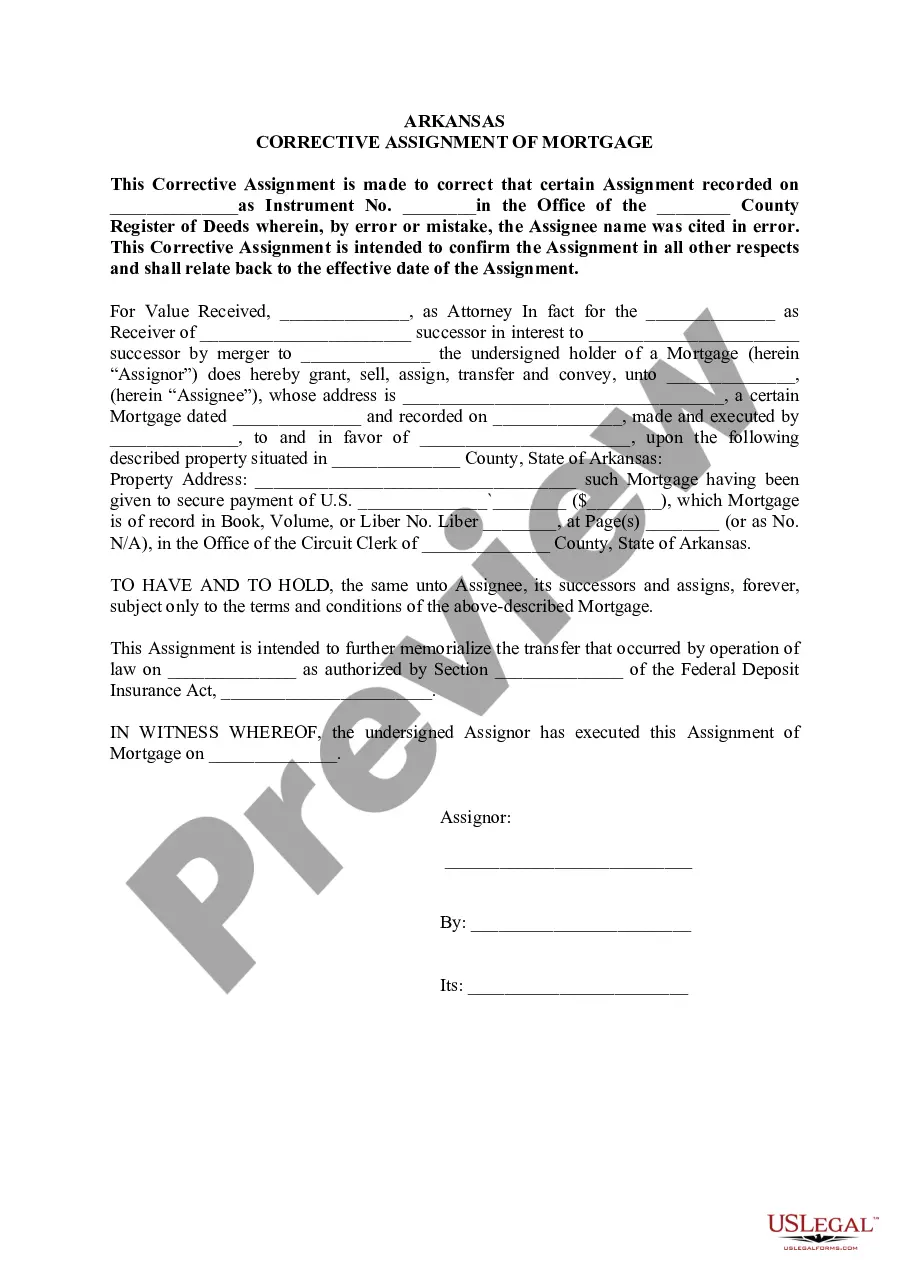

Arkansas Corrective Assignment Of Mortgage

Description

How to fill out Arkansas Corrective Assignment Of Mortgage?

Using examples of Arkansas Corrective Assignment Of Mortgage created by experienced attorneys allows you to sidestep difficulties when completing forms.

Simply download the template from our site, complete it, and seek legal advice to review it.

This approach can save you significantly more time and effort than having a lawyer draft a document from scratch for you.

