Nassau New York Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

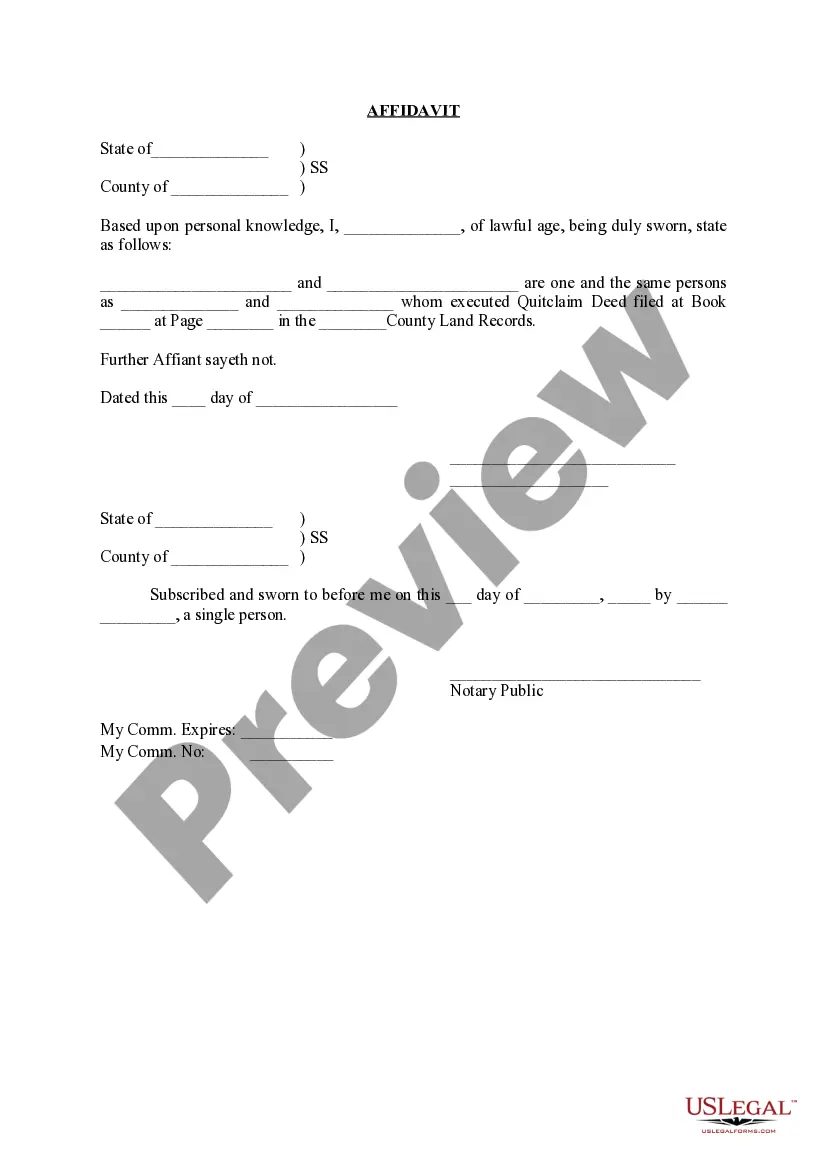

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

Whether you plan to establish your business, enter into a contract, apply for your identification renewal, or settle family-related legal matters, you must prepare specific documents that comply with your local laws and regulations.

Locating the appropriate paperwork may require significant time and effort unless you utilize the US Legal Forms library.

This service offers users access to over 85,000 professionally crafted and verified legal documents for any personal or business scenario. All files are organized by state and area of application, making it quick and easy to select a document like the Nassau Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

The forms provided by our site can be used multiple times. With an active subscription, you can access all of your previously purchased documents at any time in the My documents section of your account. Stop spending time on an endless search for current official documents. Join the US Legal Forms platform and maintain your paperwork organized with the most extensive online form library!

- Ensure the sample meets your individual needs and state legal standards.

- Review the form description and check the Preview if available on the page.

- Use the search feature specifying your state above to find another template.

- Click Buy Now to acquire the sample once you identify the right one.

- Select the subscription plan that best fits you to proceed.

- Log in to your account and pay for the service with a credit card or PayPal.

- Download the Nassau Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 in the desired file format.

- Print the document or fill it out and sign it electronically through an online editor to save time.

Form popularity

FAQ

Personal income (PI) refers specifically to the income received by individuals or households, while national income (NI) encompasses the total income earned within a nation's economy, including wages, profits, rents, and taxes minus subsidies. Distinguishing these two income types is particularly important in the context of the Nassau New York Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 to ensure you have a complete understanding of your own financial situation as well as the broader economic landscape.

To determine your current monthly income in Chapter 13 bankruptcy, you take your average monthly income for the six-month period prior to filing for bankruptcy.

When you file for Chapter 13 bankruptcy, there is no "means test" to determine whether your income is too high. In fact, opposite forces are at work in Chapter 13 -- if your income is so low that you cannot fund a repayment plan, you won't be eligible for Chapter 13.

The means test is calculated by comparing the debtor's average income for the past six months (current monthly income), annualized, to the median income for households of the same size in the debtor's state of residence.

The median income information is used by the bankruptcy court when determining whether or not an individual qualifies for relief under chapter 7 of the Bankruptcy Code, and also is used in determining the applicable commitment period for payment plans filed under chapter 13.

Either way, once you get your discharge in a Chapter 7 bankruptcy or a Chapter 13 bankruptcy, you will get credit again and be able to increase your score. Lenders will look at your credit histories such as on-time payments and debt to income ratio to determine if they should extend credit to you.

A 100% plan is a Chapter 13 bankruptcy in which you develop a plan with your attorney and creditors to pay back your debt. It is required to pay back all secured debt and 100% of all unsecured debt.

Requirements to File for Chapter 13 Bankruptcy When you file for Chapter 13 bankruptcy, there is no "means test" to determine whether your income is too high. In fact, opposite forces are at work in Chapter 13 -- if your income is so low that you cannot fund a repayment plan, you won't be eligible for Chapter 13.

Certain family and household expenses might help you pass the means test for Chapter 7 bankruptcy. If your income is higher than your state's median income for a similar size household, you must complete the entire bankruptcy means test form to determine whether you qualify for Chapter 7 bankruptcy.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.