Proposal to Authorize and Issue Subordinated Convertible Debentures Franklin Ohioio has recently put forth a comprehensive proposal to authorize and issue subordinated convertible debentures, a financing instrument that combines the features of debentures and convertible securities. This proposal aims to raise additional capital for various projects and initiatives within the city while providing flexibility and potential growth opportunities for investors. The subordinated convertible debentures offered by Franklin Ohio are designed to possess several key characteristics that make them an attractive investment option. Firstly, they offer a fixed rate of interest, ensuring a regular income stream for investors. This interest rate is usually higher than what is provided by traditional bonds, reflecting the subordinate nature of the debentures. Secondly, these debentures are convertible, meaning that investors have the option to convert their debentures into a predetermined number of shares of common stock. This provision allows investors to potentially benefit from any increase in the value of the company's stock, thereby providing an avenue for potential capital appreciation. Moreover, Franklin Ohio's proposal tailors these debentures to be subordinated, which means they rank lower in priority compared to other types of debt in case of bankruptcy or liquidation. While this implies higher risk for investors, it often results in higher interest rates, making them an appealing investment choice for those seeking a potentially higher yield. The proposal by Franklin Ohio encompasses different types of subordinated convertible debentures, each tailored to meet varying investor preferences and risk appetites. Some options offered include fixed-term debentures, which have a predetermined maturity date, and perpetual debentures, which have no fixed maturity. Additionally, Franklin Ohio also provides options for different conversion ratios, enabling investors to convert their debentures into a different number of common shares, depending on market conditions or individual preferences. To further instill investor confidence and ensure transparency, this proposal outlines the specific terms and conditions associated with the subordinated convertible debentures. It includes details regarding the interest rate, conversion price, redemption provisions, and any other pertinent information that potential investors need to make informed decisions. Overall, Franklin Ohio's proposal to authorize and issue subordinated convertible debentures presents a compelling opportunity for both the city and investors. By raising capital through these flexible and potentially lucrative investments, Franklin Ohio aims to fund vital projects while simultaneously providing investors with a chance to diversify their portfolios and earn attractive returns.

Franklin Ohio Proposal to authorize and issue subordinated convertible debentures

