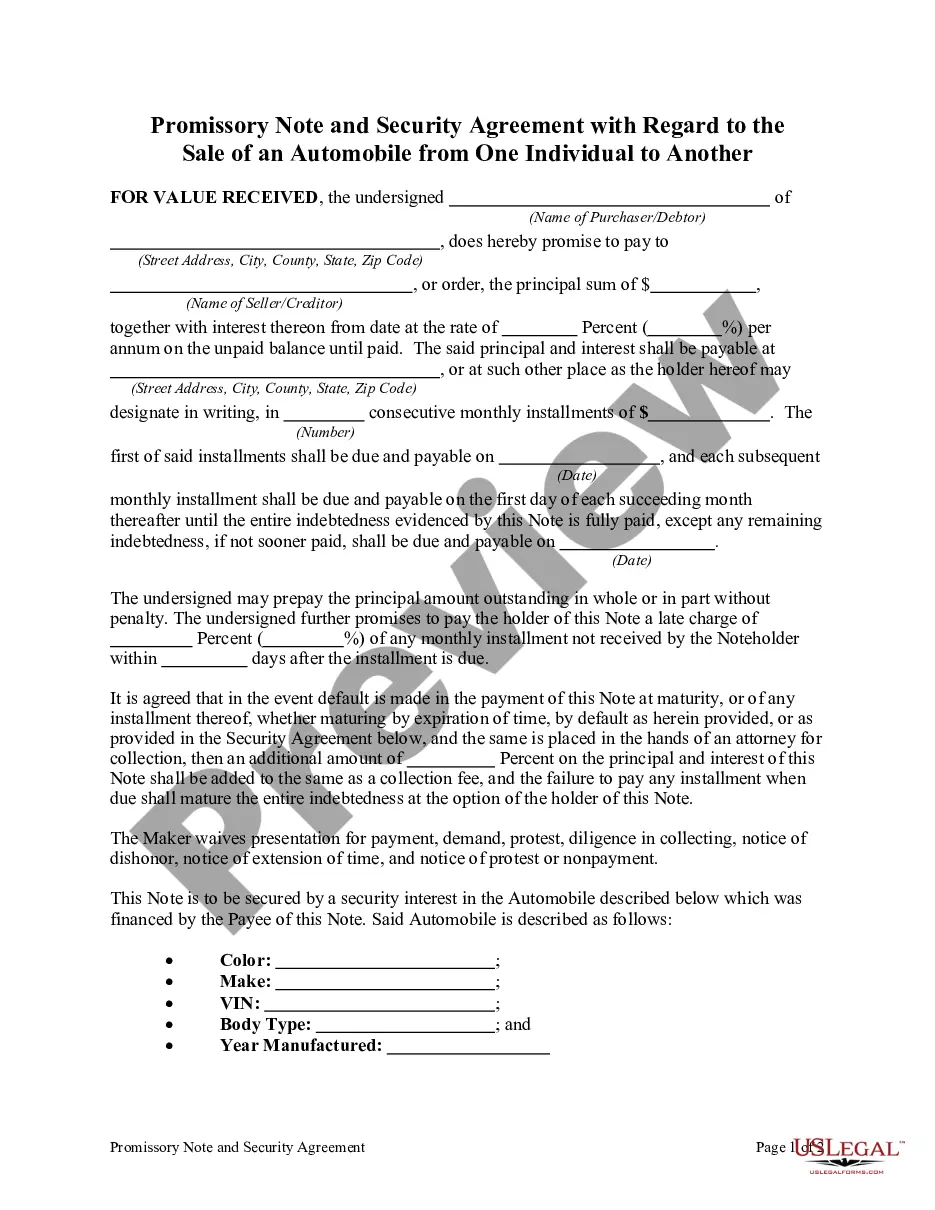

Palm Beach Florida Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Promissory Note And Security Agreement With Regard To The Sale Of An Automobile From One Individual To Another?

A document procedure consistently accompanies any legal endeavor you undertake.

Establishing a business, applying for or accepting a job proposal, transferring real estate, and numerous other life circumstances necessitate preparing formal documentation that varies across the nation.

That is why consolidating it all in one location is incredibly beneficial.

