Tarrant Texas Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages

Description

How to fill out Tarrant Texas Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Tarrant Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Tarrant Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Tarrant Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages:

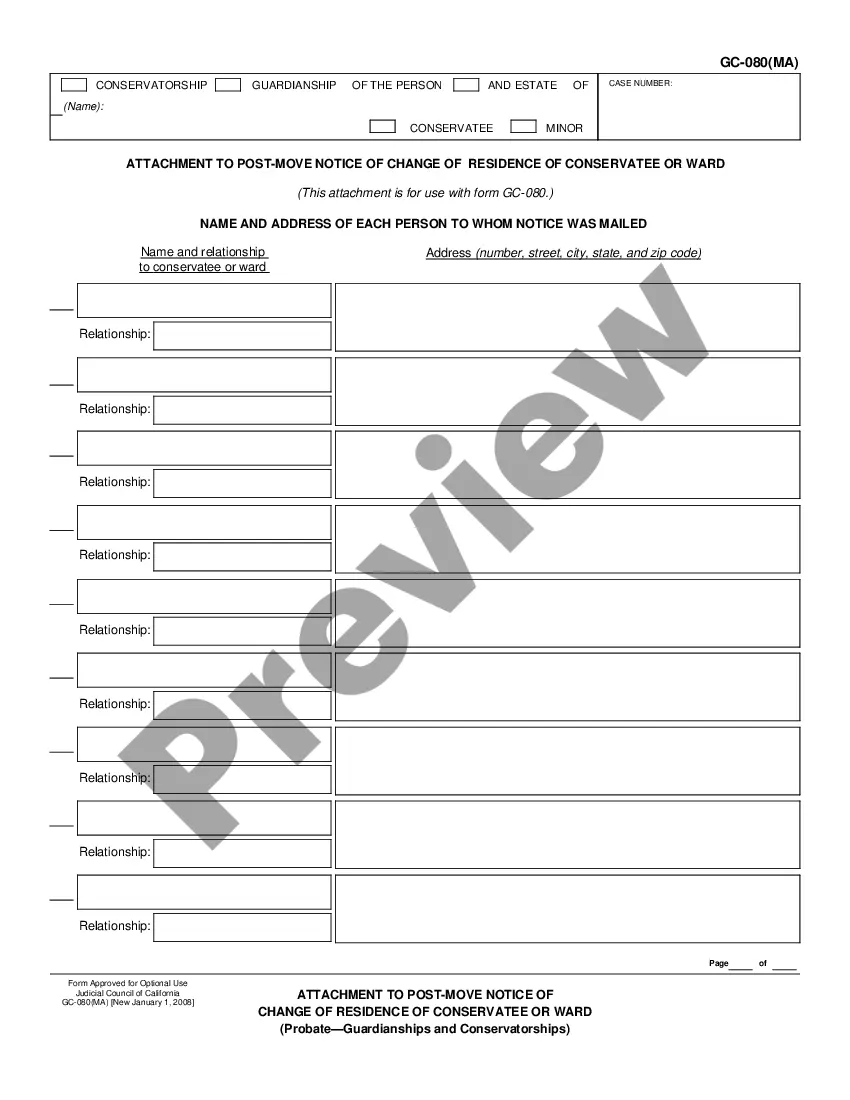

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Typically, the only issues left unresolved are those related to any children born or adopted during the marriage. Issues relating to children CANNOT be included in a prenup. This may aid in keeping divorce costs down and removes much of the stress associated with the financial aspects of a divorce.

Under Texas law, inheritances are separate property not subject to division in divorce, even if assets are inherited during the course of a marriage.

The surviving spouse automatically receives all community property. Separate personal property also goes completely to the surviving spouse, while separate real property is split down the middle between the surviving spouse and the deceased's parents, siblings or siblings' descendants, in that order.

Five Things to Do Right Now to Protect Your Inheritance Don't be a stranger.Document your parent's testamentary wishes.Deal with family photos and heirlooms now.Convince your mom and/or dad to talk to a good estate planning attorney.Talk to your parents about what there is, and find out how it is titled.

Yes, a prenuptial agreement can protect future assets. Those are common provisions you would put in to a prenuptial agreement. If there's the possibility of divorce I advise my clients to make that prenuptial agreement as ironclad as possible. You want to keep premarital accounts separate.

Generally speaking, each spouse has a right to half of the community property and so, this is automatically distributed to a widow after their spouse's death. Therefore, the deceased individual only has the right to control their half of the community property estate.

Protect an Inheritance. If one spouse (or both) expects an inheritance during a marriage, a prenuptial agreement can include provisions that state the inherited assets will remain the property of the inheriting spouseso long as the inheritance is kept separate from community property.

A spouse is not automatically entitled to your inheritance, and an inheritance can be legally protected. However, your spouse can have a claim to the inheritance depending on its status as separate or marital property.

Your spouse will inherit your half of the community property unless you leave descendants children, grandchildren, or great grandchildren. If you have separate property (many spouses mix everything together and don't have any separate property) your spouse will inherit all or a portion of it.

Yes, a prenuptial agreement can help protect inheritances and other separate property acquired before marriage. A prenuptial agreement is signed by spouses before marriage. It can include provisions about property division and distribution should the couple divorce in the future.