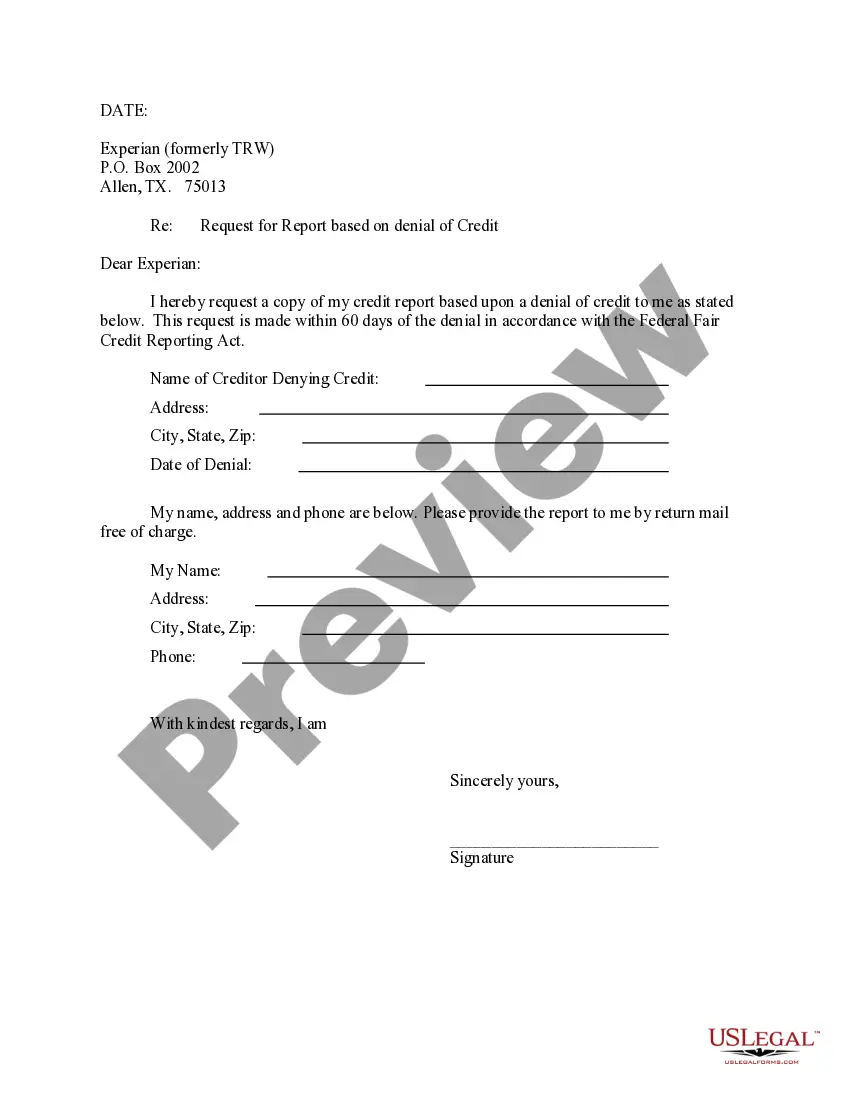

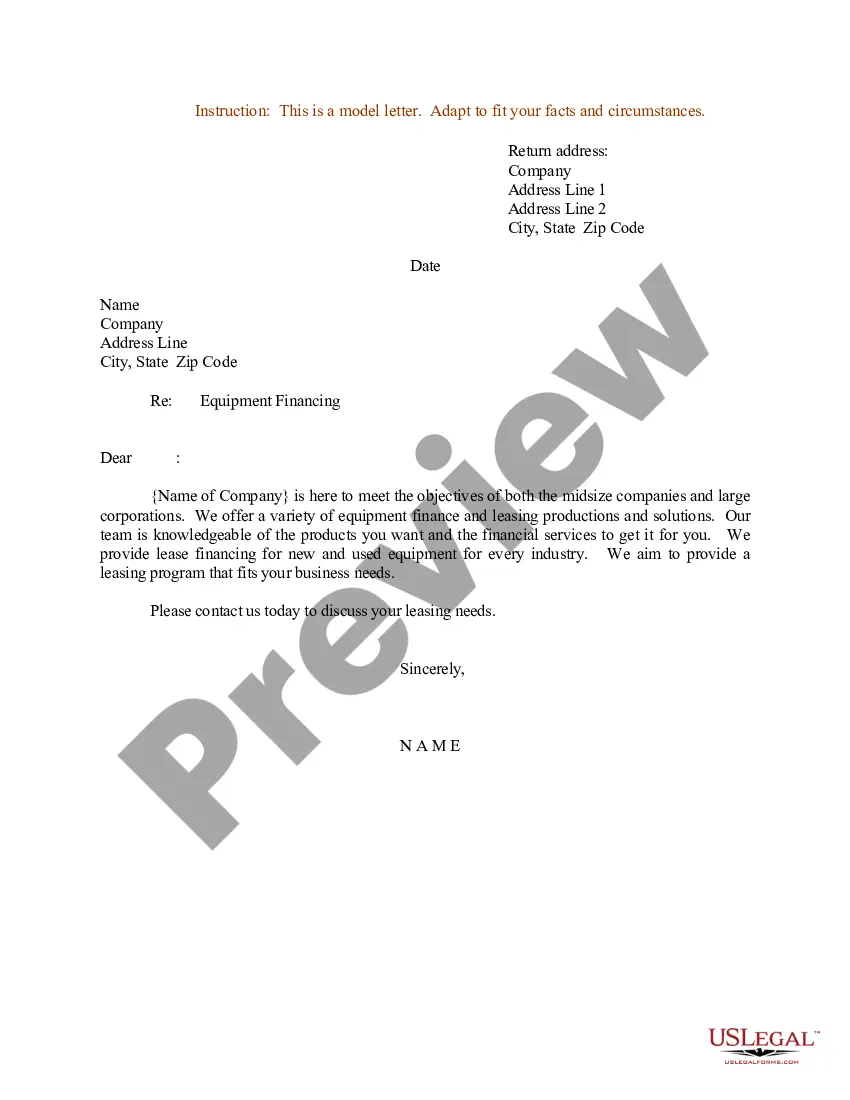

Houston Texas Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out Letter To Experian - Formerly TRW - Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Laws and guidelines in every sector vary across the nation.

If you are not a lawyer, it's simple to become confused with a range of standards when it comes to composing legal documents.

