Orange California Complex Will - Credit Shelter Marital Trust for Spouse

Description

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

A document procedure consistently accompanies any legal endeavor you undertake.

Launching a business, applying for or accepting a job proposal, transferring assets, and numerous other life circumstances require you to prepare official documentation that varies across the nation.

That is why having everything gathered in one location is incredibly beneficial.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

Read the description (if any) to confirm the template satisfies your needs. Search for another document if the sample does not suit you. Click Buy Now after you find the required template. Choose the appropriate subscription plan, then Log In or create an account. Choose your preferred payment method (via credit card or PayPal) to proceed. Select your file format and download the Orange Complex Will - Credit Shelter Marital Trust for Spouse onto your device. Use it as needed: print it or fill it out digitally, sign it, and file it where necessary. This is the easiest and most dependable method to obtain legal documents. All templates offered by our repository are professionally drafted and checked for compliance with local laws and regulations. Prepare your documents and manage your legal matters efficiently with US Legal Forms!

- Here, you can effortlessly find and acquire a document for any personal or business purpose utilized in your area, such as the Orange Complex Will - Credit Shelter Marital Trust for Spouse.

- Finding templates on the site is remarkably easy.

- If you already hold a subscription to our repository, Log In to your account, search for the template using the search bar, and click Download to save it on your device.

- Subsequently, the Orange Complex Will - Credit Shelter Marital Trust for Spouse will be available for future use in the My documents section of your profile.

- If you are interacting with US Legal Forms for the first time, follow this straightforward guide to obtain the Orange Complex Will - Credit Shelter Marital Trust for Spouse.

- Ensure you are on the correct page with your local form.

