Montgomery Maryland Jury Instruction - Presenting Or Using A False Claim In A Bankruptcy Proceeding

Description

How to fill out Montgomery Maryland Jury Instruction - Presenting Or Using A False Claim In A Bankruptcy Proceeding?

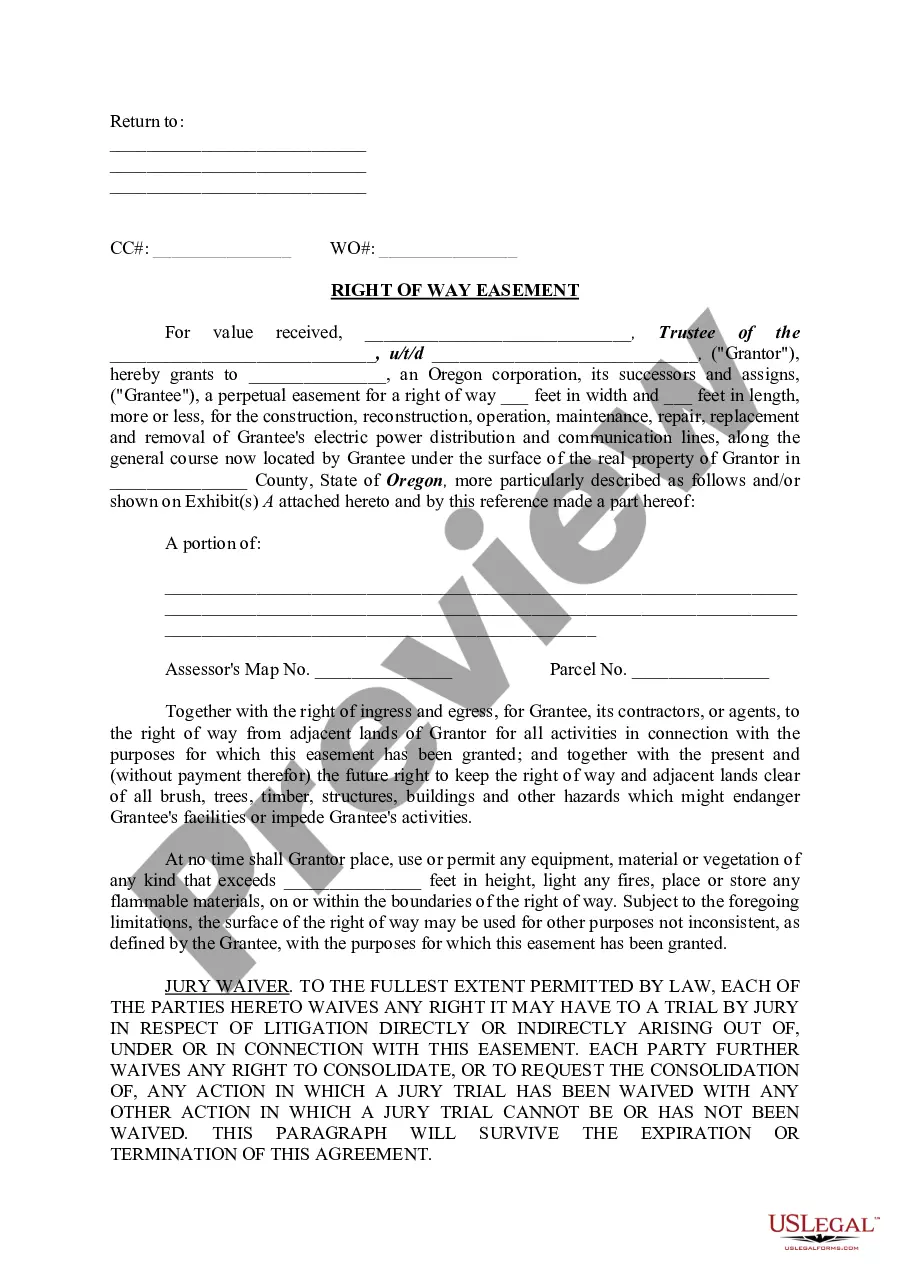

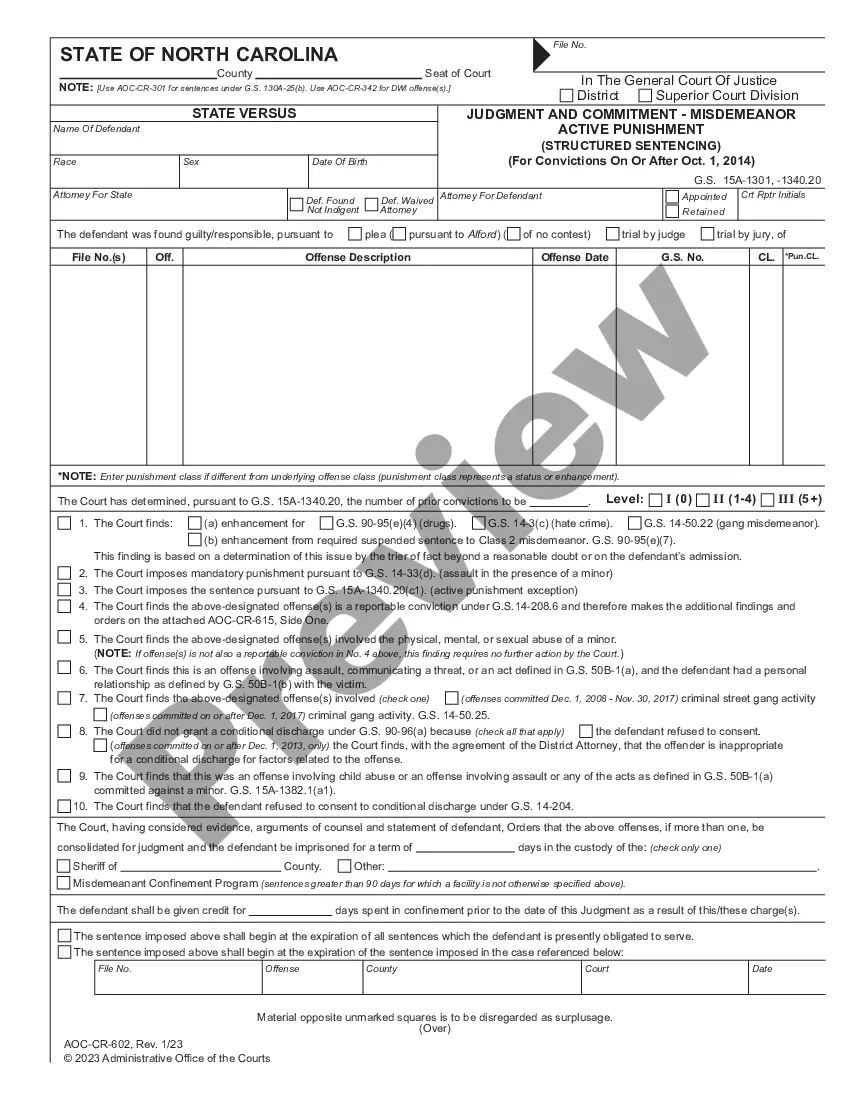

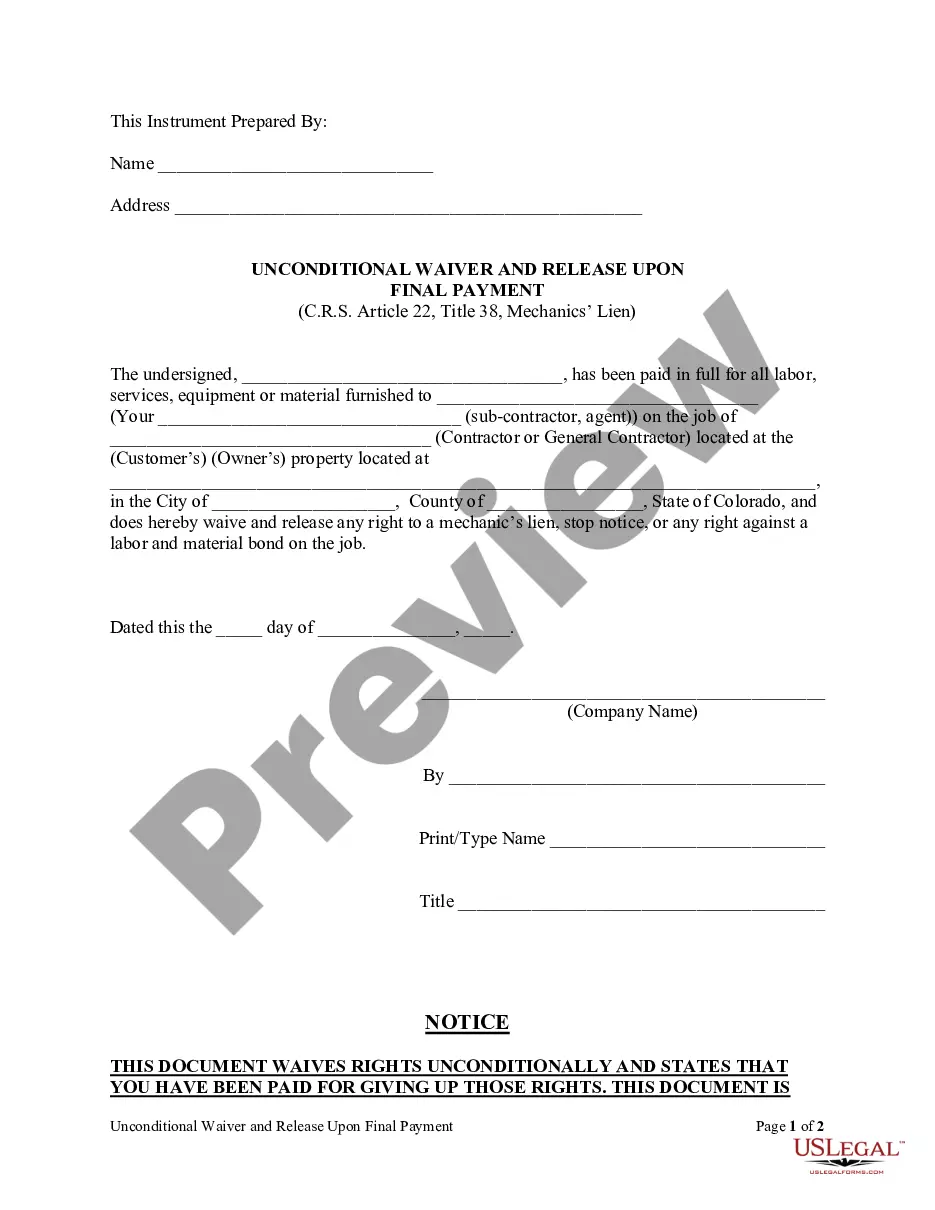

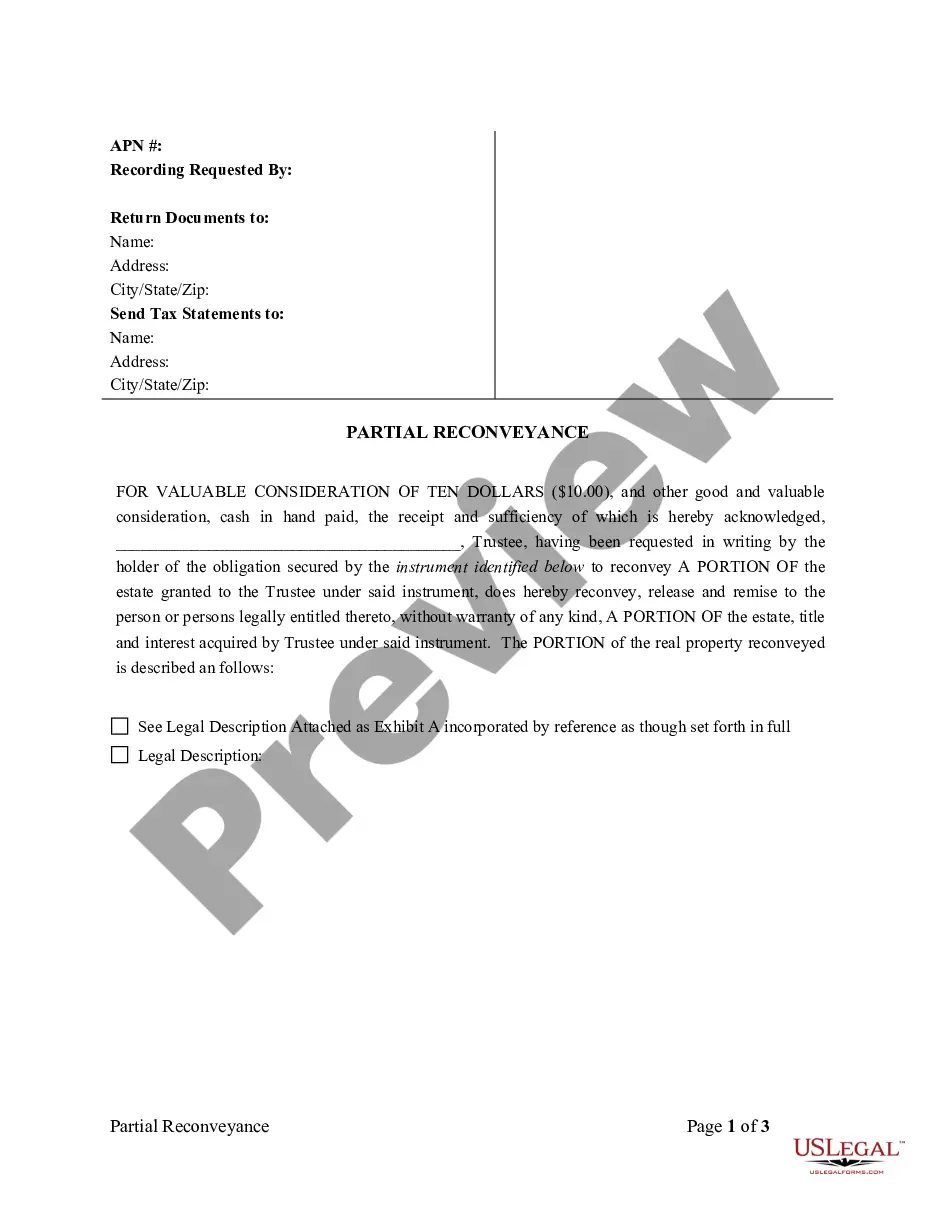

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Montgomery Jury Instruction - Presenting Or Using A False Claim In A Bankruptcy Proceeding, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the recent version of the Montgomery Jury Instruction - Presenting Or Using A False Claim In A Bankruptcy Proceeding, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Montgomery Jury Instruction - Presenting Or Using A False Claim In A Bankruptcy