Description

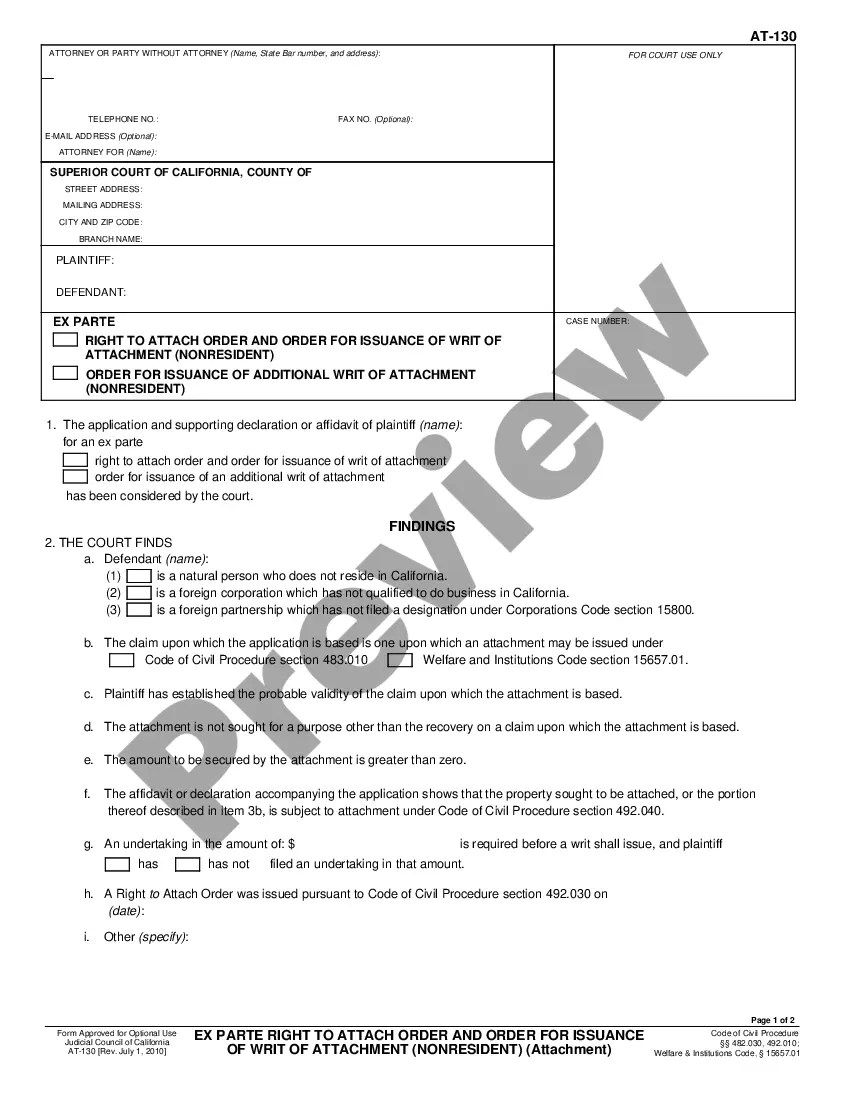

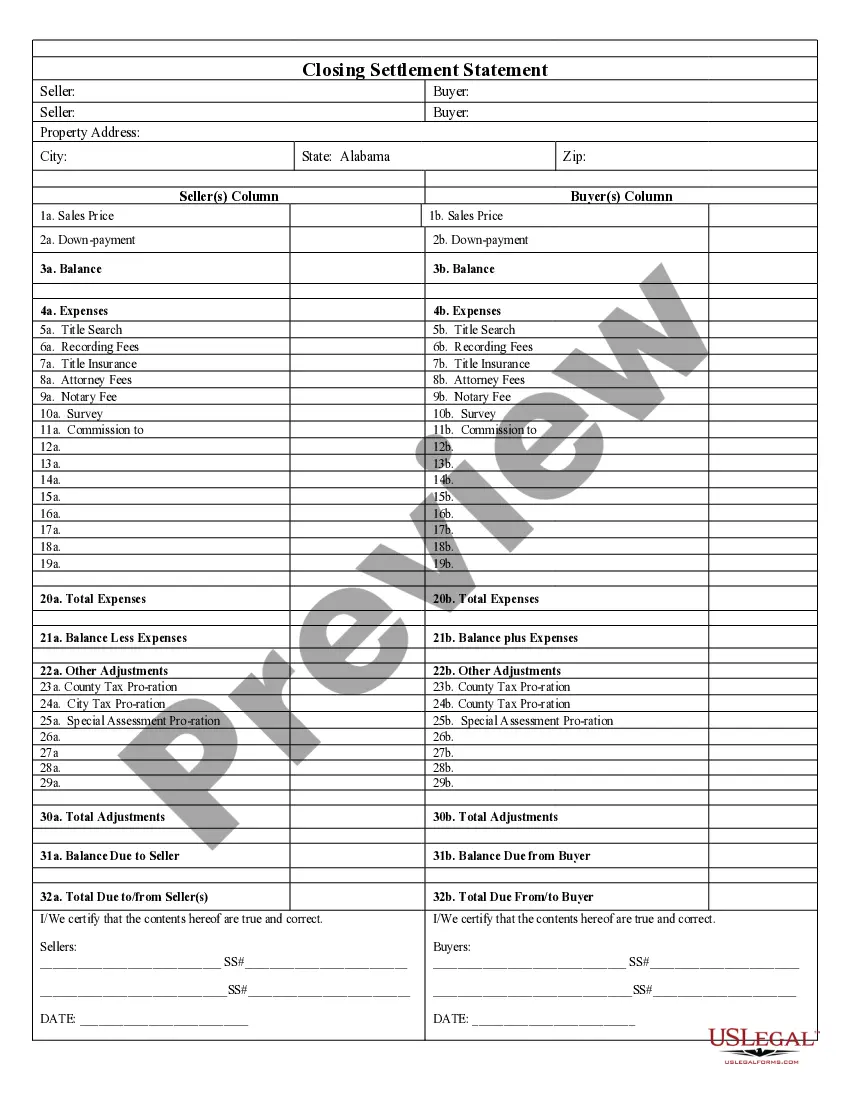

How to fill out Franklin Ohio Proposal To Authorize And Issue Subordinated Convertible Debentures?

Whether you intend to open your company, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Franklin Proposal to authorize and issue subordinated convertible debentures is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Franklin Proposal to authorize and issue subordinated convertible debentures. Adhere to the guidelines below:

- Make sure the sample meets your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample once you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Franklin Proposal to authorize and issue subordinated convertible debentures in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

Interesting Questions

More info

6% senior bonds. Atlantic Power's 6.2% senior notes and 2.6% senior bonds. Bank SIC. 4.5% senior notes of U.S. Bank, 4.5% senior notes of RBS, 4.5% senior notes of Nationwide, 4.5% senior notes of JPMorgan and 4.5% senior notes of Wells Fargo. (Note: the RBS, Nationwide and JPMorgan notes will have an “issue amount,” which is equal to the average of the highest 2.2% coupon payments with the highest 2.2% LIBOR interest rates to be paid on the outstanding notes. Thus, the highest 3.8% LIBOR interest rate gets the maximum share of the issue amount.) Bianca M/A (Coca Mi) bonds of Bank SIC. Bianca M/A (Coca Mi) bonds of Bank SIC. Bank of Nova Scotia 3.1x senior notes, 2.2x senior notes, 4.4x senior notes of Royal Bank of Scotland, 3.6x senior notes of Deutsche Bank AG, 4.4x senior notes of Barclays, 3.4x senior notes of HSBC and 3x senior notes of UBS. Bank of Nova Scotia 3.1x senior notes, 2.2x senior notes, 4.4x senior notes of Royal Bank of Scotland, 3.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.