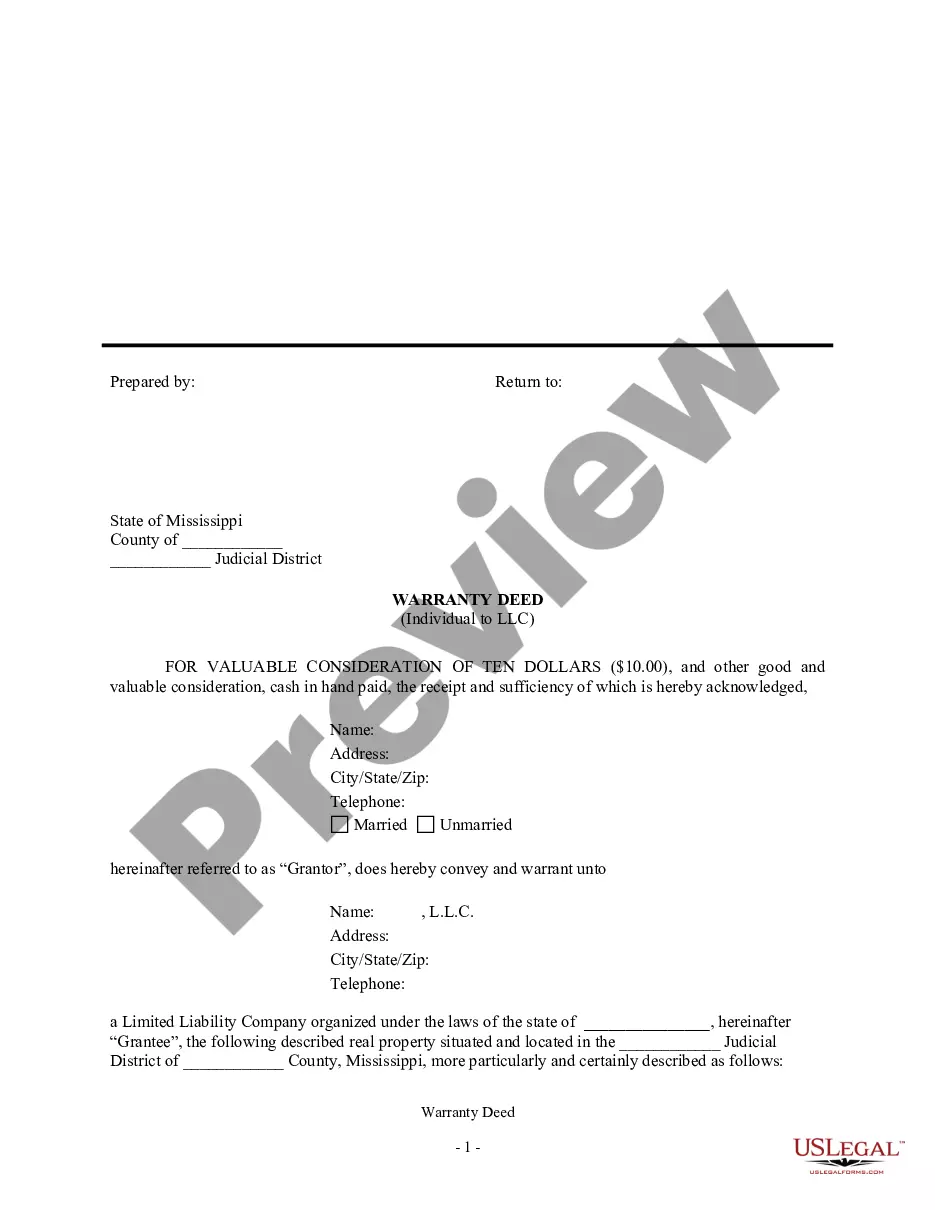

Mississippi Warranty Deed from Individual to LLC

Understanding this form

The Warranty Deed from Individual to LLC is a legal document used to transfer ownership of property from an individual (the grantor) to a limited liability company (the grantee). This form is essential for ensuring that the grantee receives clear title to the property, as it includes warranties from the grantor regarding their legal authority to convey the property. Unlike other deeds, this warranty deed includes specific clauses about the reservation of resources like oil, gas, and minerals, which is important for the parties involved in the transaction.

Form components explained

- Identification of the grantor and grantee, including full names and addresses.

- A declaration of valuable consideration, acknowledging payment or other compensation.

