Bronx New York Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

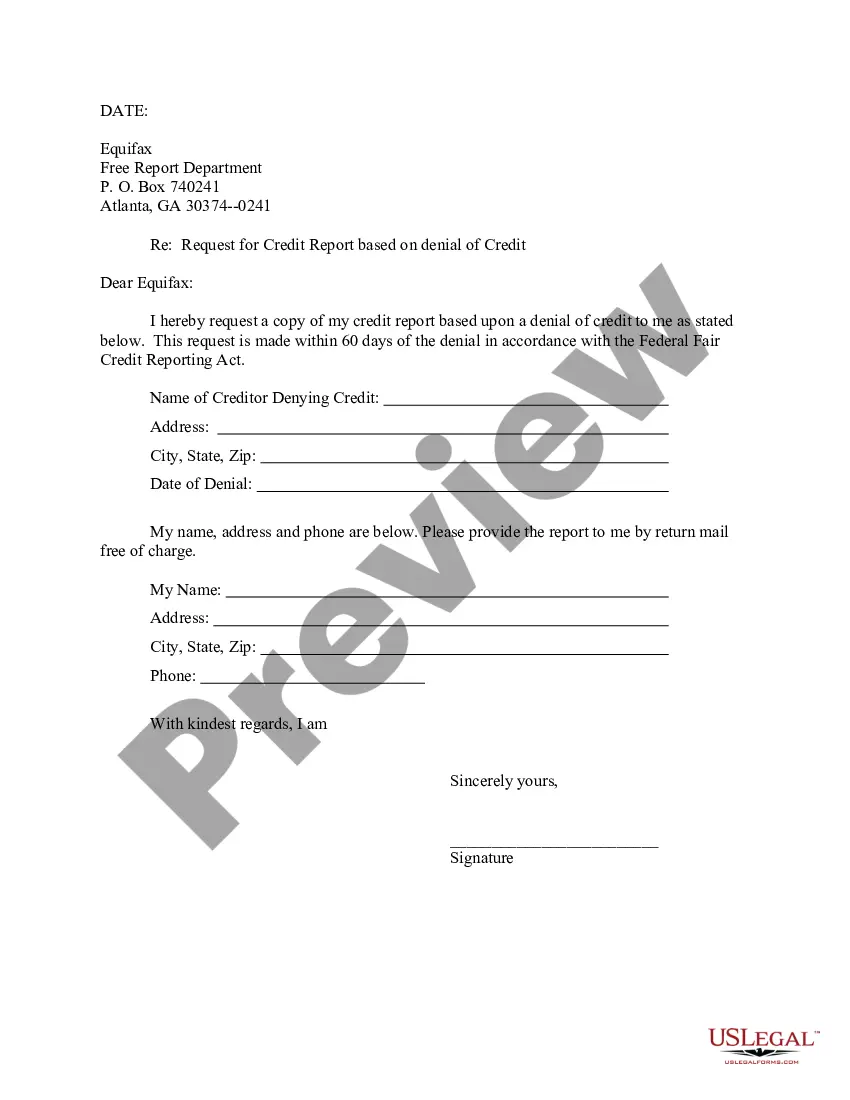

