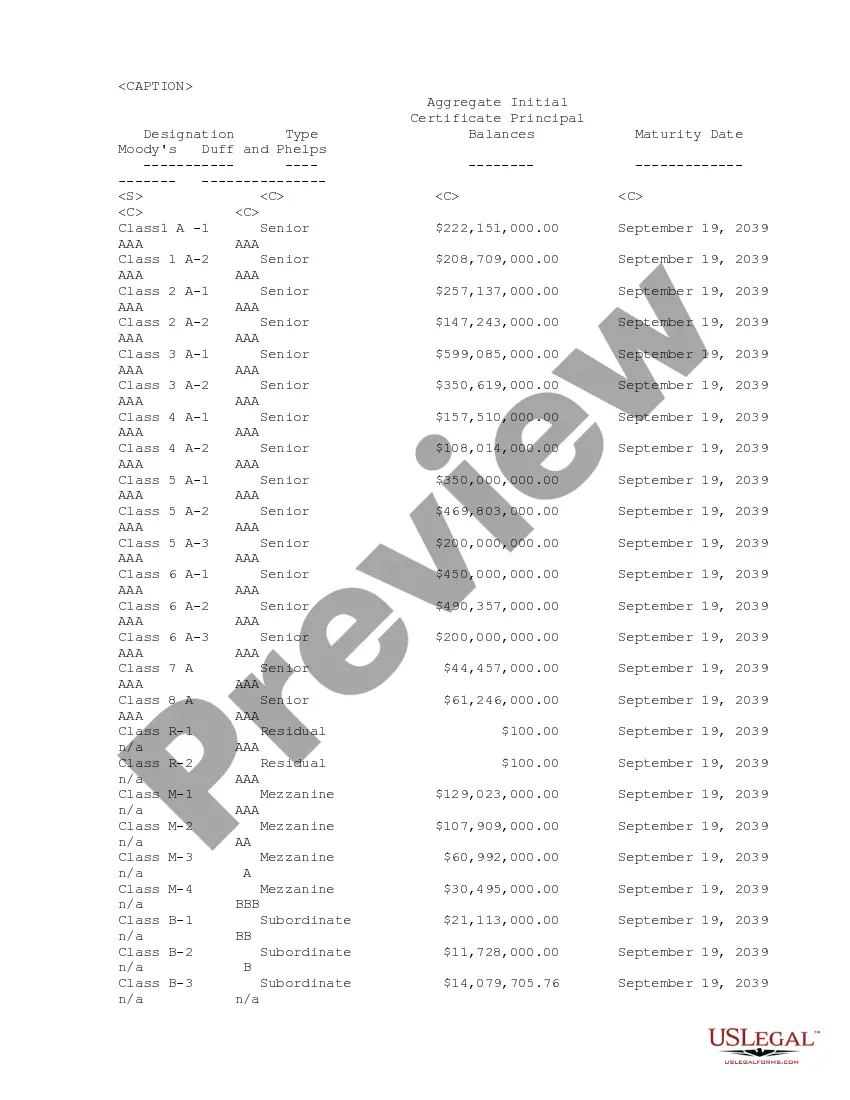

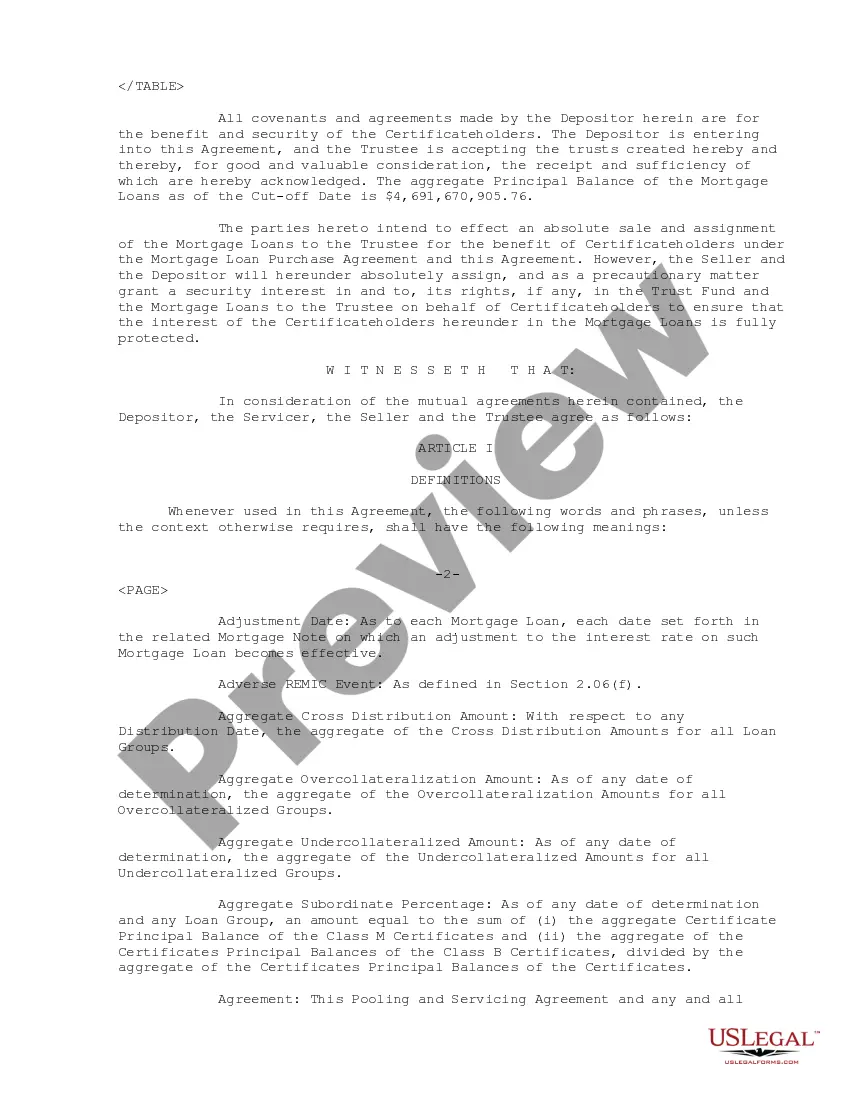

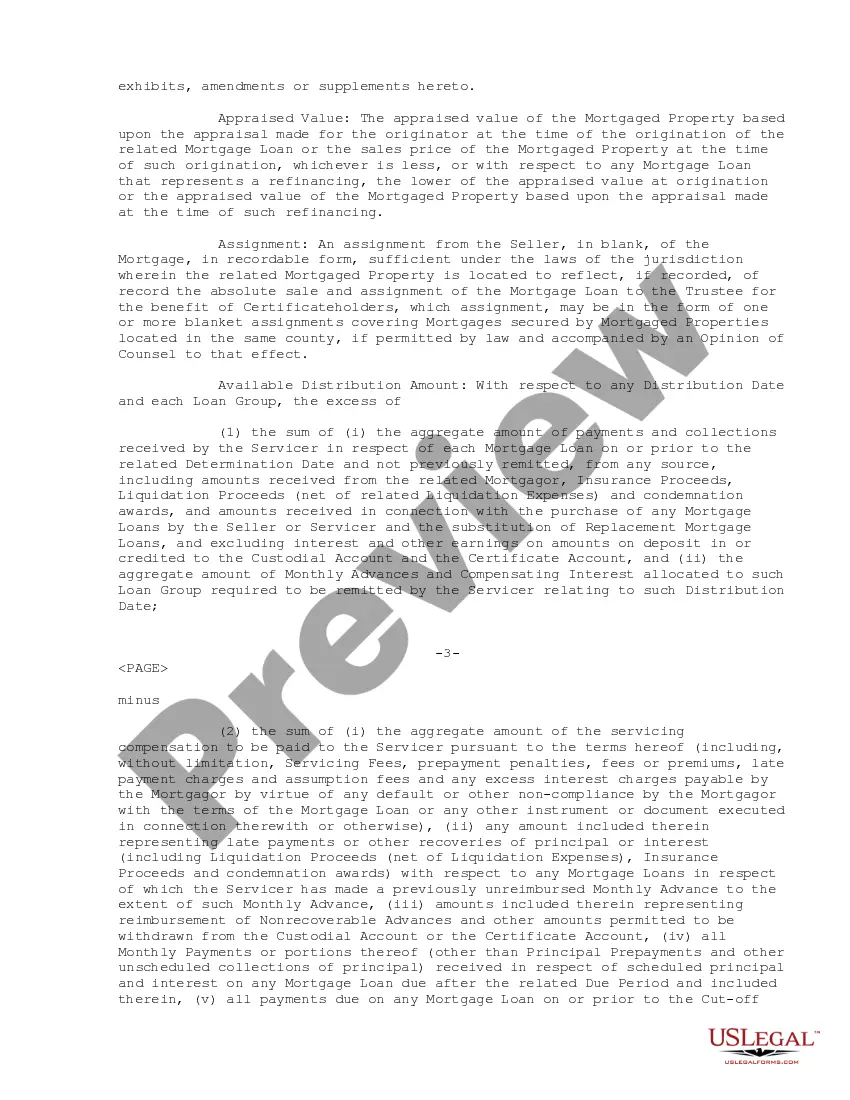

Pooling and Servicing Agr. btwn Credit Suisse First Boston Mortgage Securities Corp., Wash. Mutual Bank F.A. and Bank One - National Association dated Nov. 1, 1999. 213 pages

Free preview