Bexar Texas Jury Instruction — 4.4.3 Rule 10(b— - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning — Violation of Blue Sky Law and Breach of Fiduciary Duty is a legal matter pertaining to investment fraud and misconduct by stockbrokers in Bexar County, Texas. This specific jury instruction, 4.4.3 Rule 10(b) — 5(c), focuses on the fraudulent practice or course of dealing known as stockbroker churning and its violation of Blue Sky Law and breach of fiduciary duty. Stockbroker churning refers to a deceptive practice where a broker excessively trades securities in a client's account primarily to generate commissions, without regard to the client's investment objectives or best interests. This behavior often leads to substantial losses for investors while generating substantial profits for the broker. Such actions violate the securities industry's standards of conduct and expose the broker to legal consequences. The instruction 4.4.3 Rule 10(b) — 5(c) specifically addresses the legal standards and elements required to prove a fraudulent practice or course of dealing case involving stockbroker churning, as well as the violation of Blue Sky Law and breach of fiduciary duty in Bexar County, Texas. It highlights key factors such as the defendant's intent to defraud, material misrepresentation or omission of facts, and the harm caused to the investor. In cases involving the violation of Blue Sky Law, which is a state securities' law designed to protect investors from fraudulent practices, the jury instruction examines whether the defendant's actions fall within the jurisdiction of Blue Sky Law and if they contravene any specific provisions of the law. Furthermore, a breach of fiduciary duty claim asserts that the stockbroker failed to act in the best interests of the client and instead prioritized their own financial gain. This type of claim alleges that the broker breached their duty of loyalty, care, and perfect faith owed to their clients. Other types of Bexar Texas Jury Instructions related to fraudulent practices or courses of dealing may exist, but in this specific scenario, the focus is on the 4.4.3 Rule 10(b) — 5(c) instruction, which addresses stockbroker churning, violation of Blue Sky Law, and breach of fiduciary duty.

Bexar Texas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Bexar Texas Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