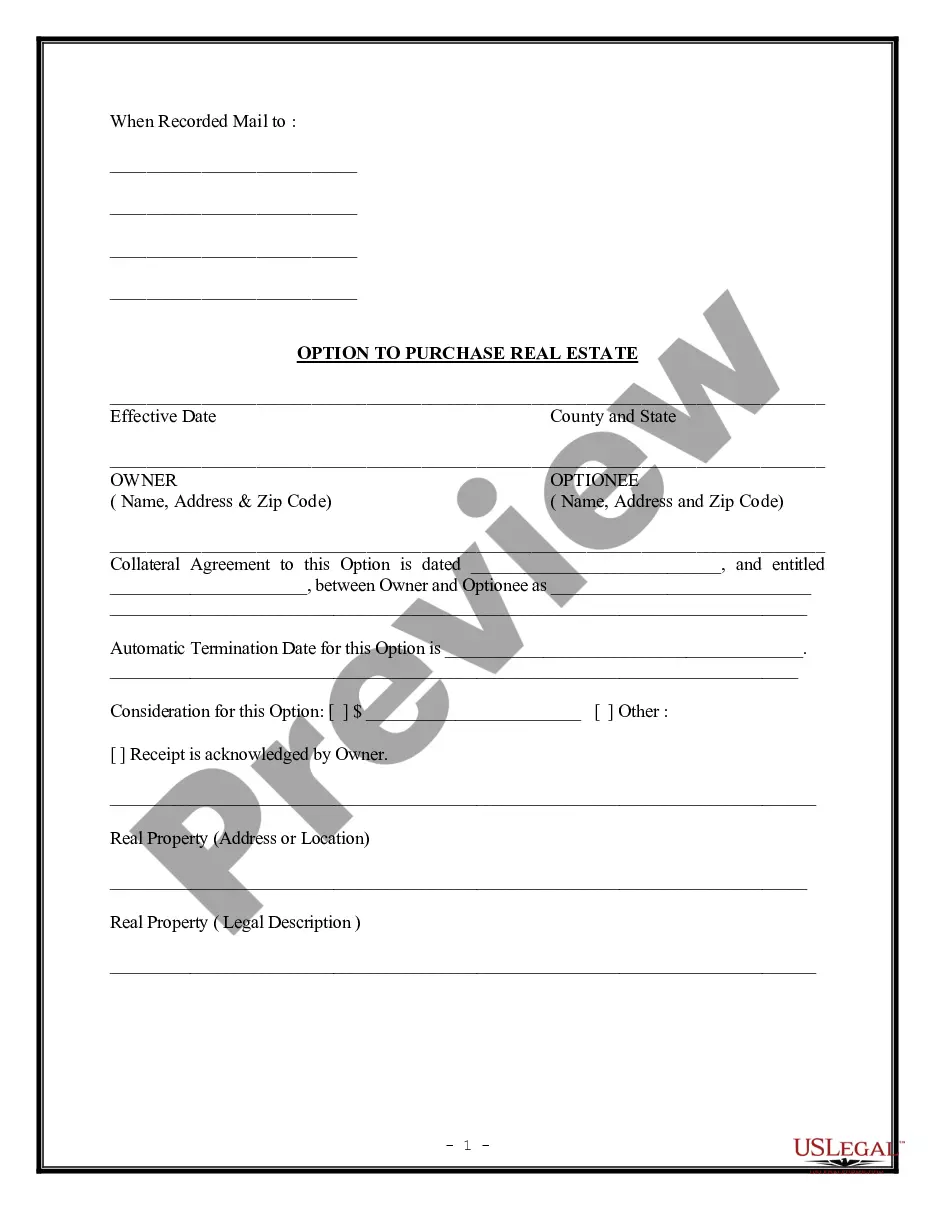

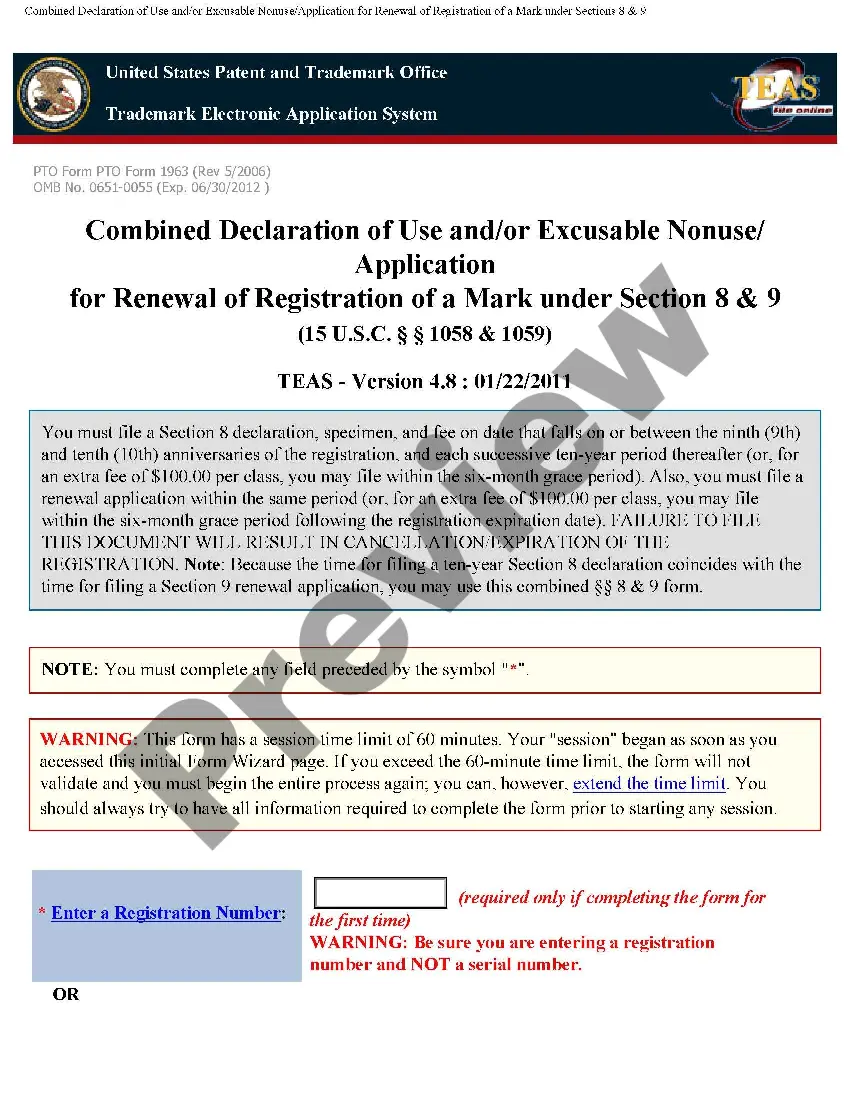

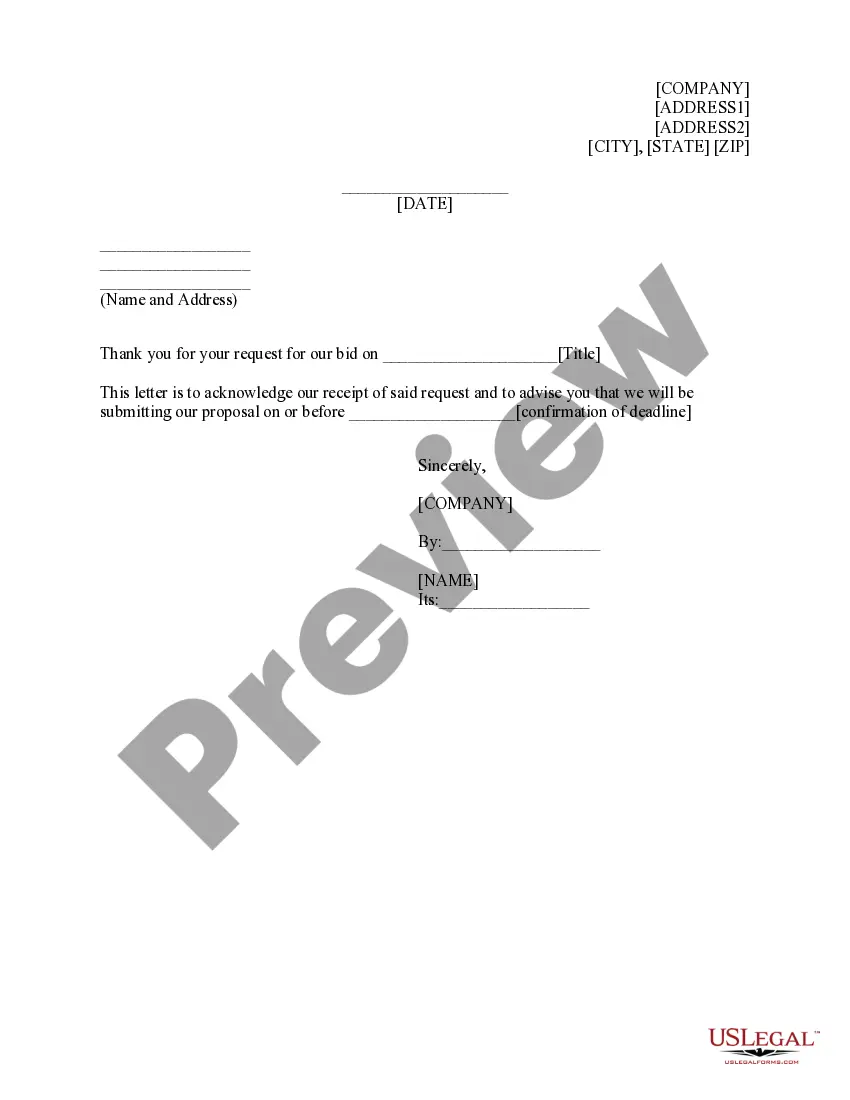

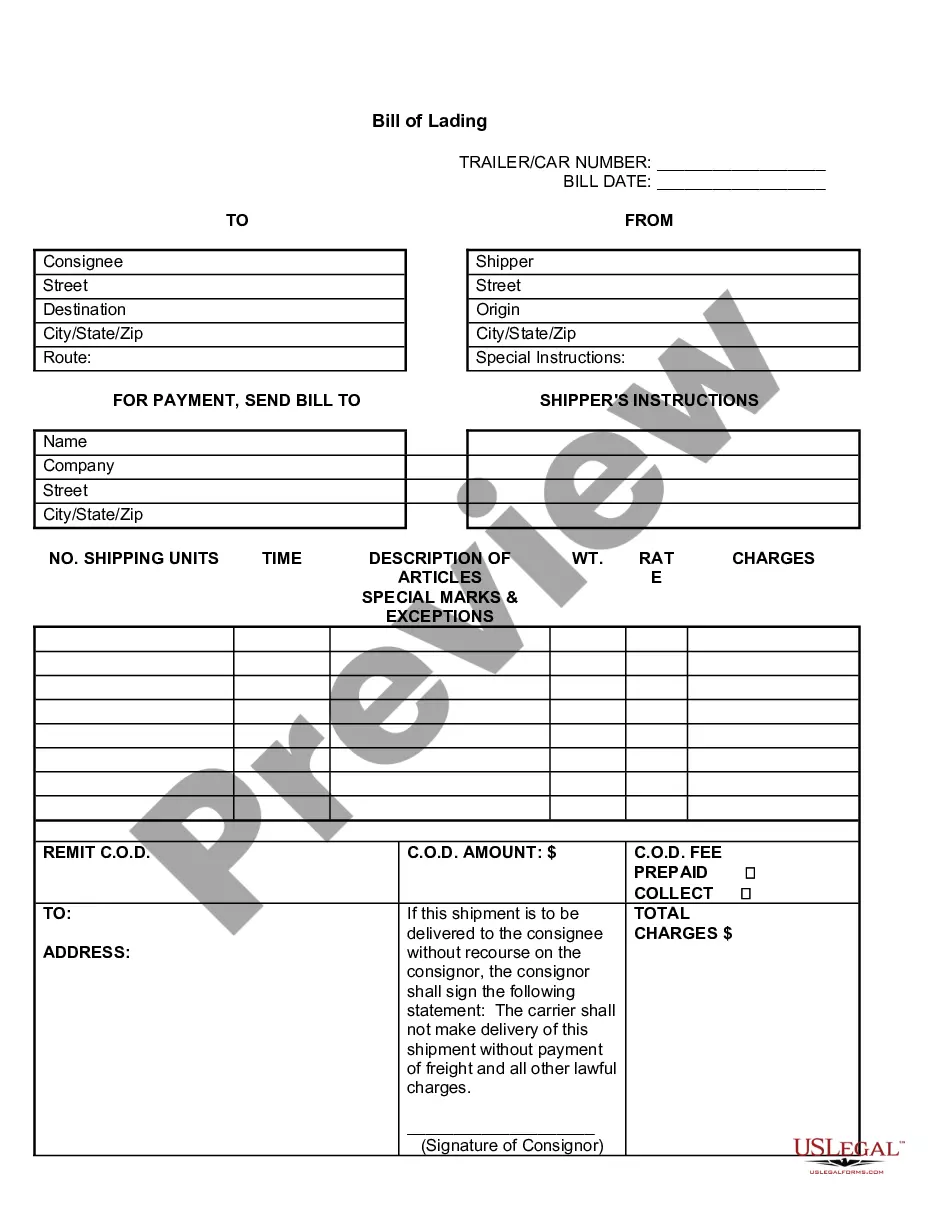

- Utilize the Preview option (if available) and review the sample.

Form popularity

FAQ

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

A credit shelter trust is a trust that is established in the will or living trust of the first to die of a married couple, most often for the benefit of a surviving spouse. It is generally created to avoid estate taxes at a first spouse's death by taking advantage of the available federal estate tax credit.

At the time of your death, the assets in your family trust are protected by the exemption, and the assets in your marital trust are protected by the marital deduction. No estate taxes are due.

A marital trust, also known as a marital deduction trust, is one type of beneficiary trust designed to protect the assets of a surviving spouse. The beneficiary of a marital trust is the surviving spouse.

Credit shelter trust (CST) (also called an AB trust or a bypass trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

The trust document must specify all assets and property held in the trust. This can include nearly anything of value. That includes stocks, bonds, mutual funds, cash and physical property. Upon the death of the trust grantor, trust assets pass on to the surviving spouse tax free.

Both joint and separate trusts have pros and cons. Joint trusts are popular for married couples because they are less expensive to set up, simpler to manage, and reflect the fact that the marital estate is a singular unit.

A marital trust is a type of irrevocable trust that allows you to transfer assets to a surviving spouse tax-free. It can also shield the estate of the surviving spouse before the remaining assets pass on to their children.

How a Marital Trust Works. A marital trust allows the couple's heirs to avoid probate and take less of a hit from estate taxes by taking full advantage of the unlimited marital deductiona provision that enables spouses to pass assets to each other without tax consequences.