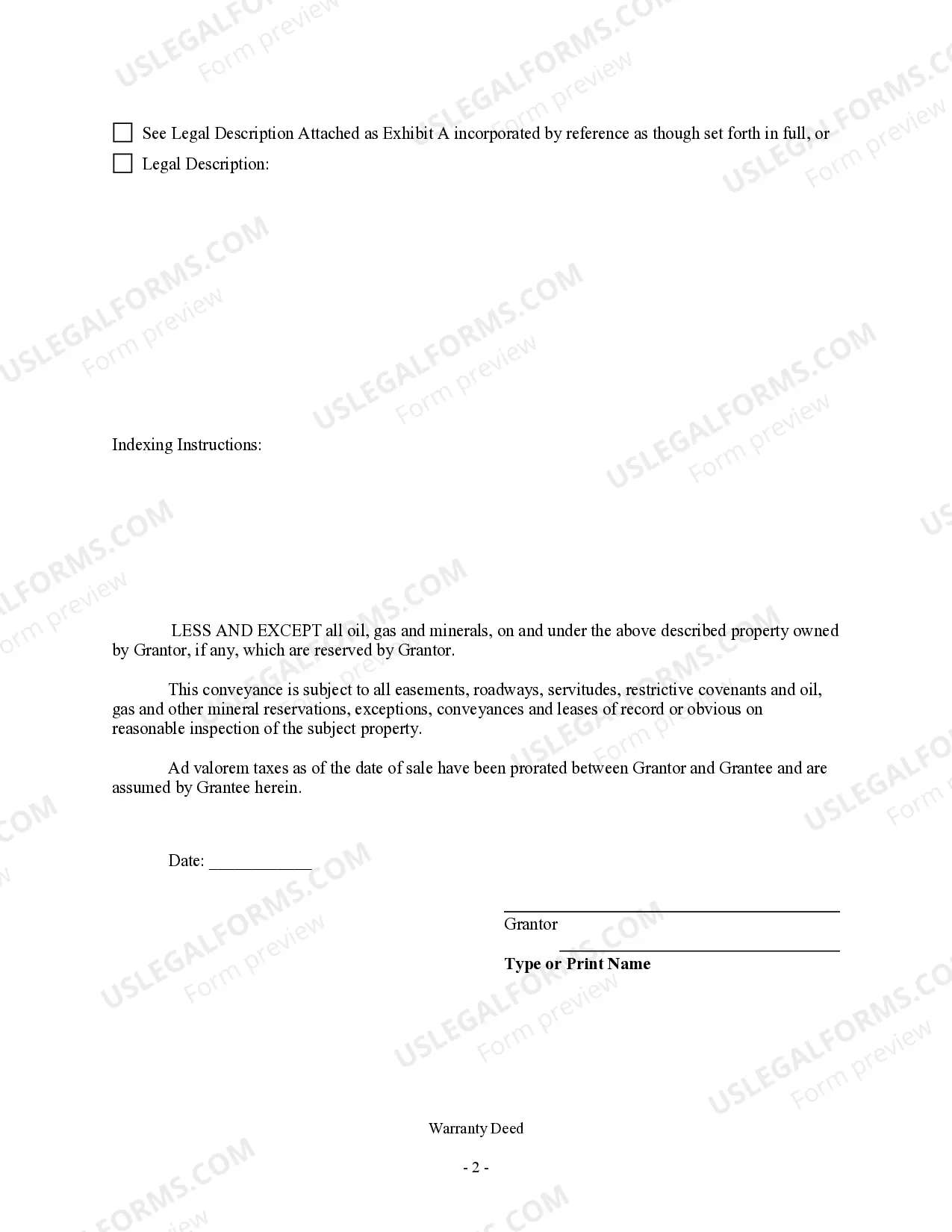

- A legal description of the property being conveyed, which can be attached as an exhibit.

- Clauses detailing the transfer and any exceptions (e.g., reserved minerals).

- Signatures of the grantor and potentially witnesses, along with the date of the signing.

State-specific compliance details

This form is designed to be used in any U.S. state. However, ensure that you follow your specific state's regulations regarding property transfers and recordings, which may vary.

When to use this form

This warranty deed is useful in various situations, such as when an individual wants to formally transfer real estate ownership to their business entity, an LLC. It is ideal in scenarios involving asset protection, estate planning, or when an individual is reassigning property they acquired to a corporate structure for tax or liability purposes.

Who should use this form

The following individuals or entities should consider using this form:

- Individuals transferring personal property to their own LLC.

- Real estate investors who wish to manage properties through an LLC.

- Anyone involved in estate planning where properties are managed through LLCs.

- Business owners looking to protect personal assets by moving property to a limited liability company.

Steps to complete this form

- Identify the parties: Fill in the full names and addresses of the grantor and the LLC.

- Specify the consideration: State the amount being exchanged (typically a nominal amount like ten dollars) and any other valuable consideration.

- Attach the legal description of the property: Ensure it is correctly documented in Exhibit A.

- Include any exceptions: Clearly specify any reserved rights, such as minerals.

- Sign and date the form: The grantor must sign, and any required witnesses should also sign as necessary.

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Typical mistakes to avoid

- Failing to include a full legal description of the property.

- Omitting signatures from required parties, which can invalidate the deed.

- Not indicating any exceptions or reservations clearly in the document.

- Using outdated forms that do not conform to current laws or regulations.

Benefits of completing this form online

- Convenience of completing and downloading the form from home.

- Editability to personalize the form based on specific needs.

- Access to professionally drafted forms created by licensed attorneys.

- Time-saving since there is no need to visit a lawyer for routine transactions.

Form popularity

FAQ

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Generally, someone else cannot remove you from title without your consent and/or knowledge. You should speak to a local real estate attorney to see how to return your name to title and how it was removed in the first place.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Once signed and notarized, a Mississippi deed must be recorded. The deed must be presented to the Recorder of Deeds in the county where the property is located. The transfer takes effect when signed and accepted by the grantee. However, recording provides notice to the public that the property was transferred.

The Mississippi general warranty deed is used to transfer real property in Mississippi with a guarantee from the seller or grantor that the property is free from hidden claims against the title and that the grantor has the legal authority to sell the property.

Before a quitclaim deed can be recorded with a county recorder in Mississippi, the grantor must sign and acknowledge it. The names, addresses, and telephone numbers of the grantors and grantees to the quit claim deed, along with a legal description of the real property should be provided on the first page (89-5-24).

Once signed and notarized, a Mississippi deed must be recorded. The deed must be presented to the Recorder of Deeds in the county where the property is located. The transfer takes effect when signed and accepted by the grantee. However, recording provides notice to the public that the property was transferred.