US Legal Forms represents the largest online collection of current federal and state-specific legal documents. Here, you can effortlessly locate and acquire a document for any personal or professional intention used in your area, including the Palm Beach Promissory Note and Security Agreement Regarding the Sale of an Automobile Between Two Individuals.

Choose the appropriate subscription plan, then Log In or register an account. Select the preferred payment method (either credit card or PayPal) to continue. Choose a file format and download the Palm Beach Promissory Note and Security Agreement Regarding the Sale of an Automobile Between Two Individuals onto your device. Utilize it as necessary: print it, fill it out electronically, sign it, and send it where required. This is the easiest and most reliable method to obtain legal documentation. All templates available in our collection are expertly crafted and verified for compliance with local laws and regulations. Prepare your documentation and manage your legal matters efficiently with US Legal Forms!

- Finding samples on the site is exceptionally straightforward.

- If you already possess a subscription to our collection, Log In to your account, search for the sample via the search bar, and click Download to save it onto your device.

- After that, the Palm Beach Promissory Note and Security Agreement Regarding the Sale of an Automobile Between Two Individuals will be accessible for further reference in the My documents section of your profile.

- If you are engaging with US Legal Forms for the first time, follow this brief guide to obtain the Palm Beach Promissory Note and Security Agreement Regarding the Sale of an Automobile Between Two Individuals.

- Ensure you have navigated to the correct page with your local form.

- Use the Preview feature (if applicable) and review the sample.

- Examine the description (if available) to confirm the template satisfies your requirements.

- Look for another document through the search option if the sample does not suit you.

- Click Buy Now once you identify the desired template.