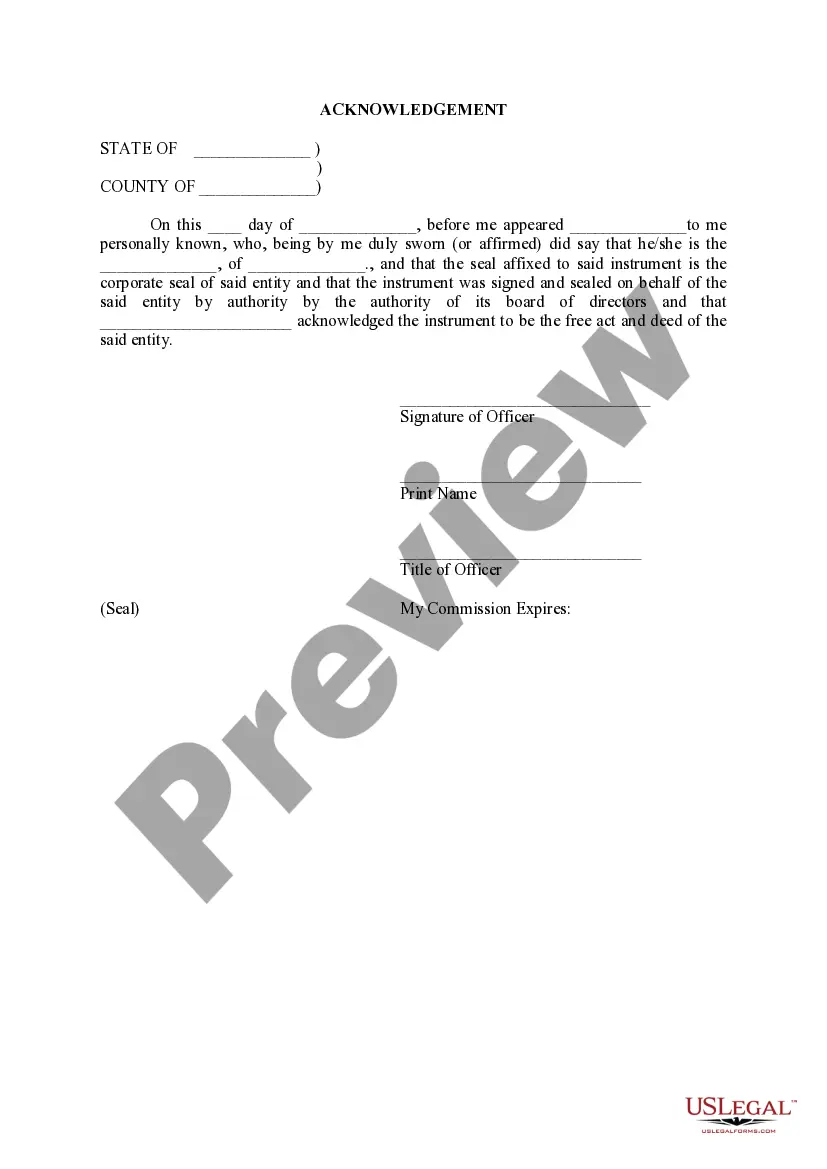

After completing all the steps above, you will be able to fill out, print, and sign the Arkansas Corrective Assignment Of Mortgage form. Remember to verify all entered information for accuracy before submitting or sending it out. Minimize the time spent on document creation with US Legal Forms!

- If you already have a US Legal Forms subscription, simply Log In to your account and navigate back to the form page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a document, you will find your saved templates in the My documents section.

- If you do not have a subscription, no worries. Just follow the steps below to register for your account online, obtain, and fill out your Arkansas Corrective Assignment Of Mortgage form.

- Ensure that you are downloading the correct state-specific document.

- Utilize the Preview feature and review the description (if available) to determine if you need this specific template and if so, click Buy Now.

- Search for another file in the Search field if necessary.

- Choose a subscription that fits your requirements.

- Start with your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

California is classified as a deed of trust state. This means that most real estate transactions in California use deeds of trust as the securing instrument rather than traditional mortgages. The structure of a deed of trust allows for a more streamlined process during foreclosure. Considering Arkansas Corrective Assignment Of Mortgage can provide valuable insights into how securities are handled in different states.

California predominantly uses deeds of trust rather than standard mortgages for real estate transactions. A deed of trust involves three parties: the borrower, the lender, and a trustee. This distinct structure enables a more efficient foreclosure process if necessary. Familiarizing yourself with Arkansas Corrective Assignment Of Mortgage can be beneficial when dealing with property ownership issues.

Lenders in California often prefer deeds of trust because they expedite the foreclosure process. Unlike traditional mortgages, deeds of trust allow lenders to avoid lengthy court involvement during foreclosure. This swift process enhances the lender's ability to reclaim the property in case of default. Understanding concepts like Arkansas Corrective Assignment Of Mortgage can provide deeper insights into similar matters.

A mortgage reassignment occurs when the ownership rights of a mortgage are transferred from one lender to another. This reassignment can affect payment terms and the servicing of the mortgage. If you are dealing with a reassignment, it is advisable to review the documents associated with the Arkansas Corrective Assignment Of Mortgage to fully understand your obligations and rights.

