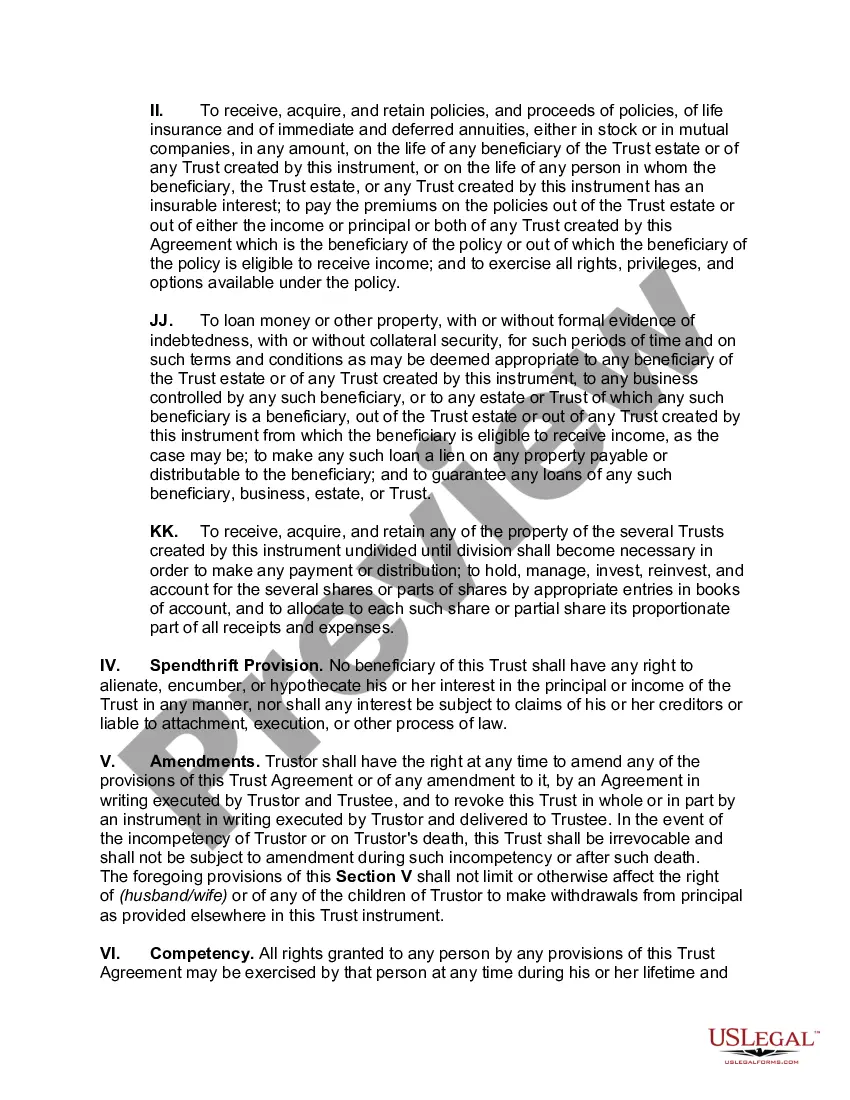

Palm Beach Florida Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Revocable Trust For Lifetime Benefit Of Trustor, Lifetime Benefit Of Surviving Spouse After Trustor's Death With Trusts For Children?

Are you seeking to swiftly establish a legally-binding Palm Beach Revocable Trust for the Lifetime Benefit of the Trustor and the Lifetime Benefit of the Surviving Spouse after the Trustor's passing, along with arrangements for children or perhaps other documentation to oversee your personal or business affairs.

You can opt for one of two alternatives: engage a specialist to draft a legitimate document on your behalf, or draft it entirely independently. The great news is there’s a different choice - US Legal Forms. This service will assist you in obtaining well-crafted legal documents without incurring exorbitant fees for legal assistance.

If the document doesn’t meet your expectations, restart the search using the search box at the top. Choose the subscription that best fits your requirements and proceed with the payment. Select the file format in which you wish to receive your document and download it. Print it, complete it, and sign where indicated.

If you have already created an account, simply Log In, locate the Palm Beach Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children template, and download it. To retrieve the form again, just navigate to the My documents section. It’s simple to find and obtain legal forms when you utilize our catalog. Furthermore, the documents we offer are revised by industry experts, providing you with increased reassurance when handling legal matters. Experience US Legal Forms today and discover its benefits for yourself!

- US Legal Forms provides an extensive collection of more than 85,000 state-adherent document templates, which include the Palm Beach Revocable Trust for the Lifetime Benefit of the Trustor, Lifetime Benefit of Surviving Spouse after the Trustor's demise with Trusts for Children and various form packages.

