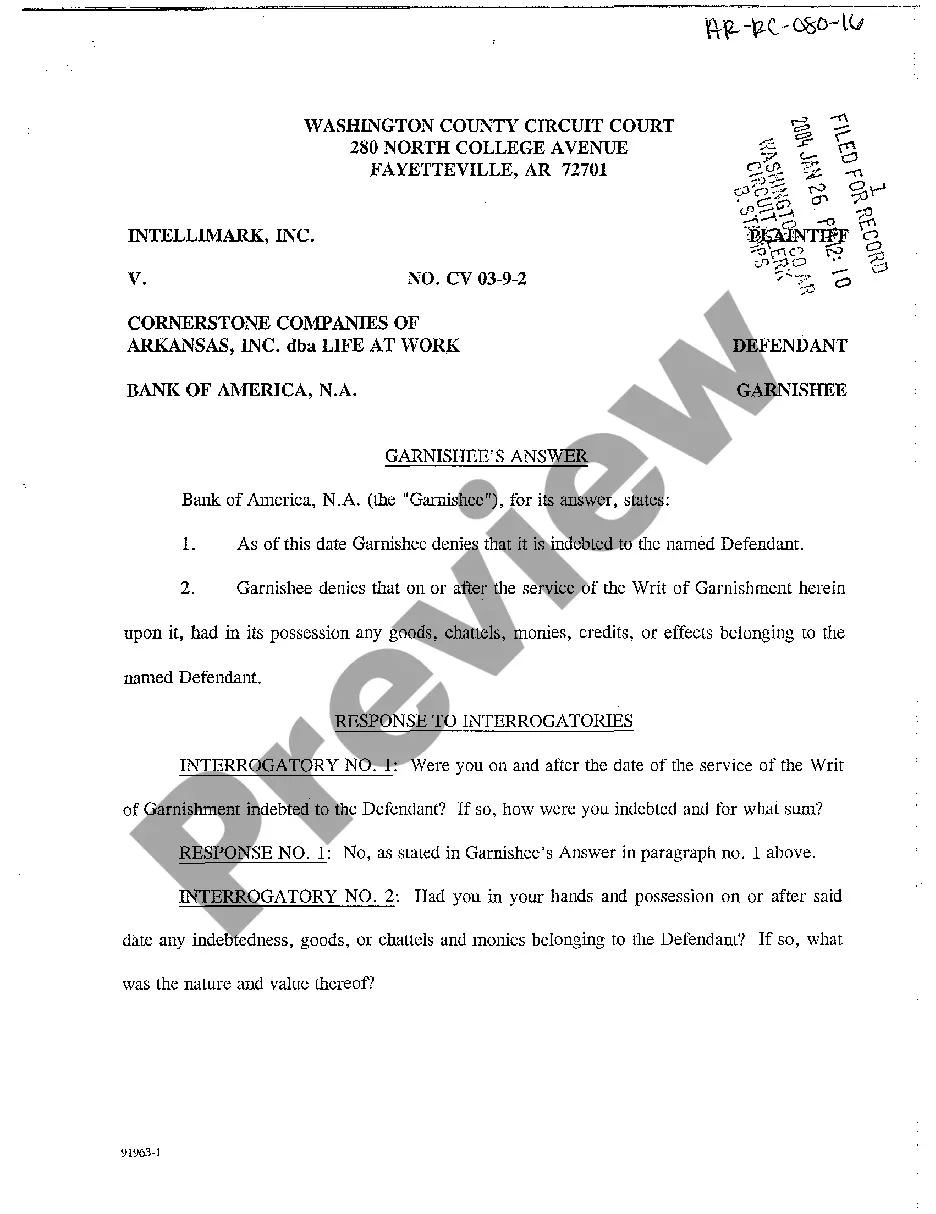

Little Rock Arkansas Garnishee's Answer to Writ of Garnishment

Description

How to fill out Arkansas Garnishee's Answer To Writ Of Garnishment?

If you are seeking a legitimate form, it’s hard to find a superior platform than the US Legal Forms site – likely the most extensive collections on the internet.