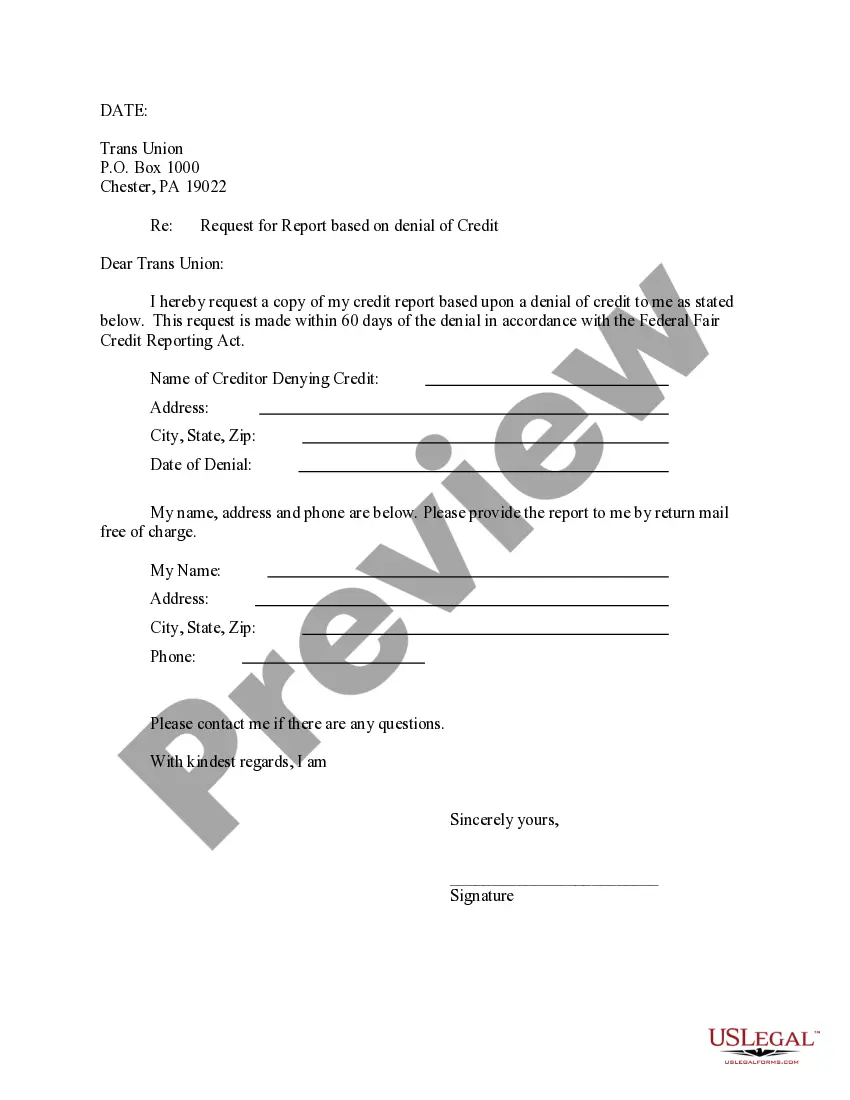

How to fill out Letter To Equifax Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