Yes, Arkansas is considered a Deed of Trust state. This means that property transactions often involve Deeds of Trust rather than traditional mortgages. If you are addressing issues connected with property financing, understanding the implications of this designation is key, particularly in relation to the Arkansas Corrective Assignment Of Mortgage.

To obtain a copy of the deed to your house in Arkansas, you can visit your local county clerk's office or access their website. Many counties provide online databases where you can search for property records. Ensuring that the deed accurately reflects any changes, especially those related to the Arkansas Corrective Assignment Of Mortgage, can help clarify ownership and rights.

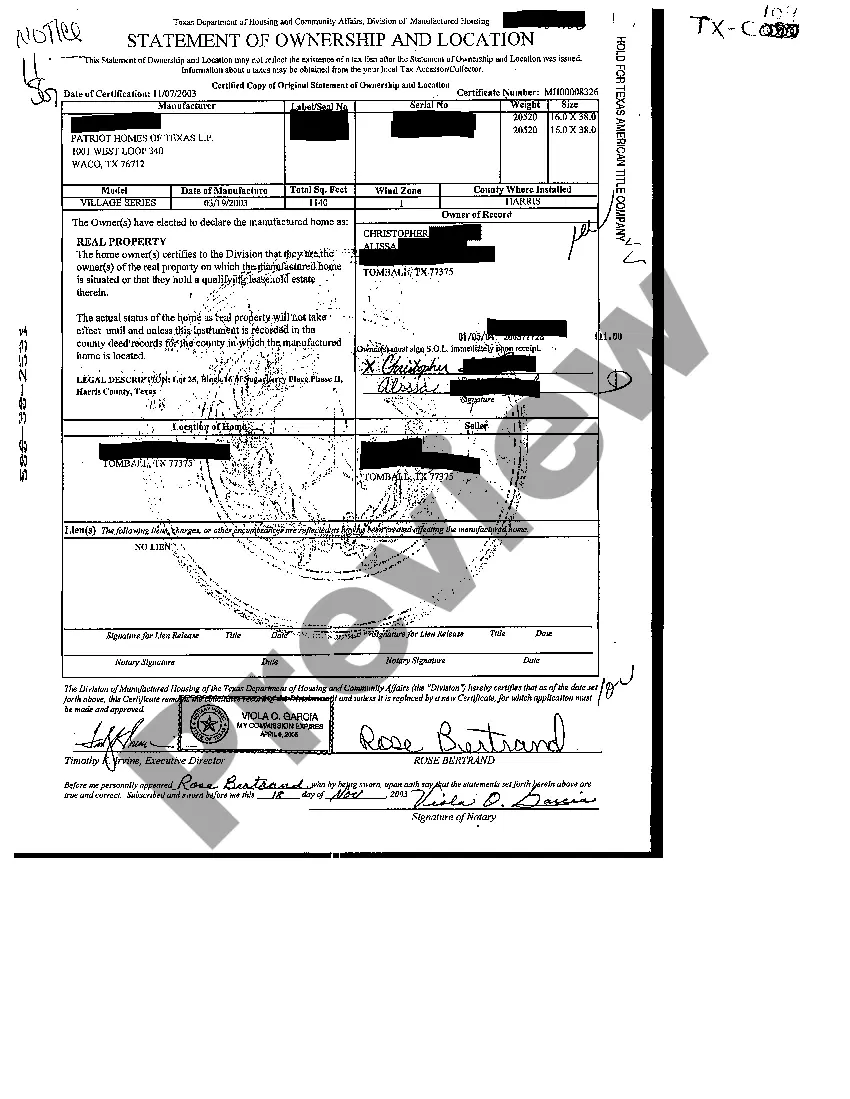

Texas utilizes Deeds of Trust for real estate transactions, much like Arkansas. In Texas, this structure provides lenders with a mechanism for foreclosure that is generally quicker than traditional mortgage processes. Familiarity with how these documents work can be beneficial when also handling matters related to the Arkansas Corrective Assignment Of Mortgage.

Arkansas is primarily a Deed of Trust state. This means most property financing is secured through Deeds of Trust rather than traditional mortgages. Understanding this distinction is essential, especially if you need to address issues related to the Arkansas Corrective Assignment Of Mortgage and ensure your interests are protected.

The assignment document for a mortgage is typically known as the Assignment of Mortgage. This document transfers the lender's interest in the mortgage to another entity. When engaging with the Arkansas Corrective Assignment Of Mortgage, it is crucial to ensure that these documents are correctly drafted to reflect the current ownership and obligations associated with your property.

Wyoming operates as a Deed of Trust state. This means that when property is financed, a borrower sign a Deed of Trust, which transfers the title to a trustee for the benefit of the lender. This arrangement facilitates foreclosure processes should the borrower default. Understanding the implications of these documents in relation to the Arkansas Corrective Assignment Of Mortgage can help clarify your options.