With this collection, you can acquire numerous templates for business and personal purposes categorized by types and states, or keywords.

Utilizing our high-quality search feature, obtaining the latest Little Rock Arkansas Garnishee's Answer to Writ of Garnishment is as simple as 1-2-3.

Download the template. Specify the file format and save it to your device.

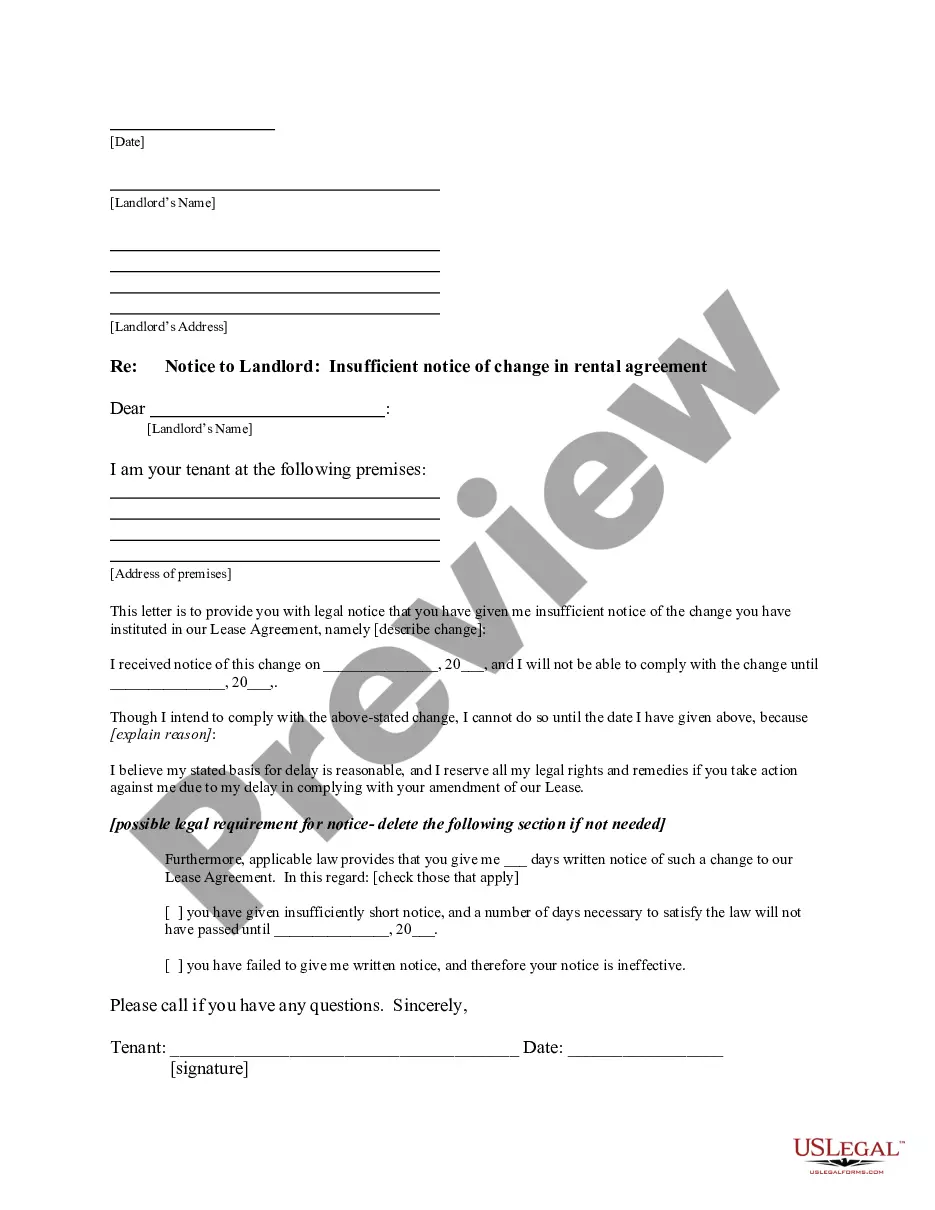

Make modifications. Complete, review, print, and sign the acquired Little Rock Arkansas Garnishee's Answer to Writ of Garnishment.

