San Antonio Texas Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust: A Detailed Description In San Antonio, Texas, the legal process of disclaiming the right to inherit or an inheritance is a crucial aspect of estate planning and asset distribution. A disclaimer is an intentional refusal to accept property or assets from a deceased person's estate or trust. This legal tool allows individuals to waive their right to inherit or receive gifts and distributions, thereby redirecting them to other beneficiaries or minimizing tax consequences. There are various types of disclaimers related to the right to inherit or an inheritance in San Antonio, Texas. These disclaimers include: 1. Renunciation of Inheritance: This type of disclaimer occurs when a potential beneficiary explicitly declines their right to receive any property or assets from the deceased's estate or trust. By renouncing their inheritance, the individual effectively forfeits any control, ownership, or interest in the assets. 2. Disclaimer of Right to Inherit: This disclaimer involves a beneficiary refusing to accept their entitlement to inherit from a particular estate or trust. By disclaiming their right to inherit, individuals can redirect their inheritance to other named beneficiaries or potentially minimize their tax liability. 3. Disclaimer of All Property from Estate or Trust: In this case, a beneficiary disclaims their entitlement to inherit any or all of the property from the deceased individual's estate or trust. By doing so, the beneficiary relinquishes all rights and interests in any assets that would have been assigned to them. It is crucial to note that a disclaimer must be made within a specific timeframe and comply with legal requirements to be valid. In San Antonio, Texas, a disclaimer generally needs to be in writing, signed by the disclaiming party, and delivered to the estate's personal representative or trustee. It is essential to consult with an experienced estate planning attorney in San Antonio, Texas, to ensure compliance with applicable laws and to maximize the benefits of disclaiming an inheritance. An attorney will guide individuals through the process, explain the potential consequences, and help determine the most suitable course of action in light of their particular circumstances. Overall, a San Antonio Texas Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust allows individuals to redirect their inheritance, protect beneficiaries, and potentially mitigate tax obligations. By strategically utilizing this legal tool, individuals can ensure that their assets are distributed according to their wishes while optimizing estate planning outcomes.

San Antonio Texas Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

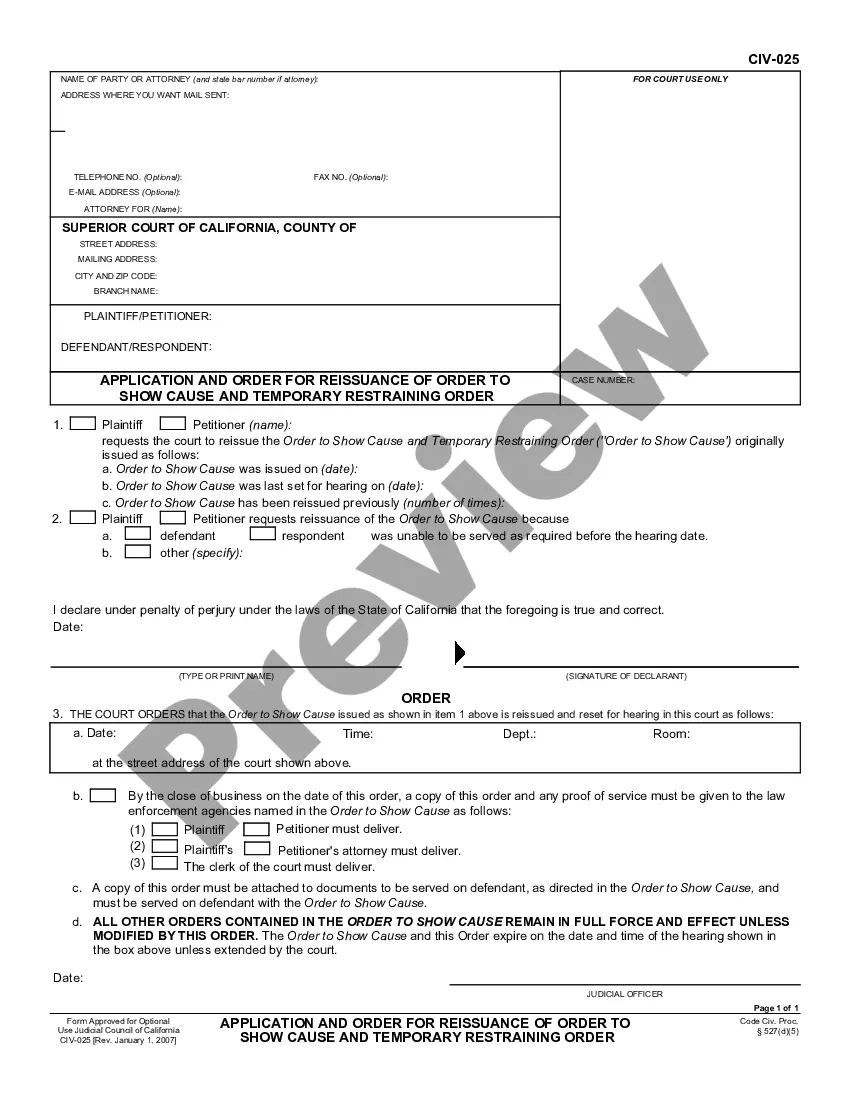

How to fill out San Antonio Texas Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business purpose utilized in your county, including the San Antonio Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the San Antonio Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the San Antonio Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the San Antonio Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

In Texas, disclaimer of your inheritance must be in writing and the statement must be notarized. You then have to file it with the probate court so your refusal is a matter of record.

Variations and disclaimers To be effective for tax purposes, both must be in writing and executed within two years of the date of death (although a disclaimer can be effective to refuse a gift, even if it is made by the conduct of the beneficiary, rather than in writing).

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

To be valid, the disclaimer must be irrevocable, in writing and executed within nine months of the death of the decedent.

Trusts can be used in estate planning to give individuals and couples greater control over how assets are transferred to heirs with the fewest tax consequences. Sometimes, however, disclaiming assets makes the most sense. No special form or document must be completed to disclaim inherited assets.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estateusually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

However, if the property is inherited through a will, and the legal heir refuses to accept the inheritance, he/ she will have to present a clear letter in favour of other heirs, stating that they are refusing the claim in the inheritance.