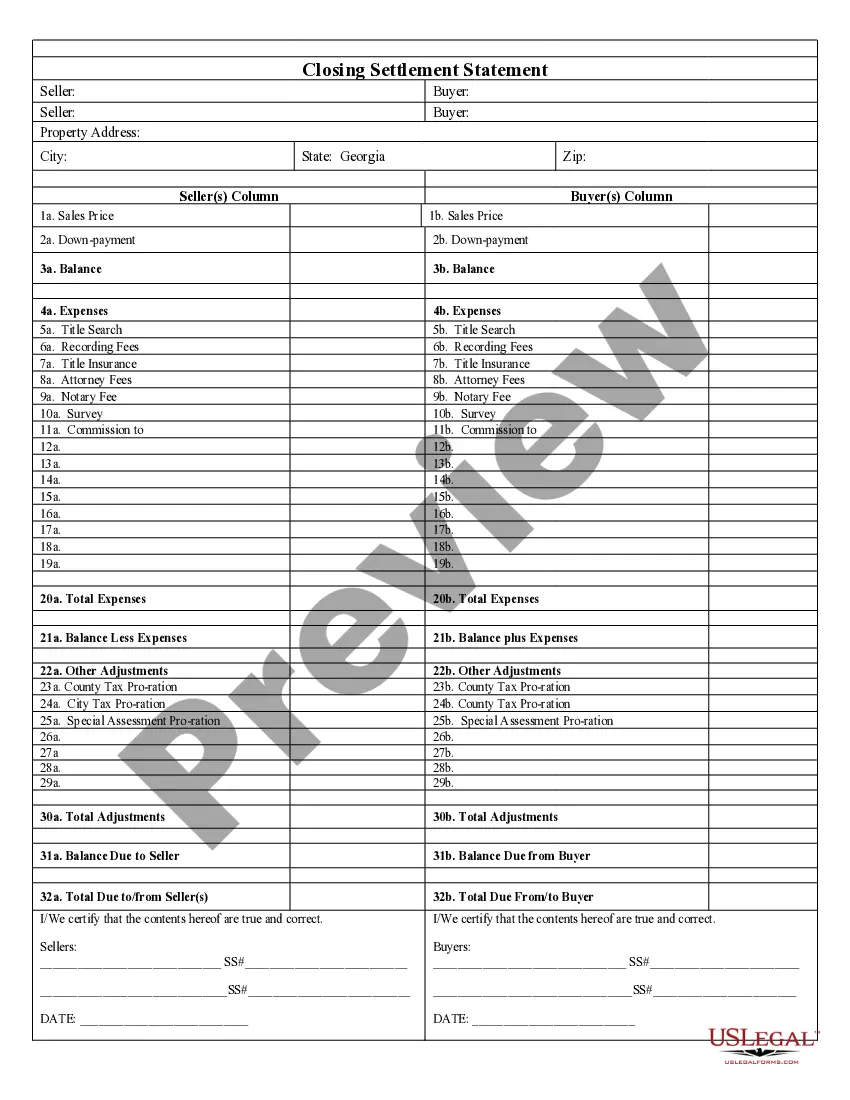

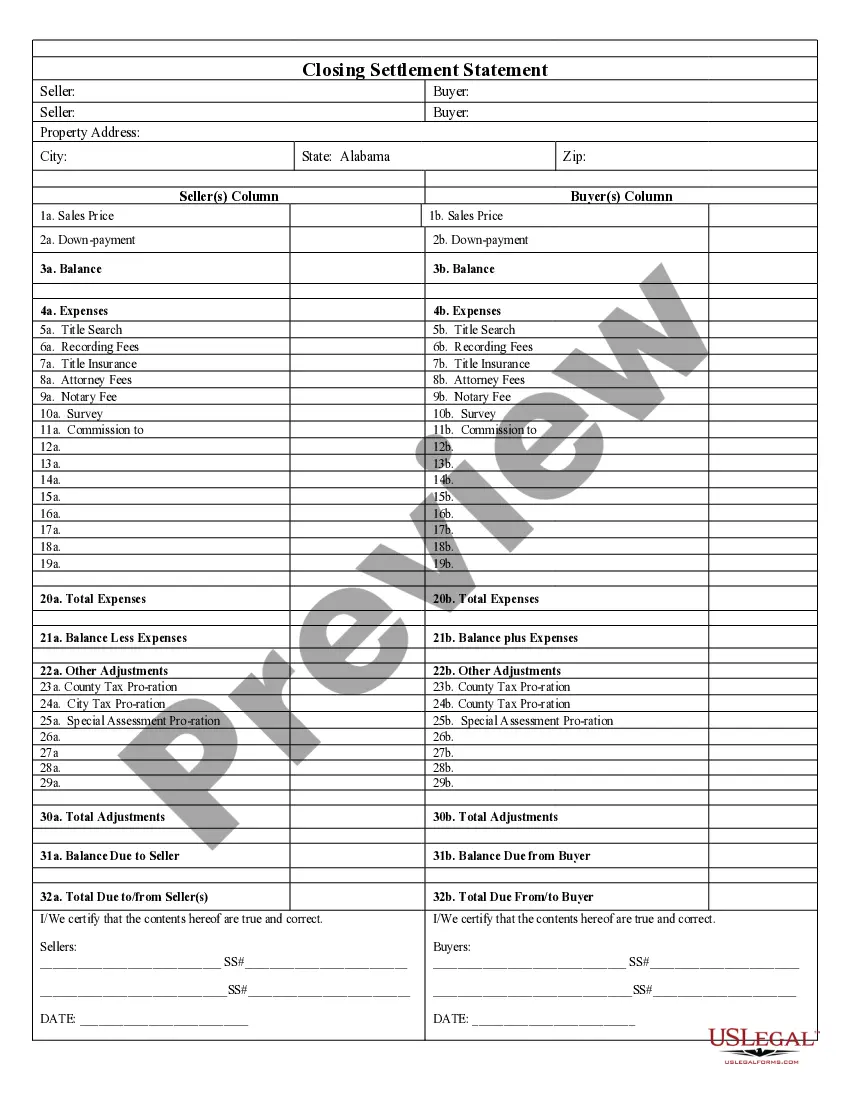

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Alabama Closing Statement

Description

Key Concepts & Definitions

Closing Statement: A document typically used in real estate transactions to outline the details and expenses associated with the sale. It includes information such as personal finance terms, agreement clauses, property purchase taxes, and more. Home Equity Loan: A type of loan where the borrower uses the equity of their home as collateral. It involves comparing loan rates and reviewing buyer-seller agreements.

Step-by-Step Guide: Navigating Your Closing Statement

- Review Buyer-Seller Agreement: Ensure all terms match those previously agreed upon.

- Use a Closing Costs Calculator: Estimate the financial requirements before the finalizing stage.

- Analyze Home Equity Loan Terms: Compare loan rates and choose the most favorable option.

- Consult Insurance Review: Verify coverage specifics to avoid future disputes or issues.

- Checkout Intellectual Property Law: If purchasing a property with associated intellectual assets, verify all legal details.

Risk Analysis

- Overlooking Additional Costs: Failing to account for items such as property purchase taxes can significantly impact personal finance.

- Inaccurate Closing Statements: Errors can lead to disputes or financial losses.

- Rate Fluctuations: Home equity loan rates might change, affecting repayment terms.

Key Takeaways

- Understanding your closing statement can significantly enhance your real estate transaction experience.

- Consulting professionals for aspects like insurance and legal matters is crucial.

- Utilizing tools like a closing costs calculator helps in financial preparedness.

How to fill out Alabama Closing Statement?

Employing Alabama Closing Statement models crafted by expert attorneys enables you to sidestep frustrations when finalizing paperwork.

Simply download the sample from our site, complete it, and request a legal expert to verify it.

Doing this can save you significantly more time and expenses than asking a legal expert to generate a document from scratch for you would.

Verify and ensure that you are retrieving the correct state-specific form. Use the Preview feature and read the description (if available) to determine if you need this particular sample; if so, just click Buy Now. Search for another sample using the Search field if required. Choose a subscription that aligns with your needs. Begin with your credit card or PayPal. Select a file format and download your document. After completing all the steps above, you'll be able to fill out, print, and sign the Alabama Closing Statement sample. Remember to double-check all entered information for accuracy before submitting or mailing it. Minimize the time spent on document creation with US Legal Forms!

- If you already possess a US Legal Forms subscription, just sign in to your account and navigate back to the sample page.

- Locate the Download button near the templates you are reviewing.

- After downloading a template, you will find all of your stored samples in the My documents tab.

- If you lack a subscription, that’s not an issue.

- Simply follow the steps below to register for an account online, obtain, and complete your Alabama Closing Statement template.

Form popularity

FAQ

