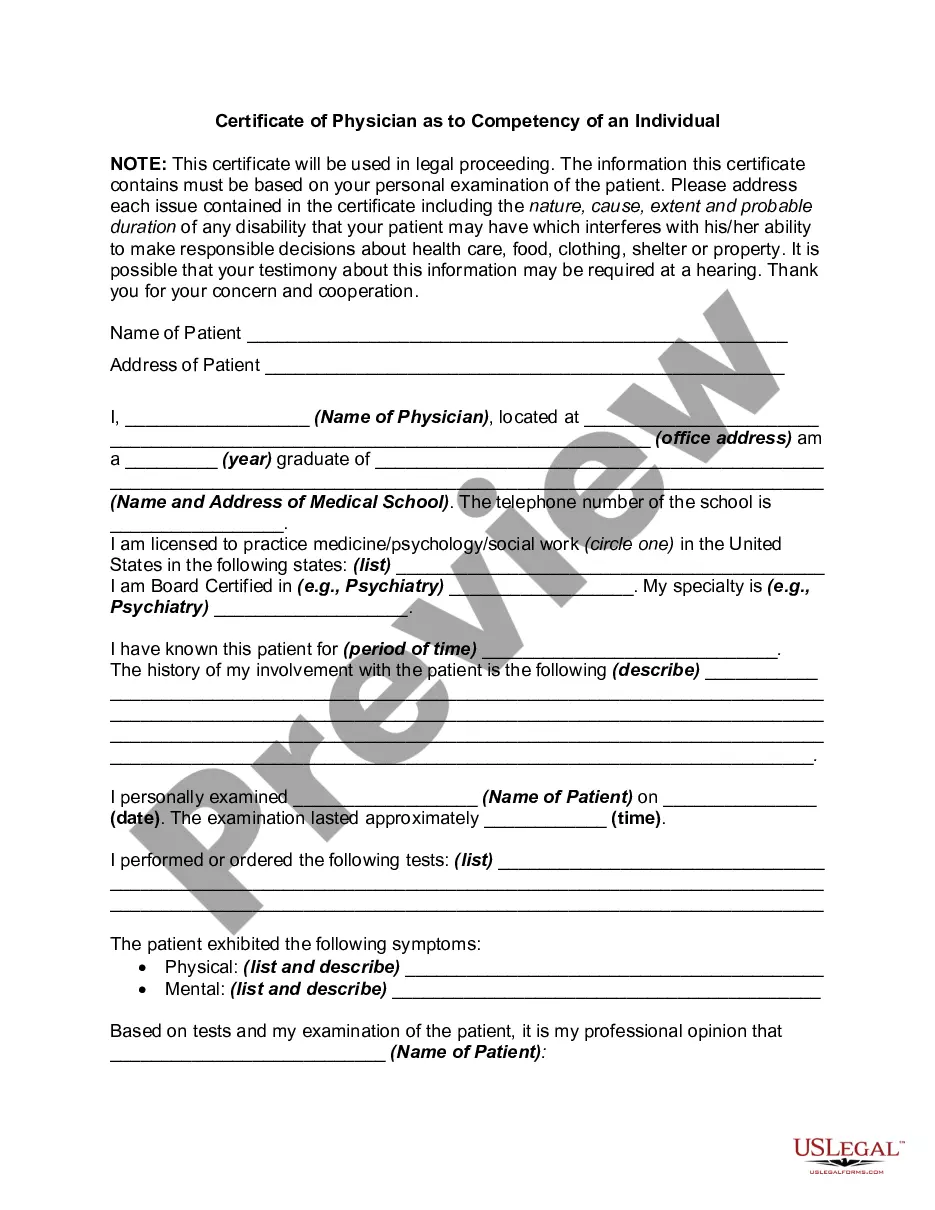

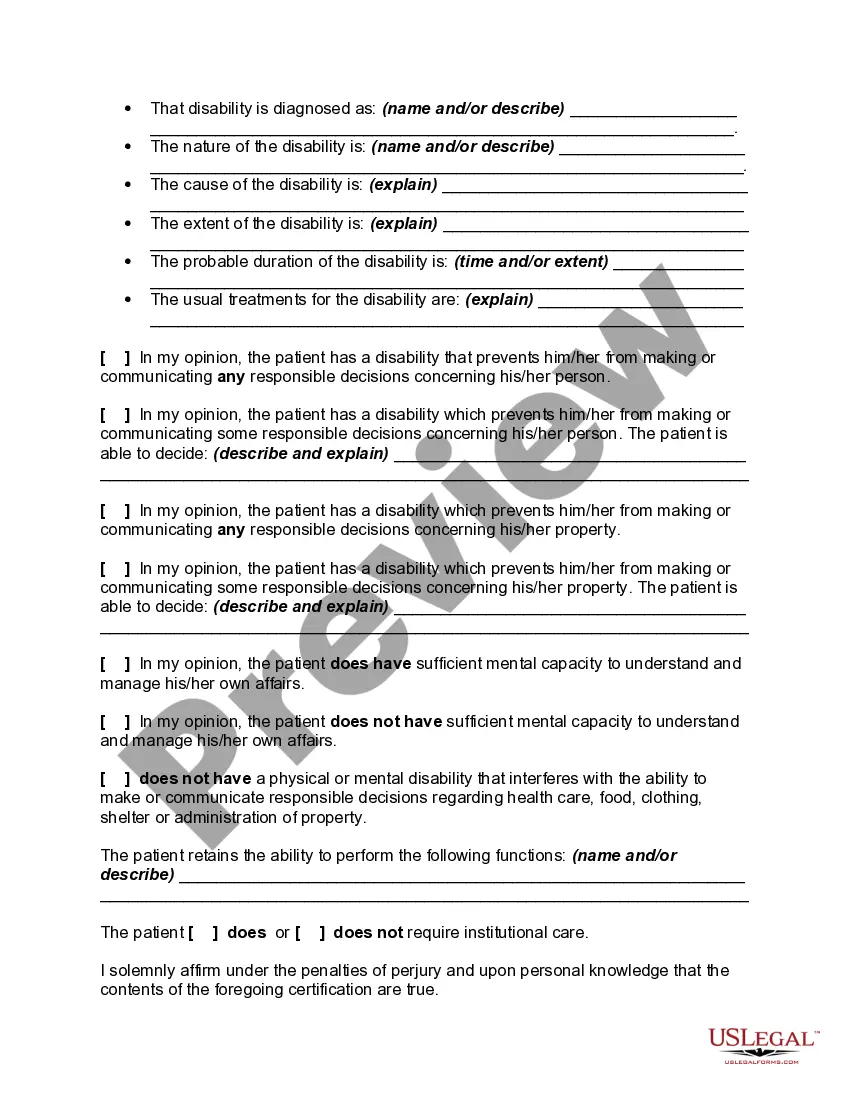

Incompetency is a term that has varied meanings in law.

• When it is used to describe the mental condition of a person subject to legal proceedings, it means the person is neither able to understand the nature and consequences of the proceedings nor able to help an attorney with his/her defense. A person who is diagnosed as being mentally ill, mentally retarded, senile, or suffering from some other illness that prevents him/her from managing his/her own affairs may be declared mentally incompetent by a court of law.

• When it is used to describe the legal qualification of a person, it means the person does not have the legal capacity to enter into a contract. A person who agrees to a transaction should possess complete legal capacity to become liable for duties under the contract.

• When it is used to describe a professional duty or obligation, it means that the person has failed to meet the duties required of that profession.