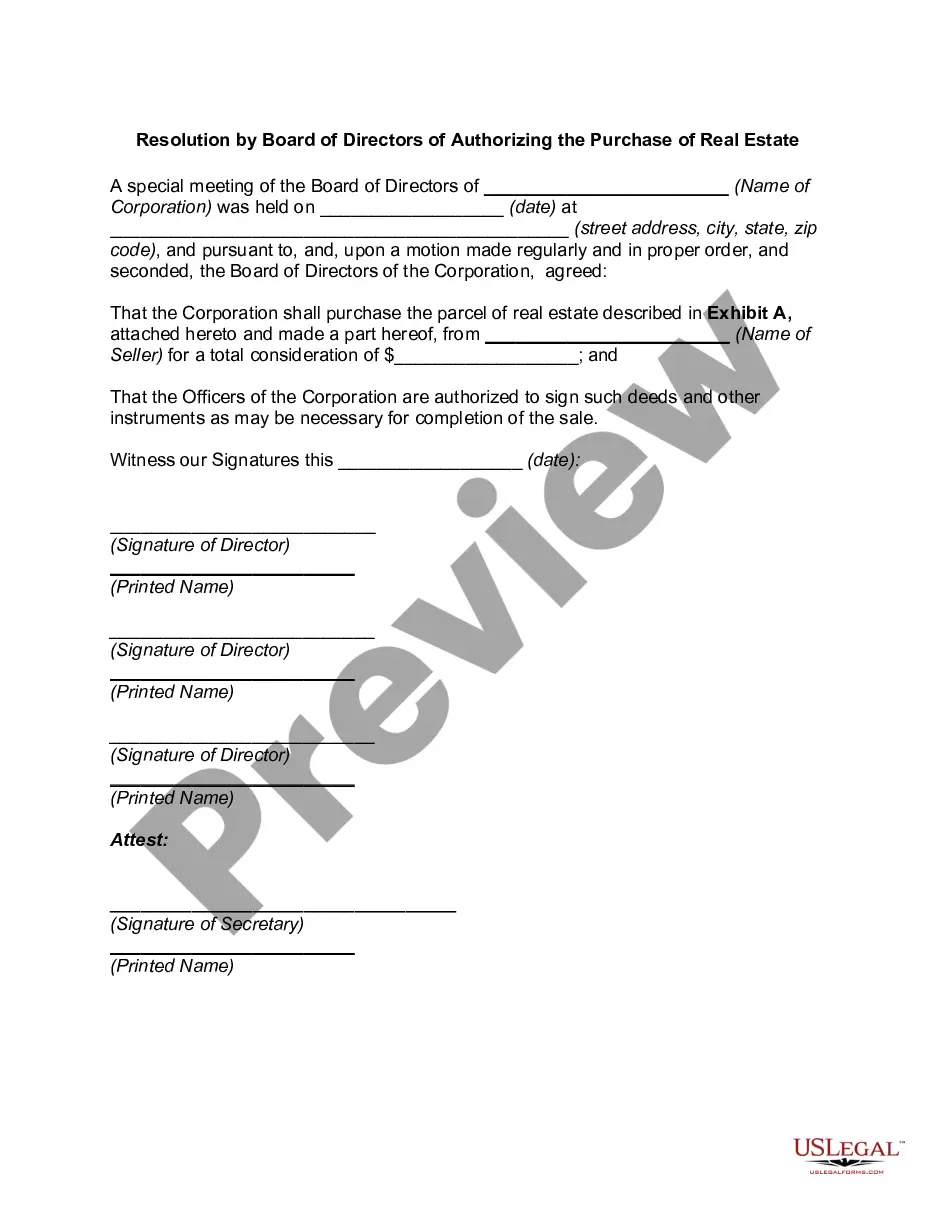

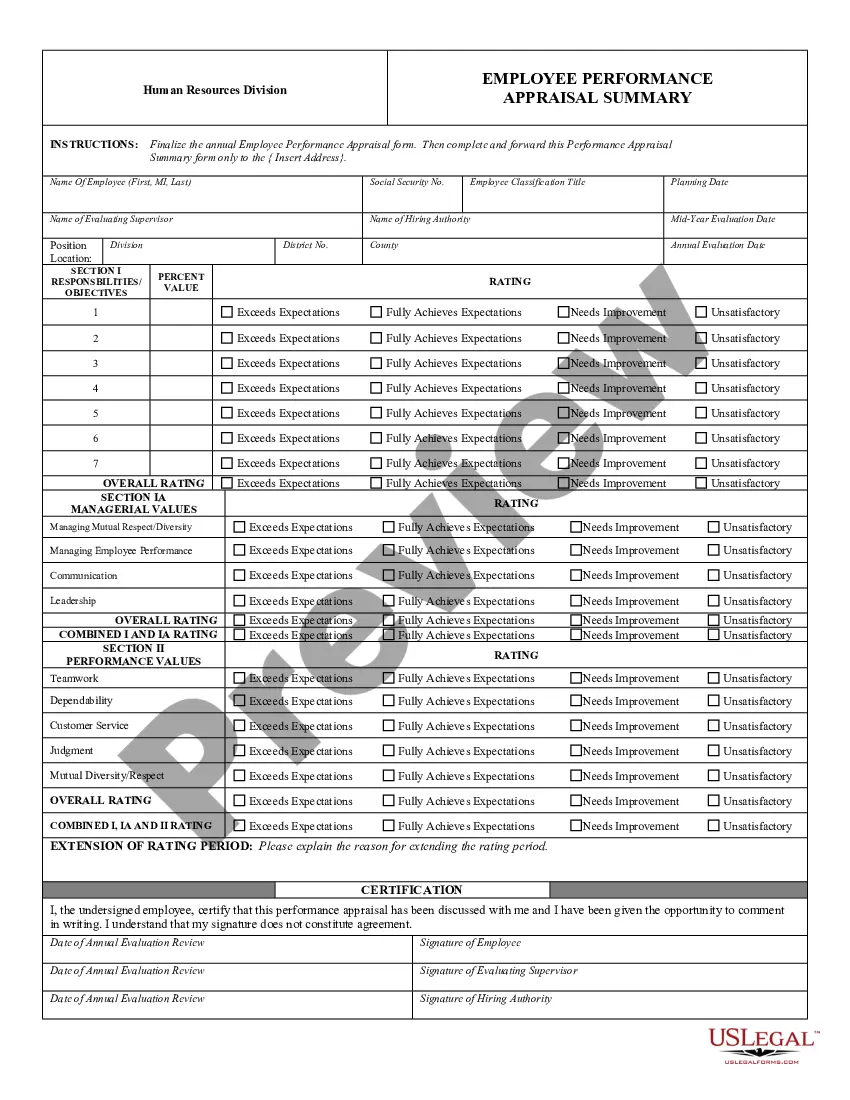

- We offer documents for an array of life situations: from divorce paperwork to real estate agreements.

- With over 25 years in the business, we have maintained an impeccable reputation among our clientele.

- Here’s how you can join our satisfied users and secure the required template without unnecessary complications.

- To start, thoroughly confirm if the Palm Beach Revocable Trust for the Lifetime Benefit of the Trustor, Lifetime Benefit of Surviving Spouse after the Trustor's Death with Trusts for Children aligns with your state or county regulations.

- If the document includes a description, ensure to check its intended purpose.

Form popularity

FAQ

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

Even with formal administration, most estates are resolved within 18 months. However, all claims against an estate must be filed within 2 years of the person's death.

Trusts usually end when the settlor dies or when one of the beneficiaries dies, but sometimes a trust ends after a certain period of time or after a certain event takes place, like when a beneficiary gets married or reaches a certain age. There are other reasons a trust can end, however.

When a revocable trust has one grantor, the trust turns irrevocable when the grantor dies or becomes incapacitated. A legal issue arises with a joint trust that determines whether a revocable trust becomes an irrevocable trust.

Terminating a Florida Living Trust after Administration 4 Important Steps Review the Trust Documents to ensure all provisions have been complied with and satisfied.Prepare and File the Final Tax Return, if applicable.Notify all known Creditors.Notify Beneficiaries that the Trust is being Terminated.

Your revocable trust becomes irrevocable upon your incapacity or upon your death. If you are incompetent, or incapacitated, your successor trustees can gather your assets which are not in the trust, and place them into the trust so that they may be managed for your benefit.

A trust can remain open for up to 21 years after the death of anyone living at the time the trust is created, but most trusts end when the trustor dies and the assets are distributed immediately.

In addition, a revocable trust may become irrevocable prior to the settlor's death. For example, the trust may provide that it becomes irrevocable upon the settlor's incapacity, or that the settlor can only revoke the trust with the consent of the non-settlor trustee.

A revocable living trust does not become irrevocable until your death(s). Upon the death of the settlor(s), the revocable living trust transforms into an irrevocable trust, whereby the trust remainder beneficiaries receive their assets as you direct.

In Florida, they can be arranged to last more than 360 years, which, in practical terms, makes the trust essentially perpetual. Of course, a dynasty trust does not have to last that long and can be limited to just a couple generations.