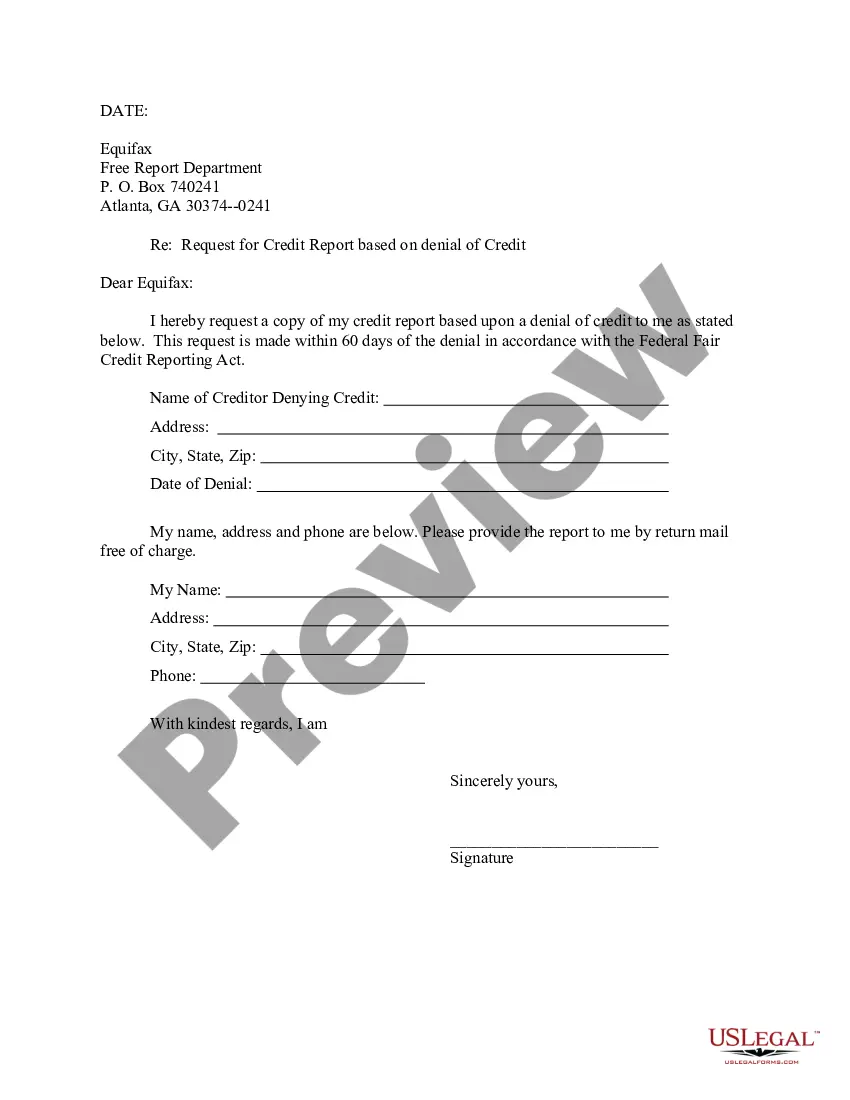

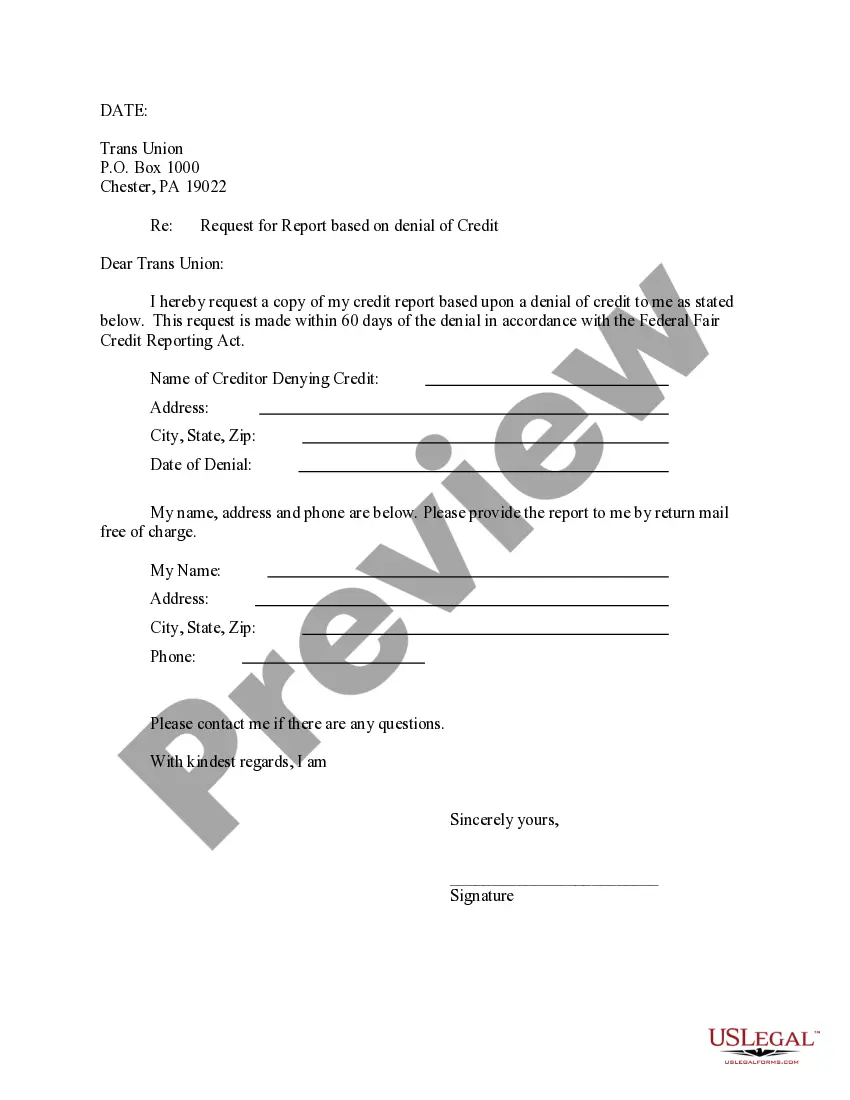

To prevent expensive legal help when drafting the Houston Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report due to Credit Denial, you require a confirmed template valid for your area.

That's the easiest and most cost-effective method to access current templates for any legal needs. Find them all with a few clicks and keep your documents well-organized using US Legal Forms!

- That's when utilizing the US Legal Forms platform proves to be beneficial.

- US Legal Forms is a reputable web directory of over 85,000 state-specific legal templates trusted by millions.

- It offers an excellent solution for professionals and individuals seeking self-service templates for various life and business situations.

- All forms can be reused: once you buy a template, it stays accessible in your account for later use.

- Thus, if you have a valid subscription account, you can simply Log In and re-download the Houston Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report due to Credit Denial from the My documents section.

- For new users, some additional steps are necessary to acquire the Houston Letter to Experian - formerly TRW - Requesting Free Copy of Your Credit Report due to Credit Denial.

- Review the page details to ensure you have found the correct template.

- Make use of the Preview feature or consult the form description if present.

Form popularity

FAQ

And according to the Equal Credit Opportunity Act, lenders are required to tell you why you've been turned down, if credit played a role. They must include a letter with the specific details, as well as the name of the credit reporting agency that supplied the information they were using.

If you are denied credit, the Equal Credit Opportunity Act requires that the credit card company or lender gives you a notice. The notice must tell you the specific reasons your application was rejected, or simply that you have the right to learn the reasons if you ask within 60 days.

