Allegheny Pennsylvania Collection Report

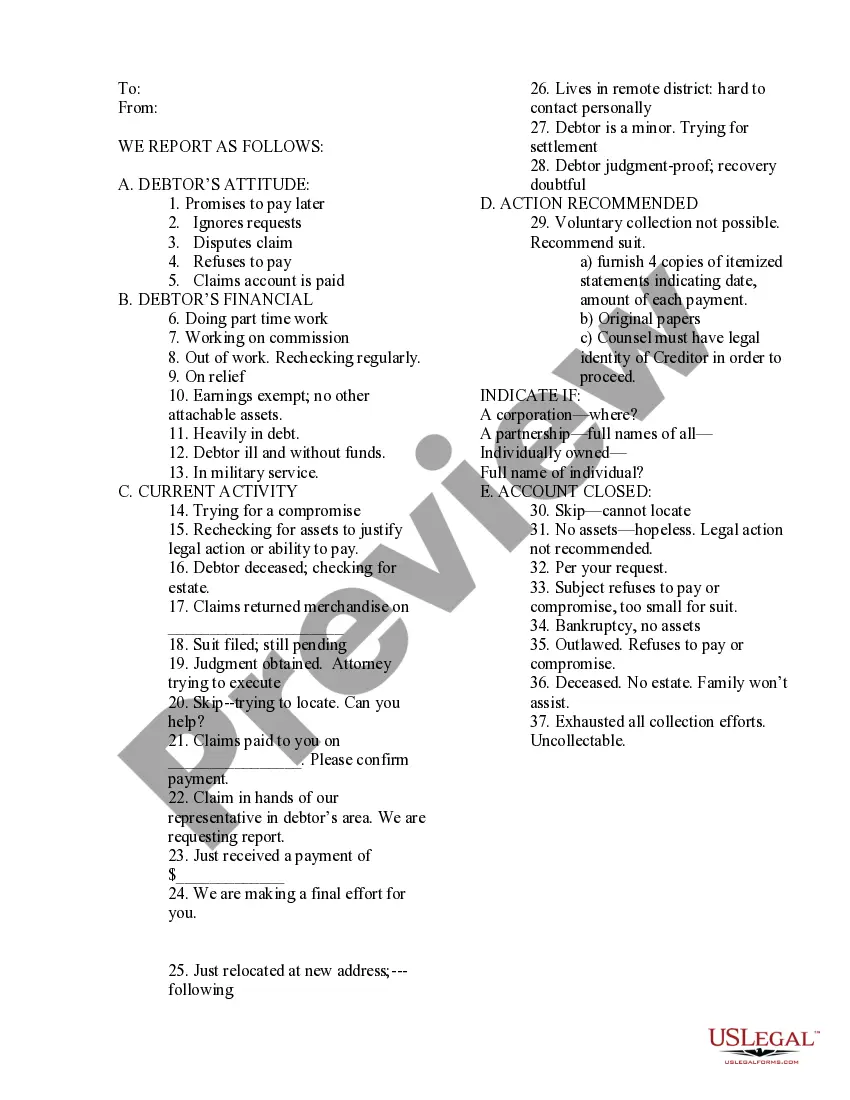

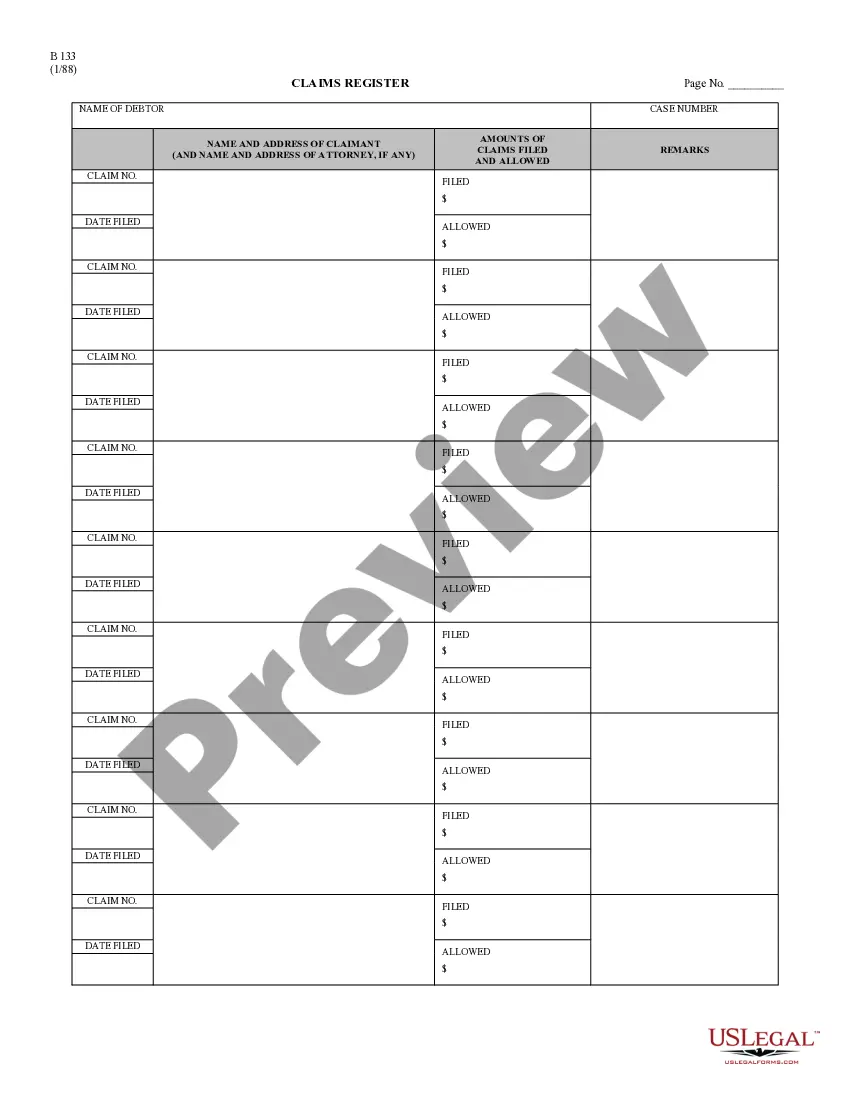

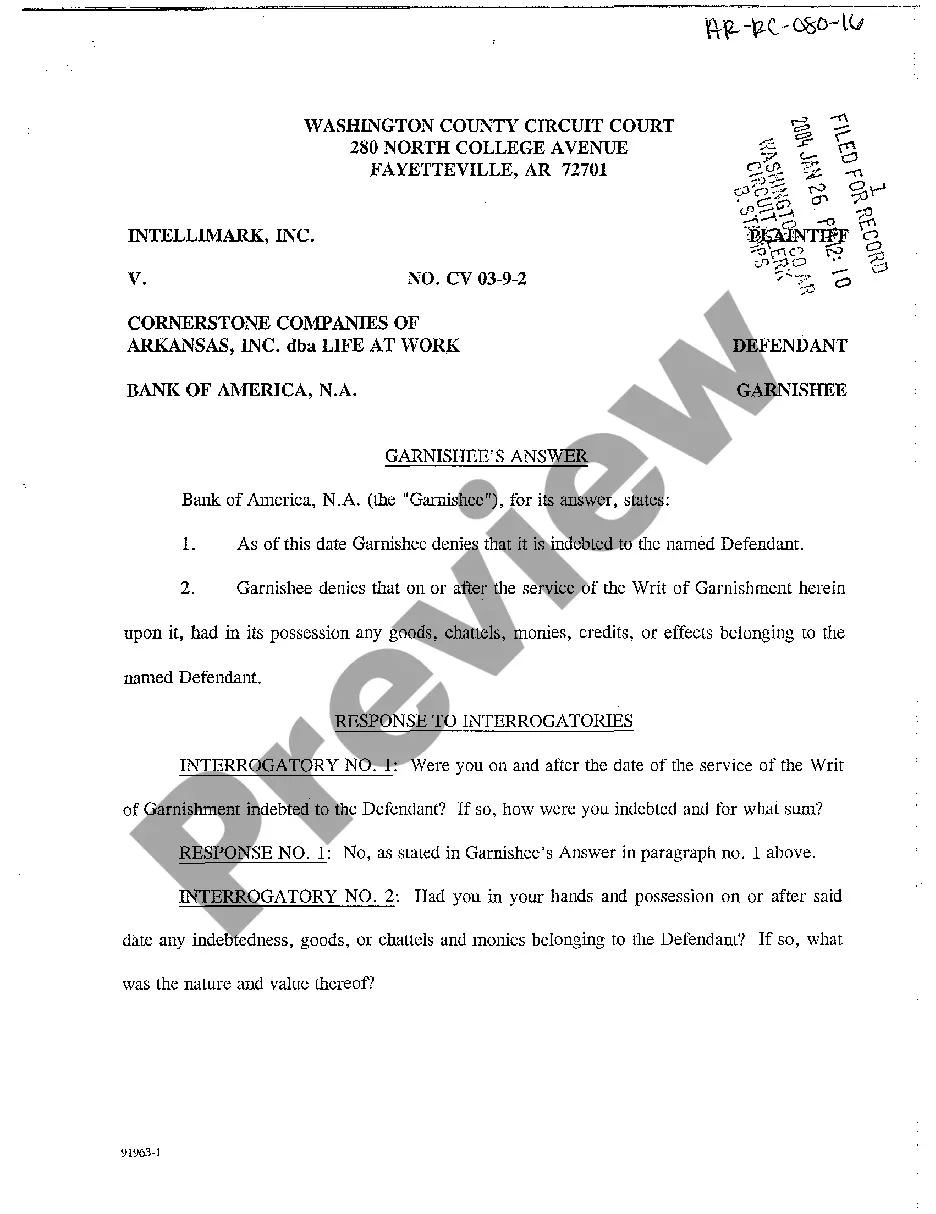

Description

How to fill out Collection Report?

Legislations and rules in every domain vary across the nation.

If you're not a legal professional, it's simple to become confused by a range of standards when it comes to creating legal documents.

To prevent costly legal consultation when drafting the Allegheny Collection Report, you require a validated template applicable to your area.

Fill out and sign the document in writing after printing it, or complete it entirely electronically. This is the easiest and most cost-effective way to acquire current templates for any legal purposes. Find them all with just a few clicks and maintain your documentation organized with the US Legal Forms!

- Review the page information to ensure you have located the right sample.

- Utilize the Preview feature or read the form description if it's available.

- Look for another document if there are discrepancies with any of your requirements.

