Chicago Illinois FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

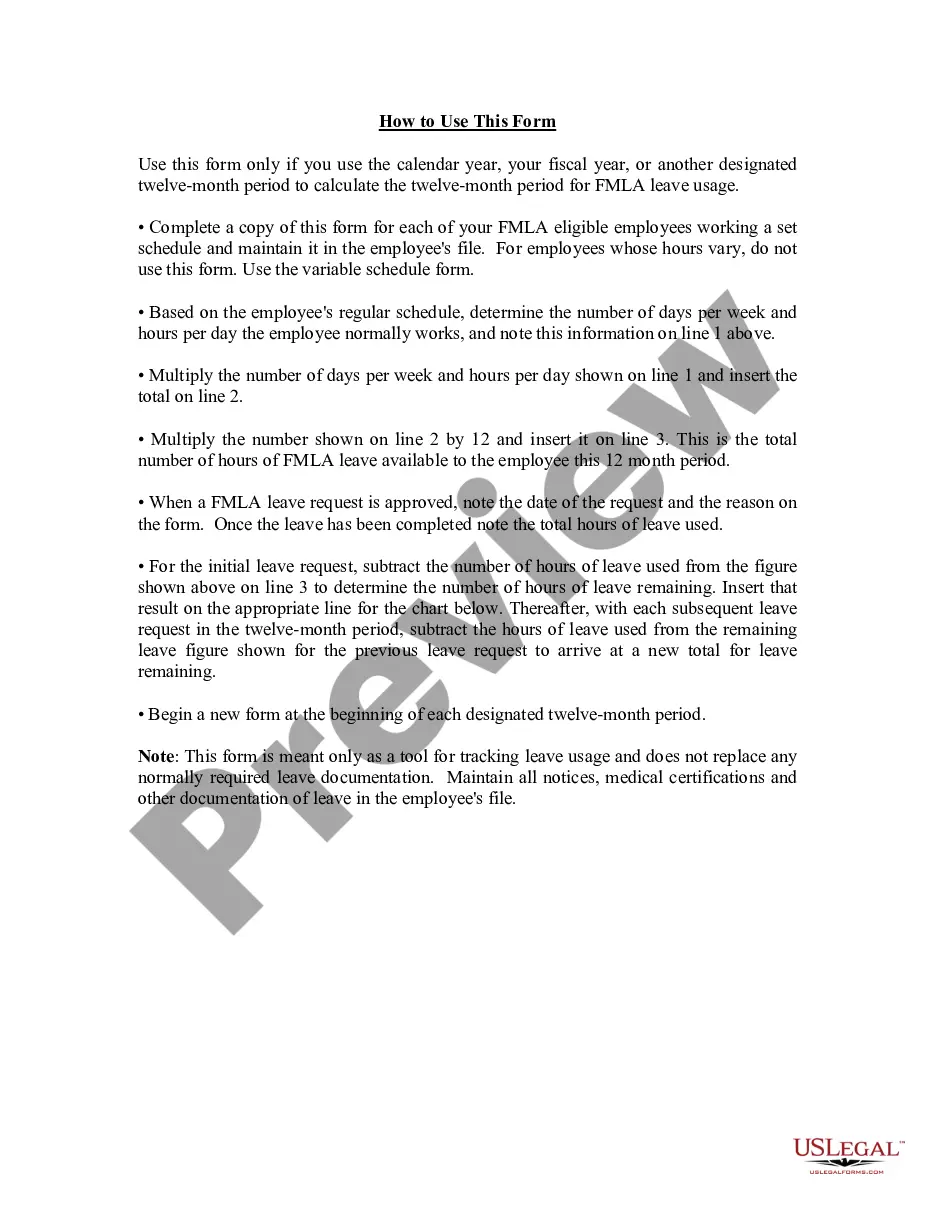

How to fill out Chicago Illinois FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

