Tarrant Texas Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Tarrant Texas Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Draftwing forms, like Tarrant Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, to manage your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for various cases and life situations. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Tarrant Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 template. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Tarrant Property Claimed as Exempt - Schedule C - Form 6C - Post 2005:

- Make sure that your document is specific to your state/county since the rules for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Tarrant Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our website and get the form.

- Everything looks good on your side? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

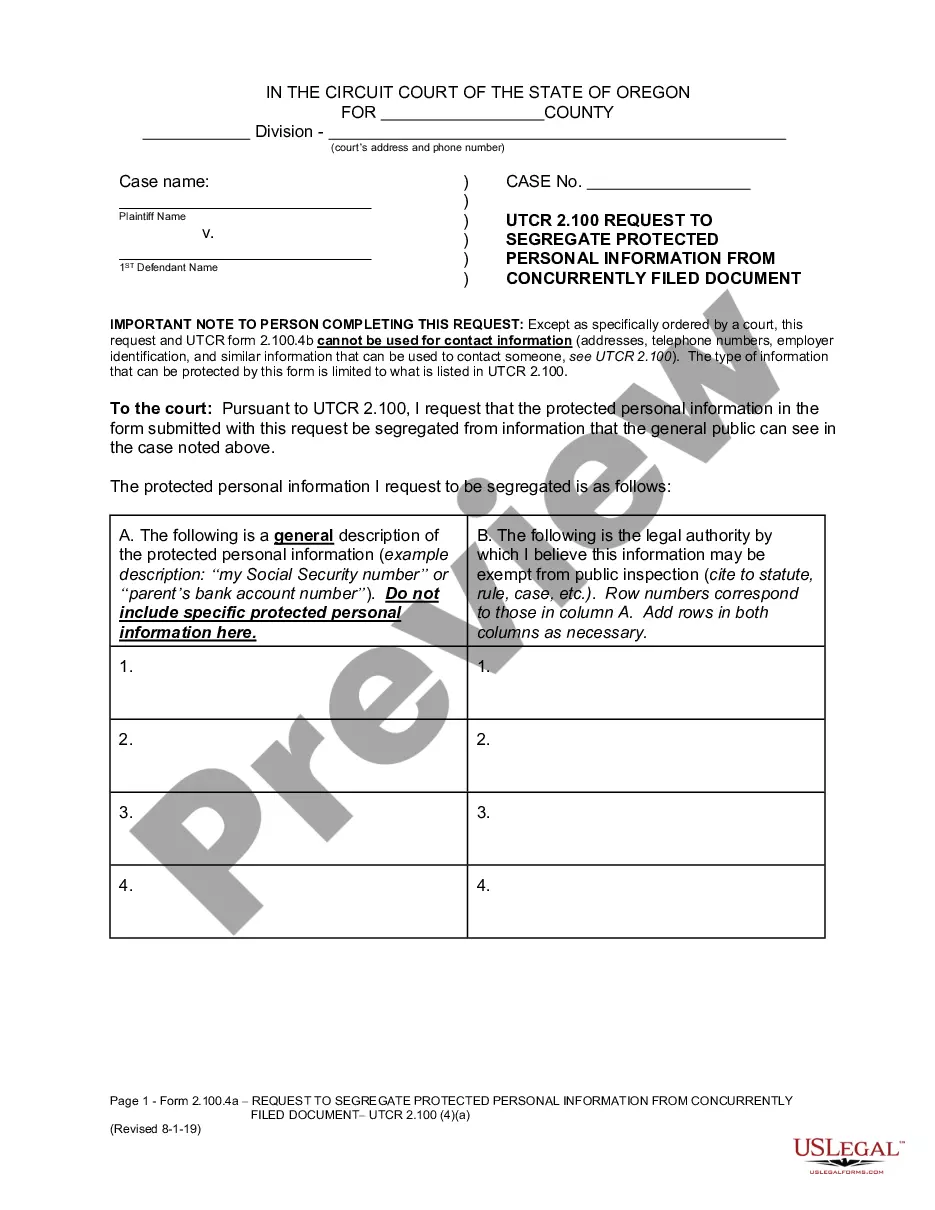

In the first column of Schedule C, you must describe each item of property or each asset you are claiming as either fully or partially exempt (it will only be partially exempt if the value exceeds the exemption amount). Use the same property description you used in Schedule A/B. Schedule A/B line number.

In the first column of Schedule C, you must describe each item of property or each asset you are claiming as either fully or partially exempt (it will only be partially exempt if the value exceeds the exemption amount). Use the same property description you used in Schedule A/B. Schedule A/B line number.

Exempt property is any property that creditors cannot seize and sell in order to satisfy debt during chapter 7 or chapter 13 bankruptcy. The type of property exempted differs from state to state but often includes clothes, home furnishings, retirement plans, and small amounts of equity in a house and car.

Form Number: B 106C. Category: Individual Debtors. Effective onApril 1, 2022. This is an Official Bankruptcy Form. Official Bankruptcy Forms are approved by the Judicial Conference and must be used under Bankruptcy Rule 9009.

Current value of the portion you own? This is where you list your share of the current market value of the property. So if the property is worth $120,000, but you have a 50% interest in the property, you would list $60,000. (Learn more about valuing your real estate in bankruptcy.)

However, exempt property in a California bankruptcy is generally described as: Your main vehicle. Your home. Personal everyday items. Retirement accounts, pensions, and 401(k) plans. Burial plots. Federal benefit programs. Health aids. Household goods.