To fill out a bill of sale in Alabama, include essential details such as the date of the sale, the buyer's and seller's information, and a detailed description of the item. Make sure both parties sign the document. Utilizing UsLegalForms for this process can streamline your efforts, helping you create a reliable Alabama Closing Statement.

Your closing statement should outline all financial transactions related to the sale, detailing the costs, fees, and credits involved. It's important to have clarity to avoid any disputes later. By using a template from UsLegalForms, you can create a comprehensive and accurate Alabama Closing Statement that meets legal requirements.

To fill out an Alabama bill of sale, start by entering the names and addresses of both the buyer and the seller. Next, describe the item being sold, including any identifying details like the serial number or model. Finally, ensure that the document is dated and signed, which formalizes the transaction and contributes to your Alabama Closing Statement.

Yes, you will receive a copy of your property title at closing, but it may not be the final copy. The title will show that ownership has transferred to you, and you should keep it with your Alabama Closing Statement for future reference. Remember, the original title may take some time to arrive from the county's clerk office after closing.

To close your Alabama taxes account, you will need to complete the necessary forms provided by the Alabama Department of Revenue. Include a written request that details your reasons for closing the account. Once submitted, make sure to keep a copy of your Alabama Closing Statement and any correspondence for your records until you receive confirmation that the account is successfully closed.

You can find your house closing statement, often referred to as the Alabama Closing Statement, through your real estate agent, mortgage lender, or closing attorney. Typically, it is provided on the day of closing or shortly thereafter. If you misplace it, contact the parties involved in your real estate transaction, as they should be able to assist you in obtaining a copy.

In Alabama, a closing statement is typically required at the conclusion of a real estate transaction. You should have it ready and use it during the closing process to outline all financial details. It's essential to ensure all parties have the relevant information about costs and payments. Using the Alabama Closing Statement, you can streamline your understanding of the transaction and prevent potential disputes.

The seller's estimated closing statement in Alabama is usually prepared by the seller's attorney or the closing agent. This document details what the seller will receive from the sale after all costs have been deducted. Being clear about these figures is crucial for the seller to understand their financial outcome. Utilizing tools from platforms like uslegalforms can further streamline this preparation.

In Alabama, the closing statement is usually prepared by the closing attorney or title company. This professional ensures that all financial details related to the transaction are accurately reflected in the Alabama closing statement. It's their responsibility to compile figures from both the buyer and seller. This helps clarify how funds will be distributed at closing.

To obtain your Alabama closing statement, you will typically receive it before the closing date. Your real estate agent, attorney, or lender can provide you with this important document. You may also find it in your online account if you are using a digital service. Ensure you review it carefully for accuracy.