Phoenix Arizona Basic Debt Instrument Workform

Description

How to fill out Basic Debt Instrument Workform?

Drafting legal documents can be tedious.

Furthermore, if you choose to hire a legal expert to create a business contract, ownership transfer documents, prenuptial agreement, divorce paperwork, or the Phoenix Basic Debt Instrument Workform, it can end up costing a significant amount. So, what is the most economical approach to conserve time and finances while generating authentic records that fully adhere to your state's laws and regulations? US Legal Forms is an excellent option, whether you are looking for templates for personal or commercial purposes.

Click Buy Now once you find the desired template and select the most suitable subscription. Log In or create an account to process your payment. Complete the transaction using a credit card or PayPal. Choose the document format for your Phoenix Basic Debt Instrument Workform and save it. Afterward, you can print it out to fill by hand or import the templates into an online editor for quicker and more convenient completion. US Legal Forms allows you to reuse all documents acquired multiple times - you can locate your templates in the My documents tab in your account. Try it now!

- US Legal Forms is the largest online repository of state-specific legal documents, offering users up-to-date and professionally validated templates for all scenarios assembled in one location.

- As a result, if you need the latest version of the Phoenix Basic Debt Instrument Workform, you can effortlessly find it on our site.

- Acquiring the documents requires minimal time.

- Those with an existing account should ensure their subscription is active, Log In, and select the template using the Download button.

- If you haven't subscribed yet, here's how you can acquire the Phoenix Basic Debt Instrument Workform.

- Browse the page and confirm there is a sample for your state.