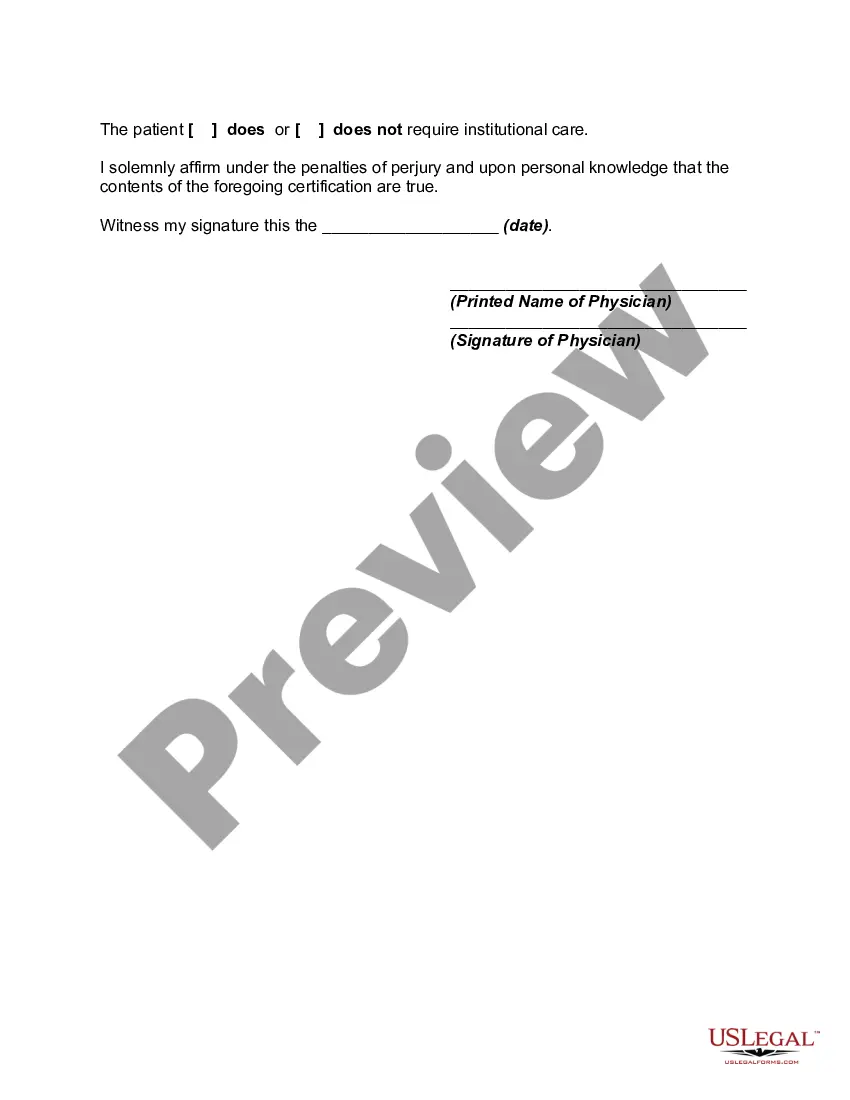

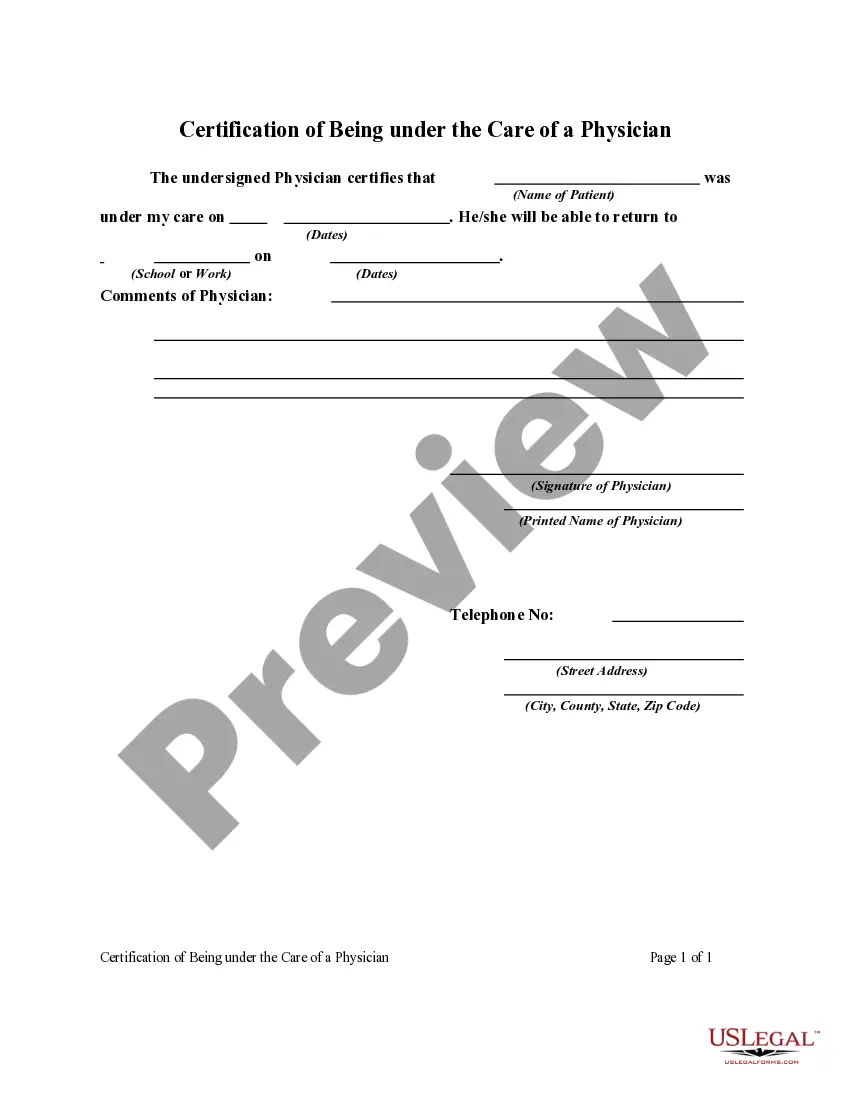