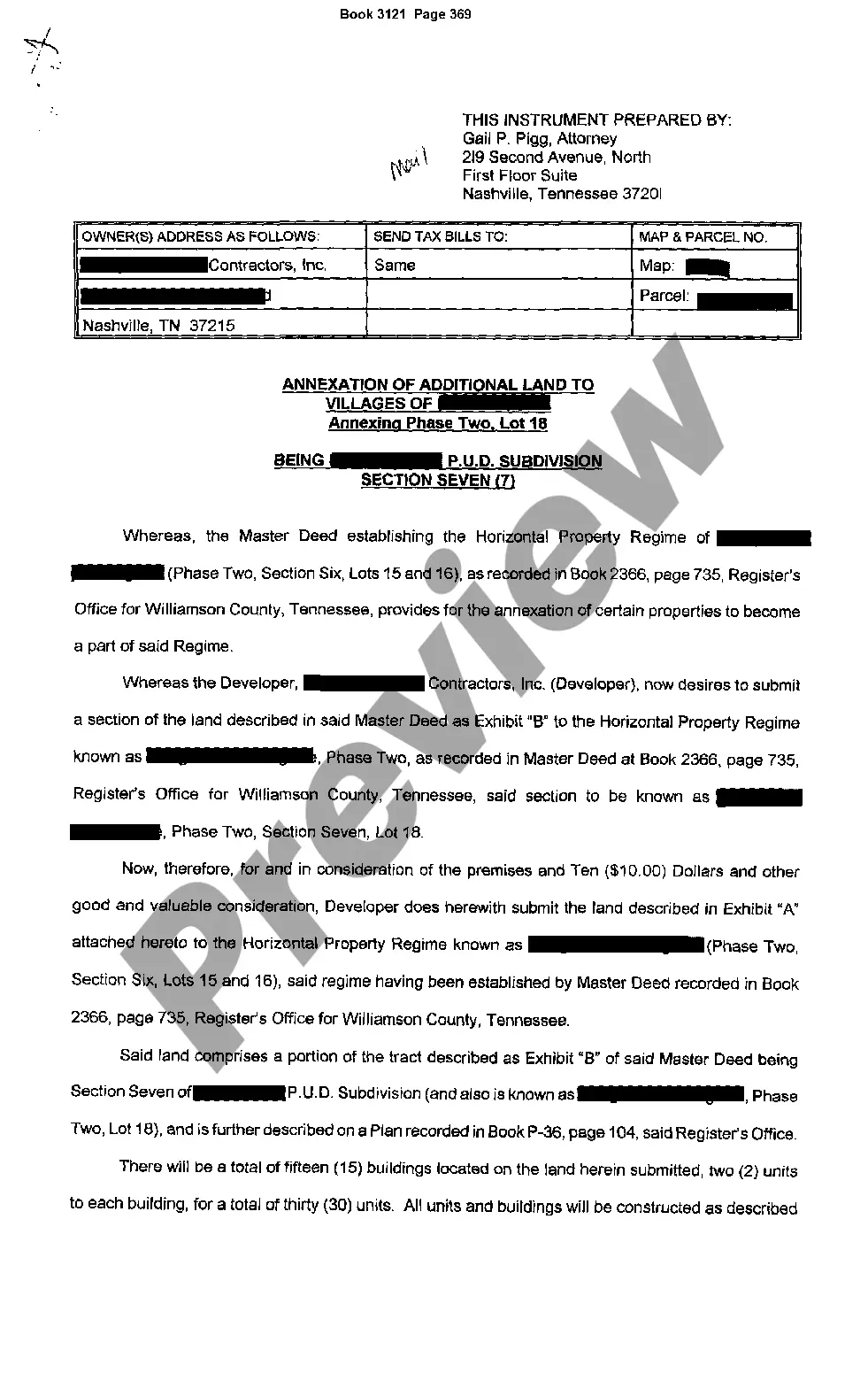

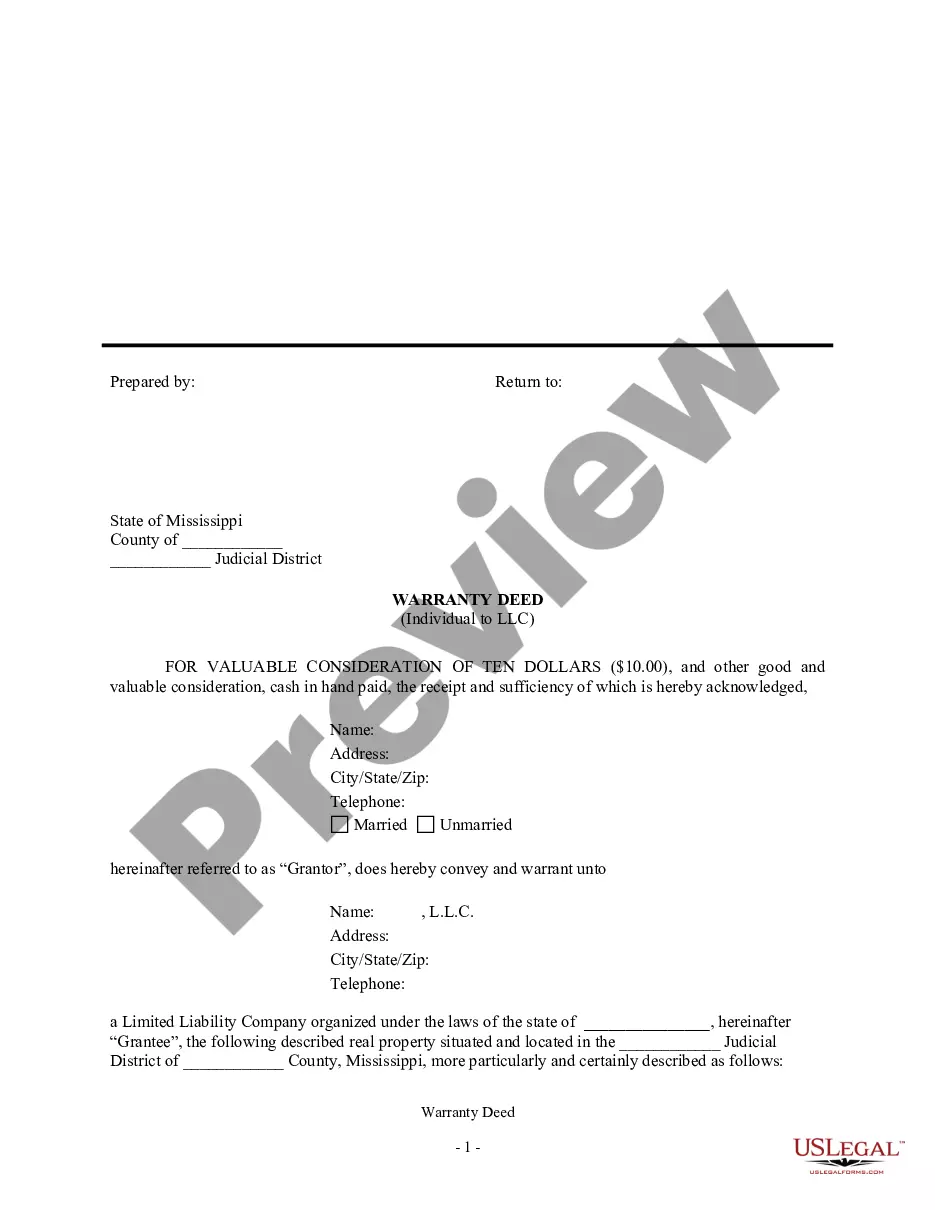

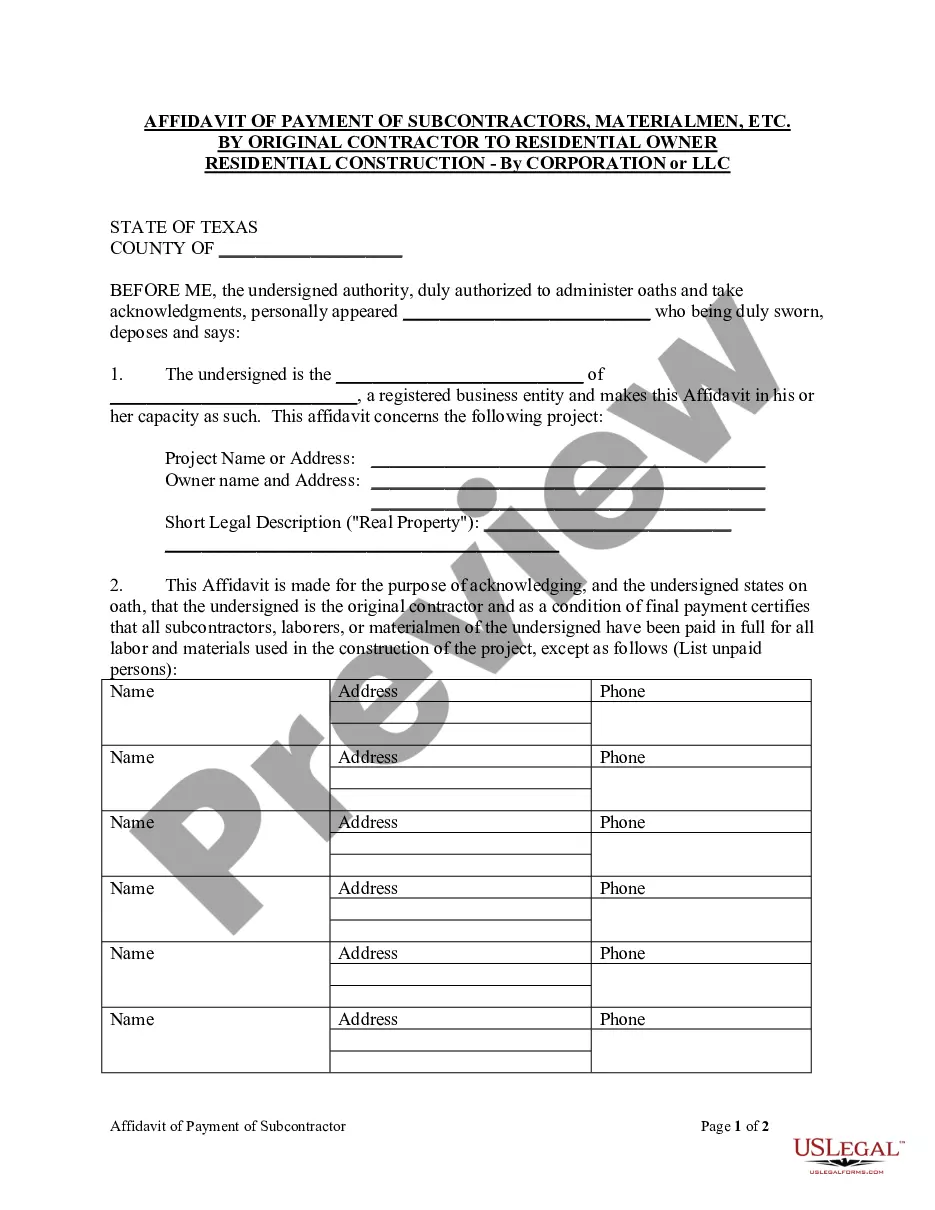

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Bexar Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the recent version of the Bexar Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Bexar Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Bexar Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

If a broker doesn't pay or is slow to pay, the factoring company works with you and your customer to collect the payment. A factoring company can help you minimize non-payment situations by: Checking the credit and payment history of a broker before you enter an agreement.

Here are 6 tips to sue your stockbroker: Conduct a Thorough Research. Before you file any claim or case, you must research about stockbroker fraud and negligence.Gather All Your Evidence.Narrow Your Basis of Claim.Review Your Brokerage Account Agreement.File the Right Type of Claim.Consult a Stock Loss Attorney.

Margin Calls If your leveraged long positions start to lose money and your margin equity level has fallen below the firm's maintenance margin requirements, the brokerage has every right to sell your securities without contacting you or obtaining your permission.

Brokerages are permitted broad discretion in limiting trades to provide flexibility in handling unusual situations like technical glitches, mechanical errors and mistakes, or to preserve an orderly market, said Columbia Law School professor Joshua Mitts, who specializes in corporate law.

If you have a complaint against your stock broker and the firm is not resolving it or you are not satisfied with the resolution, you can raise an online complaint with the National Stock Exchange (NSE) online.

If you are not satisfied with your broker's response, contact the firm's branch manager or compliance department. If you lost money or there was an unauthorized trade made in your account, you should complain in writing. Retain copies of your letter and of all other related correspondence with the brokerage firm.

A broker cannot legally steal your money, just the same as your neighbor or your bank cannot legally steal your money. However, it is possible for a stockbroker to steal your money and the money from other investors. This is called Conversion of Funds. Conversion of Funds is a violation of FINRA Rule 2150.

If your broker is trading your account and is using any measure of unauthorized discretion about the order, it is a violation of FINRA rules and may entitle you to recover any damages caused by the broker's misconduct.

A broker may be liable to a customer if a broker misrepresents or fails to disclose material facts to the investor in the sale or recommendation of an investment. This obligation requires brokers to fairly disclose all of the risks associated with an investment.