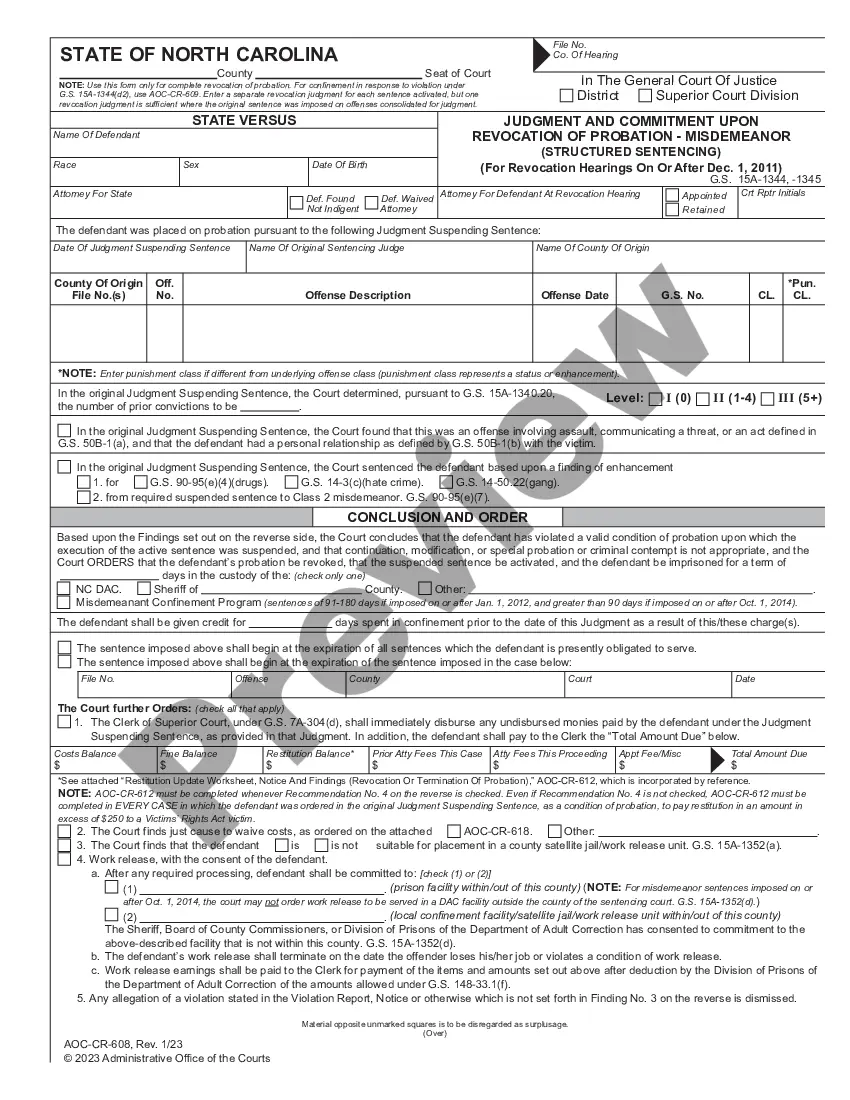

- Review the form description and utilize the Preview option, if accessible, to confirm it's the template you require.

- Don't fret if the form doesn't meet your criteria - search for the appropriate one in the header.

Form popularity

FAQ

AZ Form 285, similar to the details mentioned above, allows Arizona taxpayers to apply for an extension on their income tax filings. It’s essential to use this form correctly to avoid complications with the state tax authorities. Timely filing this request helps protect your financial interests. To facilitate this process, consider integrating the Phoenix Arizona Basic Debt Instrument Workform into your compliance toolkit.

Line 29a on Arizona Form 140 refers to the total amount of tax credits that you can claim for the tax year. This line is important because it helps reduce your overall tax liability. Accurately reporting this information can result in significant savings. For clarity, consider utilizing the Phoenix Arizona Basic Debt Instrument Workform to organize your financial details related to the credit applications.

A durable financial power of attorney in Arizona is a legal document that allows one person to manage another's financial affairs if they become incapacitated. This document remains effective even if the person who created it loses the ability to make decisions. It is a vital tool for ensuring financial management continuity. When considering creating one, the Phoenix Arizona Basic Debt Instrument Workform can help you visualize the terms of your arrangement.

Whether you need to file an Arizona state tax return depends on your income level and filing status. People who reside or earn income in Arizona usually have an obligation to file if they meet specific criteria. This step is crucial to ensure you meet state tax compliance to avoid penalties. Use the Phoenix Arizona Basic Debt Instrument Workform to assist you in determining your filing requirements and organizing your financial statements.

On your Arizona tax withholding form, you should provide personal information, including your name, address, and Social Security number. You also need to report your expected income, tax exemptions, and any additional withholding amounts. Properly filling out this form helps you manage your tax liabilities throughout the year. Leveraging the Phoenix Arizona Basic Debt Instrument Workform can empower you to organize related financial data effectively.

The Arizona amended tax form, known as Form 140-X, is for taxpayers who need to correct their original state income tax return. This form allows you to amend any discrepancies or errors in the previously filed return. It is essential to provide accurate information to avoid potential issues with the Arizona Department of Revenue. Completing the Phoenix Arizona Basic Debt Instrument Workform may help ensure your financial documents align with your amended return.

Yes, if you make certain types of payments to independent contractors or freelancers in Arizona, you need to file Form 1099-NEC. The state requires you to report these payments, which may relate to your business activities. It's important to keep accurate records to ensure compliance. Utilizing the Phoenix Arizona Basic Debt Instrument Workform can assist you with understanding any related financial agreements.

A debt typically becomes uncollectible after the statute of limitations expires, which is usually six years in Arizona. Creditors cannot take legal action or report the debt after this period. However, unpaid debts may still affect your credit score for a longer duration. To manage your finances and understand your obligations better, explore the benefits of the Phoenix Arizona Basic Debt Instrument Workform.

Debt collectors in Arizona can attempt to collect on debts for six years as well, mirroring the statute of limitations. They will generally contact you during this period to request payment or set up arrangements. However, after this time has passed, they lose the legal authority to collect the debt. For better management, consider the Phoenix Arizona Basic Debt Instrument Workform to track your debts and obligations.

In Arizona, the statute of limitations for most debts is generally six years. This means that creditors can pursue legal action to collect the debt within this timeframe. After this period, they may no longer file a lawsuit to recover the debt. Utilizing the Phoenix Arizona Basic Debt Instrument Workform can help you organize your finances and navigate your obligations efficiently.