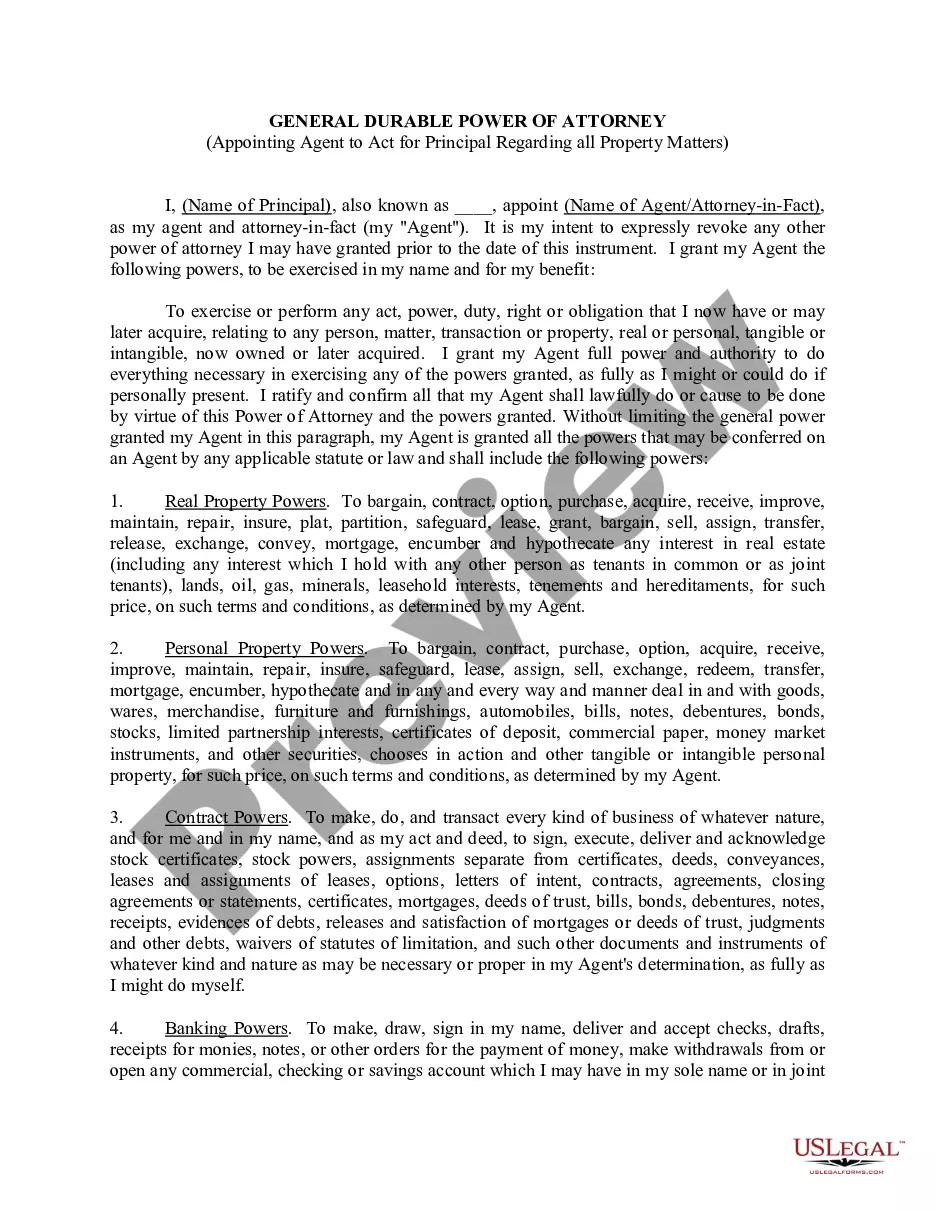

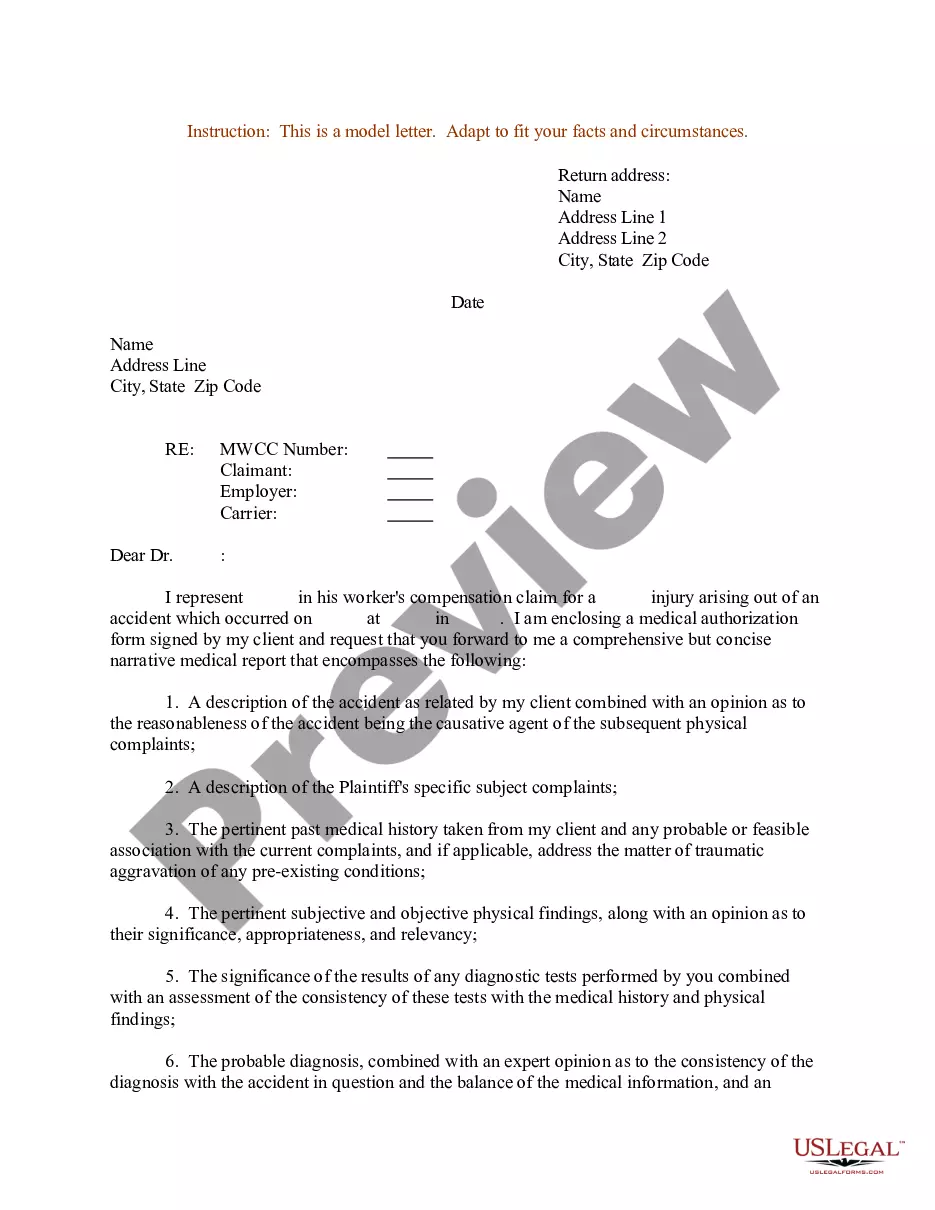

Drafting documentation for the enterprise or individual necessities is perpetually a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it’s vital to consider all federal and state regulations of the specific area.

Nonetheless, smaller counties and even towns also possess legislative protocols that you must account for.

The fantastic aspect of the US Legal Forms library is that all the documents you've ever obtained remain accessible - you can retrieve them in your profile within the My documents tab at any time. Enroll in the platform and swiftly acquire certified legal forms for any circumstance with just a few clicks!

- All these particulars make it cumbersome and time-consuming to produce Bronx Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit without professional guidance.

- It's simple to prevent squandering funds on attorneys drafting your documentation and create a legally accepted Bronx Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit independently, utilizing the US Legal Forms online library.

- It is the premier online compilation of state-specific legal documents that are expertly verified, ensuring their authenticity when selecting a template for your county.

- Previously subscribed users only need to Log In to their accounts to retrieve the necessary form.

- If you don’t possess a subscription yet, follow the step-by-step instructions below to acquire the Bronx Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit.

- Browse through the page you've opened and check if it contains the document you need.

- To achieve this, utilize the form description and preview if these choices are accessible.

Form popularity

FAQ