6 Things You Should Do If You've Been Denied Credit Review the Reason for the Denial. Plead Your Case. Check Your Credit Report and Credit Score. Address Credit Concerns. Apply With a Different Lender. Continue to Monitor Your Credit. Maintain a Long-Term Mindset.

Dear: Thank you for your recent application to . Regretfully, we are unable to approve your application at this time. The denial of your application was based upon the following reason(s): ( ) Information contained in a consumer credit report obtained from: (See list below.)

Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease. Submitting a credit card application and receiving notice that you're denied is a disappointment, especially if your credit score drops after applying.

A Credit Denial Letter is a formal statement issued by a financial institution that declined an application to obtain credit prepared by an individual or an entity.

You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com. Phone: Call (877) 322-8228. Mail: Download and complete the Annual Credit Report Request form . Mail the completed form to:

In the case of an adverse action, you're only entitled to order a free credit report from the credit bureau who provided the report used in the creditor's decision. For example, if the lender reviewed your Equifax credit report to process your application, you're only entitled to a free Equifax credit report.

You will need to complete the adverse action information that is included in the request form about the company that declined your application. The Fair Credit Reporting Act (FCRA) allows you to get a free credit report if adverse action was taken as a result of information in the credit report.

If a lender rejects your application, it's required under the Equal Credit Opportunity Act (ECOA) to tell you the specific reasons your application was rejected or tell you that you have the right to learn the reasons if you ask within 60 days.