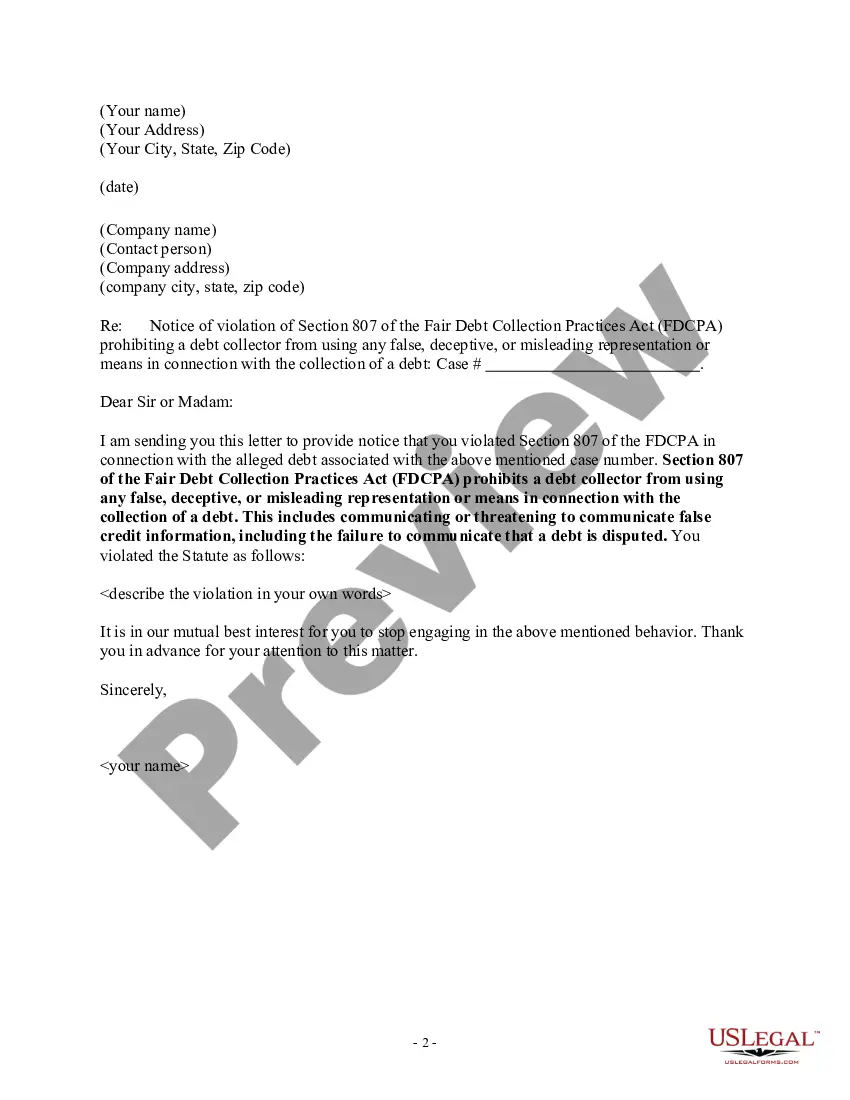

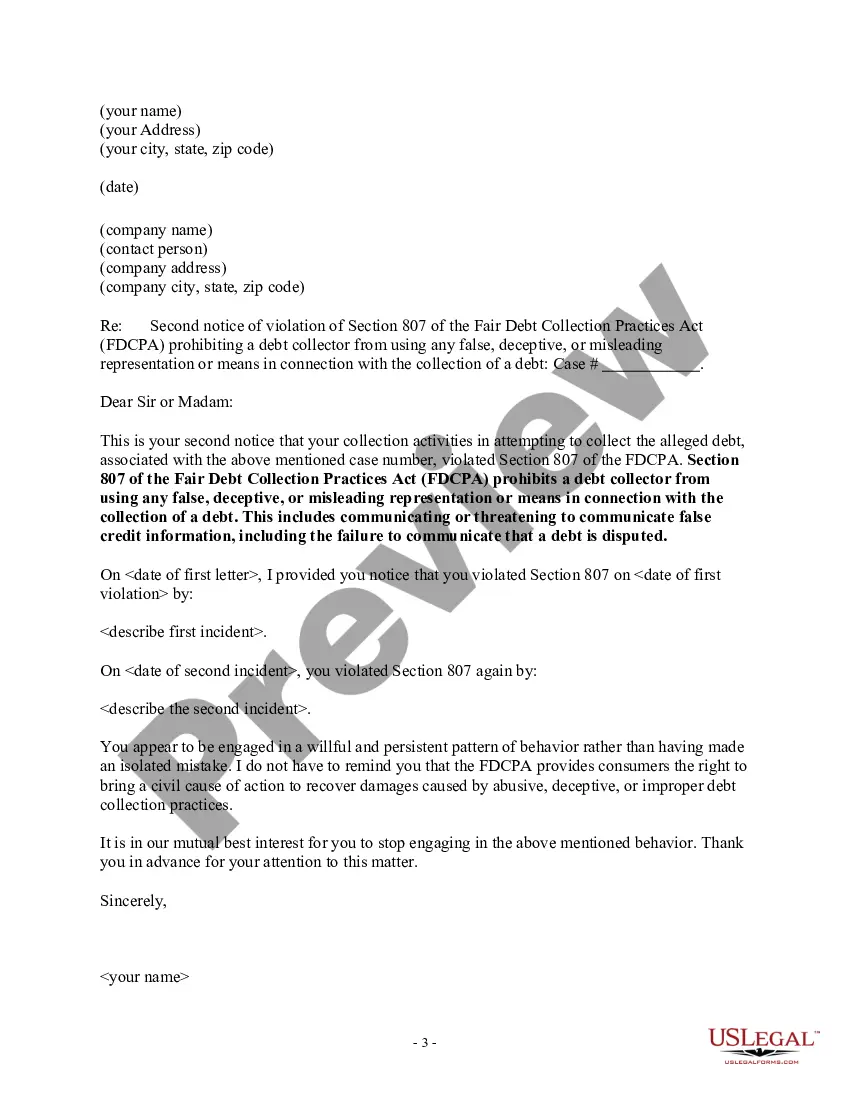

Philadelphia Pennsylvania Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

Do you require to swiftly compose a legally-enforceable Philadelphia Notice of Violation of Fair Debt Act - False Information Disclosed or perhaps any alternative document to address your personal or professional concerns? You have two choices: reach out to an expert to draft a legal document for you or create it entirely by yourself. Fortunately, there's a third option - US Legal Forms. It will assist you in obtaining well-crafted legal documents without incurring exorbitant fees for legal services.

US Legal Forms provides an extensive catalog of over 85,000 state-specific template forms, including the Philadelphia Notice of Violation of Fair Debt Act - False Information Disclosed and form packages. We furnish documents for a wide range of scenarios: from divorce paperwork to real estate agreements. We have been in business for over 25 years and have established an impeccable reputation among our clients. Here's how you can join them and acquire the necessary template without added hassles.

If you have already created an account, you can easily Log In, find the Philadelphia Notice of Violation of Fair Debt Act - False Information Disclosed template, and download it. To re-download the form, simply navigate to the My documents section.

It’s simple to discover and download legal forms if you utilize our services. Furthermore, the documents we provide are evaluated by industry specialists, which gives you increased assurance when dealing with legal matters. Experience US Legal Forms today and see for yourself!

- Firstly, confirm that the Philadelphia Notice of Violation of Fair Debt Act - False Information Disclosed is compliant with your state’s or county's regulations.

- If the document includes a description, ensure to verify its intended purpose.

- Begin the search process anew if the form isn’t what you desired by utilizing the search bar at the top.

- Choose the plan that most appropriately suits your requirements and proceed to payment.

- Pick the file format you wish to receive your document in and download it.

- Print it, fill it out, and sign on the indicated line.

Form popularity

FAQ

Defending against a debt collection lawsuit involves understanding the claims made against you and gathering relevant evidence to support your case. You can challenge the validity of the debt or assert violations of the FDCPA. In situations where Philadelphia Pennsylvania Notice of Violation of Fair Debt Act - False Information Disclosed applies, exploring legal options through Uslegalforms can provide you with necessary resources and guidance to defend yourself effectively.

What are the provisions of the FDCPA? Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Statutory Damages of $1,000 Above and beyond what the consumer might collect for losses related to lost wages, psychological distress, and the like, the FDCPA allows a consumer to recover damages up to $1,000 from the collector.

Collectors are required by Fair Debt Collection Practices Act to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.