Form popularity

FAQ

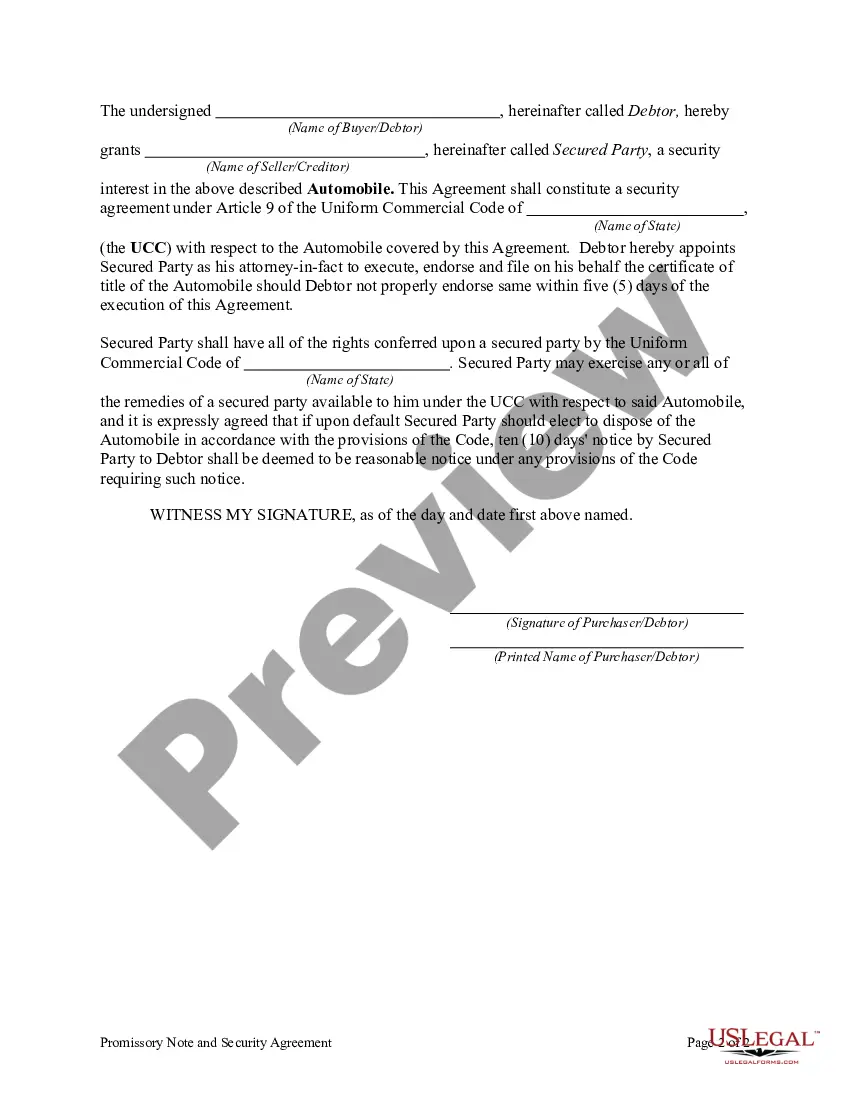

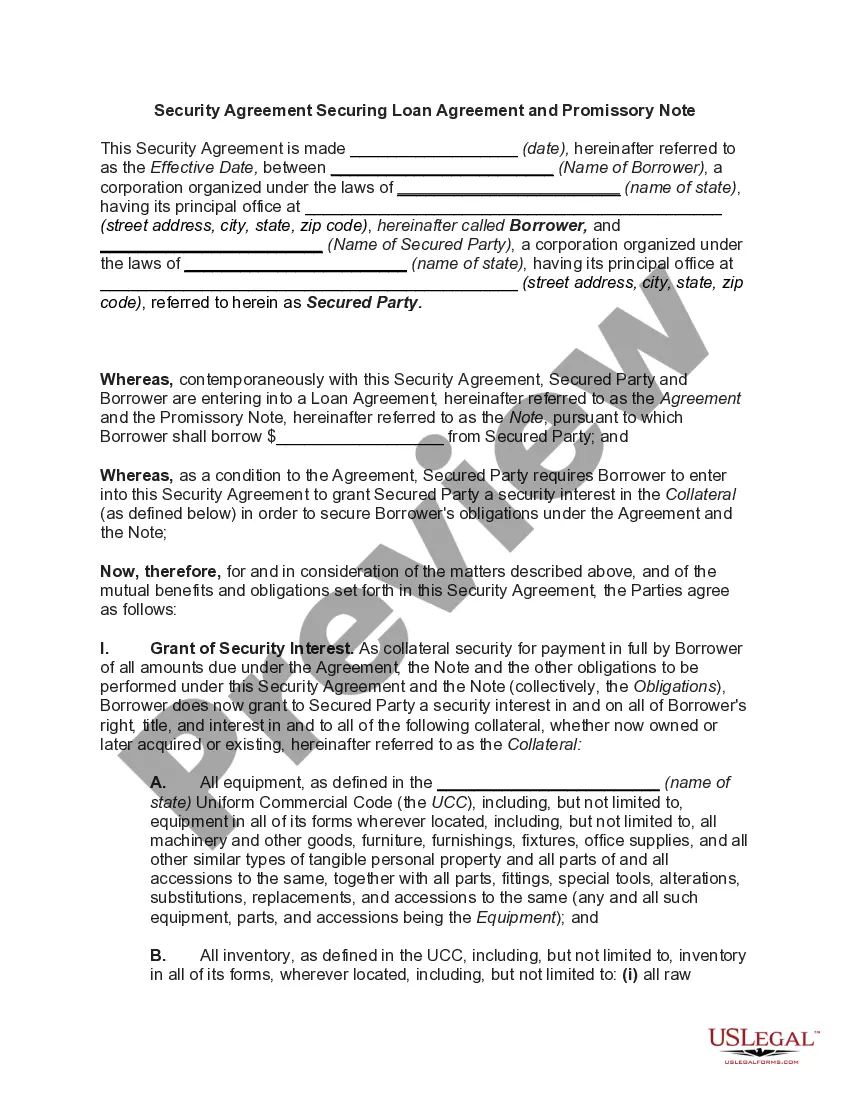

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

A promissory note is a promise to pay. So a bill of sale for an automobile with a promissory note is what you might expect from the (very long) name: A certification someone has bought, and promises to pay for, your car. In this case, likely in monthly installments.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

A promissory note can be used for different types of loans such as a mortgage, student loan, car loan, business loan or personal loan.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Promissory notes and titles can be sold. The person who owns the promissory note may sell it. Lenders typically sell promissory notes when they no longer want to be responsible for the loan or they need a lump sum of cash. The buyer of the note assumes the responsibility of collecting the money.

In general, under the federal Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).