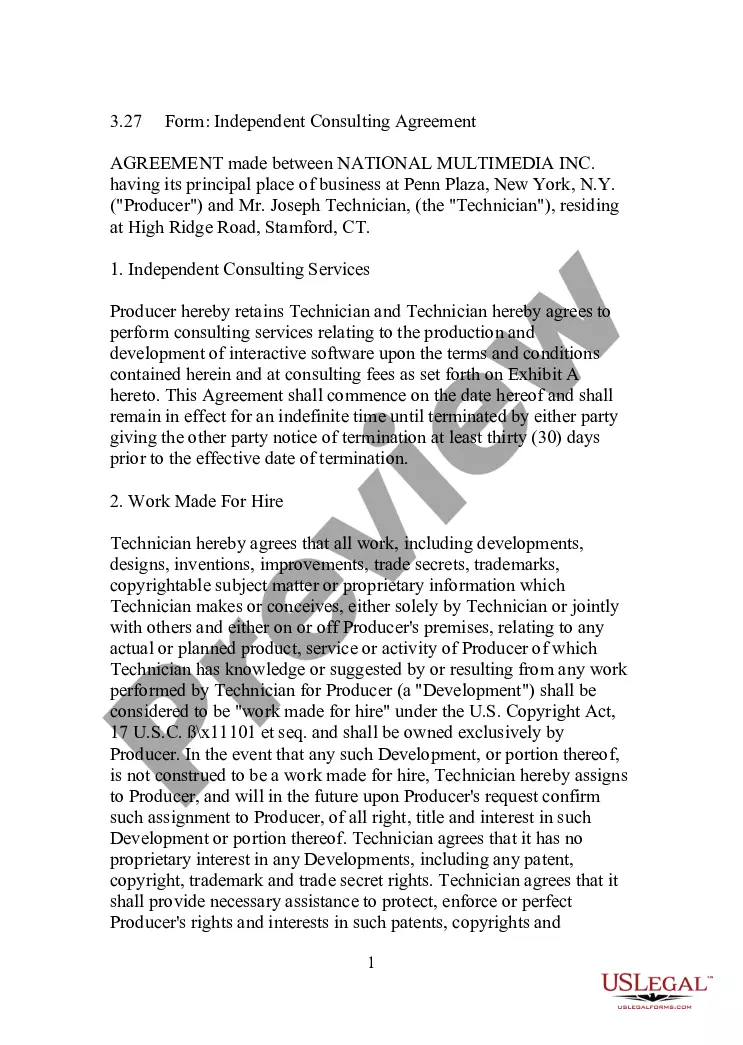

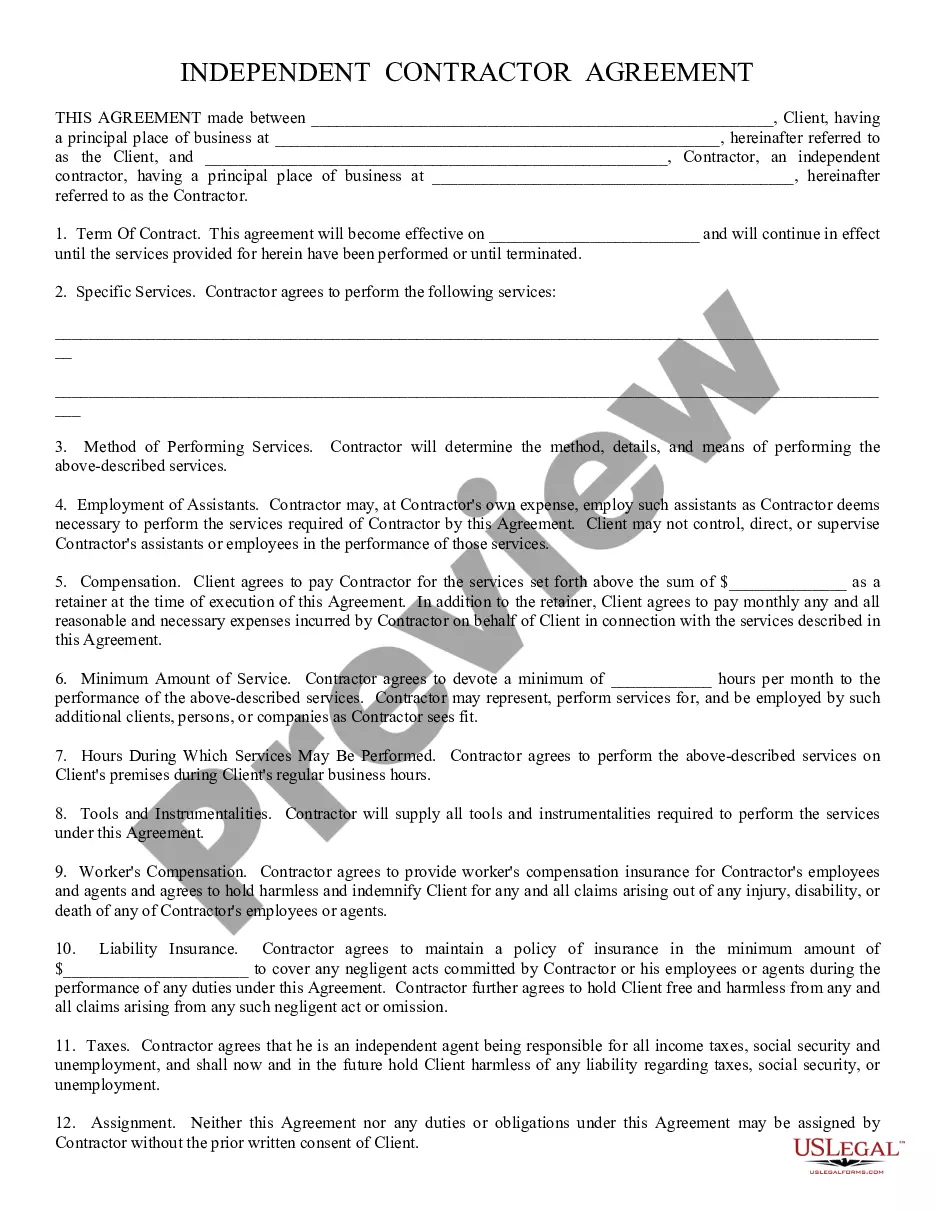

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.