- If you already have knowledge about our platform and possess a registered account, all you need to do to obtain the Little Rock Arkansas Garnishee's Answer to Writ of Garnishment is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, just follow the instructions outlined below.

- Ensure you have located the form you need. Review its description and utilize the Preview feature (if available) to examine its content. If it does not satisfy your needs, use the Search bar at the top of the page to find the right document.

- Confirm your choice. Click the Buy now button. After that, select your desired pricing plan and provide details to create an account.

- Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

In Arkansas, certain exemptions apply to wage garnishments to protect your income. For instance, funds necessary for basic living expenses, such as food and housing, may be exempt from garnishment. Additionally, a portion of your wages may be protected based on federal guidelines. Knowing these exemptions can significantly impact your financial stability and help you plan accordingly.

To stop a wage garnishment in Arkansas, consider filing a written objection to the garnishment with the court. This process often includes presenting evidence or reasons why the garnishment should be halted. If you can prove financial hardship or inaccuracies in the debt claim, the court may grant your request. USLegalForms offers templates and guidance to help you prepare the necessary documents to effectively stop a wage garnishment.

In Little Rock, Arkansas, the maximum amount that can be garnished from a paycheck typically depends on the type of debt. Generally, the law allows for up to 25% of your disposable earnings to be garnished. However, exceptions may apply based on child support or tax debts, which can allow for higher garnishments. Understanding these limits can help you better manage your finances.

To stop a writ of garnishment in Arkansas, you must file a motion with the court that issued the writ. This motion should be based on valid legal grounds, such as a dispute over the debt or proving that the garnishment is excessive. You can also request a hearing to present your case. Utilizing resources like USLegalForms can guide you through the process of filing a garnishee's answer.

To stop a garnishment in Arkansas, you can file a garnishee's answer to the writ of garnishment, often within 30 days of receiving it. This response must address the amount owed and will indicate if the garnishment is valid according to your financial situation. You may also explore options such as negotiating a payment plan with the creditor or seeking legal advice to understand your rights. Utilizing the US Legal Forms platform can simplify this process by providing easy access to the necessary legal documents and guidance for your situation.

Garnishment in Arkansas occurs when a creditor obtains a court order to collect a debt from your wages or bank accounts. Upon issuance of a writ of garnishment, your employer or bank must withhold the specified funds and send them to the creditor. To ensure your rights are protected during this process, it's wise to utilize tools like US Legal Forms to help with your Little Rock Arkansas Garnishee's Answer to Writ of Garnishment.

The most effective way to stop a garnishment is to negotiate with the creditor directly to reach a settlement. Alternatively, if you believe the garnishment is wrongful, filing an objection with the court can also be a solid approach. For help crafting your Little Rock Arkansas Garnishee's Answer to Writ of Garnishment, US Legal Forms offers valuable templates and guidance.

You can stop a writ of garnishment in Arkansas by filing a motion with the court to contest the garnishment. This requires you to present your reasons, such as demonstrating that the garnishment violates state or federal laws. Engaging with resources like US Legal Forms can simplify your response when dealing with your Little Rock Arkansas Garnishee's Answer to Writ of Garnishment.

To file an exemption for wage garnishment in Arkansas, you need to complete the proper forms and submit them to the court that issued the writ. Typically, you will want to provide evidence of your financial situation, which may include income statements and expense reports. For assistance, consider using US Legal Forms to navigate through the process of handling your Little Rock Arkansas Garnishee's Answer to Writ of Garnishment.

In Arkansas, the maximum amount that can be garnished from your wages is 25% of your disposable earnings. Disposable earnings are defined as the income remaining after mandatory deductions, such as taxes. Understanding these limits is crucial, especially when dealing with the Little Rock Arkansas Garnishee's Answer to Writ of Garnishment.