Kings New York Proposed amendment to the restated certificate of incorporation to authorize preferred stock

Description

How to fill out Kings New York Proposed Amendment To The Restated Certificate Of Incorporation To Authorize Preferred Stock?

Preparing papers for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Kings Proposed amendment to the restated certificate of incorporation to authorize preferred stock without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Kings Proposed amendment to the restated certificate of incorporation to authorize preferred stock on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Kings Proposed amendment to the restated certificate of incorporation to authorize preferred stock:

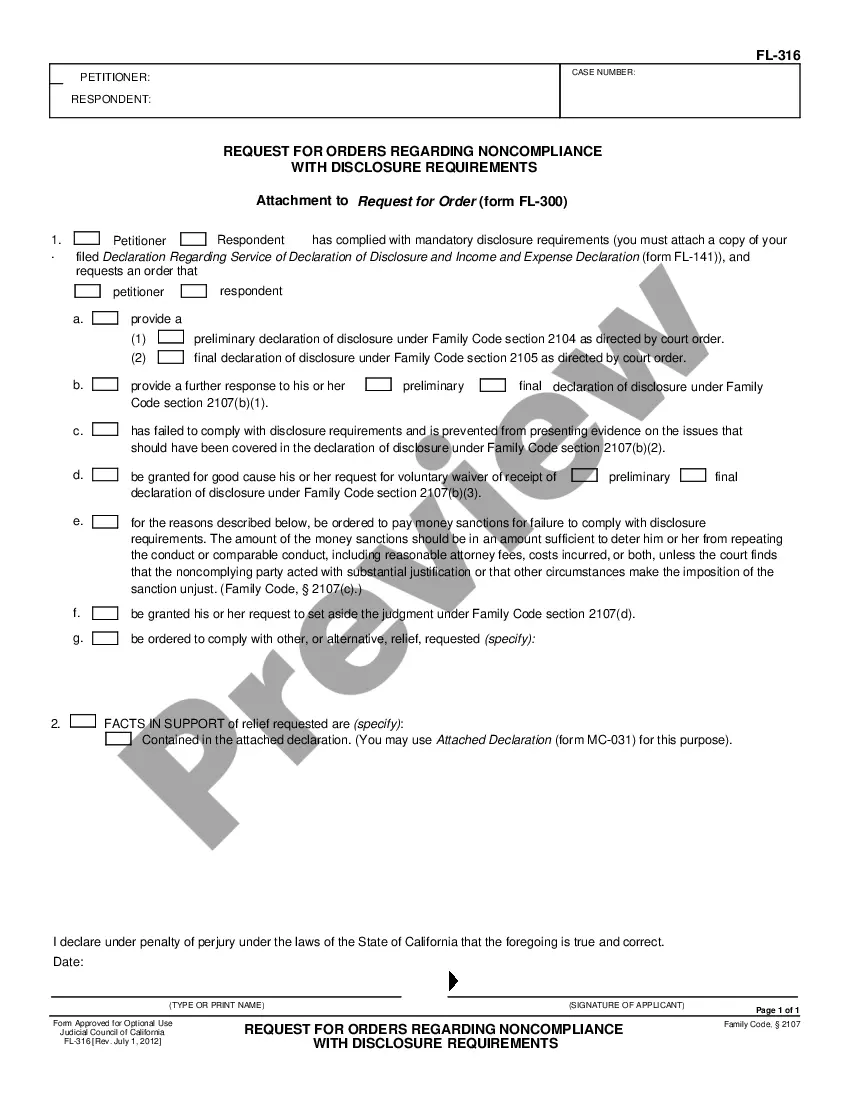

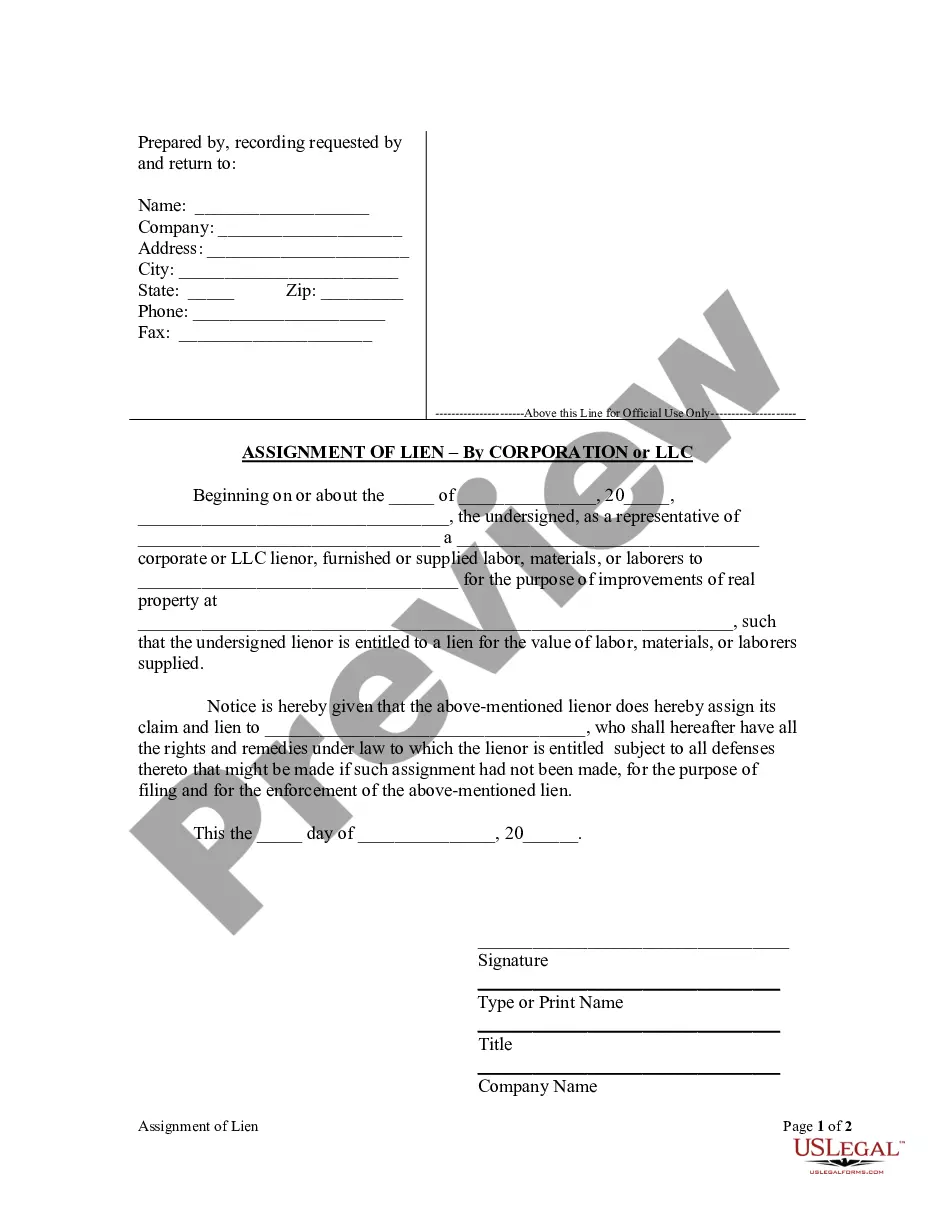

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!

Form popularity

FAQ

A stock amendment is an economical way to increase the share structure. We can help. Simply call 800-345-2677, Ext. 6911 or email us. Please be advised we will need to know the total number of shares authorized along with the new par value.

Corporations that, in separate filings, have amended sections of the original Articles of Incorporation, can use the Restated Articles of Incorporation (Form DC-4) to restate the entire articles of incorporation so that there is only one document to reference in the future.

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

The vote usually takes place at a formal meeting of the corporation (annual meeting or other) and shareholders must be advised of the proposed change before the meeting. If the shareholders approve the change to the articles of incorporation, the amended document must be attested to by the corporate secretary.

A certificate may not be amended against the will of the board of directors. Second, any amendments recommended by the board of directors must be approved by a vote of a majority of the outstanding shares of the corporation. A certificate may not be amended against the will of the majority of the stockholders.

Restated Charter means the amended and restated certificate or articles of incorporation of the Company, as in effect at the time of determination, including any certificates of designation or articles of amendment.

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

How to Amend Articles of Incorporation Review the bylaws of the corporation.A board of directors meeting must be scheduled.Write the proposed changes.Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).