Proceeding:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Montgomery Jury Instruction - Presenting Or Using A False Claim In A Bankruptcy Proceeding and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

You can typically work to improve your credit score over 12-18 months after bankruptcy. Most people will see some improvement after one year if they take the right steps. You can't remove bankruptcy from your credit report unless it is there in error.

An involuntary bankruptcy starts when one or more creditors file a petition with the bankruptcy court. A creditor can file an involuntary bankruptcy case under Chapter 7 or Chapter 11. Cases under Chapter 13 and Chapter 12 cases aren't permitted.

The primary requirement for a petition of involuntary bankruptcy is that creditors must demonstrate that a debtor has defaulted on repayments of debts. Involuntary petitions must be filed only by creditors who are owed, individually or in the aggregate, at least $16,750 in unsecured, undisputed debt.

A chapter 7 case begins with the debtor filing a petition with the bankruptcy court serving the area where the individual lives or where the business debtor is organized or has its principal place of business or principal assets.

Involuntary bankruptcy is a legal proceeding through which creditors request that a person or business go into bankruptcy. Creditors can request involuntary bankruptcy if they think that they will not be paid if bankruptcy proceedings don't take place.

Steps in the Chapter 11 Bankruptcy Process Bankruptcy Filing.Disclosure Statement.Notice to Creditors.Filing Proofs of Claim.Unsecured Creditors' Committee.Plan of Reorganization.Court Approval of Disclosure Statement.Vote on Reorganization Plan.

Stops creditors from trying to collect from Kathleen, but it does not stop them from filing lawsuits against her. Which of the following is a requirement for an involuntary Chapter 7 bankruptcy petition? a. The debtor must owe at least $150,000 in unsecured claims to the creditors who file.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time.

After you file for bankruptcy protection, your creditors can't call you, or try to collect payment from you for medical bills, credit card debts, personal loans, unsecured debts, or other types of debt.

Chapter 11 is a form of bankruptcy that involves a reorganization of a debtor's business affairs, debts, and assets, and for that reason is known as "reorganization" bankruptcy. It is most often used by large entities, such as businesses, though it is available to individuals as well.