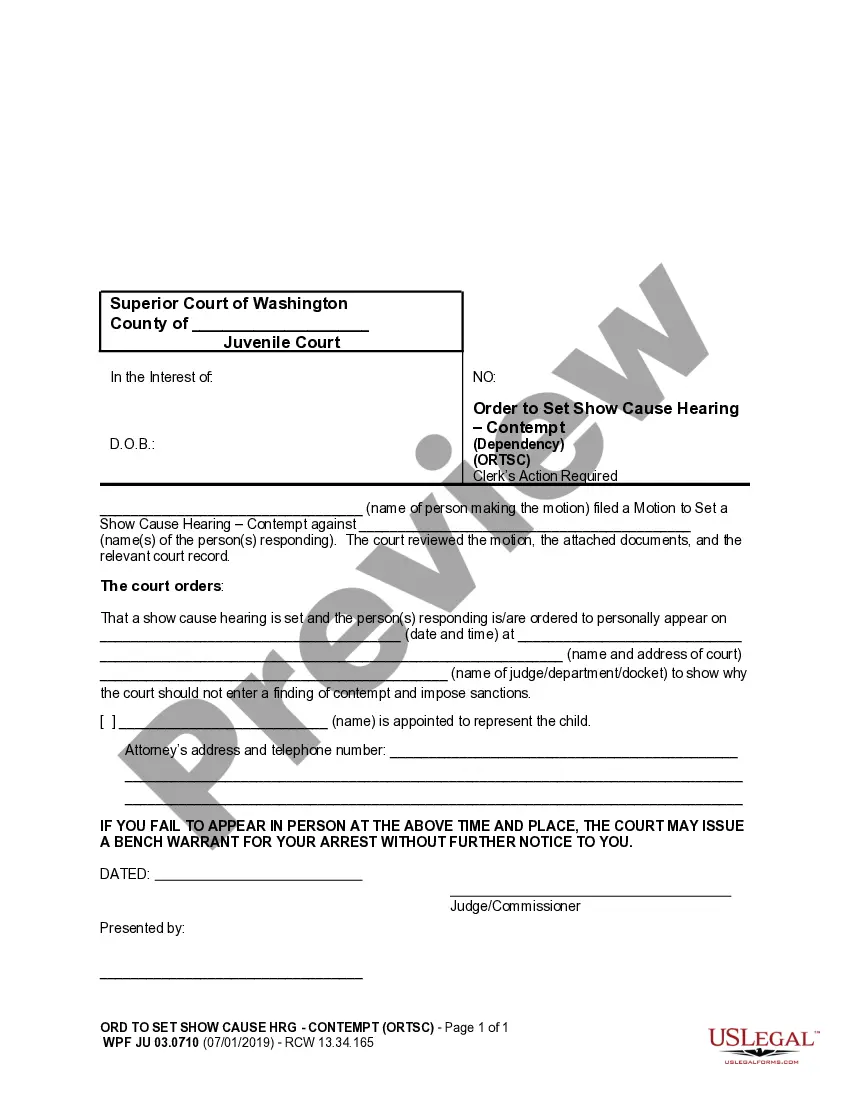

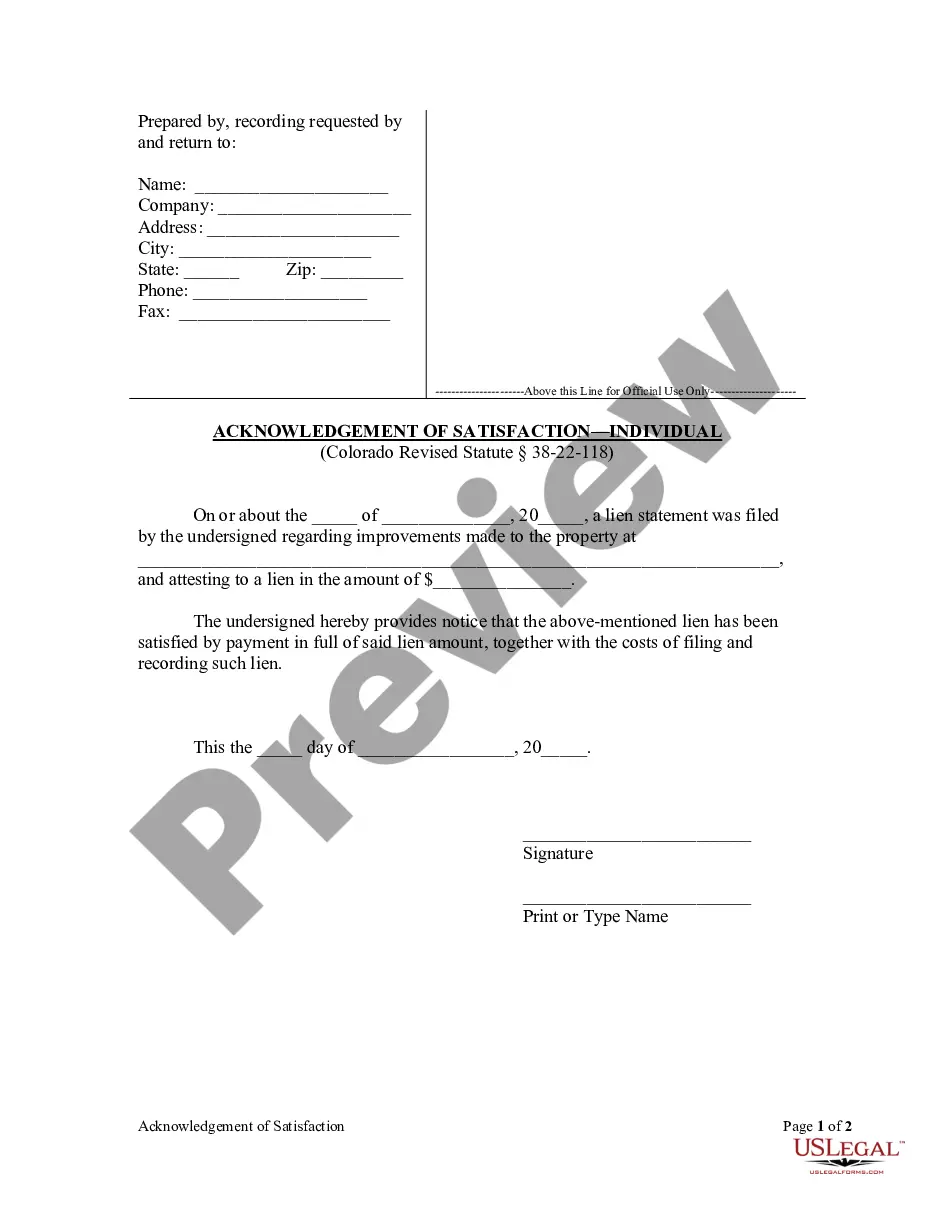

Creating documents, like Chicago FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule, to take care of your legal affairs is a difficult and time-consumming task. Many cases require an attorney’s participation, which also makes this task expensive. However, you can get your legal issues into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for various cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Chicago FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Chicago FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule:

- Make sure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Chicago FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to begin using our website and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is all set. You can try and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

