Clark Nevada Complex Guaranty Agreement to Lender

Description

How to fill out Complex Guaranty Agreement To Lender?

How long does it usually take you to draft a legal document.

Given that each state has its laws and regulations applicable to every aspect of life, finding a Clark Complex Guaranty Agreement to Lender that meets all local requirements can be daunting, and hiring a professional attorney is frequently expensive. Many online services provide the most common state-specific documents for download, but utilizing the US Legal Forms repository is the most advantageous.

US Legal Forms is the largest online database of templates, categorized by states and fields of use. In addition to the Clark Complex Guaranty Agreement to Lender, you can discover any particular document to manage your business or personal matters while adhering to your local standards. Experts confirm all templates for their accuracy, ensuring you can prepare your documents correctly.

Print the document or use any favored online editor to complete it electronically. Regardless of how many times you need to utilize the purchased template, you can find all the documents you’ve previously saved in your profile by accessing the My documents tab. Give it a try!

- Using the service is relatively straightforward.

- If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the necessary template, and download it.

- You can keep the file in your profile at any future time.

- Conversely, if you are a newcomer to the platform, there will be a few additional steps to accomplish before obtaining your Clark Complex Guaranty Agreement to Lender.

- Verify the information on the page you are currently viewing.

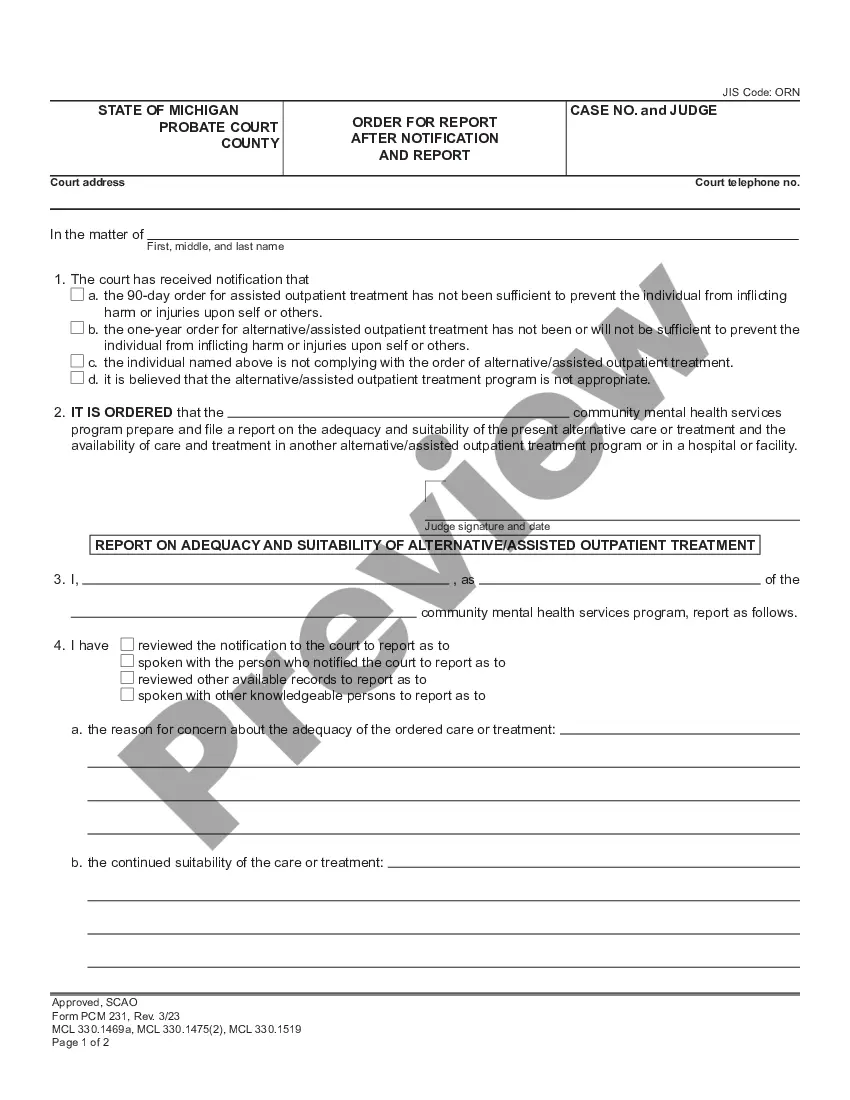

- Examine the description of the sample or Preview it (if available).

- Look for another document by using the relevant option in the header.

- Click Buy Now once you are confident about the selected file.

- Choose the subscription plan that best fits your needs.

- Register for an account on the platform or Log In to proceed with payment options.

- Pay using PayPal or your credit card.

- Change the file format if necessary.

- Click Download to save the Clark Complex Guaranty Agreement to Lender.

Form popularity

FAQ

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

A guaranty is the written promise of an individual to pay the debt of another. In a commercial setting, a guaranty is typically the promise of an owner or officer of a corporate entity to pay the debt of that corporate entity should it default on its obligation.

ANSWER: Guarantee, the broader and more common term, is both a verb and a noun. The narrower term, guaranty, today appears mostly in banking and other financial contexts; it seldom appears in nonlegal writing. Guarantee, vb. 1.

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

Guarantee can refer to the agreement itself as a noun, and the act of making the agreement as a verb. Guaranty is a specific type of guarantee that is only used as a noun.

A person who acts as a guarantor under a GUARANTEE. GUARANTY, contracts. A promise made upon a good consideration, to answer for the payment of some debt, or the performance of some duty, in case of the failure of another person, who is, in the first instance, liable to such payment or performance.

Noun, plural guar·an·ties.

Guaranty and Security Agreement means that certain Amended and Restated Guaranty and Security Agreement, dated as of the Closing Date, made by the Borrower and the Guarantors in favor of the Administrative Agent, for the benefit of the Secured Parties.