The lender must give you instructions for requesting your credit report from that particular credit reporting company. Those instructions are usually included with the declination notice. If an Experian credit report was used, you can request your free report at .

You are entitled to a free copy of your credit report You have the right to get a free copy of your credit report within 60 days of being denied credit. Simply contact the credit reporting agency that provided the credit report and ask for a free report. You can also get a free credit report every 12 months.

Contact the Creditor Directly Contact the creditor that furnished the incorrect information, and demand that it tell the credit reporting agency to remove the data from your report. You can use Nolo's Request to Creditor to Remove Inaccurate Information or write your own letter.

You may already know that you're entitled to a free credit report from each of the three credit bureaus every 12 months. In addition, you can sign up to receive six free credit reports from Equifax with a myEquifax2122 account.

You're entitled to a free copy of your credit reports every 12 months from each of the three nationwide credit bureaus by visiting . You can also create a myEquifax account to get six free Equifax credit reports each year.

Annual Credit Report Access The credit report you get when you're denied credit is in addition to the annual credit report that you can order once a year from the three credit bureaus through AnnualCreditReport.com.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com.

However, if that hasn't been your experience when requesting your credit reports, you're not alone. If the credit bureau can't verify your identity using your answers to the security questions, you won't get access to your credit report online.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com. You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com.