- Click on the Buy Now button to acquire the document when you identify the correct one.

- Select one of the subscription plans and Log In or register for an account.

- Choose how you would like to pay for your subscription (via credit card or PayPal).

- Select the format you wish to save the document in and click Download.

Form popularity

FAQ

Nine states Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming have no income taxes. New Hampshire, however, taxes interest and dividends, according to the Tax Foundation.

Berkheimer has a 80 year history of successful collection and administration of Pennsylvania taxes for all sizes of municipalities and school districts throughout the state.

State law requires Pennsylvania residents with earned income, wages and/or net profits, to file an annual local earned income tax return along with supporting and withholding documentation, such as a W-2. You must file an annual local earned income tax return even if you are: subject to employer withholding.

Who Must File. Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

For local Earned Income Tax (EIT) forms and assistance, contact the local EIT collector serving the municipality in which you reside. Visit the PA Department of Community and Economic Development (DCED) web site to find the name, address, and phone number for your local EIT collector.

Pittsburgh has a flat tax rate of 3% and mandatory local tax filing whether or not you owe, get a refund or break even. Most likely your employer withheld 3%, so you will probably file a "zero balance" return.

The tax is applied to people who earn income and/or profits and are CIty and School District residents. Residents pay 1% city tax and 2% school tax for a total of 3%. Non-Pennsylvania residents who work within the City pay 1%.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

PALite - Individual Online Filing. The Pennsylvania Local Income Tax Exchange (PALite) system allows taxpayers in participating localities to quickly prepare a tax return, which will be sent to their local earned income tax collector.

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).