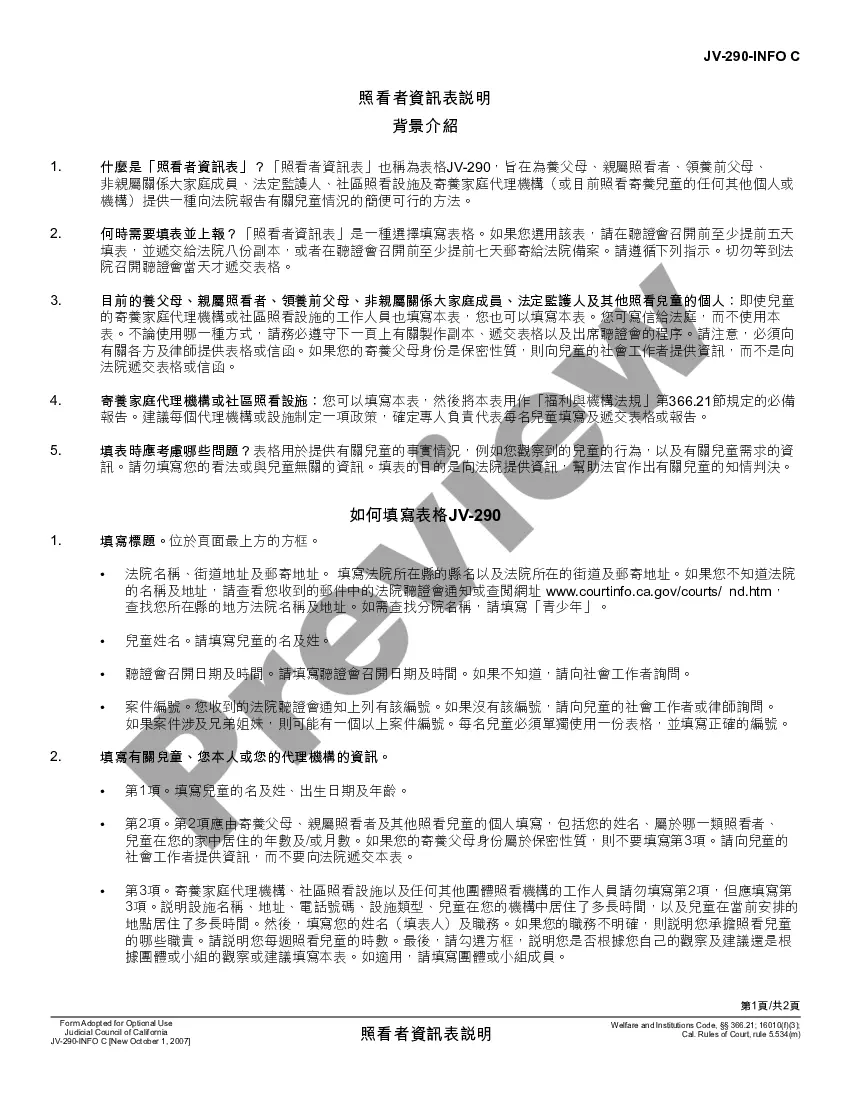

The last option may be the most complex method you to calculate FMLA periods. Under this method, called the rolling 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be any balance of the 12 weeks (which has not been used during the immediately preceding 12 months).

Using this method, the employer will look back over the last 12 months from the date of the request, add all FMLA time the employee has used during the previous 12 months and subtract that total from the employee's 12-week leave allotment.

Records pertaining to FMLA leave Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted.

A 12-month Period Measured Forward from the First Day of Your Employee's Leave. Under this method, the 12-month period begins on the first day your employee takes FMLA leave. If FMLA leave is taken after that 12 months ends, their next 12-month period begins on the first day of that leave.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

An employee is entitled to up to 12 workweeks of FMLA leave for most qualifying reasons or up to 26 workweeks of FMLA leave for military caregiver leave. The employee's actual workweek is the basis for determining the employee's FMLA leave entitlement.

The New Jersey Family Leave Act entitles certain employees to take up to 12 weeks of family leave in a 24-month period without losing their jobs.

A roll back, or roll backward, refers to a derivatives trading strategy that replaces an existing position with a new one that has a nearer expiration date. Aside from the contract's expiration date, other details are often not changed.

How to Calculate the FMLA Rolling Year Method Step 1: Determine FMLA Time Needed.Step 2: Determine FMLA Time Previously Taken.Step 3: Determine FMLA Time Left in 12-Month Period.Step 4: Determine Total FMLA Time Available for This Request.

Interesting Questions

More info

Since that time the university has remained true to this tradition by providing an environment that offers a stimulating intellectual culture, exceptional educational opportunities, innovative and comprehensive learning opportunities at the undergraduate, graduate, and professional levels. In addition, the university promotes the spirit of academic freedom, which encourages excellence in all it does, including research. To encourage and encourage excellence, the university's athletics program is recognized nationally as a model. Ball State's football program is a major source of national enthusiasm and national recognition. The football team plays in the Mid-American Conference for a 10-year period. The football program plays four home games a season at New Era Field in Muncie, IN. The remaining games are played at University Stadium with a home, away, neutral site and a neutral site date. For information about football, visit the Ball State football website.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.